Orlando Housing Market Trends and Forecast for 2024

[ad_1]

With the increase in inventory, a decline in median home prices, and favorable interest rates, the current Orlando housing market leans towards a buyer-friendly environment. The rise in pending sales indicates an active buyer pool, while the extended time homes spend on the market suggests sellers may need to adjust their strategies to meet buyer expectations.

Noteworthy is the fact that distressed homes, including bank-owned properties and short sales, accounted for 1.3% of all home sales in January. This represents a 69.2% increase from December, emphasizing the evolving nature of the market and the potential opportunities for both buyers and sellers.

Orlando Housing Market Trends in 2024

How is the Housing Market Doing Currently?

In Orlando’s residential real estate, the latest data from January 2024 reveals intriguing trends and shifts. The new listings surged by an impressive 46.3% from December to January, marking a robust start to the new year. January saw a total of 3,524 new homes hitting the market, a substantial increase from the 2,409 recorded in the previous month.

However, amid this surge in new listings, the overall market witnessed a 13.3% decline in sales from December to January. Specifically, there were 1,719 home sales in January, down from 1,982 in December. This dip in sales is noteworthy as it extends a trend observed over the past eight months, indicating a consistent decrease in home sales.

How Competitive is the Orlando Housing Market?

The Orlando housing market continues to be dynamic and competitive, as reflected in the 32.4% increase in pending sales from December to January. Pending sales surged from 2,495 in December to 3,303 in January, showcasing the active participation of both buyers and sellers in the market.

Additionally, the average number of days a home spent on the market (DOM) increased to 57 days in January, up from 49 days in December. This shift suggests a nuanced aspect of the market dynamics, indicating that homes are taking slightly longer to sell compared to the previous month.

Are There Enough Homes for Sale in Orlando to Meet Buyer Demand?

Inventory is a crucial factor in determining the balance between supply and demand in the housing market. In January, the inventory increased by 4.8%, reaching 8,217 homes, up from 7,838 in December. This growth in inventory aligns with the increased number of new listings, providing more options for potential buyers.

However, the supply of homes, measured in months, increased to 4.78 months in January, up by 20.9% from December’s 3.95 months. A balanced market typically has a six-month supply, indicating that the current market leans towards a more favorable position for buyers.

What is the Future Market Outlook for Orlando?

The Orlando housing market has witnessed a series of changes in key indicators. Notably, the median home price for January was $360,000, reflecting a decline from $367,250 in December. This trend marks the third consecutive month of decreasing median prices, with a cumulative drop of $17,000 since October 2023.

Interest rates, a pivotal factor influencing market dynamics, experienced a slight dip from 6.6% in December to 6.5% in January. This marks the third consecutive month of falling rates, providing an additional incentive for potential buyers.

Rose Kemp, President of the Orlando Regional REALTOR® Association, expressed optimism for the market, attributing the spike in new listings to the healthy market conditions experienced in 2023. As interest rates decline and sellers find satisfaction in their home equity, the market is poised for further activity in 2024.

Orlando Housing Market Forecast 2024 and 2025

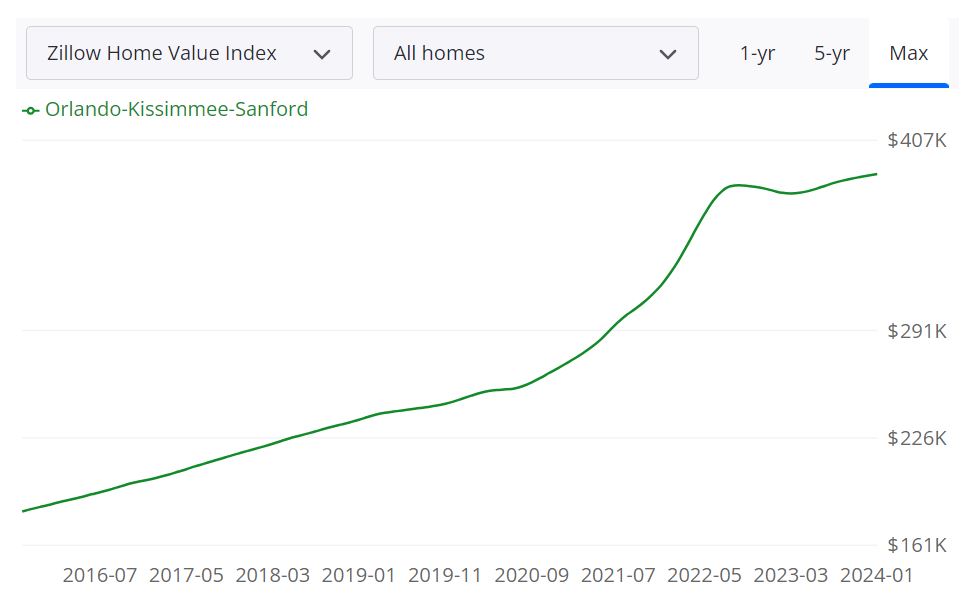

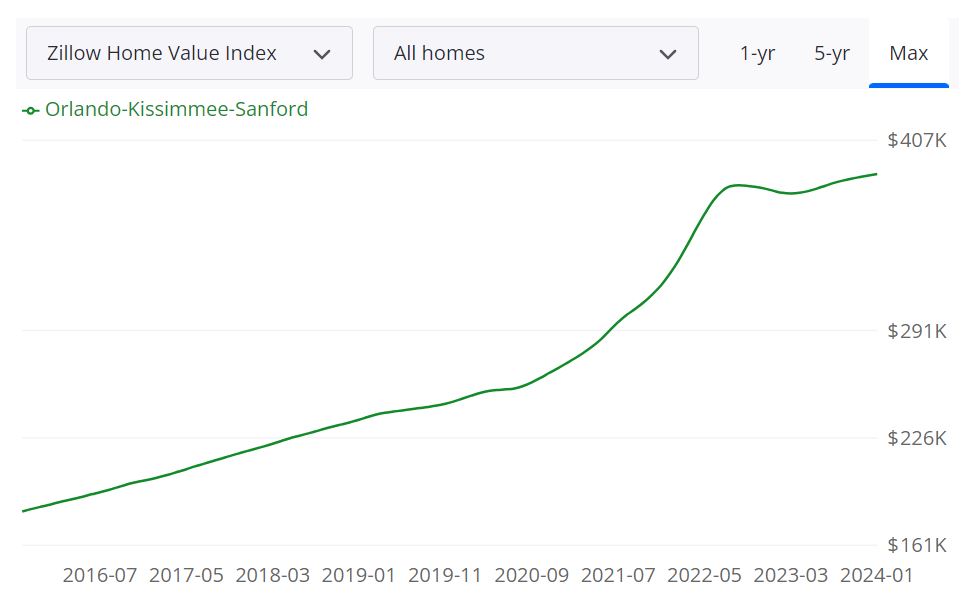

According to Zillow, the average home value in the Orlando-Kissimmee-Sanford area stands at $386,687, reflecting a 2.7% increase over the past year. Homes in this region typically go pending in approximately 29 days, indicating a dynamic and competitive market as of January 31, 2024.

1-Year Market Forecast

Zillow’s projection for the next year anticipates a 5.5% increase in the Orlando housing market, offering a positive outlook for property owners and investors as of January 31, 2024. The Orlando-Kissimmee-Sanford Metropolitan Statistical Area (MSA) encompasses several counties, including Orange and Seminole. This vibrant housing market plays a significant role in the broader Central Florida region, contributing to the state’s overall real estate landscape.

Key Housing Metrics Explained

For Sale Inventory

The total number of properties available for sale in the Orlando area as of January 31, 2024 is 10,627.

New Listings

There were 2,852 new listings added to the market as of January 31, 2024, showcasing ongoing activity and growth in housing options.

Median Sale to List Ratio

The median sale to list ratio, a key indicator of market competitiveness, is 0.982 as of December 31, 2023.

Median Sale Price

The median sale price for homes in the Orlando area is $375,333 based on data from December 31, 2023.

Median List Price

As of January 31, 2024, the median list price for properties in the Orlando-Kissimmee-Sanford region is $424,967.

Percent of Sales Over/Under List Price

Examining market dynamics, 14.9% of sales in the region were over list price, while 64.7% were under list price as of December 31, 2023.

Are Home Prices Dropping in Orlando?

As of the most recent data available, there is no indication of a decline in home prices in the Orlando-Kissimmee-Sanford area. The median sale price stands at $375,333 as of December 31, 2023, and the forecasted 5.5% increase in the next year suggests a stable and potentially appreciating market. Homebuyers can take comfort in the current market conditions.

Will the Orlando Housing Market Crash?

Based on the data and forecasts, there is no immediate indication of a housing market crash in Orlando. The market is showing signs of growth and stability, with the 5.5% forecasted increase suggesting sustained positive momentum. However, it’s essential to monitor economic and external factors that could influence the real estate landscape.

Is Now a Good Time to Buy a House in Orlando?

Considering the current market conditions, including the 2.7% increase in average home value over the past year and the 5.5% forecasted market growth, now could be a favorable time for prospective homebuyers. The median sale price of $375,333 as of December 31, 2023 aligns with a competitive yet stable market, providing opportunities for those looking to make a real estate investment.

Orlando Real Estate Investment: Should You Invest in Orlando?

Is Orlando a Good Place Real Estate Investment? Many real estate investors have asked themselves if buying rental property in Orlando is a good investment. You need to drill deeper into local trends if you want to know what the market holds for the year ahead. We have already discussed the Orlando housing market 2024 forecast for answers on why to put resources into this market.

Let’s talk a bit about Orlando and the surrounding metro area before we discuss what lies ahead for investors and homebuyers. The City of Orlando is nicknamed “the City Beautiful and is one of the most-visited cities in the world primarily driven by tourism, major events, and convention traffic.

Orlando’s housing market is expanding at a great pace and people from all over the country and even beyond are either choosing to move permanently or invest here. Orlando has once again proved to be one of the best places to invest in real estate in Florida. Owing to its picturesque beaches, rapidly improving quality of life, booming population, and economy, Orlando is proving to be a secure real estate investment destination for not only local but also international investors.

Top Reasons To Invest In The Orlando Real Estate Market | |

| |

Let’s look at the number of positive things going on in the Orlando real estate market which can help investors keen to buy an investment property in this city.

Increasing Foreign Investment in Orland0

International investors from all major countries of the world are exhibiting their interest in the Orlando real estate market because of its beautiful scenery, improving quality of life, and ambient weather. It is also extremely popular for foreign investments because of its intercultural connectivity with people from various Latin American countries. In addition to this, many Chinese, as well as Spanish and Middle Eastern investors, are also attracted to Orlando, FL for real estate investment.

Dramatic Population Growth

Owing to people from various walks of life and demographic differences choosing to reside in the suburbs of Orlando, this city is going through major population growth. During the last 3 years, the population in Orlando has been growing at a rate of 7.2% which has never been experienced by this city before. The current population of Orlando in 2020 is 1,964,000, a 2.13% increase from 2019. The population of Orlando in 2019 was 1,923,000, a 2.18% increase from 2018.

Orlando is rapidly becoming a central attraction for businessmen, students, and small families owing to its growing trend of upward life mobility which makes lures investors to invest in the Orlando real estate market. Another reason for the growing economy and population expansion in Orlando, Florida, is the developed transportation infrastructure which makes traveling between destinations more convenient. Generally, Florida has an efficient transportation network that complements its tourism growth as well.

Orlando’s Increasing Job Opportunities

While improving the Orlando real estate market and flourishing tourism is two of the most important reasons behind Orlando’s economic stability, these two industries have a lot to gain from the successful economy. This expansion is related to the growing population and job opportunities in this city, this translates to more rental income and tourism leading to a better economy for the city. Orlando is the new hub for many young professionals especially those with various types of technological expertise, including engineers and IT professionals.

This city has experienced annual job growth of around 4.4% and is also one of the fastest-growing metro areas in the country. The city is also set to experience its highest job growth rate in the 10 years to come. A market with high job growth is a great market for real estate investment as well. Orlando metro area is adding STEM jobs at a faster clip than the Bay Area metros. The Orlando–Kissimmee–Sanford MSA was ranked among Forbes’ 15 Best Big Cities for Jobs. They cited Orlando’s science, technology, engineering, and mathematics (STEM) job growth in recent years as one contributing factor.

Orlando’s Rental Market

Thanks to a strong economy, Orlando’s rental market continues to boom. It is consistently named as one of the best rental markets in the nation and the #1 place in Florida to buy a profitable rental property. While tourism is one of the driving forces in the local economy, Orlando is also an important high-tech hub. Since job opportunities in Orlando are growing, people from all over the country and even some other countries are choosing to move here.

This directly translates to a boom in rental income as there is a resultant increase in the demand for both residential and commercial property rentals, and this means more steady income for investors in Orlando real estate market. The soaring rental rates are good signs for real estate investors. Around 46% of the households in Orlando, FL are renter-occupied.

Current Rental Market Trends

The average size for an Orlando, FL apartment is 962 square feet with studio apartments being the smallest and most affordable, 1-bedroom apartments are closer to the average, while 2-bedroom apartments and 3-bedroom apartments offer more generous square footage. About 60% of the apartments can be rented for $1,500/mo or less. 26% of the apartments fall in the price range of $1,501-$2,000, and only 8% are as expensive as $2,000/mo.

As of February 2024, the median rent for all bedroom counts and property types in Orlando, FL is $1,955. This is +3% higher than the national average. Rent prices for all bedroom counts and property types in Orlando, FL have remained the same in the last month and have decreased by 5% in the last year.

Flexible Tax Laws

Investing in Orlando’s real estate market can help investors to lighten their taxes as Florida is one of the few states with no personal income tax. Its flexible tax laws are a blessing for investors, especially in this climate of a booming economy. Tax laws in Florida are considered to be the 4th friendliest laws in the country which is why a significant number of businesses choose to be based here.

Florida does impose a 5.5 percent corporate income tax. Orlando, owing to its friendly tax environment and affordable real estate can prove to be a vital opportunity for up-and-coming start-ups. Entrepreneurs and small business owners can rent showrooms and shops on better terms than most other cities and states.

Orlando is a Top-notch Tourism Center

Orlando has been boasting of economic stability since the beginning of the year 2018, and tourism growth and opportunities are some of the main reasons for its smooth expansion. Considered to be a “Theme-Park Capital of the World,” Orlando attracts most of its tourism due to the presence of Universal Studios as well as SeaWorld, and the most popular, Disneyland. In addition to this, Orlando’s beautiful beaches and warm weather also attract thousands of tourists every year.

Maybe you have done a bit of real estate investing in Florida but want to take things further and make it into more than a hobby on the side. It’s only wise to think about how you can and should be investing your money. In any property investment, cash flow is gold. Speaking about Orlando’s real estate market has a high potential for growth considering the current state of its economic expansion and population influx. This market currently has an ideal environment for US investors in housing properties, especially for turnkey real estate investments.

Good cash flow from Orlando rental property means the investment is, needless to say, profitable. A bad cash flow, on the other hand, means you won’t have money on hand to repay your debt. Therefore, finding the best investment property in Orlando in a growing neighborhood would be key to your success. When looking for real estate investment opportunities in Orlando or anywhere in the country, the generally accepted standard is to purchase a property that will give you a modest but minimum of 1% profit on your investment. An example would be: at $120,000 mortgage or investment cost, $1200 per month rental.

That would be the ideal equation for example. Even with rent increases, buying a $500,000 investment property in Orlando is not going to get you $5000 per month on rent. When looking for the best real estate investments in Orlando, you should focus on neighborhoods with relatively high population density and employment growth. Both of them translate into high demand for housing.

Here are the ten neighborhoods in Orlando having the highest real estate appreciation rates since 2000—List by Neigborhoodscout.com.

- Baldwin Park East

- Baldwin Park

- Southport / Lake Nona Estates

- Lake Fredrica North

- Azalea Park South

- Countryside

- Park Central

- Engelwood Park North

- Lake Buchanan

- Beacon Park

REFERENCES

Market Prices, Trends & Forecasts

https://www.orlandorealtors.org/marketreports

https://www.orlandorealtors.org/housingmarketnarrative

https://www.zillow.com/orlando-fl/home-values

https://www.redfin.com/city/13655/FL/Orlando/housing-market

https://www.neighborhoodscout.com/fl/orlando/real-estate

https://www.realtor.com/realestateandhomes-search/Orlando_FL/overview

Foreclosures

https://www.realtytrac.com/statsandtrends/fl/orange-county/orlando

Reasons to Invest in Orlando Florida

https://www.thebalance.com/the-best-places-to-invest-in-real-estate-4163978

http://www.noradarealestate.com/blog/best-cities-to-invest-in-real-estate-in-2018

https://www.mashvisor.com/blog/orlando-real-estate-market-new-investors

https://www.lee-associates.com/centralflorida/2018/01/15/5-reasons-to-invest-in-central-florida

https://news.orlando.org/blog/orlando-leads-nation-in-job-growth-four-years-in-a-row/

[ad_2]