Share Buy Plan and Tranche 2 Placement Raises $1.1 Million

[ad_1]

Overview

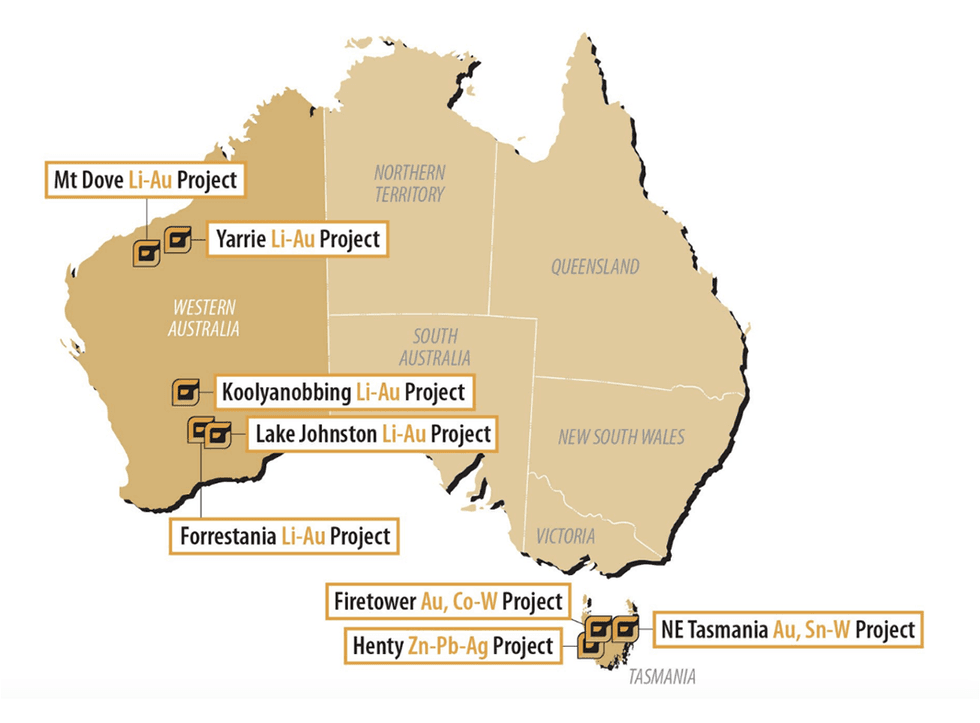

Flynn Gold Restricted (ASX: FG1) is an Australian mineral exploration firm with a portfolio of initiatives in Tasmania and Western Australia.

Tasmania is dwelling to a number of world-renowned deposits and is wealthy in various mineral assets and working mines. The area has established mining districts, glorious infrastructure corresponding to rail and ports, and a talented workforce, with a secure political and regulatory atmosphere. These options are a giant optimistic for the corporate’s initiatives on this area.

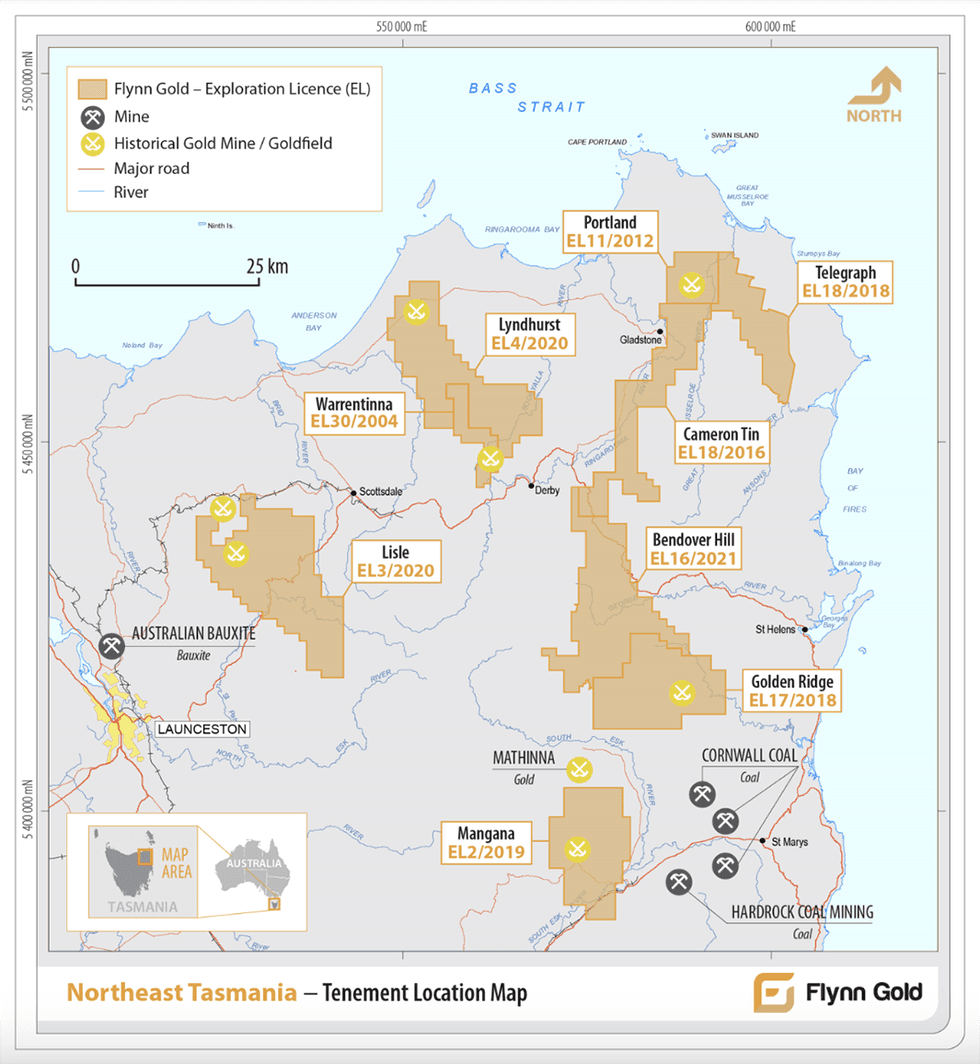

The corporate has 9 100% owned tenements in Northeast Tasmania that are extremely potential for gold and tin/tungsten with three main initiatives — Golden Ridge, Portland and Warrentinna. In Northwest Tasmania, it has the Henty zinc-lead-silver and the Firetower gold and important minerals initiatives.

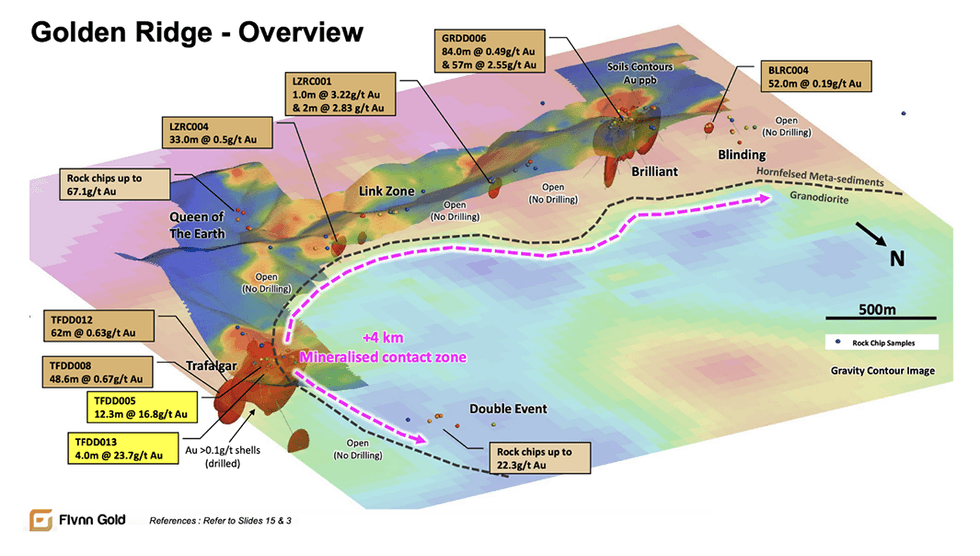

Flynn Gold’s exploration at its Golden Ridge Challenge has targeted on an 8-kilometre-long granodiorite-metasediment contact zone with diamond drilling applications accomplished on the Sensible and Trafalgar prospects, with a number of high-grade gold vein intersections.

Furthermore, the corporate’s first diamond drilling applications at its Warrentinna and Firetower initiatives have been accomplished with assays pending.

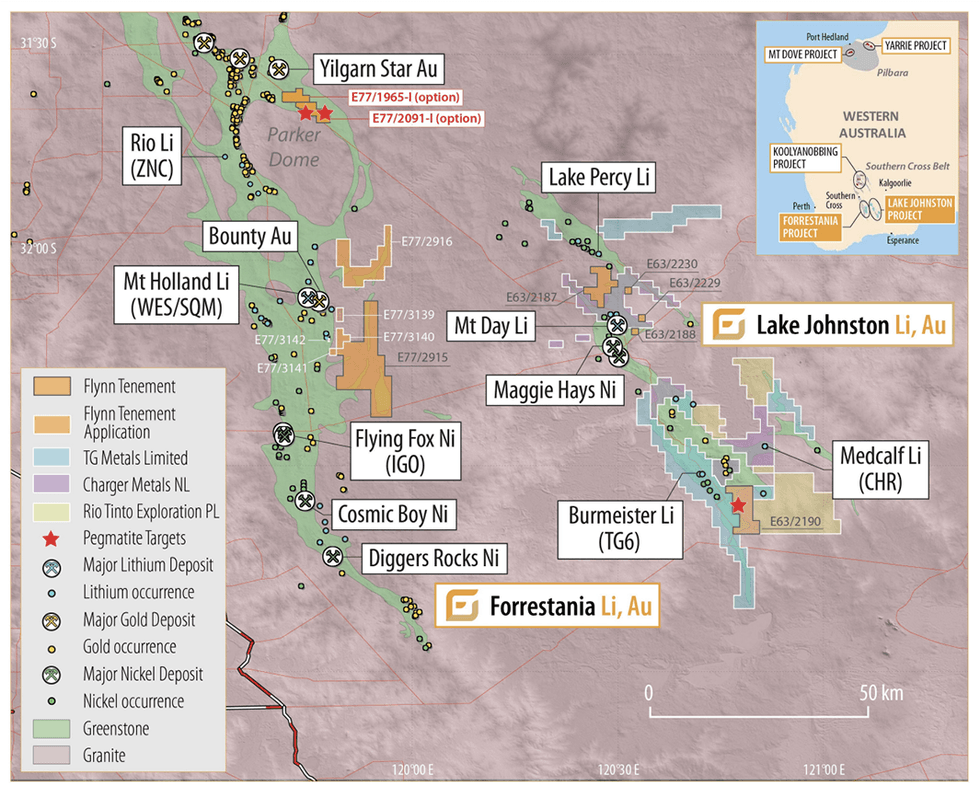

Other than Tasmania, the corporate is constructing a strategic lithium and gold portfolio in Western Australia, focusing on hard-rock lithium pegmatites and intrusive associated gold deposits within the Pilbara area and Yilgarn Craton. Its 5 lithium-gold initiatives in Western Australia are strategically situated in districts internet hosting massive gold and lithium deposits or in areas which are comparatively under-explored for lithium. Of those, three lithium-gold initiatives are within the Yilgarn area: Forrestania, Lake Johnston and Koolyanobbing. The remaining two lithium-gold initiatives are within the Pilbara area: Mt Dove and Yarrie.

Flynn’s latest acquisitions have been targeted on strengthening its lithium portfolio. This consists of the choice settlement to buy two exploration licences on the Parker Dome Challenge in Western Australia, which is taken into account extremely potential for lithium. Along with this, Flynn has additionally elevated its land place nearer to the Mt Holland lithium venture. 4 new exploration licence purposes masking roughly 20 sq. km. have been lodged with the Division of Power, Mines, Trade Regulation and Security.

The give attention to lithium positions the corporate to learn from the worldwide transition in direction of clear power. The latest COP28 summit in Dubai signaled the world’s want to maneuver away from fossil fuels over the subsequent few a long time to deal with local weather change. Electrical automobiles are prone to stay in focus as a key answer to the local weather challenges. A lot of the lithium is used to make lithium-ion batteries for electrical automobiles and cellular gadgets. Summarily, lithium can be in excessive demand given this development.

Firm Highlights

- Flynn Gold is an Australian mineral exploration firm with a portfolio of gold and battery metals initiatives in Tasmania and Western Australia.

- In Tasmania, the corporate holds 12 tenements unfold throughout 1,475 sq. km., together with three essential initiatives in Northeast Tasmania — Golden Ridge, Warrentinna and Portland — which are potential for gold and tin. Furthermore, it has two initiatives in Northwest Tasmania: the Henty zinc-lead-silver venture and the Firetower gold-cobalt-tungsten-copper venture.

- In Western Australia, Flynn holds 24 tenements throughout 1,140 sq. km., together with lithium-gold initiatives within the Pilbara and Yilgarn areas. The Yilgarn area has three lithium-gold initiatives: Forrestania; Lake Johnston and Koolyanobbing. The Pilbara hosts two gold-lithium initiatives: Mt Dove and Yarrie.

- Along with these focus areas, the corporate holds an choice to amass two exploration licences at Parker Dome in Western Australia, located close to the world-class Mount Holland lithium venture.

- The corporate’s near-term focus is on its Northeast Tasmania gold portfolio as a result of its geological similarity to the Victorian goldfields.

- Flynn Gold’s exploration at its flagship Golden Ridge Challenge in NE Tasmania has targeted on an 8-kilometre-long granodiorite-metasediment contact zone with diamond drilling thus far intersecting a number of high-grade gold vein intervals.

- In November 2023, the corporate introduced sturdy metallurgical take a look at outcomes from the Golden Ridge venture, as exploration commenced at two different Tasmanian initiatives — Warrentinna and Firetower – with outcomes pending.

- In December 2023, the corporate introduced plans to lift $2.4 million that can assist advance its exploration actions together with the acquisition of the exploration licences at Parker Dome.

- The corporate’s senior management crew has a confirmed monitor document within the mining sector to capitalize on the excessive useful resource potential of its initiatives.

Key Initiatives

Northeast Tasmania

The corporate has three essential initiatives in northeast Tasmania — Golden Ridge, Portland and Warrentinna. The under-explored Northeast Tasmania area is interpreted to be a part of the Western Lachlan Orogen, a geological extension of the wealthy Victorian Goldfields which boast of historic gold manufacturing of over 80 million ounces (Moz). The corporate’s landholding throughout 9 100% owned tenements within the area has supplied it with vital potential for gold and tin discoveries.

Golden Ridge Challenge

Focused for intrusive associated gold system (IRGS) type mineralization, the Golden Ridge venture is situated 75 kilometres east of Launceston in Northeast Tasmania. Earlier gold exploration on the Golden Ridge Challenge has been very restricted with shallow historic workings situated over an 8-kilometre-long granodiorite-metasediment contact zone. Flynn Gold’s exploration has targeted on the Sensible and Trafalgar prospects, with diamond drilling applications accomplished at each places between June 2021 and August 2023. As well as, a restricted reconnaissance RC drilling program in late 2022 to check for gold mineralisation on the Hyperlink Zone confirmed the presence of shallow gold mineralisation between the Sensible and Trafalgar prospects, highlighting the numerous gold potential of the granodiorite-metasediment contact zone.

Drilling at Trafalgar consisted of 14 holes for five,218.3 metres with a number of vein intersections grading >100 grams per ton (g/t) gold reported. One of the best intersections recorded in drilling at Trafalgar had been 16.8 g/t gold over 12.3 metres (from 108.7 to 121 metres), together with 0.7m at 152.5 g/t gold and 23.7 g/t gold over 4 metres (from 23 to 27 metres), together with a high-grade zone of 0.5 metre at 169.8 g/t gold.

Drilling accomplished at Trafalgar intersected high-grade gold over a strike size of 400 metres and from depths of 40 to 400 metres under floor, confirming a big new gold discovery that’s open in all instructions.

Preliminary metallurgical exams had been efficiently accomplished in November 2023 on 26 drill samples from the Trafalgar prospect. Common gold restoration of 94.5 % was recorded utilizing standard bottle roll leaching.

Portland Challenge

The Portland gold venture covers 370 sq. kms. and includes three adjoining tenements: Portland, Telegraph and Cameron Tin. The venture falls throughout the area mined traditionally from 1870 to 1917 and is analogous to Victorian geology with high-grade “Fosterville-style” gold mineralization confirmed. Geochemical surveys and costean sampling applications at Portland confirmed the presence of anomalous gold zones. Drilling on the Grand Flaneur prospect in 2022 and the Popes prospect in 2023 have each confirmed the presence of gold mineralization.

Warrentinna Challenge

The Warrentinna venture was acquired in 2023 from Greatland Gold plc (LSE:GGP). The Challenge is situated in northeast Tasmania and covers an space of roughly 37 sq km instantly adjoining to Flynn’s present Lyndhurst Challenge. The tenement encompasses two historic goldfields, Forester and Warrentinna. Each fields produced high-grade gold deposits within the late 1800s and early 1900s. The Warrentinna goldfield is outlined by quite a few historic workings and largely untested prospects over a strike size of 6 kilometres.

Preliminary drilling by Flynn in September/October 2023 at Warrentinna consisted of two diamond drill holes, designed to check the continuity and extension of orogenic type gold mineralisation recognized in historic drilling. The holes are additionally designed to supply stratigraphic and structural info important to advancing understanding of the venture. Assay outcomes are pending.

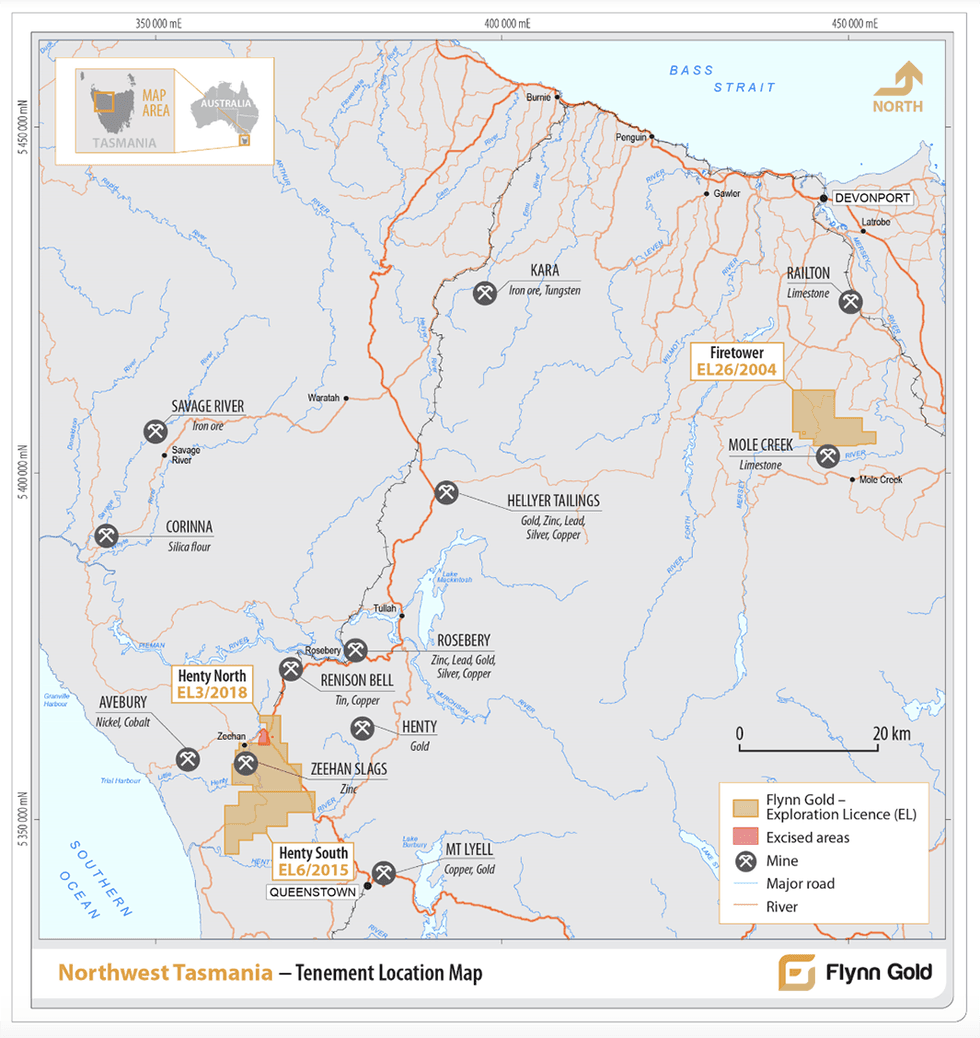

Northwest Tasmania

The corporate has two initiatives within the Northwest Tasmania area: the Henty zinc venture and the Firetower venture.

Henty Zinc Challenge

The venture is a 130 sq. km land holding beneath two 100% owned exploration licences and offers the corporate with a dominant place in a wealthy base metals area with proximity to an present zinc/lead focus producer (MMG’s Rosebery mine).

The Henty Challenge has a big pipeline of exploration targets with the Mariposa and Grieves Siding prospects prepared for useful resource drilling

Firetower Challenge

The venture was acquired in 2023 from Greatland Gold plc (LSE: GGP). The venture spans greater than 62 sq. kms. and represents a sophisticated gold plus battery metals venture, which incorporates three notable prospects: Firetower, Firetower East and Firetower West. The Firetower venture lies within the extremely mineralized Mt Learn volcanic sequence which hosts main polymetallic base metals and gold deposits corresponding to Hellyer and Rosebery, copper-gold deposits corresponding to Mt Lyell (3 million tons contained copper, 3.1 Moz contained gold), and the Henty gold mine (1.64 Moz gold @ 12.5 g/t gold).

Resampling of the historic core at Firetower has confirmed the numerous potential for gold and important minerals – cobalt, tungsten and copper. The outcomes have made it clear this venture represents an thrilling polymetallic alternative. The corporate commenced a diamond drilling program in October 2023 to focus on each the gold and polymetallic minerals potential.

Western Australia

Flynn holds 5 gold-lithium initiatives within the resources-rich state of Western Australia, strategically situated close to massive gold and lithium deposits or in areas which are comparatively under-explored for lithium.

The 5 initiatives embody: Mt. Dove and Yarrie in Pilbara; and Koolyanobbing, Forrestania and Lake Johnston in Yilgarn.

Mt Dove Challenge

Situated 70 kilometres south of Port Hedland within the Pilbara area, Mt Dove includes 5 granted licences masking 86.6 sq. kms. and one tenement software. The venture is situated close to the massive Hemi gold deposit (De Gray Mining, ASX:DEG) and the massive lithium mines at Pilgangoora and Wodgina. The corporate has accomplished two soil sampling applications at Mt Dove, which have recognized lithium and gold anomalies. The follow-up exploration, which is prone to embody aircore drilling, intends to check lithium and gold anomalies recognized throughout the soil sampling program accomplished in 2022 and 2023.

Yarrie Challenge

The Yarrie Challenge includes three tenements and one software masking 424 sq. kms. Very restricted historic exploration has been undertaken for lithium, gold and copper on the venture. The venture is extremely potential for iron ore, being near historic mining operations and present rail infrastructure.

Forrestania Challenge

The Forrestania venture consists of 1 exploration licence and 5 exploration licence purposes over a 320 sq. km. space. It’s situated close to the Mt Holland lithium deposit (Wesfarmers (ASX:WES)/ SQM (NYSE:SQM) JV) and high-grade nickel deposits, Flying Fox and Maggie Hays.

Lake Johnston Challenge

Lake Johnston consists of 5 exploration licenses over a 116 sq. km. space, and is situated close to the Burmeister lithium discovery (TG Metals (ASX:TG6)) and the Medcalf, Lake Percy and Mt Day Lithium initiatives.

Koolyanobbing Challenge

Koolyanobbing includes one exploration licence and two purposes focusing on gold and lithium mineralization over an 82 sq. km. space within the Marda-Diemals greenstone belt.

Parker Dome Challenge

Along with the above-mentioned initiatives, Flynn has secured an choice settlement to buy two exploration licences on the Parker Dome venture in Western Australia, which is taken into account extremely potential for lithium. The Parker Dome venture covers 42 sq. kms. and is located 50 kilometres north of the world-class Mount Holland lithium venture in Western Australia. The licences are absolutely permitted permitting for a direct graduation of exploration and drilling. The corporate expects to start drilling at Parker Dome in early 2024.

Administration Staff

Clive Duncan – Non-executive Chair

Clive Duncan has over 4 a long time of expertise at massive field {hardware} chain Bunnings, together with as chief working officer and firm director. He has wealthy expertise in company and enterprise growth, together with mergers and acquisitions, enterprise integrations, company authorities, technique growth and advertising. He has accomplished post-graduate research at Harvard College and London Enterprise College and is a member of the Australian Institute of Firm Administrators. He’s a long-term vital shareholder of Flynn Gold’s predecessor firms.

Neil Marston – Chief Government Officer and Managing Director

Neil Marston was appointed managing director in Might 2023 and has been the corporate CEO since August 2022. He has greater than 30 years of expertise within the mining and minerals exploration sector and is a confirmed ASX-listed firm chief, with a powerful governance and company finance background. Beforehand, he held a number of senior roles together with managing director at Bryah Assets (ASX:BYH) and Horseshoe Metals (ASX:HOR).

Sam Garrett – Technical Director

Sam Garrett has greater than 30 years of exploration administration, venture evaluation and operational expertise with multinational and junior mining and exploration firms, together with Phelps Dodge and Cyprus Gold. He has a background in copper and gold exploration with sturdy publicity to iron ore, base metals and specialist commodities. He’s related to discoveries at Mt Elliott (copper), Havieron (copper-gold), and Tujuh Bukit (gold). Furthermore, he co-founded Flynn Gold and its predecessor Pacific Developments Assets.

John Forwood – Non-executive Director

John Forwood is a director and chief funding officer of Lowell Assets Funds Administration (LRFM). He’s certified as a lawyer and geologist and has greater than 20 years of assets financing expertise, together with with ASX-listed Lowell Assets Belief (ASX:LRT), as a director of RMB Assets, and as supervisor of Telluride Funding Belief.

This text was written in collaboration with Couloir Capital.

[ad_2]