The Shifting Landscape of the Housing Market

[ad_1]

Every year, the National Association of REALTORS® delves into the dynamics of the real estate landscape through its comprehensive Profile of Home Buyers and Sellers. The 2023 report unveils intriguing trends that spotlight the evolving nature of the housing market.

Rising Income Dynamics in the Housing Market

For those navigating the competitive realm of real estate, **household incomes** became crucial. Despite escalating home prices and interest rates, successful home buyers experienced a significant uptick in their financial capabilities. Notably, first-time buyers witnessed a staggering $25,000 increase in their household incomes, reflecting the challenges they overcame to enter the market.

Empowered Home Buyers and their Downpayments

As the housing market grapples with limited inventory and multiple offers, successful home buyers showcased their financial prowess through substantial **downpayments**. This surge is fueled by wealthier repeat buyers leveraging housing equity, enabling them to invest more in their next property. The downpayment figures reached a two-decade high, underscoring the resilience of those navigating the competitive landscape.

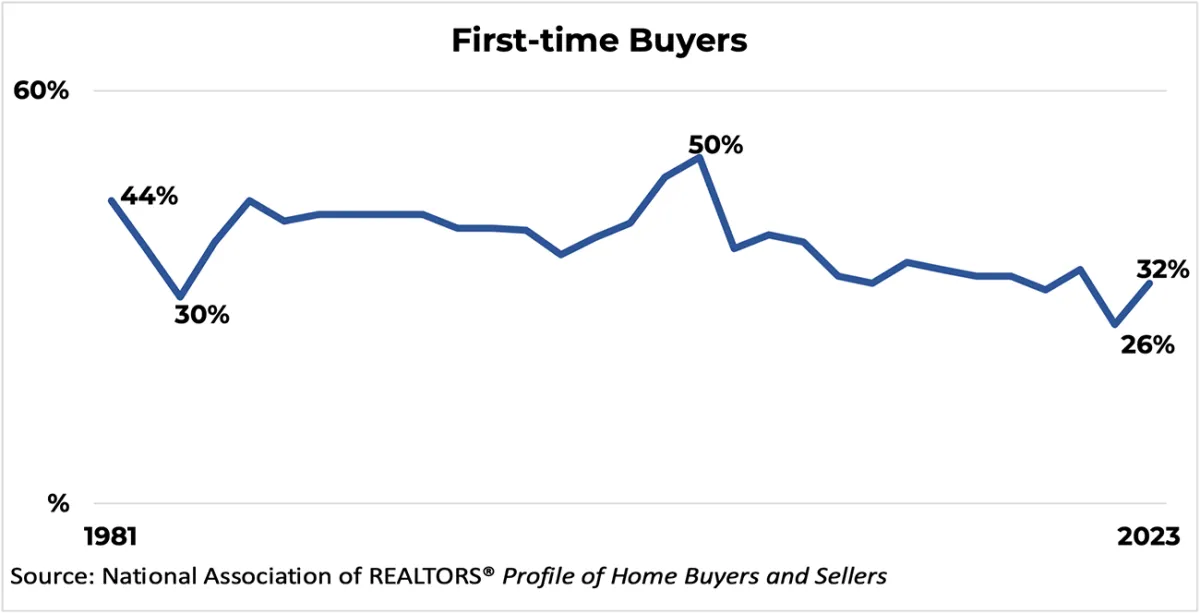

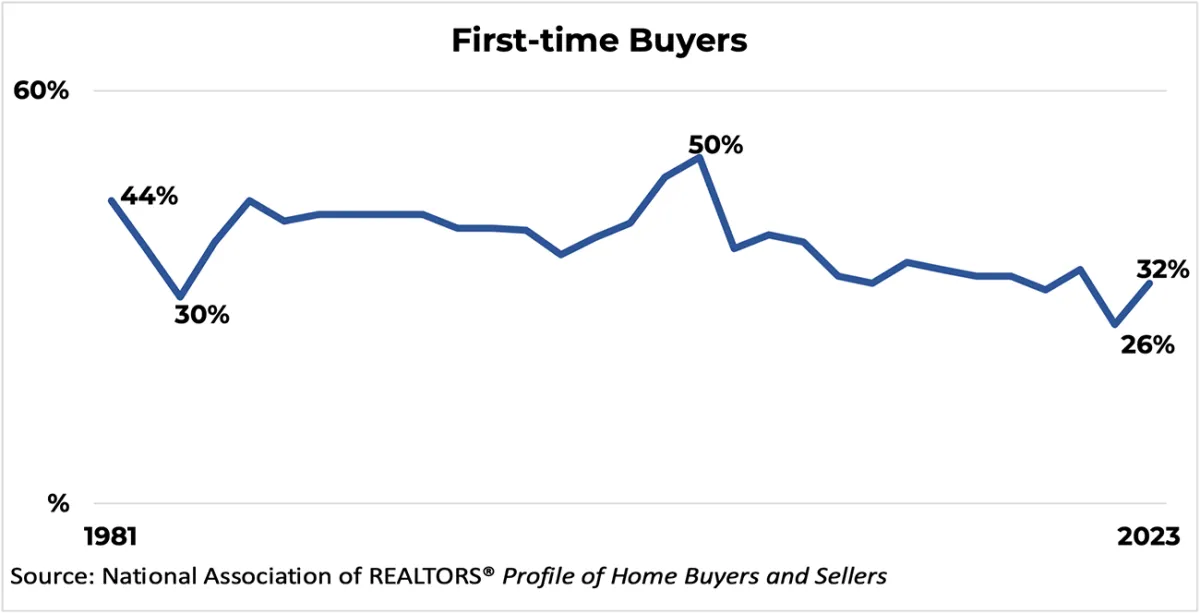

According to the 2022 Profile of Home Buyers and Sellers, the share of first-time home buyers saw an unexpected rise despite challenges such as limited inventory and eroding housing affordability. The historically low share of 26% in 2022 experienced a rebound, hinting at a potential resurgence for first-time buyers. The slight dip in market competition provided an opportunity for these buyers to cautiously re-enter the housing fray.

Changing Demographics: Singles on the Rise

Marriage rates are on a decline, and this shift reverberates in the housing market. The percentage of **singles**, especially single women, has risen to 29%, while married couples have decreased to 59% from a high of 81% in the 1980s. This shift brings forth differences in the preferences of single buyers concerning home size and neighborhood amenities.

Another noteworthy demographic shift is the decreasing share of buyers with children under 18 in their homes, dropping to a historic low of 30%. This change is attributed to older repeat buyers, a decline in birth rates, and delayed family planning. Consequently, this alteration influences neighborhood preferences and the frequency of home moves, aligning with changing family dynamics.

The Surge of Multi-generational Living

A significant trend identified is the rise in **multi-generational buying**, with 14% of home buyers opting for multi-generational homes. This includes housing elderly relatives, adult children over 18, or diverse family compositions for both cost savings and the desire for more spacious living arrangements. Post-COVID-19, families are prioritizing proximity and support, with living together emerging as an effective means to achieve this.

Reversion to Pre-COVID-19 Trends: Distance Moved and Location Choices

After a spike to 50 miles in 2022, the average distance moved seems to be reverting to pre-COVID-19 patterns, settling at a still-elevated 20 miles. Homebuyers are also transitioning back to suburban areas from small towns and rural locations. This shift is attributed to CEOs favoring in-person office time, last year’s buyers seeking proximity to city centers, and the increased purchasing power of buyers this year.

The Integral Role of Real Estate Professionals

The report underscores the importance of **real estate agents and brokers** in the home buying and selling process. An overwhelming 89% of both home buyers and sellers relied on professionals to navigate the complexities of the real estate market. Buyers seek agents who can guide them not only in finding the right home but also in negotiating and understanding the market. Sellers, on the other hand, value agents for their expertise in pricing, marketing, and securing qualified buyers within specified timeframes.

[ad_2]