[ad_1]

Social Safety provides a considerable share, and infrequently the bulk, of a retiree’s revenue. For these older employees delaying signing up for his or her advantages is usually a sensible technique.

For yearly they wait, the delay will improve the dimensions of their month-to-month checks by 7 % or extra.

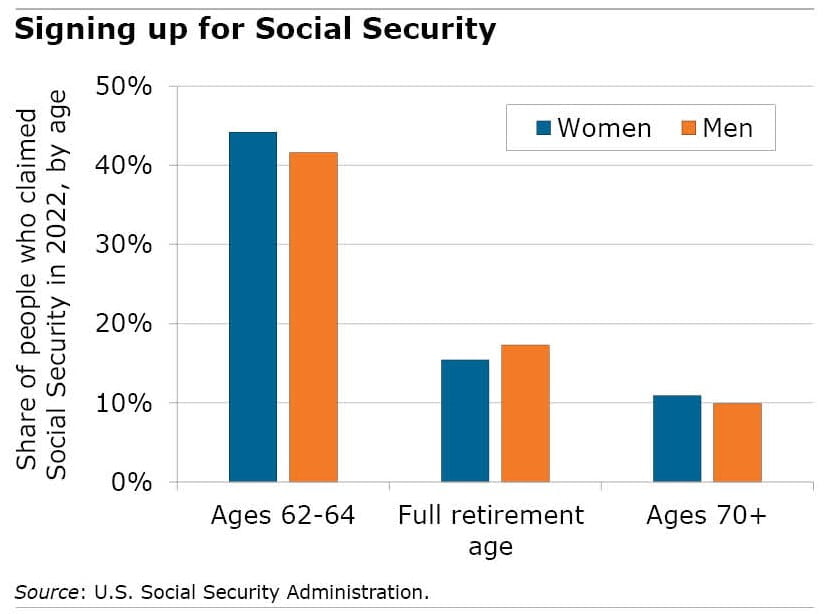

However, as researchers Suzanne Shu and John Payne level out in a newly revealed research, that isn’t what many individuals do. They explored the explanations so many join quickly after they flip 62 and develop into eligible. In addition they might have discovered a approach to current details about advantages that helps employees make the smarter selection.

Individuals could also be beginning their advantages early for sound monetary causes. In a Nice Recession survival technique, for instance, laid-off child boomers have been claiming their advantages early. However there are additionally psychological causes for prematurely beginning Social Safety even when it doesn’t make monetary sense. That’s what this research investigates.

One purpose is that employees, after years of payroll taxes being deducted from their paychecks, really feel a way of possession about their future advantages – and they’re keen to assert what’s theirs. The people on this research who mentioned in a web-based survey that they intend to begin Social Safety on the sooner facet expressed a powerful feeling of possession, agreeing with the assertion that they had “earned these retirement advantages.”

One other essential purpose individuals join sooner is the pure human aversion to dropping, which this survey gauged by asking the members to decide on what kind of gamble they might be keen to take. They have been thought of to be extra loss averse in the event that they selected a big gamble that will have a excessive likelihood of both a $400 acquire or a $400 loss over the riskier gamble by which they may both win $800 or threat a bigger $600 loss.

One group with the alternative tendency – a willingness to delay advantages – was individuals who predicted they might stay longer. On this case, the reasoning could be that, given the low balances in employees’ 401(ok) accounts, they might be involved about working by means of that supply of revenue shortly in retirement. Missing enough financial savings to get by means of previous age, the bigger verify that comes with delaying Social Safety will assist.

Delaying so long as attainable might be the correct technique for employees who haven’t saved sufficient on their very own. However how one can persuade them? To attempt to affect the choice, the researchers examined a few methods of presenting their future profit data to the employees of their research.

One group noticed a chart that listed how a lot a hypothetical employee might count on in his month-to-month Social Safety verify, starting from $1,339 at age 62 to $2,395 at 70.

A second group’s chart totalled up the lifetime advantages. The retiree who signed up for the $1,339 verify at 62 would accumulate a complete of $353,500 in advantages if he lived to 85. But when he waited till 70, the $2,395 advantages paid each month would add as much as $402,360.

The individuals who noticed the bigger lifetime totals mentioned they might declare their advantages a lot earlier.

The rationale they have been postpone by the bigger quantity might come again to the psychological phenomenon of loss aversion. Seeing that bigger greenback determine apparently heightened their worry of loss.

Maybe seeing the totals made them “extra impatient for receiving it,” the researchers mentioned.

To learn this research by Suzanne Shu and John Payne, see “Social Safety Claiming Intentions: Psychological Possession, Loss Aversion, and Info Shows.”

The analysis reported herein was derived in complete or partially from analysis actions carried out pursuant to a grant from the U.S. Social Safety Administration (SSA) funded as a part of the Retirement and Incapacity Analysis Consortium. The opinions and conclusions expressed are solely these of the authors and don’t signify the opinions or coverage of SSA, any company of the federal authorities, or Boston School. Neither the US Authorities nor any company thereof, nor any of their staff, make any guarantee, specific or implied, or assumes any authorized legal responsibility or accountability for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any particular industrial product, course of or service by commerce title, trademark, producer, or in any other case doesn’t essentially represent or indicate endorsement, advice or favoring by the US Authorities or any company thereof.

[ad_2]