Strategies to Implement Before the 2025 Estate Planning Twilight

[ad_1]

At Mission Wealth, we believe in proactive planning for our clients. Previously, Director of Estate Strategy, Andrew Kulha wrote about the upcoming changes to the tax code – also known as the tax law sunset. This will occur at the end of 2025, subject to any action by Congress. If you haven’t read that article, you can find it here.

Use It or Lose It, Says IRS

The IRS has said that the expanded exemption is a “Use it or Lose it” deal – if you don’t give away or use more than the post-Sunset exemption amount before the sunset, you will not get to claim that you were trying to use the additional exemption.

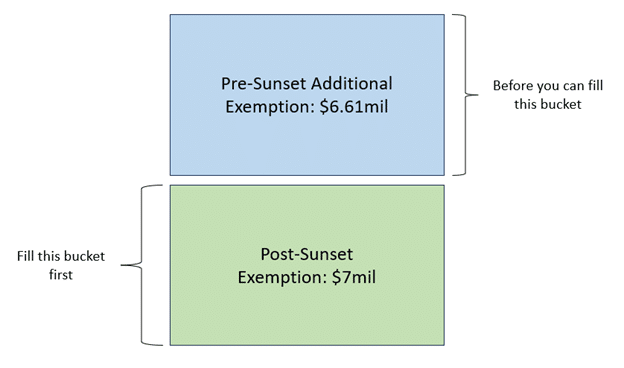

For example, the lifetime unified credit exemption right now in 2024 is $13.61 million per person. We project the exemption to drop to roughly $7 million per person on 1/1/2026. To avail yourself of the additional $6.61 million available right now, you would have to give away at least $1 more than the $7 million, 2026 figure.

Think of your lifetime unified credit exemption to be 2 big buckets sitting on top of one another. The top bucket is the additional exemption we have now, and the bottom bucket is the exemption we’ll revert to after the sunset. The top bucket has a hole in the bottom and can only be filled up and used once you’ve filled the bottom.

How Do I Not Lose It?

There are several strategies to take advantage of the expanded exemption we enjoy today, but the critical components to all of these are that you must have sufficient (and the right kind of) assets to do so. There are positives and minuses to each strategy as well.

Let’s look at a few estate tax deduction strategies:

Gifting

One tried and true strategy is outright gifting. Giving money away is the easiest method to reduce your potential for a taxable estate in the future. Any gifts you give to someone that exceed the annual exclusion begin to use your lifetime unified credit exemption. The annual exclusion is $18,000 per recipient for 2024 and is not an aggregate figure. You can gift $18,000 to as many people as you like, and it has no gift tax implications. As previously stated though, once you gift $18,001, you use $1 of your lifetime unified credit exemption, and a gift tax return must be filed. To take advantage of the expanded exemption, you would therefore need to gift more than $7 million before 12/31/2025 for any additional gifting to break into the current expanded exemption.

There are two drawbacks to outright gifting. The first is that you give up any control over those assets. The second is that your recipients also receive your cost basis in those assets. Certain assets receive a step up in basis at death, meaning future capital gains may be minimized if an asset is inherited rather than received via a gift.

Generic Irrevocable Trusts

For those who may not wish to give up full control over their assets yet, coupling gifting with an irrevocable trust structure can solve some of those concerns. With an irrevocable trust, you can outline who the beneficiaries of the trust will be, but you can remain as the trustee and therefore in control of when and how the beneficiaries receive the gifted funds. You could give them full access at a certain age, give them access only to income generated by the trust, restrict distributions to only the value of their W-2 income each year – the options are limitless.

On the gifting side, this works similarly to outright gifting. Every dollar you give to the trust uses a dollar of your exemption, meaning you would need to gift more than the post-sunset exemption amount to break into your expanded exemption.

However, just like with outright gifting, there are drawbacks to this structure. The step up in basis would not occur at your death. And just like with outright gifting, you lose access to the gifted assets.

Additionally, trusts have their own set of income tax brackets and generally owe tax on any income that is not distributed each year. The trust income tax brackets are compressed compared to individual tax brackets. A trust reaches the maximum 37% bracket after only $14,451 of income, while a single filer in 2024 has just broken into the 12% bracket with a similar amount of taxable income.

Complex Irrevocable Trusts – SLATs

There’s more to the irrevocable trust world than just giving away assets to a trust and that being it. There are a multitude of different trust options out there, some that allow for continued asset usage, some that have a charitable component, and others with provisions around income tax planning to preserve the trust principal.

We’ll focus on one type of trust that is an option that we’ve had many discussions about with married couples over the past few years – the Spousal Lifetime Access Trust (SLAT).

When the lifetime unified credit exemption was significantly lower – think the Bush Sr. and Clinton years – almost all estate plans included an A/B Trust or Credit Shelter trust set up at the first spouse’s death. The surviving spouse continued to have use of the assets, but the Credit Shelter trust could grow outside of the spouse’s estate and was not subject to estate tax once the survivor passed.

A SLAT is a similar structure, but we pull that split forward in time instead of waiting for death. One spouse, the donor spouse, creates an irrevocable trust for the benefit of the other spouse, the beneficiary spouse. The trust is set up to last for the lifetime of the beneficiary spouse. The beneficiary spouse has the right to pull income and principal from that trust and use it for just about anything. Once the beneficiary spouse passes, the trust assets are passed to the next beneficiaries, who are typically the children. Any appreciation that’s occurred within the trust is not considered part of the taxable estate, potentially sheltering significant amounts of wealth that would otherwise be taxed. The benefit to the donor spouse is that they continue to have indirect access to the assets that went into the trust.

There are drawbacks and risks to this structure as well. The primary risks are if the couple gets divorced, the SLAT assets continue with the beneficiary spouse, or the beneficiary spouse passes away before the donor spouse. There are ways to mitigate these risks, but it is important to understand the risks before committing to a major trust and gifting program. You do lose out on the step-up basis on all assets in the trust at death. You also can’t use certain assets to fund these trusts – the primary home and retirement account assets are generally the largest assets that can’t be used, but there are others.

Act Before 2025

The change in tax laws is coming, and the exemption is set to be cut in half. To take advantage of the expanded exemption, you must move more than the post-sunset exemption amount to start using the expanded portion. To summarize, the main ways for individuals with the right set of circumstances to take advantage of the opportunities today are:

- Outright Gifting

- Generic Irrevocable Trusts

- Complex Irrevocable Trusts

Even for those who may not be able to use the expanded exemption today, there are reasons to explore estate tax mitigation and transfers. The power of compounding doesn’t just apply to our long-term asset growth – there can be a significant change for an estate’s taxation with transfers now of assets that have a long runway and a high appreciation potential.

Please consult with a Mission Wealth financial advisor if you have any additional questions or are interested in Mission Wealth’s Estate Planning services.

[ad_2]