Pending Home Sales Trends and Forecast for 2024

[ad_1]

The Pending Home Sales Index is a leading indicator of housing activity. It measures housing contract activity and is based on signed real estate contracts for existing single-family homes, condos, and co-ops. When a seller accepts a sales contract on a property, it is recorded into a Multiple Listing Service (MLS) as a “pending home sale.” Most pending home sales become home sale transactions, typically one to two months later.

ALSO READ: United States Existing Home Sales Trends

Pending Home Sales: A Comprehensive Analysis

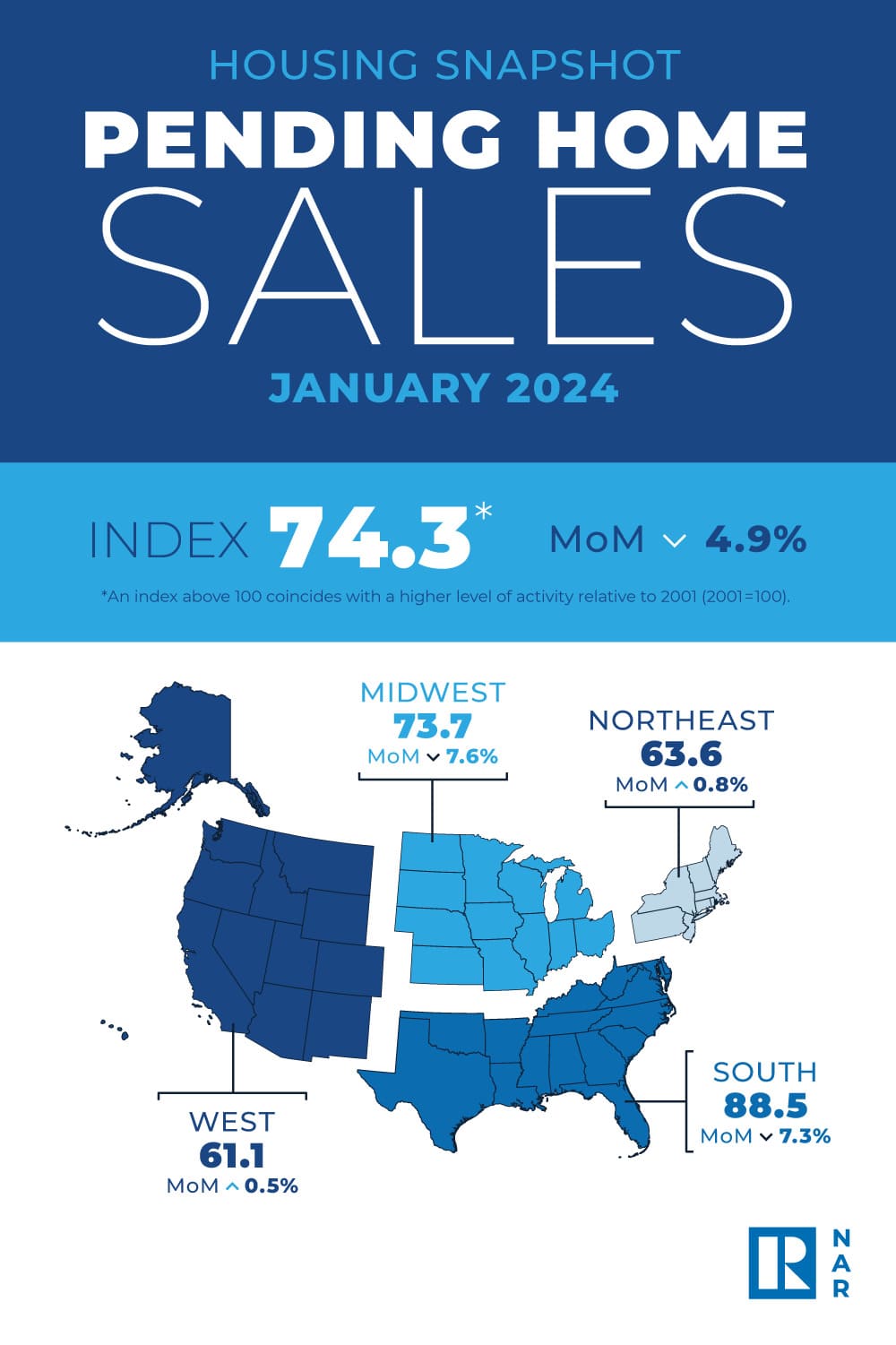

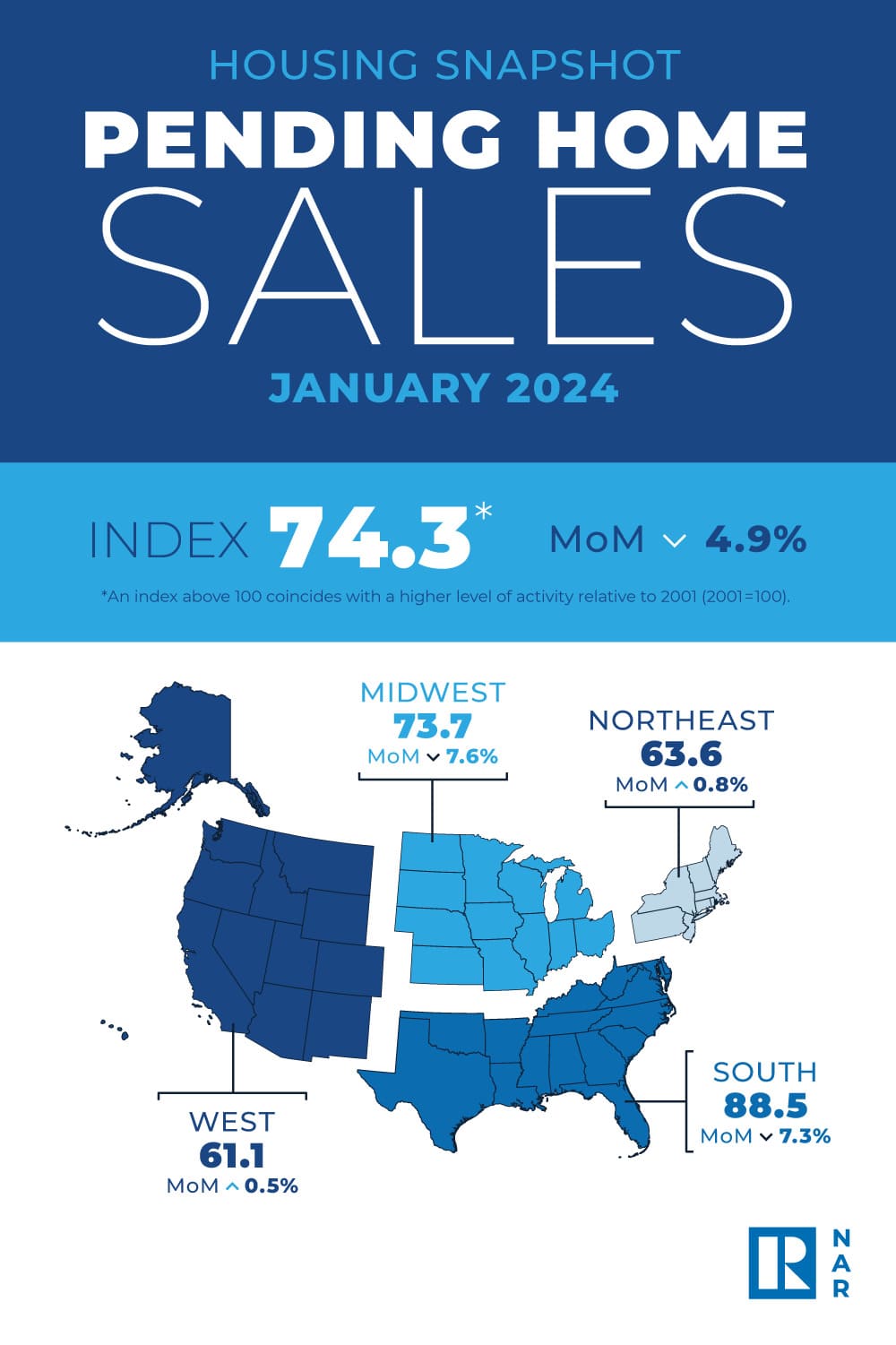

Pending home sales took a dip in January, marking a 4.9% decrease compared to previous months, as reported by the National Association of REALTORS®. This decline, though not unexpected, has brought attention to the nuanced trends within the real estate market. While the Northeast and West regions experienced a slight uptick in transactions, the Midwest and South faced setbacks. Additionally, when compared to the same period last year, all U.S. regions showed a decline in pending home sales, indicating a broader shift in the housing landscape.

Understanding the Numbers

The Pending Home Sales Index (PHSI), a metric used to forecast home sales based on contract signings, dropped to 74.3 in January. This figure reflects an 8.8% decrease from the previous year. It’s essential to note that the PHSI operates on a scale where an index of 100 represents the level of contract activity in 2001, providing valuable insight into market fluctuations over time.

Insights from Experts

NAR Chief Economist Lawrence Yun sheds light on the current market conditions, emphasizing the robustness of the job market and the nation’s burgeoning wealth. Despite these favorable economic indicators, consumers are exhibiting heightened sensitivity to fluctuations in mortgage rates, influencing their decisions regarding home purchases. This highlights the interconnectedness of economic factors and consumer behavior in shaping the real estate landscape.

Regional Variances

Delving deeper into regional trends, the Northeast saw a modest 0.8% increase in the Pending Home Sales Index, contrasting with a year-over-year decline of 5.5%. Conversely, the Midwest experienced a notable 7.6% decrease in January, marking an 11.6% drop from the previous year.

In the South, the index plummeted by 7.3% to 88.5, reflecting a 9.0% decline from January of the previous year. Meanwhile, the West managed to buck the trend slightly with a 0.5% increase in January, although still down by 7.0% from the same period in the previous year.

Factors Driving Regional Dynamics

Yun points out the influence of regional economic dynamics on housing demand, particularly highlighting the Southern states and those in the Rocky Mountain time zone. These areas have witnessed accelerated job growth, thereby driving long-term housing demand. However, the pace and extent of housing transactions are contingent upon prevailing mortgage rates and the availability of inventory, underscoring the multifaceted nature of the real estate market.

The fluctuations in pending home sales in January offer valuable insights into the broader dynamics at play within the real estate market. While regional variations exist, the overarching trends reflect the delicate balance between economic conditions, consumer sentiment, and external factors such as mortgage rates and inventory levels.

ALSO READ: Will the Housing Market Crash Again?

Pending Home Sales Trends (Previous Months)

The table shows data from regarding pending home sales in four regions of the United States – Northeast, Midwest, South, and West. The data reveals interesting trends in pending home sales across the regions. The National Association of Realtors (NAR) publishes monthly data on pending home sales, which is seasonally adjusted and presented in the form of a seasonally adjusted annual rate (SAAR) in thousands.

In December 2023, the Pending Home Sales Index (PHSI) for the Northeast stood at 62.3, reflecting a decline of 3.26% from the previous month and a year-over-year decrease of 3.86%. This indicates a challenging month for the Northeastern housing market, facing both short-term and long-term declines in pending home sales. However, it’s essential to consider these variations in the context of the broader economic factors influencing the region.

Conversely, the Midwest experienced a positive month, with a PHSI of 80.5 in December, representing a month-over-month increase of 5.64% and a year-over-year growth of 4.27%. This suggests a robust real estate market in the Midwest, characterized by increasing demand and positive momentum. The Midwest’s resilience in both short-term and long-term metrics points to a favorable environment for home sales.

The Southern region demonstrated remarkable strength in December, recording a PHSI of 93.0, indicating a substantial month-over-month increase of 11.78% and a modest year-over-year growth of 1.53%. The South’s performance highlights a buoyant real estate market with a significant surge in pending home sales, making it a key contributor to the overall positive trends observed in the national data. The robust month-over-month increase showcases the region’s responsiveness to market dynamics.

Similarly, the West displayed a robust performance in December, boasting a PHSI of 61.0. This represents an impressive month-over-month increase of 12.96% and a steady year-over-year growth of 1.50%. The West’s housing market exhibits resilience and adaptability, responding positively to changing conditions. The substantial month-over-month increase indicates a strong demand for homes in the region, aligning with broader market trends.

Examining the total data, the national PHSI in December was 77.3, with a month-over-month change of 7.96% and a modest year-over-year growth of 1.31%. This comprehensive view of pending home sales across the United States reflects a generally positive trend, driven by the robust performance of specific regions. The month-over-month increase in the total index indicates a widespread demand for homes, contributing to the overall health of the real estate market.

Here is the tabular data of pending home sales from Dec 2022 to Dec 2023. The units displayed are in thousands and are the seasonally adjusted annual rate.

The Pending Home Sales Index Explained

The Pending Home Sales Index is a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing. Pending contracts are good early indicators of upcoming sales closings. However, the amount of time between pending contracts and completed sales is not identical for all home sales.

Variations in the length of the process from pending contract to closed sale can be caused by issues such as buyer difficulties with obtaining mortgage financing, home inspection problems, or appraisal issues. According to the National Association of REALTORS®, the index is based on a sample that covers about 40% of multiple listing service data each month.

In developing the model for the index, it was demonstrated that the level of monthly sales-contract activity parallels the level of closed existing-home sales in the following two months. An index of 100 equals the average level of contract activity during 2001, which was the first year to be examined. By coincidence, the volume of existing home sales in 2001 fell within the range of 5.0 to 5.5 million, which is considered normal for the current U.S. population.

Source:

- https://www.nar.realtor/research-and-statistics/housing-statistics/pending-home-sales

- https://www.mortgagenewsdaily.com/data/pending-home-sales

[ad_2]