The Easy Guide To Calculate Contribution Margin

[ad_1]

Hello there, fellow finance adventurers! I’m thrilled to be your guide today on our journey to understanding contribution margins. I know, I know, you’re probably picturing me as some Wall Street guru, crunching numbers with a steely gaze. But let me tell you a little secret – it wasn’t always like this.

Once upon a time, I was just like you – staring wide-eyed at financial documents, wondering why they couldn’t just be in plain English. I mean, who even comes up with these terms, right? “Contribution Margin” sounded more like a charity event to me than a financial metric.

But here’s the thing: understanding your contribution margin is like having a secret key to your business’s treasure chest. It unlocks insights into how profitable your products or services are, and can help you make smart decisions about pricing, production, and more.

By the end of this guide, you’ll be chatting about contribution margins like a pro at your next dinner party. Let’s dive in!

Key Takeaways

- In simple terms, the contribution margin is the revenue remaining after subtracting the variable costs that go into producing a product. This remaining revenue is used to cover a company’s fixed costs, and any leftover money contributes to profit.

- The formula for calculating the contribution margin is Contribution Margin = Total Sales – Variable Costs.

Understanding the Basics

Alright, let’s get down to business (literally!). So what on earth is this contribution margin thing? In the simplest terms, the contribution margin is like your business’s report card. It tells you how much money each product or service is contributing to cover your fixed costs and start making a profit.

Imagine you’re running a lemonade stand. Each glass of lemonade you sell is contributing not only to cover the cost of lemons, sugar, and water (those are your variable costs), but also to pay off that fancy lemon squeezer you bought (that’s a fixed cost). The money left over after paying for the lemons, sugar, and water is your contribution margin. It helps you see how many glasses of lemonade you need to sell before you start actually making a profit.

Now, why does this matter? Well, knowing your contribution margin is like having a GPS for your business. It shows you if you’re on the right path to profitability or if you need to make some adjustments — maybe raise the price of your lemonade, or find a cheaper supplier for lemons.

The Math Behind Contribution Margin

So, now that we’ve got our adventure hats on, let’s delve into the heart of the matter. Don’t worry, I can already see some of you breaking into a cold sweat at the thought of math. But remember, this isn’t like that dreaded high school algebra test. It’s more like baking a cake – just follow the recipe, and you’ll do fine!

Let’s break down the formula for contribution margin: it’s as simple as Sales Revenue minus Variable Costs.

Now, before you panic, let’s decode these terms. ‘Sales Revenue’ is just a fancy word for the total amount of money your business makes from selling its products or services. Think of it as the total cash you’d have if you sold every single glass of that delicious lemonade at your stand.

On the other hand, ‘Variable Costs’ are those pesky expenses that change depending on how many products you sell. In our lemonade stand scenario, these would be the costs of lemons, sugar, and water. The more glasses of lemonade you sell, the more lemons, sugar, and water you’ll need, right?

So, when you subtract your variable costs (lemons, sugar, and water) from your revenue (money from selling lemonade), you get your contribution margin. This is the money you’re left with to cover any fixed expenses (like that fancy lemon squeezer) and then start making a profit.

Step-by-Step Guide to Calculating Contribution Margin

Alright, my fellow finance adventurers, it’s time to roll up our sleeves and dive into the nitty-gritty of calculating contribution margins. Don’t worry, I’ll be right by your side, guiding you through each step. Let’s create a fictitious business scenario to make things more relatable. Meet Bob, the proud owner of “Bob’s Brilliant Bagels.”

Make sure to download our free Excel template for contribution margin to follow along:

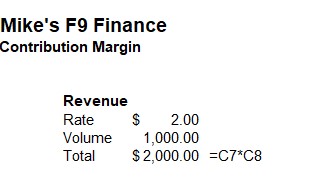

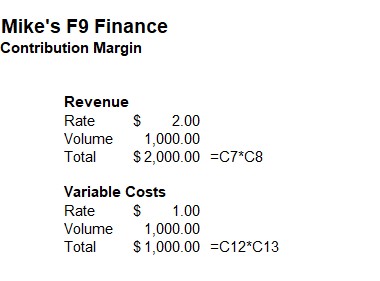

Step 1: Calculate Revenue

First off, let’s figure out Bob’s total revenue. Bob sells each bagel for $2 and he’s sold a whopping 1000 bagels this month. So, his total revenue is $2 x 1000 = $2000. Wow, go Bob! And look at you, already crunching numbers like a pro!

Step 2: Determine Variable Costs

Next, we need to figure out Bob’s variable costs. These are the costs that change depending on how many bagels Bob bakes. For simplicity’s sake, let’s say Bob spends $1 on ingredients for each bagel. So, his total variable costs for 1000 bagels would be $1 x 1000 = $1000.

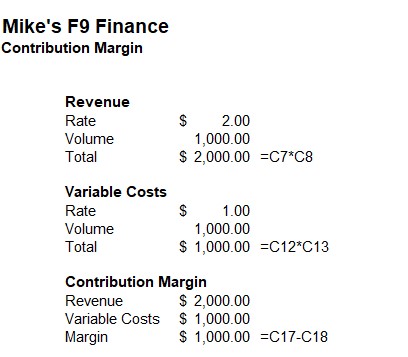

Step 3: Subtract Variable Costs from Revenue

Now comes the magic moment. We subtract Bob’s variable costs ($1000) from his total revenue ($2000). Drumroll, please… Bob’s contribution margin is $2000 – $1000 = $1000!

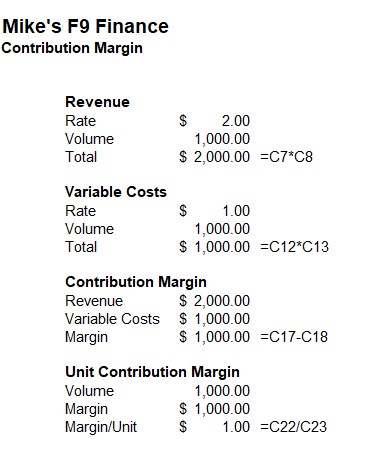

Step 4 (Optional): Calculate Unit Contribution Margin

We can also calculate Bob’s unit contribution margin, which is the contribution margin per bagel. To do this, we divide his total contribution margin ($1000) by the number of bagels sold (1000). So, Bob’s unit contribution margin is $1000 / 1000 = $1.

Interpreting the Results

Okay, my fellow finance gurus, we’re back and ready to make sense of this shiny new number we’ve calculated. Remember Bob’s Brilliant Bagels? We discovered that Bob’s contribution margin was $1000. But what does that really mean for Bob’s business?

Think of the contribution margin as the financial fuel for your business engine. It’s the money that keeps everything running smoothly. In Bob’s case, that $1000 is the cash he has left after covering the costs of ingredients (variable costs) for his bagels. This is the money Bob can use for covering fixed costs, like the rent for his bakery or his snazzy new bagel-making machine.

Now, let’s talk strategy. Contribution margin analysis can help Bob make important business decisions. For example, maybe Bob is thinking about introducing a new type of bagel. By calculating the contribution margin for this new product, Bob can figure out if it’s financially worth it. Or perhaps Bob is considering raising the price of his bagels. He can use his contribution margin to see how this price increase would affect his profitability.

What is a good contribution margin?

A good contribution margin varies by industry and company, but generally a higher contribution margin is better. A positive contribution margin means that revenue is available to cover fixed costs and generate profit. A low or negative contribution margin indicates that a business may not be generating enough revenue to cover its variable costs, which could lead to financial issues in the long run.

Common Mistakes and How to Avoid Them

It’s time to navigate the tricky terrain of common errors people make while calculating or interpreting contribution margins. But here’s the thing: mistakes are just stepping stones on the path to mastery. So, let’s look at these missteps not as blunders, but as opportunities to learn and grow.

Mistake #1: Mixing Up Fixed and Variable Costs

The first pitfall that can trip up even the most diligent of us is confusing fixed costs with variable costs. Remember our friend Bob from earlier? His bagel ingredients were variable costs because they changed based on how many bagels he sold. His rent, on the other hand, stayed the same no matter how many bagels he baked, making it a fixed cost.

Tip: Keep a clear list of your fixed and variable costs. Regularly review and update this list as your business evolves.

Mistake #2: Overlooking Some Variable Costs

Another common mistake is forgetting to include all variable costs in your calculations. Maybe you remembered the cost of your raw materials, but forgot about the packaging? Or perhaps you overlooked the commission you pay for each sale?

Tip: Be thorough. Every penny counts when you’re calculating your contribution margin. Make sure to account for all costs associated with producing and selling your product or service.

Mistake #3: Misinterpreting the Contribution Margin

Lastly, it’s crucial to remember that a high contribution margin doesn’t always mean your business is swimming in profits. Why? Because contribution margin doesn’t take into account fixed costs. You could have a high contribution margin, but if your fixed costs are sky-high, you might still be struggling to turn a profit.

Tip: Always consider your contribution margin in context. Look at it alongside your fixed costs to get a true picture of your business’s profitability.

Quick Recap

Well, my financial comrades, we’ve journeyed through the fascinating world of contribution margins together, and what a ride it’s been! We started with the basics and learned how to calculate contribution margins, using our friend Bob’s Brilliant Bagels as a relatable example.

We then explored how to interpret these results and use them to make informed business decisions. Remember, your contribution margin is like the pulse of your business – it provides valuable insights into the health and potential profitability of your venture.

We also navigated the common pitfalls that can trip us up along the way. But remember, mistakes aren’t failures – they’re stepping stones on our path to becoming finance-savvy entrepreneurs.

I’d love to hear from you. Got any questions about contribution margins? Or maybe you’d like to share your own experiences? Feel free to drop a comment below. Let’s keep this conversation going and continue to build our community of finance adventurers.

Frequently Asked Questions

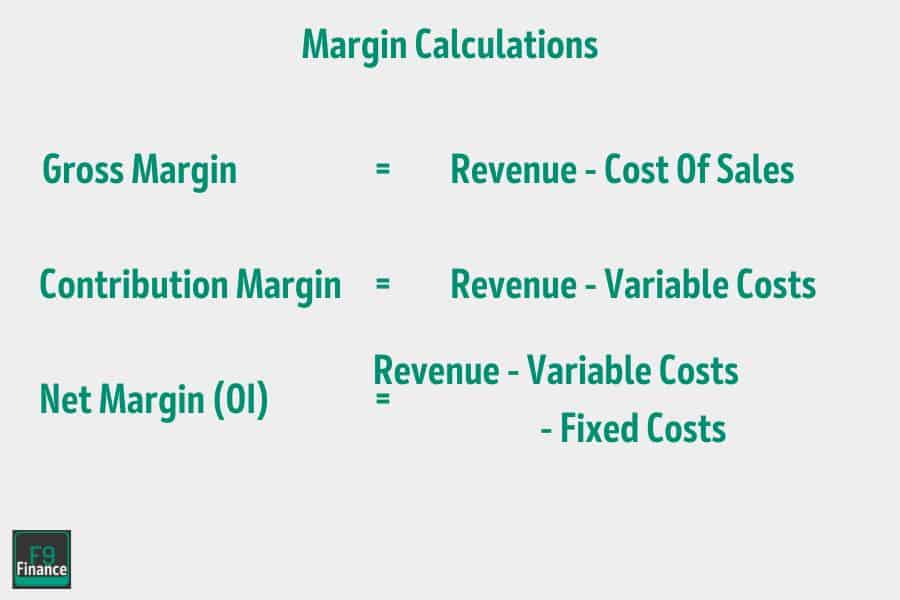

Is contribution margin the same as gross margin?

No, the contribution margin and gross margin are not the same. While both provide valuable information about a company’s profitability, they are calculated differently and serve different purposes. Gross profit margin considers only the cost of goods sold (COGS), whereas the contribution margin takes into account all variable costs.

Is contribution margin the same as net income?

No, contribution margin and net income are not the same. Net income takes into account all expenses, including fixed costs, whereas contribution margin only considers variable costs. Furthermore, net income is a measure of overall profitability while contribution margin is a measure of profitability on a per unit basis.

How do you calculate contribution margin per unit?

The unit contribution margin is calculated by subtracting the variable cost per unit from the sales price per unit.

What is contribution per unit formula?

The formula for contribution per unit is: Contribution Per Unit = Sales Price Per Unit – Variable Cost Per Unit.

What is the contribution margin ratio?

The contribution margin ratio is the percentage of each sale that contributes to fixed costs and profit after variable costs have been paid. It is calculated using the formula: Contribution Margin Ratio = Contribution Margin / Total Sales.

What is CM1 and CM2?

CM1 and CM2 are terms used in cost accounting. CM1 refers to the contribution margin after deducting variable costs, while CM2 refers to the contribution margin after deducting both variable and fixed costs.

Is contribution margin always a percentage?

While the contribution margin is often expressed as a ratio or percentage, it can also be expressed as a total dollar amount or on a per unit basis.

Have any questions? Are there other topics you would like us to cover? Leave a comment below and let us know! Also, remember to subscribe to our Newsletter to receive exclusive financial news in your inbox. Thanks for reading, and happy learning!

![[CO Only] Air Academy Credit Union $225 Checking Bonus [CO Only] Air Academy Credit Union $225 Checking Bonus](https://i3.wp.com/www.doctorofcredit.com/wp-content/uploads/2023/12/air-academy-1.png?w=520&resize=520,292&ssl=1)