Costs Rise for the Second Consecutive Month

[ad_1]

Property costs throughout the nation are persevering with their restoration, as worth rose 0.5% in April following a 0.6% rise in March, based on the most recent knowledge from CoreLogic.

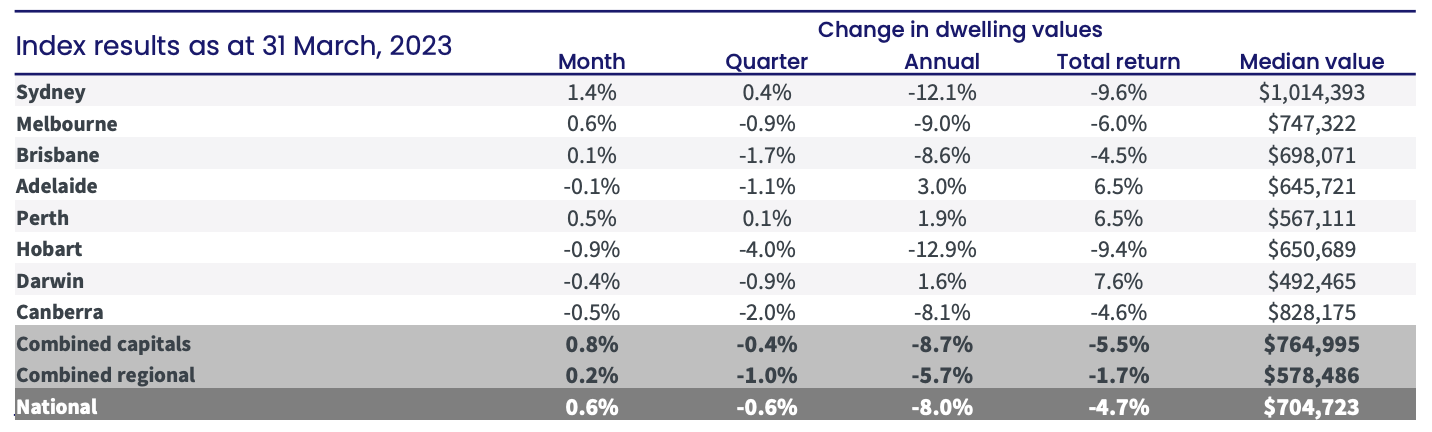

Dwelling costs throughout the nation had dropped 9.1% after the COVID interval growth, however latest indicators recommend the housing market's decline could also be ending. However even with the latest drop in values, the median worth of a capital metropolis dwelling stays 12% or roughly $83,000 increased than it was on the onset of COVID in March 2020.

Main the property value rebound is Sydney, the place costs rose 1.3% in April and dwelling values have been growing every month since February. Sydney values are actually 3% increased than their lowest level in January.

Costs in Brisbane elevated by 0.3%, in Melbourne by 0.1%, in Adelaide by 0.2%, and in Perth by 0.6%. Darwin was the one capital metropolis to expertise a decline, with costs falling by 1.2%. Whereas throughout regional Australia, values additionally rose by 0.1%.

Supply: CoreLogic

CoreLogic’s Analysis Director, Tim Lawless, mentioned that the housing market seems to have reached a turning level.

“Numerous indicators are supporting the constructive shift, akin to housing values stabilizing or rising in most elements of the nation, public sale clearance charges staying barely above the long-term common, improved sentiment, and residential gross sales trending across the earlier five-year common,” Mr Lawless mentioned

Mr Lawless attributes the elevated demand to an increase in immigration that’s reaching report ranges.

“A major enhance in web abroad migration has collided with a scarcity of housing provide,” he mentioned.

Although housing circumstances are wanting extra beneficial, values in most areas stay under their latest cyclical peaks.

Hobart is experiencing the biggest drop from its latest market peak, with a decline of 13%. Sydney dwelling values had seen a 13.8% drop from their market peak to their latest low level, however a 3% enhance in values over the past three months has left the market 11.2% under its latest excessive. Brisbane has seen the third-largest decline, with values remaining 10.7% under their latest peak.

Inventory ranges stay under common

A main issue supporting the housing market has been the restricted provide of inventory which has been a typical theme over the previous few years.

Mr Lawless mentioned that with the circulate of recent listings remaining under common, complete marketed stock is monitoring 21.8% under the earlier five-year common for this time of the yr.

“The circulate of recent listings is very seasonal, sometimes trending decrease by way of winter earlier than rising into spring and early summer time,” Mr Lawless mentioned.

“For the time being it appears like this seasonal pattern is holding true, with the circulate of recent listings as soon as once more falling into winter. This will likely be an necessary pattern to look at.”

“As market circumstances enhance we may see potential distributors turning into extra prepared to check the market and beat the spring rush when competitors amongst distributors is more likely to be extra obvious.”

Rental markets are tight

CoreLogic’s rental index recorded an additional 1.1% enhance throughout the mixed capital cities in April, whereas regional rents noticed a smaller 0.5% rise.

Mr Lawless believes immigration is making life very laborious for tenants all throughout the nation.

“There may be additionally the extra rental demand from abroad migration, particularly college students, which tends to be extra pronounced in inside metropolis areas in addition to precincts near universities and transport hubs which can be sometimes related to increased density types of rental lodging.”

“One other issue taking part in out is a scarcity of recent unit provide. Medium to excessive density dwelling approvals have largely held under common since 2018, setting the scene for a continual undersupply throughout the medium to excessive density sector a number of years from now.”

Outlook

In accordance with Mr Lawless, the Australian housing market appears to have handed by way of a comparatively temporary however extreme downturn.

“The first drivers of this constructive shift look like the bigger than anticipated enhance in web abroad migration, which has generated further housing demand throughout a interval of exceptionally tight rental circumstances and nicely under common ranges of marketed provide,” mentioned Mr Lawless.

He mentioned that whereas the downturn’s finish appears convincing, housing values are unlikely to extend considerably till rates of interest drop, credit score insurance policies are relaxed, or housing-focused stimulus measures are launched, or probably a mixture of those elements.

Mr Lawless mentioned the outlook for housing markets largely rests with the trajectory of rates of interest.

“The timing of a charge reduce stays extremely unsure, nonetheless, as soon as we see charges coming down, that’s once we may see extra sustained momentum collect in housing markets,” he mentioned.

[ad_2]