What Is the Insurance coverage Worth of Social Safety by Race and Schooling? – Middle for Retirement Analysis

[ad_1]

The temporary’s key findings are:

- The worth of Social Safety’s retirement program to people is commonly measured by evaluating anticipated advantages to payroll taxes.

- However this method ignores this system’s insurance coverage worth, which is bigger for these with extra unsure lifespans.

- The evaluation estimates the insurance coverage worth utilizing a lifecycle mannequin for stylized households by race, schooling, and marital standing.

- Accounting for insurance coverage worth, the outcomes present that this system is considerably extra worthwhile than lifetime taxes for nearly all family varieties.

- Social Safety’s insurance coverage element additionally will increase racial fairness, as a result of lifespans range extra amongst Black people.

Introduction

Social Safety helps Black people and people with low instructional attainment – and due to this fact low earnings – by means of its progressive profit construction. Alternatively, the character of Previous-Age and Survivors Insurance coverage (OASI) as a life annuity inherently will increase anticipated lifetime advantages for people who are likely to stay longer. No matter how these components steadiness out, although, wanting solely at anticipated advantages doesn’t present a full image of Social Safety’s worth. Particularly, it neglects this system’s longevity insurance coverage worth, which favors Black beneficiaries and people with much less schooling as a result of they sometimes face larger uncertainty over how lengthy they’ll stay.

This temporary, primarily based on a latest paper, assesses the worth of OASI, together with this system’s longevity insurance coverage worth, by race, gender, marital standing, and schooling; and it estimates the extent to which incorporating longevity insurance coverage enhances the equalizing impact of OASI.

The dialogue proceeds as follows. The primary part explains why OASI’s worth may differ by race and socioeconomic standing (SES). The second part describes the information and methodology. The third part presents the outcomes. The ultimate part concludes that when the insurance coverage worth of OASI is taken into account, this system is considerably extra worthwhile than the lifetime OASI payroll taxes paid for nearly all family varieties; and OASI will increase racial fairness in retirement safety greater than is recommended by measures of anticipated advantages alone.

Background

OASI advantages are generally evaluated when it comes to cash’s value: the current worth of anticipated advantages relative to contributions. The progressive profit method offers larger charges of return on contributions for teams with decrease lifetime earnings, whereas the longer life expectations of upper earners imply that they’ll obtain advantages for an extended time period.

The cash’s value method, nonetheless, neglects the longevity insurance coverage offered by this system. OASI is a life annuity, so it affords households safety towards outliving their assets, and the worth of this safety will increase with the unpredictability of their lifespan. It seems that OASI longevity insurance coverage is especially necessary for Black households and people with low schooling, as a result of, whereas these teams have decrease common lifespans than others, they face larger uncertainty round their averages. The next evaluation makes use of a structural mannequin to look at each OASI’s insurance coverage worth and its cash’s value by race and SES.

Knowledge and Methodology

The evaluation considers stylized households, differentiated by race (Black or White), SES (low- or high-education), and family composition (single man, single girl, or married couple). This course of leads to 12 stylized households (8 singles by gender, schooling, and race; and 4 {couples} by schooling and race) that differ when it comes to their mortality chances, lifetime earnings, pension revenue, Social Safety advantages, and wealth at age 65.

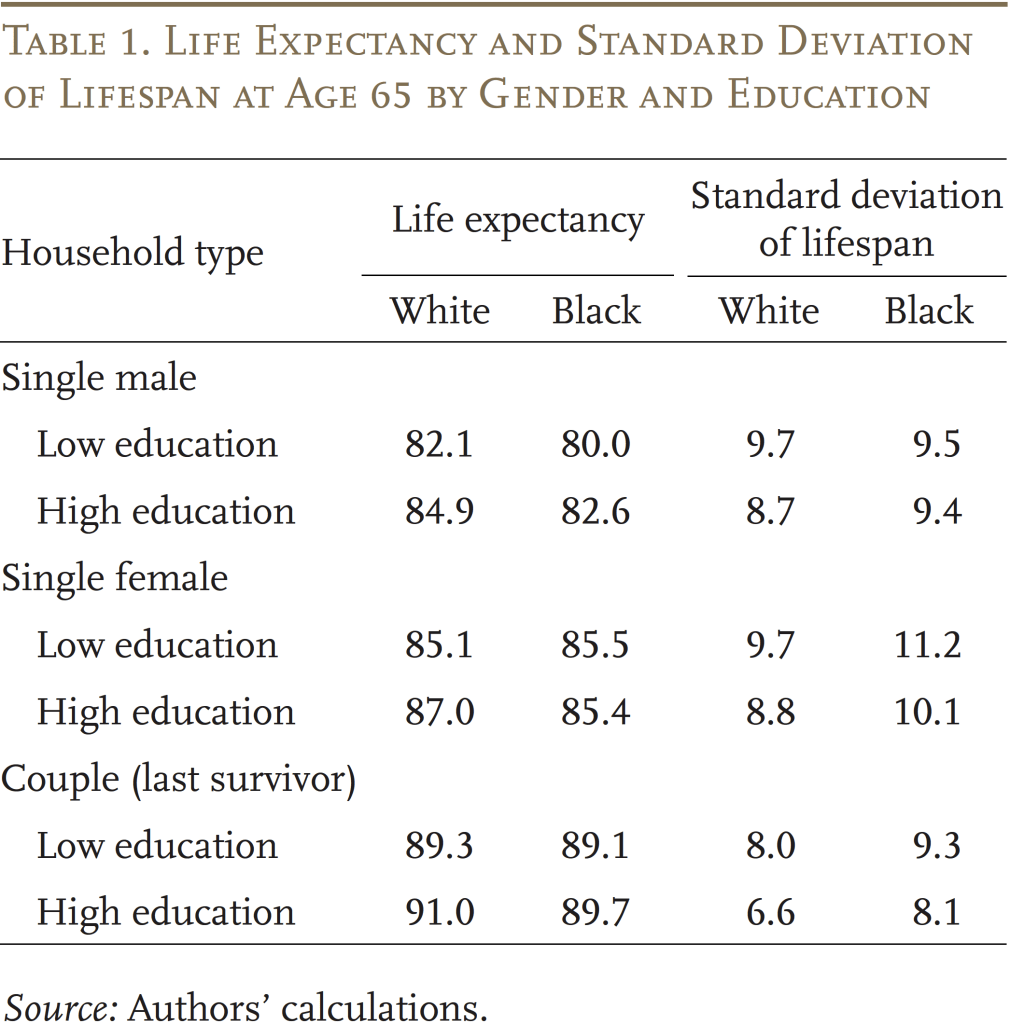

The info used to assemble the stylized households’ OASI advantages, payroll tax contributions, and monetary traits are from the Well being and Retirement Research linked to administrative earnings data. The calculation of mortality charges by race and SES is predicated on mortality information from the Nationwide Very important Statistics System and demographic and SES info from the American Neighborhood Survey. Desk 1 reveals that Black households at age 65 typically have a shorter life expectancy than White ones, whereas in addition they face larger variance round their common lifespans.

The calculation of the cash’s value of OASI is simple: the anticipated current worth of every family’s advantages is said to the lifetime contributions of the family to the OASI program. On this calculation, future advantages are discounted at a 2-percent fee and by the anticipated mortality chances for every family’s demographic traits. This calculation leads to a measure of the anticipated return on every greenback of contributions from a purely monetary perspective, neglecting any insurance coverage worth.

Subsequent, to measure Social Safety’s longevity insurance coverage, the evaluation estimates OASI’s “wealth equivalence.” This measure displays how way more wealth households would should be as properly off in a world with no OASI program as they’re with this system. As a result of households pay into this system throughout their working years, this wealth equivalence can also be associated to lifetime contributions, yielding a ratio of wealth-to-contributions (W-to-C). This ratio signifies how a lot worth, measured in {dollars}, households derive from each greenback they contribute to OASI.

Calculating wealth equivalence requires a lifecycle mannequin. Within the mannequin, households select their consumption optimally to maximise their anticipated lifetime utility, contemplating their out there assets and their survival uncertainty. The wealth equivalence of OASI for every stylized family is estimated in two steps. First, the anticipated lifetime utility at age 65 for the family is calculated with OASI advantages; second, the calculation is repeated in a world with out OASI advantages to search out the quantity of further wealth at age 65 the family would should be simply compensated for not having the OASI profit.

Each the W-to-C ratio and the cash’s value calculation measure the lifetime worth of OASI advantages relative to the corresponding tax funds. Nevertheless, solely the previous accounts for the longevity insurance coverage worth of OASI and is, due to this fact, anticipated to be larger than the latter. Thus, evaluating these two measures sheds mild on the extent to which neglecting longevity insurance coverage underestimates the worth of OASI to numerous kinds of households.

Outcomes

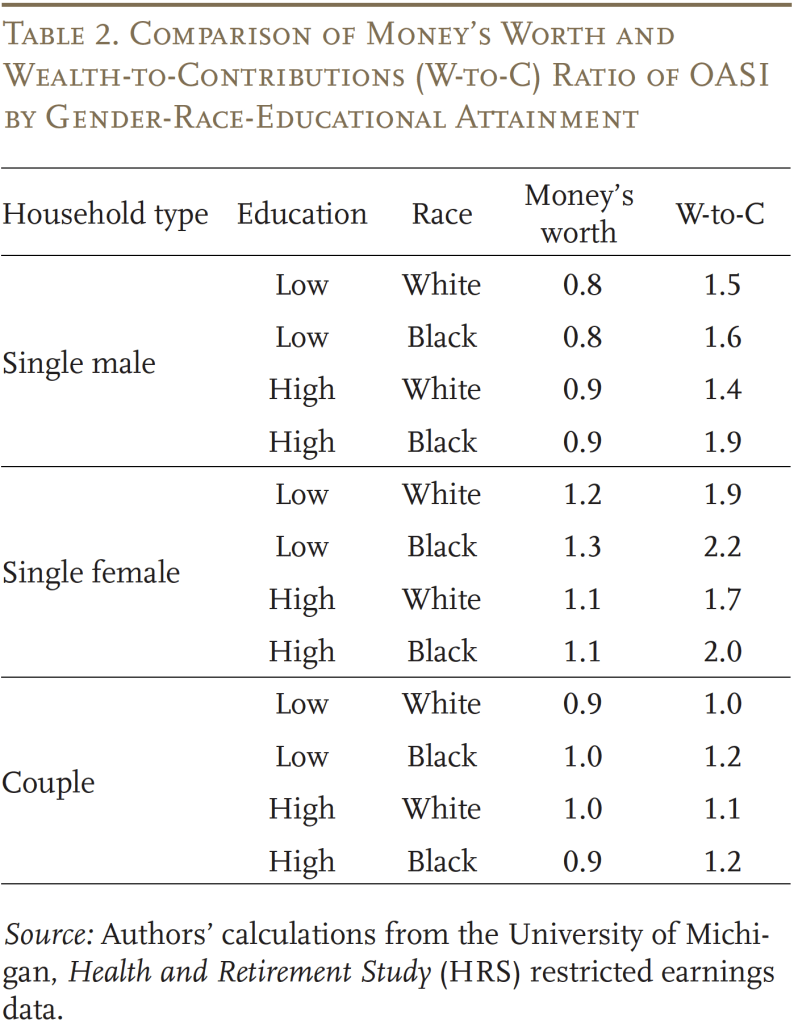

Desk 2 reveals the cash’s value and the W-to-C ratio of OASI for the stylized households. Because the OASI program is meant to be actuarially balanced for the final inhabitants, the cash’s value ratios for the stylized households range round 1. Cash’s value additionally tends to be larger for girls than males, reflecting each their decrease earnings (which will increase the return on contributions as a result of progressivity of advantages) and their longer life expectancy, which suggests they’ll obtain advantages for extra years. In distinction, the patterns by race and schooling are extra blended: on the one hand, Black and lower-education households profit from progressivity on account of their decrease earnings. Alternatively, these households even have decrease life expectations, offsetting the progressivity to some extent.

In distinction to cash’s value, the W-to-C ratio is strictly bigger than 1 for nearly all households. The truth that W-to-C is larger than 1 implies that almost all households, no matter race, gender, schooling, or family composition, want a world wherein OASI exists to at least one wherein it doesn’t. Furthermore, on the margin, nearly all households ought to be prepared to pay somewhat extra into the system if essential to protect its profit ranges. Moreover, as anticipated, the W-to-C ratios are larger than cash’s value for all family varieties, implying households worth longevity insurance coverage.

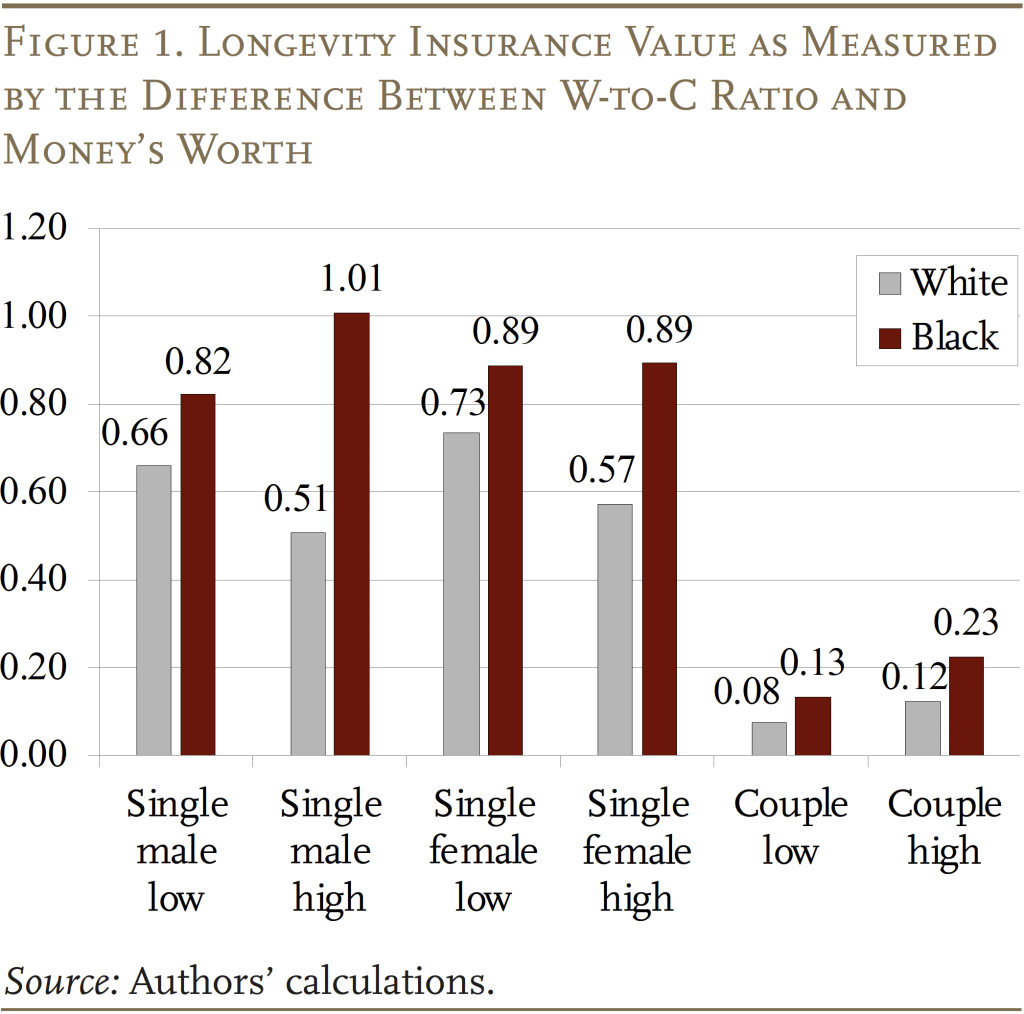

The distinction between the W-to-C ratio and the cash’s value ratio serves as an approximate measure of the longevity insurance coverage worth of OASI. This worth is very massive for singles (for all singles mixed, it’s value about 80 % of complete payroll tax paid on common; see Determine 1). In distinction, {couples} have significantly decrease W-to-C ratios which indicate average longevity insurance coverage values (value 10 to twenty % of complete payroll tax paid). This consequence displays the truth that a considerable portion of the longevity threat could be self-insured between members of the family who allow different members of the family to obtain their wealth after demise.

The outcomes additionally present that Black households derive extra insurance coverage worth from OASI than White ones inside every family type-education group, per the truth that Black households face larger longevity threat. This consequence means that OASI is an much more necessary consider rising fairness in retirement safety throughout racial teams than is recommended by the cash’s value of OASI.

Conclusion

The worth of OASI for various racial and SES teams is usually examined primarily based on this system’s cash’s value, however this method neglects its longevity insurance coverage worth, which is bigger when the dispersion of longevity is larger. To calculate how the worth of OASI differs throughout racial and SES teams incorporating this system’s longevity insurance coverage worth, this examine calculates the wealth equivalence of OASI advantages utilizing a lifecycle mannequin for stylized households that differ by race, instructional attainment, and marital standing.

The outcomes present that the wealth equivalence of OASI is no less than as nice because the lifetime OASI payroll taxes paid for nearly all family varieties, no matter race, gender, schooling, or family composition. This discovering implies households typically want a world wherein OASI exists to at least one wherein it doesn’t. Evaluating the wealth equivalence with the cash’s value of OASI means that, as soon as insurance coverage worth is accounted for, OASI will increase racial fairness in retirement safety greater than the cash’s value of OASI advantages suggests.

References

Arapakis, Karolos, Gal Wettstein, and Yimeng Yin. 2023. “What Is the Insurance coverage Worth of Social Safety by Race and Socioeconomic Standing?” Working Paper 2023-14. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Clingman, Michael, Kyle Burkhalter, and Chris Chaplain. 2022. “Inner Actual Charges of Return Beneath the OASDI Program for Hypothetical Staff.” Actuarial Observe 2021.5. Baltimore, MD: U.S. Social Safety Administration, Workplace of the Chief Actuary.

Kotlikoff, Laurence J. and Avia Spivak. 1981. “The Household as an Incomplete Annuities Market.” Journal of Political Financial system 89(2): 372-391.

Leive, Adam A. and Christopher J. Ruhm. 2021. “Schooling Gradients in Life Expectancy by Gender and Race.” Working Paper 28419. Cambridge, MA: Nationwide Bureau of Financial Analysis.

Sanzenbacher, Geoffrey T. and Jorge D. Ramos-Mercado. 2016. “Calculating Anticipated Social Safety Advantages by Race, Schooling, and Claiming Age.” Working Paper 2016-14. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Sasson, Isaac. 2016. “Traits in Life Expectancy and Lifespan Variation by Instructional Attainment: United States 1990-2010.” Demography 53(2): 269-293.

Wettstein, Gal, Alicia H. Munnell, Wenliang Hou, and Nilufer Gok. 2021. “The Worth of Annuities.” Working Paper 2021-5. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.