Which Big Tech Stock Is the Better Buy? – TipRanks Financial Blog

[ad_1]

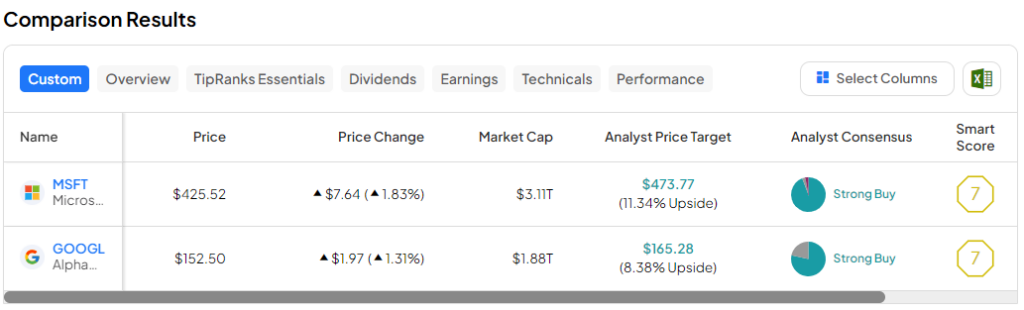

In this piece, I evaluated two big tech stocks, Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL), using TipRanks’ comparison tool below to see which is better. A closer look suggests long-term bullish views for both, although a near-term winner emerges upon careful consideration.

Neither company really needs much of an introduction. Of course, Microsoft is a technology company that offers a variety of software, services, devices, and other technologies to consumers and business users. Alphabet is the parent company of search giant Google, offering apps and content via Google Play, video-streaming services through YouTube, and devices like Chromebooks, smartphones, and smart-home products.

Shares of Microsoft are up 13.4% year-to-date and 47% over the last year, while Alphabet stock has gained 9.2% year-to-date and 40.7% over the last year.

With both companies being essential staples of Big Tech, their nearly identical performances make total sense. Both have received a boost from artificial intelligence (AI), but a closer look at each company’s AI progress and revenue mix identifies a clear winner from this pairing.

Microsoft (NASDAQ:MSFT)

At a P/E of 38.6x, Microsoft is trading at a significant premium to Alphabet. Its forward P/E of 34.5 is also reasonable, suggesting earnings will rise in the future, as would be expected for a behemoth like Microsoft. The company’s steady progress in AI and long-term share-price appreciation call for a long-term bullish view.

First, Microsoft shares have soared 268% over the last five years and 1,147% over the last 10, trouncing Alphabet’s still-tremendous long-term appreciation (156% and 456%, respectively). More recently, the company has been putting up strong results across nearly all divisions.

For example, Microsoft’s most recent earnings report revealed an 18% year-over-year increase in revenue, including a 20% increase in the Intelligent Cloud division and a 30% increase in Azure (cloud computing) revenue. Revenue from the More Personal Computing division rose 19%, while Productivity and Business Processes revenue increased 13%. The one area of softness was Search and Advertising revenue, which grew only 8%.

This broad-based growth demonstrates that essentially every part of Microsoft is growing, which is somewhat unusual among Big Tech companies because many have numerous irons in the fire, some of which remain unprofitable for a while.

Additionally, Microsoft’s investment in OpenAI, the creator of the ChatGPT chatbot, has paid off in a big way and should continue to pay dividends as the company continues to grow in the coming years. The successful integration of AI into its Azure platform is only the first step, and the success is clear in the 30% boost to Azure’s revenue.

What Is the Price Target for MSFT Stock?

Microsoft has a Strong Buy consensus rating based on 33 Buys, one Hold, and one Sell rating assigned over the last three months. At $473.77, the average Microsoft stock price target implies upside potential of 11.3%.

Alphabet (NASDAQ:GOOGL)

At a P/E of 28.2x and a forward P/E of 26x, Alphabet is trading at a steep discount to Microsoft. Unfortunately, the company’s generative AI bot Gemini flopped right out of the gate, so it will take more time for Alphabet to get up to speed there. Additionally, search is becoming an area of concern due to AI. However, Alphabet won’t be going anywhere, so a long-term bullish view seems appropriate.

First, the latest earnings report raised some questions about the future of search, which has long been Alphabet’s bread and butter. Alphabet holds a more-than 90% share of the global search market, so if AI continues to take a bite out of search, the company could face some setbacks there.

While GOOGL’s total revenue rose 13.5% year-over-year in the fourth quarter to $86.3 billion, its ad revenue rose only 11%, coming up slightly short of expectations at $65.5 billion. It would be a good idea to monitor Alphabet’s Search and ad revenue going forward to see if this concerning trend continues.

Meanwhile, Google Cloud revenue rose 26% year over year, demonstrating strong growth there. Of course, the Other Bets segment continued to lose money, although it still notched a sizable revenue increase to $657 million from $226 million in the year-ago quarter.

Additionally, Alphabet faced a major setback with its Bard chatbot (now named Gemini), which flopped at launch, sharing inaccurate information in a promotional video. Later, Alphabet’s Gemini chatbot caught fire for showing historically inaccurate images and refusing to honor requests to show white people.

Thus, Alphabet will be playing catch-up in the AI game, but that doesn’t mean the company will lose out entirely. It just needs more time to perfect its technology. In the meantime, there may be a buying opportunity in Alphabet stock.

What Is the Price Target for GOOGL Stock?

Alphabet has a Strong Buy consensus rating based on 29 Buys, eight Holds, and zero Sell ratings assigned over the last three months. At $165.28, the average Alphabet stock price target implies upside potential of 8.4%.

Conclusion: Long-Term Bullish on MSFT and GOOGL

Both Alphabet and Microsoft look like excellent buy-and-hold positions for the long term because investors can’t go wrong with either stock. However, despite Microsoft’s higher multiples, it’s the clear near-term winner here.

GOOGL stock offers a buying opportunity based on valuation. However, the concerns about Search revenue, which constitutes the lion’s share of Alphabet’s revenue, could present a temporary setback for the company. Adding the AI issues into the mix only deepens the potential near-term concerns for Alphabet, although they are likely only temporary.

Thus, Microsoft is the winner of this pairing because the chances for near-term growth and share-price appreciation seem greater due to its broad-based revenue growth versus Alphabet’s revenue concentration in Search.