A Bet on Tesla Stock Is a Bet on the Autonomous Future, Says Analyst Who Rates It a ‘Buy’ – TipRanks Financial Blog

[ad_1]

People are bad drivers, and no human should really be trusted behind the wheel. At least that is the opinion of Canaccord analyst George Gianarikas.

Thing is, there’s a solution to this problem. That would be AVs – autonomous vehicles. Yes, the technology is not quite there yet, and there are plenty of regulatory hurdles to overcome, but nevertheless, autonomy is “well on its way.”

That said, not everyone is as enthusiastic as Gianarikas about that prospect, and that is something the analyst finds hard to understand.

“I honestly don’t get it,” the analyst says. “When I see people texting, smoking, or arguing AND driving, I can’t stop myself from thinking – why do so many people have such a negative reaction to autonomous vehicles?”

“We, for our part – are autonomy uber-bulls,” Gianarikas goes on to say. “Unabashed and unrelenting. We believe AVs are set to increase resource utilization, improve productivity, save lives, and much more. We see vehicle autonomy as one of the highest value-creating technologies to be deployed. Ever.”

And all that brings us to Tesla (NASDAQ:TSLA). Despite delays in the deployment schedule, Gianarikas expects the company will be “leaders in autonomy.”

While Tesla’s viewpoint on AVs is not to everyone’s liking and Gianarikas concedes its camera-only, neural-network approach is not guaranteed to be “THE technology winner long-term,” he thinks the market has “room for multiple solutions.”

The recent Reuters report stating Tesla is scrapping its plans for a low-cost model were greeted with derision by Elon Musk, with the Tesla CEO posting on X that “Reuters is lying (again)” but in a separate subsequent post, he did say the company will unveil its Robotaxi on August 8. Looking ahead to the reveal, Gianarikas says it “sounds like it will likely pay homage to autonomy.” While many questions remain regarding the Robotaxi, Gianarikas is betting on the event being an autonomy day. “Take it or leave it, a bet on Tesla is a bet on an autonomous future. We’ll take it,” he summed up.

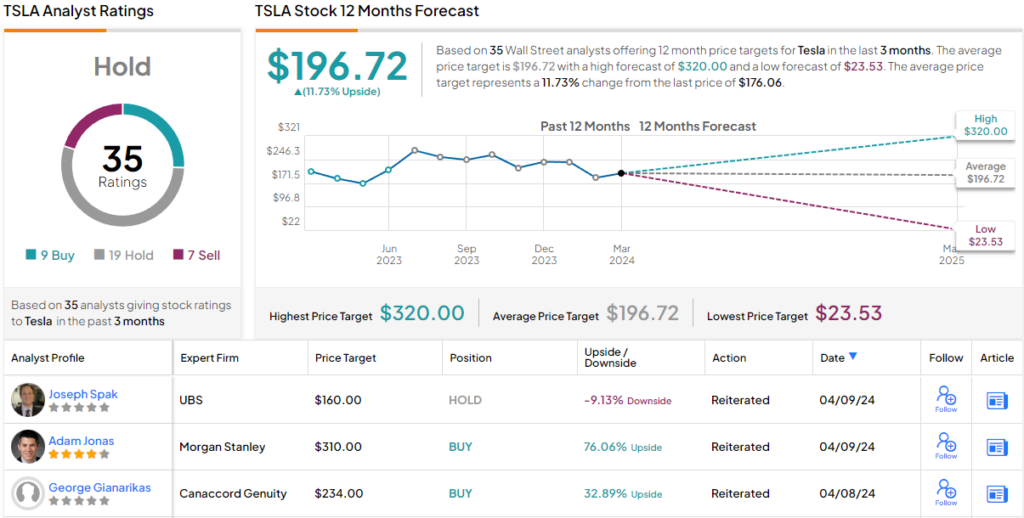

All told, Gianarikas rates TSLA shares a Buy along with a $234 price target. Should the figure be met, investors will be pocketing returns of 33% a year from now. (To watch Gianarikas’s track record, click here)

Overall, 8 other Street analysts remain TSLA bulls with Buy ratings, but with an additional 19 Holds and 7 Sells, the stock claims a Hold consensus rating. Going by the $196.72 average price target, in 12 months time, the stock will be changing hands for ~12% premium. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.