What Is A Good Savings Account Interest Rate?

[ad_1]

What Is A Good Savings Account Interest Rate?

This question is about savings accounts.

It can be tough to know if you’re getting a good savings account interest rate. Today, the best savings accounts are paying out 5% or more. But these high rates may not last.

Currently, the FDIC says the average savings account interest rate is just 0.47% APY.

Technically, if you’re above the national average of 0.47%, you’re getting a good savings account rate. But let’s be honest: that’s still very low compared to the best rates.

Our rule of thumb is that you should be within 10% of the top rates to consider yourself having a “good” savings account interest rate. Since banks change their rates often, it can be hard to always be the top (and you don’t want to move banks every month).

Your goal, instead, should simply be to find a bank that is consistently at the top of the interest rate list – through good times and bad times.

How To Find A Good Savings Account Interest Rate

How do you find this magical bank that always has a good savings account interest rate? Well, lucky for you, our team here consistently reviews the top banks and we put them in our list here: Best High-Interest Savings Accounts.

These banks offer the top interest rates right now – and we order our list in best rate order. No gimmicks like you see on some websites (example in the screenshot below).

On those lists, you’ll find some lower rates up at the top because they’re sponsored or big advertisers. Sometimes these banks even pay companies to be listed in the top spot. These big banks and companies would rather spend one-time marketing dollars, than to pay you higher interest rates on your money. Keep that in mind – its how they afford to name stadiums!

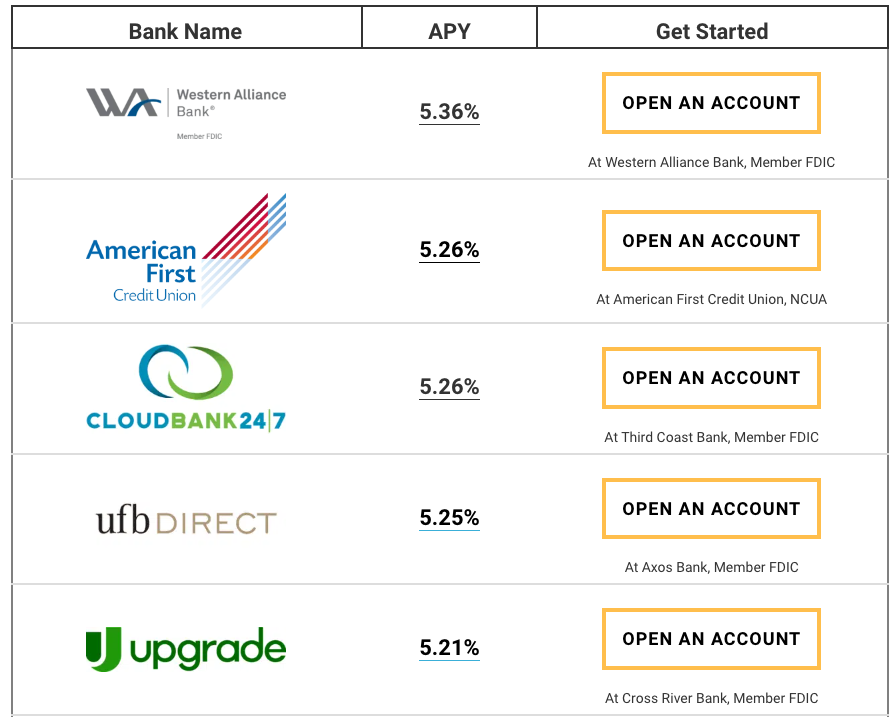

See how this list stacks up:

Screenshot from April 2, 2024

You can compare that list to ours, and see that we do have some of their same banks – just in the proper order. We may be missing some banks, but we strive to keep it ranked by the highest rates, from banks we know and trust:

Screenshot from April 2, 2024

Why does this matter? Every 1% difference in interest on $10,000 is $100 that you’re not getting. That can really add up over time.

What To Watch Out For

Some banks and investment firms have other gimmicks when offering high interest rates on their savings. For example, some banks have minimum requirements to earn the highest rate, or even worse, maximum dollar amounts to earn the highest rates.

For example, most of the high-interest checking accounts cap the account balance that allows you to earn the high interest. A $10,000 cap is very common.

Other products may charge a monthly service fee to be a member in order to earn the highest interest rate. For example, Robinhood offers a great cash savings program, but you must be a member of Robinhood Gold, which costs $5/mo. It might not sound like much – but when you realize that you’re paying that monthly fee AND not even getting the highest interest rate, that doesn’t make sense.

People Also Ask

Which bank gives 7% interest on a savings account?

Currently, there are no banks that earn 7% interest on their savings account.

Where can I get 5% interest on my savings account?

There are over a dozen banks that currently offer 5% interest or more on their savings accounts. Check out this list of 5% savings accounts here.

What is a good amount of interest on a savings account?

A “good” amount of interest is the highest rate you can earn without paying fees or dealing with account minimums.

What is a really good savings rate?

Right now, the best savings account rates are above 5.25%.