Morgan Stanley Recommends Loading Up on AAPL, AMZN, and META After Earnings – TipRanks Monetary Weblog

[ad_1]

The inventory market’s excellent efficiency over the previous yr has been pushed by tech, particularly the cohort dubbed the Magnificent Seven shares. So, it’s no shock that the Road was wanting to see how the world’s Most worthy firms are doing of their newest earnings reviews, because it might present some perception relating to the viability of an prolonged rally.

Whereas not all these reporting delivered out-and-out stellar readouts, taking into account the markets stepped on the fuel in Friday’s session, the overall reply should be that Wall Road evidently thinks the rally has legs.

The analysts at Morgan Stanley definitely suppose Massive Tech is primed for additional good points. The post-earnings evaluation by the banking big’s inventory specialists exhibits that they’re retaining religion in a number of of final week’s headline grabbers, and they’re telling buyers to maintain loading on three mega caps – Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), and Meta (NASDAQ:META).

So, let’s take a more in-depth have a look at the three and with assist from the TipRanks database, we will additionally see whether or not the remainder of the Road thinks the great instances are set to proceed for these Magnificent Seven names.

Apple

We’ve grown accustomed to calling Apple essentially the most helpful firm on this planet, however that has not been the case just lately. That place is now occupied by Microsoft after Apple’s long-standing rival took the AI alternative by the horns, one thing Apple has not but conclusively achieved.

It could be laborious to say Apple has been underperforming over the previous yr – the inventory’s good points nonetheless exceed these of the S&P 500 – nevertheless it has fallen behind a few of its tech friends with cracks showing within the progress story. These have come amidst issues that demand for its flagship product, the iPhone, shouldn’t be as sturdy because it as soon as was. On the identical time, buyers are questioning the place the subsequent leg of progress will come from.

That query was front-and-center final week when Apple delivered its first fiscal quarter earnings (December quarter). Whereas the report featured a return to top-line progress after 4 consecutive declines, issues about its standing in China and a tender outlook drove the narrative.

Income within the quarter reached $119.6 billion, representing a 2.1% year-over-year improve and beating the consensus estimate by $1.34 billion. On the different finish of the size, EPS of $2.18 got here in $0.07 forward of the forecast. Apple attributed the sturdy efficiency to progress in its Companies enterprise, whereas the iPhone outcomes have been higher than anticipated. Nevertheless, the Road was not impressed by the truth that China’s income dropped by 13%, with Apple showing to lose smartphone market share. Moreover, for the March quarter, the corporate’s steerage known as for gross sales of about $90 billion, a 5% drop in comparison with the identical interval a yr in the past, thereby disappointing Wall Road.

Submit-earnings sentiment is likely to be relatively low, however that has not altered the bull thesis, says Morgan Stanley analyst Eric Woodring.

“In our view,” mentioned the analyst, “bears will proceed to argue that fundamentals don’t assist Apple’s present valuation. However sentiment is already negatively skewed, and and not using a catalyst for derating – Apple’s income has declined in 4 of the final 5 quarters but its P/E is up 2-3x turns over this time, so unfavourable earnings revisions haven’t had the meant impression bears anticipated – we’re unsure what ‘breaks’ the story.”

“As a substitute, we see [the] information down as a clearing occasion (as we previewed),” Woodring went on so as to add. “Which means, Apple has now gotten its ‘information down’ out of the best way, and buyers can now look to the June Worldwide Developer Convention, the place we count on Apple to introduce its first Gen AI-enabled software program improve, and the September iPhone 16 launch, as upside catalysts to assist reaccelerate progress in FY25, the place our income and EPS are 1-4% above consensus.”

These feedback underpin Woodring’s Chubby (i.e., Purchase) score whereas his $220 worth goal suggests the shares will climb 18% larger over the approaching months. (To observe Woodring’s monitor report, click on right here)

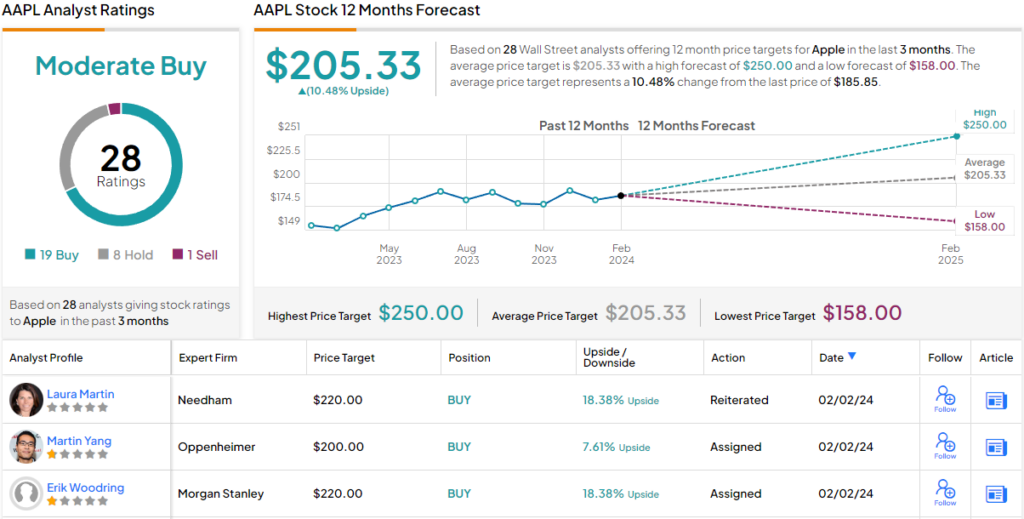

Most analysts agree with Woodring’s stance though not all are on board. Based mostly on a mixture of 19 Buys, 8 Holds and 1 Promote, the inventory claims a Average Purchase consensus score. Going by the $205.33 common goal, the inventory will add 10.5% over the one-year timeframe. (See Apple inventory forecast)

Amazon

Whereas buyers weren’t impressed with Apple’s newest print, the identical can’t be mentioned for one among its Massive Tech brethren. Amazon shares rallied by 8% to achieve a 2-year excessive within the post-earnings session because the e-commerce big impressed on all fronts in its This autumn report.

Amazon may need been seen as a laggard within the AI recreation to this point, nevertheless it appeared to place that argument to mattress within the newest report. On the again of seven consecutive quarters of flat gross sales, progress at AWS was again on the menu as the advantages of AI-focused initiatives began to turn out to be evident. All informed, AWS income climbed by 13% year-over-year (excluding FX) to $24.2 billion in This autumn.

That was removed from the one optimistic metric. North American income additionally rose by 13% year-over-year to $105.5 billion, outpacing consensus at $102.9 billion. On the identical time, worldwide income noticed a 17% uptick to $40.2 billion, additionally trumping the Road’s $39 billion forecast. In complete, income reached $170.0 billion for a 13.9% year-over-year enchancment whereas beating the analysts’ name for $166.3 billion.

The outcomes on the different finish of the equation have been additionally spectacular, with working earnings hitting $13.2 billion vs. the Road’s expectation of $10.49 billion and above the guided vary of $7 to $11 billion. To not point out, it utterly obliterated final yr’s results of $2.7 billion.

And whereas the Q1 top-line income steerage between $138 billion and $143.5 billion got here in a contact mild on the midpoint vs. the Road’s forecast of $142 billion, there was an excessive amount of great things on supply for that to bitter proceedings.

The upbeat response from buyers is mirrored within the evaluation of Morgan Stanley analyst Brian Nowak, who acknowledged: “AMZN’s outcomes and information converse to how bettering execution, value self-discipline, and an AWS restoration are resulting in outsized EBIT and free money movement revisions… $24.2bn of AWS income got here in 1% higher than us (rising 13% Y/Y), with the 4Q $155.7bn backlog up 17% ($22.7bn) Q/Q. This could present incremental confidence about ahead progress. The impression of value optimizations continues to decrease, and the tempo of recent offers, initiatives, and present migrations to the cloud is accelerating. We count on these tendencies and rising Generative AI choices to result in a continued acceleration in ’24.”

Conveying his confidence, Nowak charges Amazon shares an Chubby (i.e. Purchase), whereas elevating his worth goal from $185 to $200, making room for one-year returns of ~16% from present ranges. (To observe Nowak’s monitor report, click on right here)

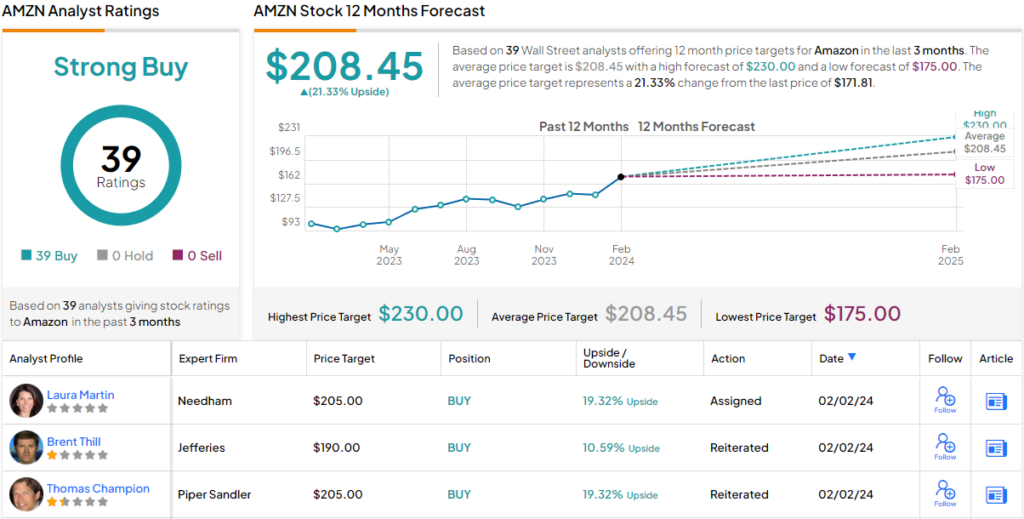

None of Nowak’s colleagues seem to have a problem with that take. Based mostly on Buys solely – 39, in complete – the inventory claims a Sturdy Purchase consensus score. At $208.45, the typical goal implies share appreciation of 21% over the approaching yr. (See Amazon inventory forecast)

Meta

Okay, so each Apple and Amazon reported on Thursday with diverging fortunes, however the headlines have been reserved for the opposite Magnificent Seven identify, which launched its newest quarterly outcomes on the identical time.

Subsequently, META shares surged by 20%, including an enormous $197 billion to its market cap in a single day. The large transfer represents essentially the most vital one-day acquire in inventory market historical past, surpassing the prior report set by Apple and Amazon in 2022. It additionally positioned Meta’s market cap at $1.22 trillion.

Based mostly on such a surge, you’d count on the social media big to be firing on all cylinders, and that certainly was the case in This autumn. The highest-line confirmed $40.11 billion, amounting to a 24.7% improve vs. the identical interval final yr and beating the Road’s forecast by $940 million. The majority of the income was generated by promoting, which reached $38.7 billion, outpacing the analysts’ expectations of $37.8 billion. The corporate additionally reported each day lively customers (DAUs) of two.11 billion, above the two.08 billion anticipated on Wall Road. There was a beat on the bottom-line too, as EPS of $5.33 exceeded the $4.96 consensus estimate.

The outlook was sturdy as nicely. In Q1, Meta anticipates income between $34.5 billion and $37 billion. The Road was solely searching for $33.87 billion. Even higher, Meta initiated a dividend for the primary time in its historical past and elevated its inventory buyback program by $50 billion.

The report drew plaudits from loads of Road specialists, amongst them Morgan Stanley’s Brian Nowak. In reality, the analyst thinks there’s room for additional progress from right here.

“We stay bullish META given its sturdy engagement progress (pushed partially by Reels) and decrease however rising monetization fee of Reels,” Nowak mentioned. “We estimate that Reels remains to be monetizing at 37% the speed of core… with runway to shut that hole over the subsequent 2 years now set to drive ~60%/~70% of the income progress in ’24/’25. Past Reels, META can also be targeted on click-to-message and Retailers adverts (now $2bn annual run fee) to assist create partaking platform experiences… and for advertisers, META is investing in AI-powered instruments to drive efficiency together with the Benefit+ product suite, extra choices for automation, options in Conversions API and extra measurement/reporting capabilities.”

Quantifying his stance, Nowak charges Meta shares an Chubby (i.e., Purchase), whereas boosting his worth goal from $375 to $550. The implication for buyers? Upside of 16% from present ranges.

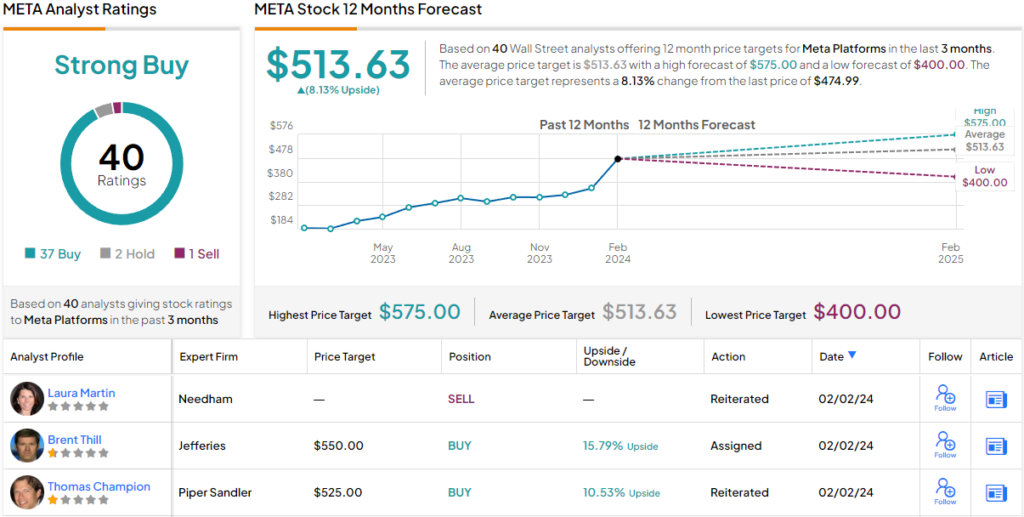

Most on the Road concur; the analyst consensus charges the inventory a Sturdy Purchase, primarily based on 37 Buys, 2 Holds and 1 Promote. The forecast requires 12-month returns of 8%, contemplating the typical goal clocks in at $513.63. (See Meta inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely vital to do your individual evaluation earlier than making any funding.