A Nearshoring Beneficiary with Upside Potential – TipRanks Monetary Weblog

[ad_1]

Steelmaking is a cyclical enterprise, however I imagine you can also make extra returns investing in metal firms with a value moat, robust stability sheet, and low valuation. Enter Ternium (NYSE:TX), the main steelmaker in Mexico and a particularly well-run enterprise headed by Italian billionaire Paolo Rocca. With an $8.8 billion working capital place, a $7.8 billion market cap, and a nearshoring tailwind, I’m bullish on Ternium S.A.

Ternium is a Nearshoring Beneficiary

Firms are transferring increasingly of their manufacturing manufacturing to the Americas. With geopolitical tensions hovering in China and the waters surrounding it, firms need to strengthen and diversify their provide chains, and who can blame them? The previous couple of years have been turbulent. So far, Mexico has been a significant beneficiary with its low labor prices. As firms proceed to construct in Mexico, Ternium is there to supply them with metal.

In Ternium’s Q2 earnings name, administration and analysts mentioned this nearshoring at size. Within the auto business alone, administration stated that loads of half producers are transferring into Mexico and that Tesla is constructing a manufacturing facility in Mexico in a few years. A major funding by Kia can be anticipated. That is necessary as a result of auto producers want metal to construct factories, gear, and vehicles. This could create a constant stream of earnings for Ternium.

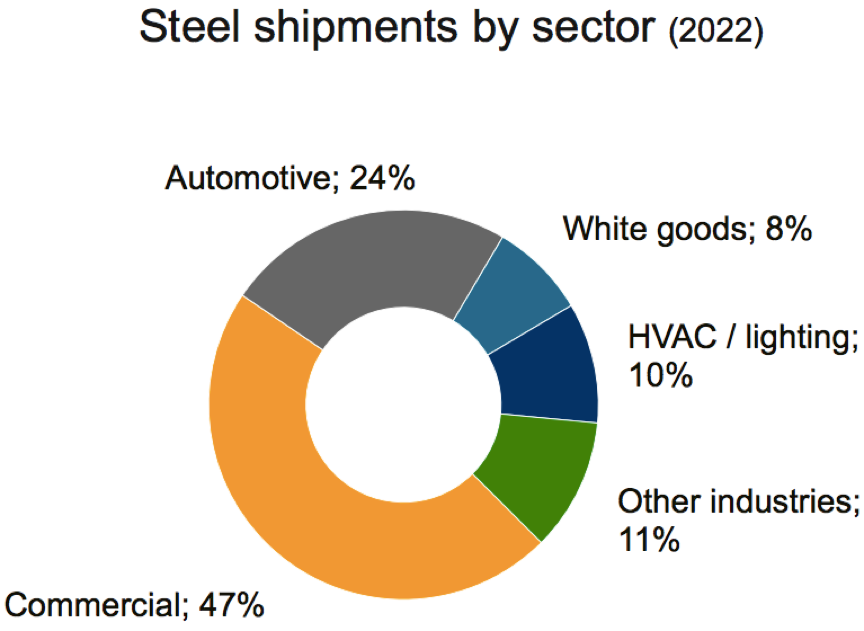

Ternium’s inventory has risen on the again of robust metal costs, however, in my view, the enduring progress of Mexico just isn’t but priced in. Listed below are the top markets for Ternium’s metal shipments:

Supply: Ternium’s August 2023 Investor Presentation

The Industrial section can be issues like infrastructure, building, manufacturing gear, pipelines, oil rigs, and renewable vitality tasks. White items are home equipment like fridges, ovens, and washing machines, whereas HVAC represents heating, air flow, and air con. These are all issues {that a} creating economic system like Mexico will want.

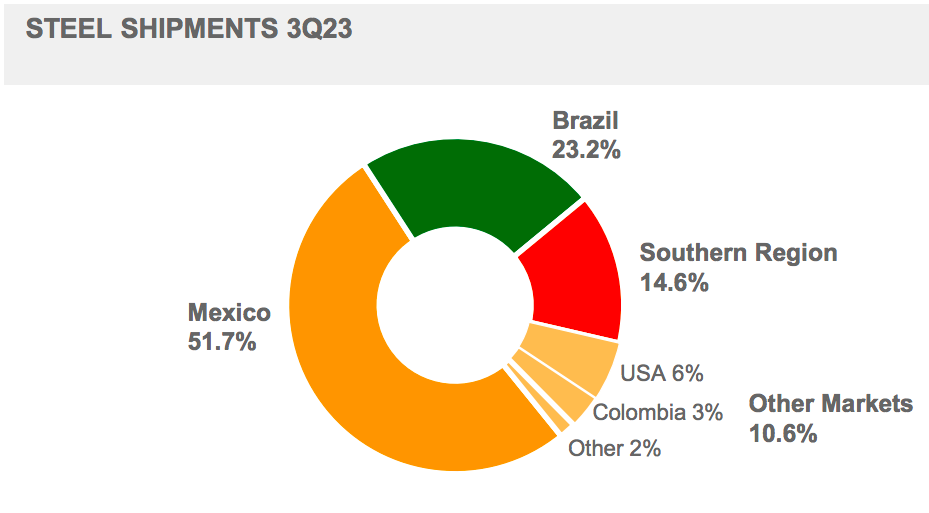

Mexico has simply 1/seventh the GDP per capita of a rustic like the US. So, there’s tons of room for progress. The important thing phrase is “tons,” as in tons of metal. Ternium additionally operates within the following areas:

Supply: Ternium’s August 2023 Investor Presentation

A Competitor Shutters Its Doorways

One other tailwind for Ternium is the shutdown of AHMSA, which closed its operations in late 2022. AHMSA was Mexico’s largest built-in metal plant. One analyst speculated it might take one and a half to 4 years to get it again up and working after a myriad of inside points and a January 2023 chapter.

So why does this matter? As a result of somebody has to fill the manufacturing gap left by AHMSA, and it’s more likely to be Ternium. AHMSA had $2.65 billion in gross sales in 2021. AHMSA’s chapter can be a testomony to Ternium’s moat (aggressive benefit), which we’ll talk about subsequent.

The Price Moat

Ternium claims it’s “vertically built-in, from iron ore mines to service facilities.” So, it could exert management over your complete manufacturing course of, offering itself with a few of its personal iron ore (a key commodity used to make metal) and delivering its completed items to prospects.

With Ternium’s clever administration, environment friendly expertise, sturdy provide chain, strategic positioning, and low prices, the corporate has maintained a few 22.5% gross margin on common via the cycle (from 2007 to 2023). Rivals Gerdau (NYSE:GGB), ArcelorMittal (NYSE:MT), and Nucor Company (NYSE:NUE) had gross margins within the excessive single digits to mid-teens over the identical interval.

Ternium has a big market share in Mexico and Argentina, giving it substantial energy. The corporate may also promote its low-cost items throughout the border into the US.

Uptrending Metal Costs, Robust Earnings

Ternium’s free money stream profile has been fairly robust, except 2017 (on account of a change in working capital). On the web earnings facet, the corporate has averaged $1.02 billion of earnings from 2013 to 2022. Over that time-frame, metal costs have additionally trended larger, rising from $655/ton at first of 2013 to $744/ton on the finish of 2022 and $943/ton now.

Ternium has barely elevated its stage of manufacturing and long-term property over that interval, so I estimate that the corporate’s normalized earnings are round $1.1 billion ($5.60 per share). This means a normalized P/E ratio of 7x versus the present P/E ratio of 24.8x for the S&P 500 (SPX).

Headed into This autumn earnings, Ternium ought to profit from elevated metal costs. HRC metal costs above $750/ton look sustainable, given the big enhance within the cash provide from 2019 to at the moment.

What About Development?

Ternium is on no account a fast-growing firm. However, it does have the tailwinds of nearshoring in Mexico, the closure of a significant competitor’s plant, the development of its personal $2.2 billion plant in Northern Mexico, and rising metal costs.

South America ought to proceed to see its infrastructure and financial output broaden over time. Additionally, over the very long run, the value of metal tends to extend alongside inflation, which is a boon for revenues and income.

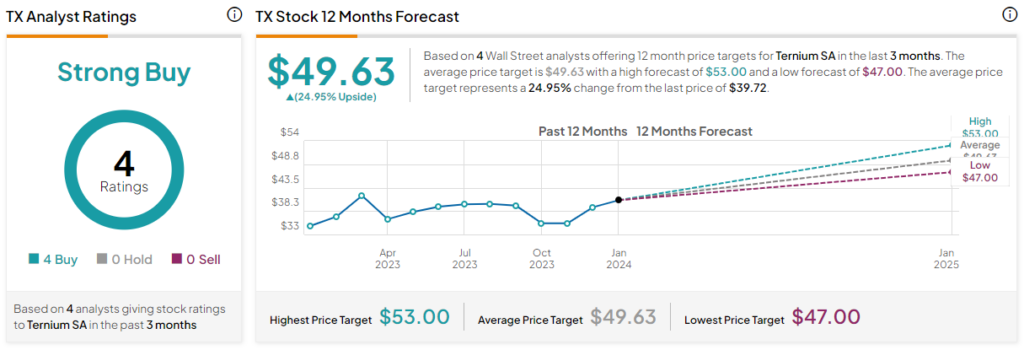

Is TX Inventory a Purchase, In response to Analysts?

After a latest improve from Financial institution of America (NYSE:BAC), all 4 analysts overlaying Ternium now give it a Purchase ranking. The common TX inventory value goal is $49.63, implying upside potential of 24.95%. Analyst value targets vary from a low of $47.00 per share to a excessive of $53.00 per share.

The Backside Line on TX Inventory

Ternium SA inventory definitely seems to be undervalued, given its price moat, robust stability sheet, and nearshoring tailwinds. It might additionally profit within the quick time period as metal costs stay elevated relative to historic ranges and a significant competitor in Mexico closes down.