30 Years of Monetary Market Returns

[ad_1]

A colleague not too long ago requested me to run the 30 yr annual returns for U.S. shares, bonds and money.

He simply needed the returns. I couldn’t assist however slice and cube the numbers and overanalyze the info as a result of that’s what we do right here.

Let’s dig in.

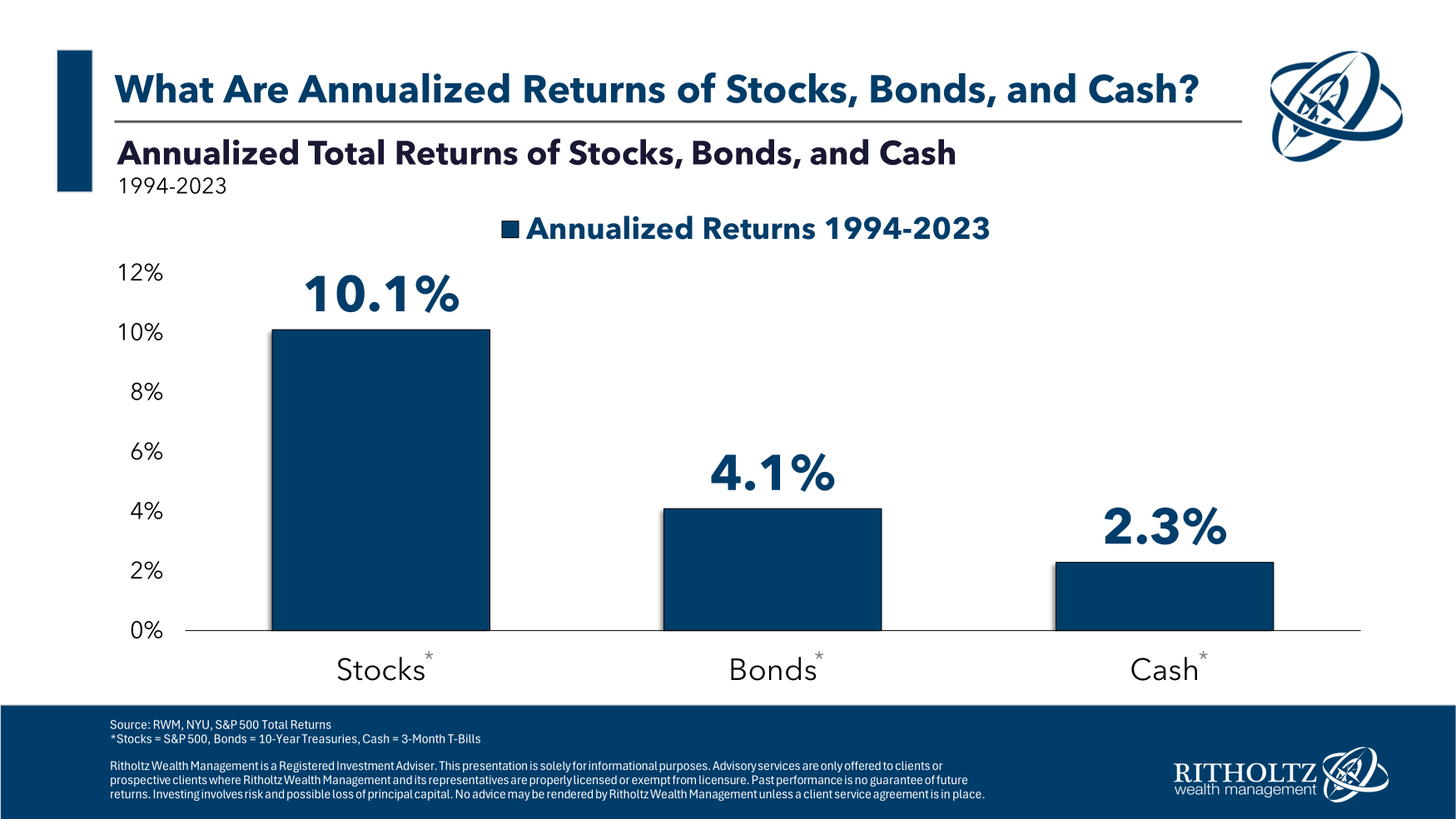

First the annual return numbers for the S&P 500, 10 yr treasuries and three month T-bills over the 30 years ending in 2023:

Some ideas about these numbers:

Inventory returns look common regardless of the turmoil. From 1994 to 2023, there was the dot-com bubble, a 50% crash, 9/11, a housing bubble, the Nice Monetary Disaster (which got here with one other 50%+ crash), a handful of wars, 3 recessions and a pandemic.

And but…the inventory market was up 10% per yr.

We had booms and busts, ups and downs, good and unhealthy, however issues nonetheless turned out OK.

No ensures concerning the future however that’s nonetheless fairly spectacular.

Bond returns weren’t unhealthy regardless of the bear market. Yields on authorities bonds have been under common for a while now. We’re nonetheless within the midst of the worst bond bear market of all-time.

In 2022 and 2023, 10 yr Treasuries have been down 22% in complete.1

The 5 worst calendar yr returns for U.S. authorities bonds since 1928 have all come prior to now 30 years. Three of these 5 years have occurred since 2009.

Beginning yields have been larger within the mid-Nineteen Nineties2 and falling charges helped, particularly within the first decade of this century.

However 4% returns usually are not unhealthy contemplating how bizarre the yield scenario has been for the previous 15 years or so.

Money returns have been respectable regardless of 0% yields for therefore lengthy. T-bill returns of somewhat greater than 2% per yr aren’t nice when contemplating inflation within the 30 years ending 2023 was 2.5% per yr.

Greater than half (16) of the previous 30 years have been returns beneath 2%. Eleven occasions the returns have been beneath 1% in a calendar yr.

However now T-bill yields are over 5%!

I don’t understand how lengthy that’s going to final however it means returns are a lot larger (for now) than they’ve been in a few years.

In truth, the prospects for money and bonds are each in a significantly better place than they’ve been in a while.

Listed here are some extra quick-hit stats:

- Shares have been up 80% of the time over the previous 30 years. The inventory market was down double digits 4 occasions however up double digits in 19 out of 30 years. 4 out of each 10 years the S&P 500 was up 20% or extra. One of the best annual return was +37%. The worst annual return was -37%.

- Bonds have been up 80% of the time over the previous 30 years. The bond market was down double digits twice (2022 and 2009) and up double digits in 9 years. One of the best annual return was +24%. The worst annual return was -18%.

- Money didn’t have a single damaging (nominal) yr however it additionally had the worst annual returns over the previous 30 years. One of the best annual return was +6% whereas the worst return was 0%.

I don’t know what the subsequent three a long time will carry however there’ll possible be recessions, bear markets, geopolitical crises, battle, perhaps pestilence, and who is aware of what else.

However I do know that not investing your cash ensures you’ll fall behind inflation.

And I’ve a sense threat will likely be rewarded with larger returns.

I simply don’t know precisely what these returns will likely be.

They wouldn’t be known as threat belongings if there was no threat.

Additional Studying:

Historic Returns For Shares, Bonds & Money

1That means yields included.

2Round 6% heading into 1994.

This content material, which incorporates security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here will likely be relevant for any explicit details or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or provide to offer funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the chance of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.