Online Tax Prep From CPAs

[ad_1]

Picnic Tax is a platform that matches tax filers with certified accountants who can help them file their returns. It covers personal tax filing, small business tax filing, and self-employed tax returns. People can also request tax planning and tax advice from Picnic CPAs.

Here’s what else you need to know about the platform in 2024. You can also see how Picnic Tax compares to the best tax software here.

Picnic Tax – Is It Free?

Picnic Tax doesn’t offer free services but it does offer free price quotes to all users. People interested in using the service can complete a questionnaire to determine costs. Users who opt to use the service pay the fee upfront. Then, Picnic matches the filer with their personalized accountants. Filing starts at $225 for federal filing and one state.

Short interview to determine costs

What’s New In 2024?

For 2024, your accountant will use updated tax brackets and limits for deductions and credits as set by the IRS. Because you’re not filing with tax software, you don’t have to worry about those details.

The other major update we noticed was for small businesses. Small business tax prep pricing is up by $250 this year, now starting at $750. This is pricey compared to FlyFin but still cheaper than a traditional CPA.

Does Picnic Tax Make Tax Filing Easy In 2024?

Picnic Tax simplifies tax filing as much as possible. Users can upload their tax documents to the company’s website. Accountants can then ask questions and request additional information before preparing returns on clients’ behalf.

Filers don’t need to worry about whether they’re maximizing deductions or claiming things correctly. The CPA they connect with will take care of those details.

Picnic Tax Features

Picnic Tax is a bit like the Uber of tax filing, but it matches accountants and tax filers instead of connecting riders with drivers. Since it’s not traditional tax software, the features highlighted here showcase how Picnic Tax differs from traditional tax prep services and tax software.

Secure Document Upload

Users can upload all their tax documents through a secure online portal. They don’t need to worry about emailing or hand-printing tax documents and sending them in the mail.

Online Or Offline Communication With CPAs

Picnic Tax users can communicate via Zoom, email, or secure chat with a dedicated CPA. The company ensures filers can easily communicate all the pertinent information to their accountants.

CPAs Prepare And Submit Returns

Picnic Tax makes filing as easy as possible. CPAs take on the heavy lifting associated with preparing tax returns. Filers only need to convey their tax situation to the CPAs before the CPA does the work.

Picnic Tax Drawbacks

As an online tax preparation company, Picnic Tax has a few notable drawbacks.

High Cost Compared To DIY

Personal tax filing can cost up to several hundred dollars. TurboTax Full Service (where an agent prepares user returns) costs less for similar service levels.

Multi-Factor Authentication Not Enforced

Users only need an email address and password to sign into Picnic Tax. Multiple forms of authentication are not required. This could be a security risk, so be extra sure to use a unique password to keep your data safe.

Picnic Tax Plans And Pricing

Pricing for Picnic Tax starts at $225 for federal filing. Users can add state returns for $50 per state. The final price of the service increases depending on the complexity of a filing situation. The software increases in price by $100 for each additional service.

Picnic will file both small business and personal tax returns. Business returns start at $750 and go up with additional filing needs and requirements. Compared to using tax prep software, this may be more expensive. However, compared to enlisting the help of a traditional CPA, Picnic Tax is a bargain.

Finally, users can set up Tax Planning and Advice appointments with their Picnic CPA. These consultations start at around $300.

|

Small Business Tax Filing |

|||

|---|---|---|---|

|

Anyone who wants a tax professional to handle their return, but wants a reasonable price and online service. |

Small business owners who want help maximizing their business deductions and staying on top of IRS requirements. |

Anyone who wants to optimize their taxes |

|

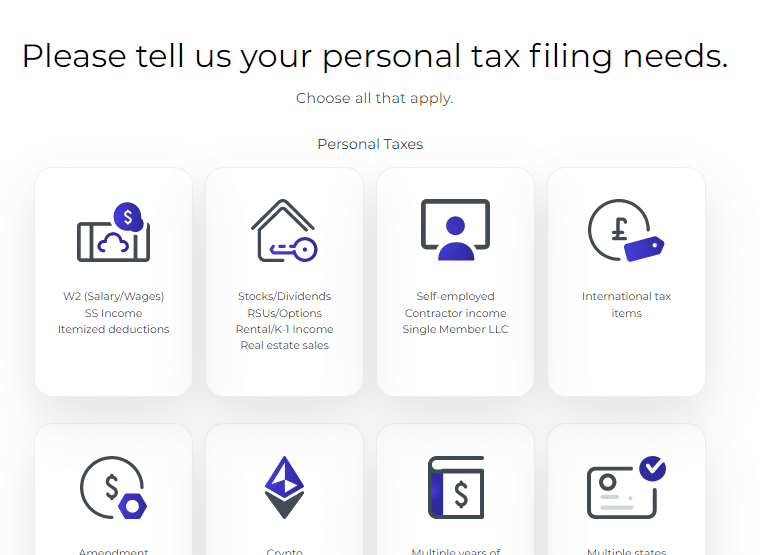

How To Get Started With Picnic

The Picnic Tax process starts with a quick onboarding process to learn about your tax prep needs. The questions asked are simple, direct, and easy to answer. The onboarding process aims to get you matched with an accountant as soon as possible so the accountant can do the hard work for you.

Once your onboarding is complete, you’ll see your personalized price quote. After payment, the app matches you with your accountant.

Once you’re matched, you are directed to a document upload page. The page has clear instructions for organizing and adding your files. It’s fast and efficient to upload your information here.

Several different file formats are supported, and the website supports drag-and-drop uploads. All you have to do is upload your documents and answer the questionnaire. Then, you can sit back, relax, and enjoy a cold beverage while someone else completes your tax forms.

Once your docs are uploaded, you can access a dashboard to communicate directly with your accountant. This user-friendly interface has a status update box indicating how far along your accountant is with your return.

How Does Picnic Tax Compare?

Picnic Tax supplies CPAs for all tax situations. It covers everything from crypto trading to real estate sales. It offers a comparable service to full-service online tax prep brands like TurboTax Full Service and Visor.

The chart below compares prices and services offered by these companies. Picnic is a bit more expensive than TurboTax Full Service, but it’s comparable to the prices from Visor.

|

Header |

|

|

|

|---|---|---|---|

|

$1,000+ Federal & |

$389 Federal & |

$694+ Federal & |

|

|

Self-Prepared or |

|||

|

Same Tax Preparer Each Year |

|||

|

Cell |

Is It Safe And Secure?

Picnic Tax has decent online security. It uses strong data encryption and allows users to securely upload documents only their CPA can access. It also offers secure communication channels for discussing the return.

One possible drawback to Picnic Tax is its authentication process. Users only need an email and a password to create an account. Multi-factor authentication (such as adding an email or phone number) isn’t required.

Filers need to be careful whenever they’re working with an accountant. If the filer emails documents to their accountants, the document is no longer secure. The filer must also trust that the CPA will not accidentally store documents in an unsecured server.

How Do I Contact Picnic Tax Support?

Once you’ve connected with your CPA, you can reach out any time via Zoom, email, or secure chat. But before then, your Picnic Tax support options are limited.

If you have questions about how the company’s services work, you’ll need to email info@picnictax.com or support@picnictax.com.

Is It Worth It?

Most people can file their own taxes online using tax software. However, some people have very complex tax situations and need help from a pro. Picnic Tax is ideal for those situations.

The service guarantees that filers will have help from a qualified CPA. And it displays pricing before a user starts filing. If you have a complex filing need, I recommend Picnic Tax in 2024.

FAQs

Can Picnic Tax help me file my crypto investments?

Yes, the platform’s accountants can help all types of tax filers. Active crypto traders can find accountants who have experience preparing crypto returns. Filers may be required to upload a spreadsheet with all trades or an IRS Form 8949 to the Picnic Tax website.

Can Picnic Tax help me with state filing in multiple states?

Yes, it supports filing in all states. Filers must pay $50 per state.

Does Picnic Tax offer refund advance loans?

No, it does not offer refund advance loans.

Picnic Tax Features

|

|

|

Import Tax Return From Other Providers |

Will vary by the tax software that your specific accountant uses |

|

Deduct Charitable Donations |

|

|

Refund Anticipation Loans |

|

|

Web/Desktop Account Access |

|