Super Bowl 2024 Highlights NFL’s Aging Billionaire Problem

[ad_1]

What You Need to Know

- The NFL was responsible for 93 of the 100 most-watched TV broadcasts last year, and brought in nearly $20 billion in revenue.

- Growth has created succession-planning challenges — and could force the doors open for investors driven by financial imperatives.

- Bringing in institutional owners and private equity investors could help teams raise capital and give minority partners a way to cash out.

When she was nine years old, Virginia McCaskey attended the first NFL playoff game, at Chicago Stadium in December 1932. The Chicago Bears, coached by her father, George “Papa Bear” Halas – the team’s founder and owner — beat the Spartans of Portsmouth, Ohio, by a score of 9-0 to become the then 12-year-old league’s champions.

Moved indoors because of a blizzard, the game, a precursor to the annual championship now known as the Super Bowl, was played in front of about 11,000 people on a 60-yard field using dirt and manure left over from a traveling circus.

One punt hit the stadium’s organist. Two years later, a radio station owner paid $7,952.08 (about $180,000 in today’s dollars) to buy the Spartans and move them to Detroit, where they now play as the Lions.

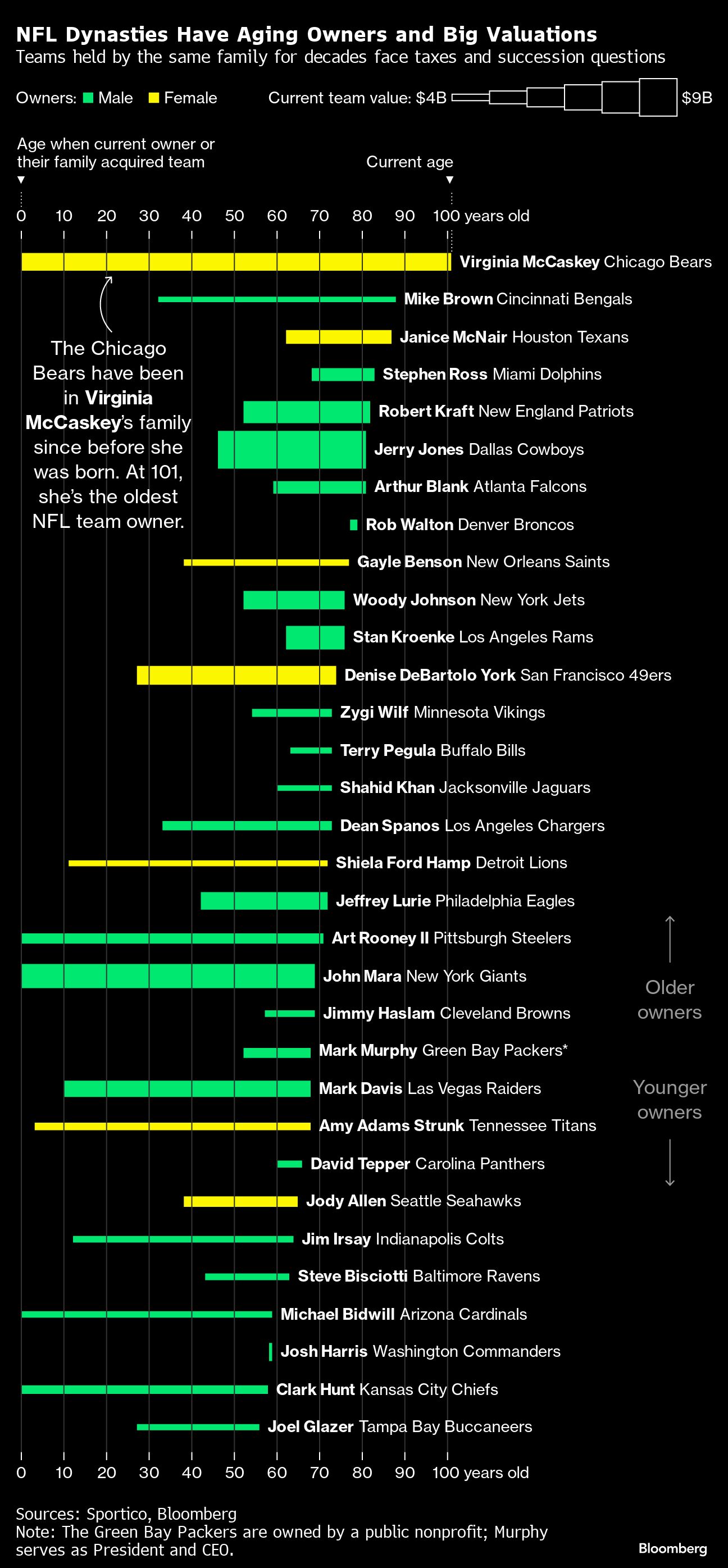

Now, the 101-year-old McCaskey owns the Bears. Before his death in 1983, her dad came up with a plan to pass the team to McCaskey, his only living child, without saddling her with a heavy tax burden.

Halas divided the 49.35% of the Bears he owned into equal shares for his 13 grandchildren using a set of trusts. Voting power over those shares went to McCaskey, who already owned close to 20% of the team. McCaskey has since raised 11 children, with 21 grandchildren, 35 great-grandchildren and four great-great-grandchildren.

The Bears are part of a towering U.S. media colossus. The National Football League was responsible for 93 of the 100 most-watched TV broadcasts last year, and brought in nearly $20 billion in revenue.

McCaskey’s team alone is worth $6 billion, according to the latest estimates by sports-business media outlet Sportico, and across the league average franchise valuations rose 69% between 2020 and 2023.

That growth has helped make NFL team owners rich. But it has also created succession-planning challenges in a league that venerates family and tradition — and could force the doors open for investors driven by financial imperatives.

Time for Private Equity?

In September, the NFL formed a special committee of five owners to consider ending a block on private-equity funds. Other top sports leagues have already lowered the gates for such investors, but the country’s most popular one has remained a holdout.

Clark Hunt, a part owner and chairman of the Kansas City Chiefs — who will face the San Francisco 49ers in Super Bowl LVIII in Las Vegas on Sunday — said in an interview that the league has been watching as other sports dip their toes into private equity.

“I do think it is an avenue that can be helpful from a capital standpoint,” said Hunt, who is also chairman of the NFL’s finance committee, a member of the panel looking into the private-equity rules and a son of Chiefs founder Lamar Hunt.

Clearing a path for private equity is likely to result in a series of deals in short order, with six to eight teams potentially selling minority stakes within a year, according to an executive for one NFL team who declined to be identified because they aren’t authorized to speak publicly on the matter.

Approval of the private equity plan is expected to come at the league’s annual meeting next month, according to people familiar with the process.

The NFL declined to comment for this article.

A History of Family Businesses

For most of its more than 100-year history, the NFL has operated as a closely knit collective of family businesses — and has taken steps to try to keep it that way. Under Commissioner Roger Goodell, who has held his post since 2006, the NFL has repeatedly adjusted its rules to make it easier to pass teams across generations, as average team values climbed to around $5 billion.

“He appreciates the continuity, the history, the skin in the game that the family ownerships provide,” said Marc Ganis, president of the consulting firm Sportscorp Ltd. and confidant to many NFL owners. “You’re making decisions for a much longer horizon if you’re thinking of a team staying in the family with your children.”

Yet the NFL’s prosperity has made maintaining such cohesion a costlier and more complicated proposition, as an aging cohort of owners aims to keep their families in control and avoid exposing heirs to hundreds of millions in tax liabilities.

Forced to Sell

“In our experience, sports team owners rarely if ever sell their teams unless they are forced to for external reasons — which is happening with a few NFL franchises at the moment,” said Andrew Kline, a former St. Louis Rams offensive lineman and now investment banker at Park Lane.

The U.S. taxes inherited assets after an individual exemption of $13.6 million at a rate of 40%, with an additional 40% levy on assets passed to grandchildren. The exemption is expected to be cut nearly in half in 2026, when changes passed in 2017 under President Donald Trump are scheduled to lapse.

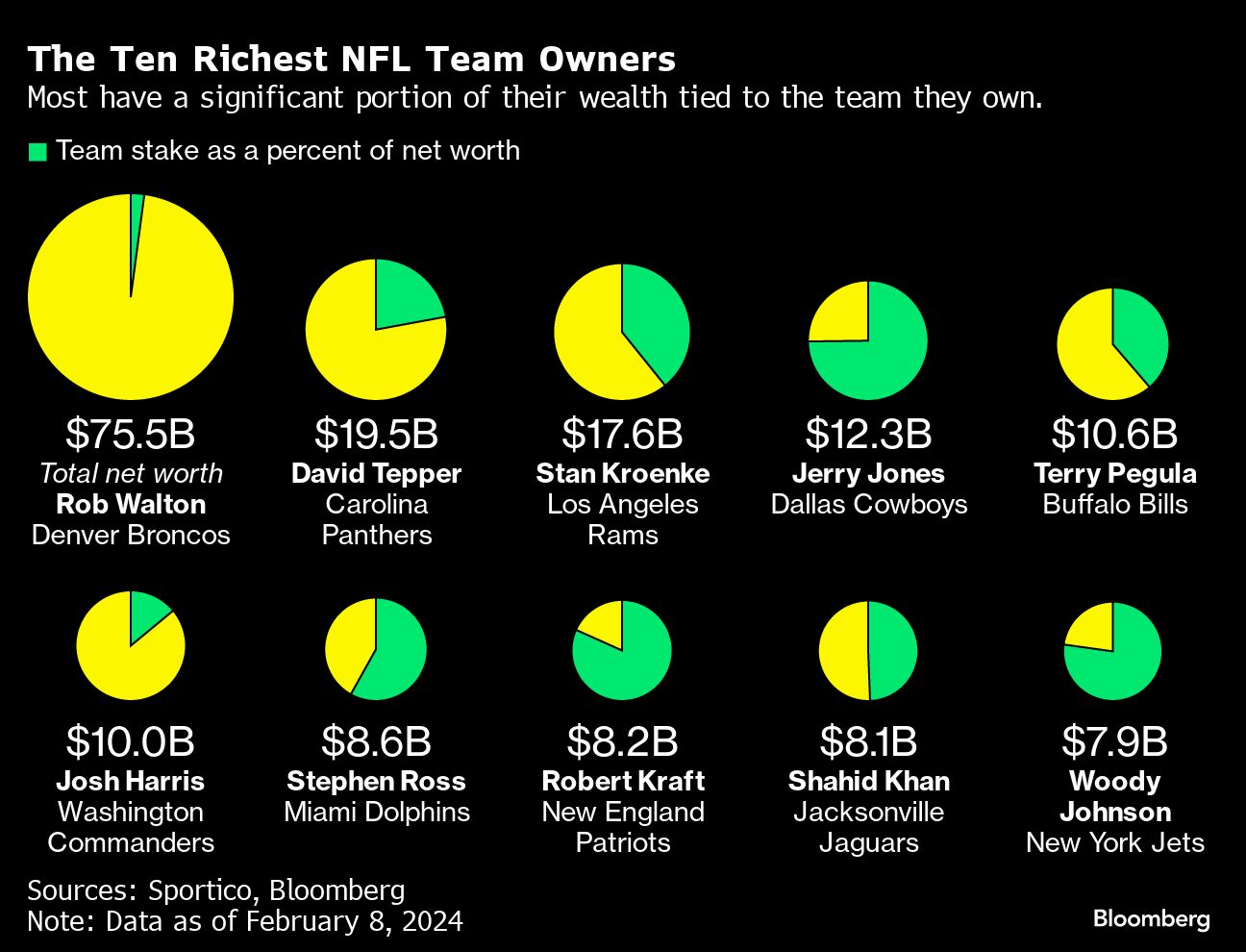

The average age of the league’s 32 principal owners is 72. Seven are 80 or older. Eight teams are still owned by their founding families. Under NFL rules, those families must hold at least 30% of a franchise, led by a single controlling owner. For many of the league’s oldest families, whose wealth is mostly tied up in their teams, a large tax bill could leave them with little choice but to sell.

“When teams were worth $300 million, that was one thing,” said Ganis. “When they are worth $7 or $8 billion, that may be a different story.”

Over the past decade, the NFL has approved four record-breaking franchise sales. In 2014, fracking billionaire Terry Pegula and his wife, Kim, bought the Buffalo Bills from the estate of founding owner Ralph Wilson for a then-record $1.4 billion. That deal was followed four years later by the sale of the Carolina Panthers to hedge fund billionaire David Tepper for $2.3 billion.

Walmart Inc. heir Rob Walton led a group that in 2022 bought the Denver Broncos for $4.65 billion after its controlling Bowlen family couldn’t agree on a succession plan. And last year, private equity billionaire Josh Harris led a group of more than 15 partners who paid over $6 billion for the Washington Commanders.

Meanwhile, other investors have expressed interest in taking a smaller slice of a team. Clearlake Capital co-founders Behdad Eghbali and Jose Feliciano were said last year to be weighing a bid for a stake in the Los Angeles Chargers.

Issues with New Money

Some longstanding owners have been unnerved by the influx of new money.

“There’s old owners who want to stay and are very concerned with franchise values getting out of control,” said Frank Hawkins, a former NFL executive who runs a consulting firm, “and others who are very interested in maximizing their value.”

Other top U.S. leagues have dealt with surging franchise values, which have put buying even part of a team out of reach for all but the ultra-rich, by letting in institutional investors.

Specialized private equity firms have set up funds to buy passive stakes in franchises in the National Basketball Association, Major League Baseball and the National Hockey League.

For the NFL, allowing in such vehicles would help teams raise capital and give minority partners a way to cash out.

“To give an example the cost of building and renovating stadiums continues to rise at a very fast rate,” said Hunt, the Chiefs owner, “and having the ability to access outside capital to help facilitate projects like that would be beneficial.”

Allowing more outside investors would shift the character of the league. Traditionally, limited partners have been friends of ownership, former players, local celebrities and others who see the investment as more than an alternative asset class for their portfolio.

Private equity investors would add to the pressure to push revenues higher — and for teams to change hands at ever-higher prices.