You Can Earn $400 When You Signal Up for New PNC Financial institution Account

[ad_1]

“Take pleasure in the advantages of a giant nationwide financial institution and obtain free money if you happen to meet the necessities.”

In search of a brand new checking account? If you join a brand new PNC Digital Pockets account, which mixes checking and financial savings, you may obtain a aggressive welcome bonus.

By opening a brand new account earlier than the tip of April and establishing direct deposits of $500 to $5,000 throughout the first 60 days, you may earn as much as $400.

Nevertheless, you’ll need to attend. The bonus could take as much as 90 days to achieve your account after you full the qualifying actions.

Is that this new account bonus price contemplating? Let’s take a better take a look at the bonus and PNC’s Digital Pockets account to see in the event that they fit your wants.

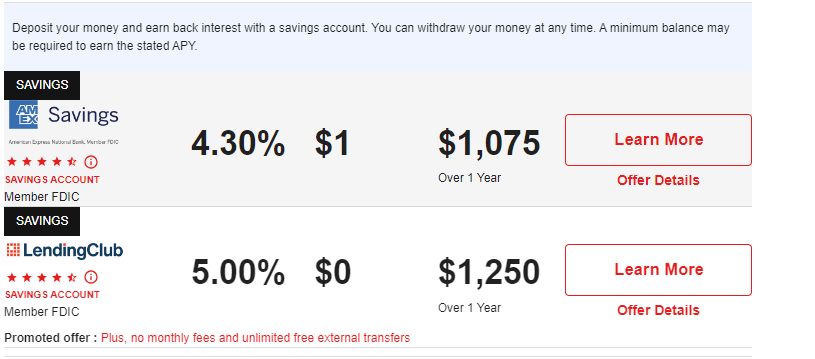

Main financial institution accounts as of April 19, 2024

Earn $400 When You Signal Up for New PNC Financial institution Account provides

After verifying that you simply reside in an eligible space by getting into your ZIP code on PNC’s new account bonus web site, you may obtain $100, $200, or $400 in bonuses while you open a brand new PNC Digital Pockets by April 30, 2024. The Digital Pockets consists of three sub-accounts:

- Spend checking account, which capabilities like an everyday checking account.

- Progress financial savings account, much like a conventional financial savings account.

- Reserve checking account, designed for short-term monetary planning.

The bonus quantity you qualify for is dependent upon the full direct deposits you make within the first 60 days.

| Spend account | Bonus | Direct deposit minimal |

| Digital Pockets | $100 | $500 |

| Digital Pockets with Efficiency Spend | $200 | $2,000 |

| Digital Pockets with Efficiency Choose | $400 | $5,000 |

Qualifying direct deposits consist of standard recurring digital funds from an employer or outdoors businesses like pensions or Social Safety. New account holders can get the bonus in the event that they haven’t been on any present or closed account up to now 90 days or in the event that they haven’t acquired a promotion bonus from PNC within the final two years. After you meet the direct deposit necessities, the bonus cost could arrive in 60 to 90 days.

PNC Digital Pockets supplies an outline

PNC ranks because the sixth-largest financial institution in the US by way of property, based on the newest information from the Federal Reserve. PNC provides the comfort of a giant nationwide financial institution with revolutionary cell instruments comparable to financial savings targets, because of its over 2,600 branches and entry to greater than 60,000 fee-free ATMs, enabling you to handle your account from wherever. With its Digital Wallets with Efficiency Spend and Efficiency Choose, you may obtain reimbursements of as much as $5 or $10 per assertion cycle for out-of-network ATM charges.

Nevertheless, much like different massive banks, PNC’s annual share yields (APYs) for its Digital Pockets account don’t provide a lot attraction. The fundamental Digital Pockets Spend account doesn’t present curiosity. The Efficiency Spend and Efficiency Choose accounts earn a minimal APY of 0.01% and require a month-to-month stability of no less than $2,000.

One other frequent function PNC shares with main banks is the month-to-month charge. Relying in your account exercise, you possibly can pay between $7 and $25 monthly in case your direct deposit falls beneath $500 to $5,000 within the Spend accounts or if you happen to don’t keep a mean month-to-month stability of $10,000 in Efficiency Spend or $25,000 in Efficiency Choose accounts.

In comparison with the highest checking accounts listed by CNET, the PNC Digital Pockets doesn’t measure as much as expectations. Extra enticing choices can be found, together with some that provide bonuses.

| Financial institution | APY | Bonus | Month-to-month charge | Bonus necessities |

| Axos Financial institution | As much as 3.30% | $300 | $0 | Obtain $5,000 in month-to-month direct deposits for the primary seven months. |

| SoFi | 0.50% | $50 – $350 | $0 | Obtain $1,000 to $5,000 in direct deposits throughout the first 25 days. |

| Laurel Street | 0.01% | $100 | $0 | Obtain $2,500 in direct deposits throughout the first 60 days. |

| PNC Financial institution | 0% – 0.01% | $100 – $400 | $7 – $25 | Obtain $500 to $5,000 in direct deposits throughout the first 60 days. |

Take into account these elements when evaluating a brand new account bonus

PNC is a big nationwide financial institution that gives handy entry to many individuals all through the nation. Having a financial institution with easy-to-reach branches and ATMs might be helpful, particularly if you have to deposit substantial quantities of money or want in-person customer support.

In the event you reside in an space the place the brand new Digital Pockets account bonuses can be found and wish a brand new checking account, it’s smart to think about all choices.

Nevertheless, opening a brand new account primarily for the financial institution bonus could price you in the long term. Earlier than selecting an account due to the financial institution bonus, maintain these factors in thoughts:

Examine the wonderful print. Make sure you qualify for the bonus. PNC provides bonuses solely in sure areas, so confirm the bonus availability earlier than opening a brand new account. Plan to pay taxes. Your financial institution will ship you a 1099-INT type, and you need to report any checking account bonuses to the IRS. Have a look at all charges. Every of the three Digital Pockets Spend accounts carries a month-to-month charge. The charge might be waived, however be sure that the situations don’t create any points for you. Know the account closure coverage. Pay attention to any early account closure charges and keep away from closing the account throughout that time-frame. PNC additionally doesn’t provide a bonus to anybody who has closed an account throughout the previous 90 days.

Is the brand new account bonus from PNC deal?

The PNC new Digital Pockets bonus has some regarding situations. In the event you can’t simply meet the minimal direct deposit necessities or keep minimal mixed Spend account balances to keep away from a month-to-month charge, you would possibly wish to search for a brand new account bonus at a distinct financial institution. Paying a month-to-month charge would scale back any advantages from the $100 to $400 financial institution bonus.

Additionally, the rates of interest on the Efficiency Spend and Choose Digital Wallets are usually not as aggressive as these provided by different on-line banks’ checking accounts. Holding a big stability to keep away from the month-to-month charge whereas incomes little or no in curiosity could hinder your curiosity progress targets.

The fundamental Digital Pockets has the bottom month-to-month direct deposit requirement to qualify for a bonus and keep away from the month-to-month charge if you happen to’re within the digital instruments, bodily branches, and nationwide presence that PNC financial institution provides. Different banks like Capital One and Ally could provide related options and providers with out a month-to-month charge. Take into account all of your choices earlier than deciding whether or not PNC Financial institution and its Digital Pockets bonus are best for you.

[ad_2]