November 2023 Early Retirement Replace – Fall Shade Explosion

[ad_1]

Welcome again to a different month-to-month replace from Root of Good! Right here we’re midway between Thanksgiving and Christmas having fun with the previous few weeks of the 12 months. As this submit goes dwell, we’re days away from crusing on a cruise to South America and Central America the place we are going to have a good time Christmas. We return residence simply earlier than New 12 months’s so our 2023 is quickly drawing to an in depth!

Although we didn’t actually do any touring this fall, we nonetheless stored busy with different day by day routines round residence. Wanting forward, 2024 is shaping as much as be a busy 12 months for journey, with just a few home journeys deliberate within the first few months of the brand new 12 months. In the summertime, we head to Europe the place we are going to spend a few months highway tripping round Poland.

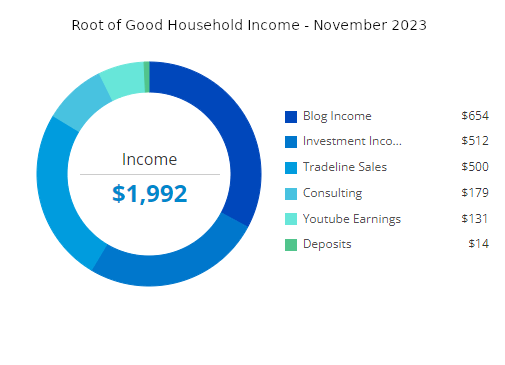

On to our monetary progress. November was an ideal month for our funds. Our web value skyrocketed by $134,000 to finish November at $2,817,000. Our earnings totaled $1,992, whereas our spending was a bit extra at $2,682 for the month of November.

Let’s bounce into the main points from final month.

Revenue

Funding earnings totaled $512 in November. Our fairness index funds and ETFs pay dividends quarterly on the finish of March, June, September, and December. In consequence, we had a smaller than regular quantity of funding earnings final month. However we should always get an enormous payday in December! Right here’s extra on our dividend investments.

Weblog earnings totaled $654 for the month. That is the “new regular” for weblog earnings since I solely submit on right here about as soon as monthly.

My early retirement life-style consulting earnings (“consulting”) was $179 in November which represents one hour of consulting. Issues are lastly choosing up on this division within the early a part of December, with two new purchasers booked thus far. We’ll see how 2024 goes! I believe I’ll give myself a small inflation increase on my charges for subsequent 12 months. However nothing loopy.

Tradeline gross sales earnings totaled $500 in November. It’s good to see this earnings stream come again after just a few sluggish months. I ramped up my tradeline gross sales just a few years in the past mentioned it in a bit extra element in my October 2020 month-to-month submit and in my July 2021 month-to-month submit.

For November, my “deposit earnings” of $14 got here from money again and incentive bonuses from the Rakuten.com and Mrrebates.com on-line buying portals (a few of which was earned from you readers signing up by way of these hyperlinks).

When you join Rakuten by way of this hyperlink and make a qualifying $25 buy by way of Rakuten, you’ll get a $10 enroll bonus (or extra!).

Youtube earnings was $131 in November. Youtube solely pays out while you hit $100 in accrued income. Lately, my Youtube earnings have been just below $50 monthly on common, so I solely receives a commission each two or three months.

Right here is the Youtube channel for the curious. It’s random journey movies, birds, children, and a few DIY movies. There are just a few foremost movies that herald many of the site visitors (and income!).

When you’re taken with monitoring your earnings and bills like I do, then try Empower Private Dashboard, previously referred to as Private Capital (it’s free!). All of our financial savings and spending accounts (together with checking, cash market, and 5 bank cards) are all linked and up to date in actual time by way of Empower Private Dashboard. We’ve got accounts in all places, and Empower Private Dashboard makes it very easy to test on every part at one time.

Empower Private Dashboard can also be a strong instrument for funding administration. Maintaining observe of our complete funding portfolio takes two clicks. When you haven’t signed up for the free Empower Private Dashboard service, test it out in the present day (evaluation right here).

Monitoring spending was one of many vital steps I took that allowed me to retire at 33. And it’s now simpler than ever with Empower Private Dashboard.

Bills

Now let’s check out November bills:

In whole, we spent $2,682 throughout November which is about seven hundred {dollars} lower than our frequently budgeted $3,333 monthly (or $40,000 per 12 months). Groceries and insurance coverage have been the 2 highest classes of spending in November.

Detailed breakdown of spending:

Groceries – $1,190:

The grocery spending is barely inflated as a result of I purchased $400 value of Walmart present playing cards at a reduction throughout November, however I spent a few of these throughout the month as effectively. We nonetheless had just a few hundred {dollars} remaining on the present card that we’ll spend all through December.

One other issue driving grocery spending in November was an enormous Thanksgiving day celebration. We had an enormous household gathering at our home this 12 months and cooked plenty of the meals ourselves. Many within the household take pleasure in cooking, in order that they introduced plenty of potluck type dishes too.

Insurance coverage – $736:

I paid our six month auto insurance coverage invoice throughout November. With a teen driver on the coverage, the insurance coverage nonetheless feels fairly low-cost. I all the time assumed we might pay much more for auto insurance coverage for a teen driver. Since she has over a 12 months of driving expertise and not using a wreck, they lowered the premiums for her a bit. Including our second automobile in September elevated our premiums a small quantity as effectively.

Utilities – $261:

We spent $148 on our water/sewer/trash invoice.

The pure gasoline invoice, which gives heating and scorching water, totaled $29 for final month. We didn’t use the warmth a ton throughout the billing interval included in final month’s invoice. Nevertheless, it’s usually chilly in North Carolina now so we now have to make use of the warmth most days.

The electrical energy invoice totaled $84 in November.

Healthcare/Medical/Dental – $176:

Our present 2023 medical health insurance prices $18 monthly, due to very beneficiant Inexpensive Care Act subsidies that we obtain because of our low ~$45,000 per 12 months Adjusted Gross Revenue.

Our 2023 dental insurance policy price a complete of $29 in premiums monthly.

I selected a really primary plan for $9 monthly for me that covers most preventive care however no fillings. Mrs. Root of Good has a unique set of dental wants than I accomplish that we stored the extra complete $20 monthly plan for her (identical as 2022’s plan).

By shopping for insurance coverage, we should always save a pair hundred {dollars} on my dental care. For Mrs. Root of Good, we are going to find yourself saving a web quantity of $63 in comparison with paying money for the preventive dentist visits all year long.

In November, Mrs. Root of Good went to the dentist and the fees after insurance coverage have been $129. This included fee for the deductible and co-insurance that was owed from one other dental go to six months in the past.

Presents – $130:

Varied Christmas presents for household totaled $130.

Journey – $97:

We didn’t spend a ton on journey in November.

I spent $80 for a reduced $100 Airbnb present card on the grocery retailer.

The opposite $17 in journey spending was the airport taxes for 3 one-way flights on Southwest utilizing factors. We’re tentatively planning on visiting Phoenix in January for 5 nights, with a multi-day pit cease in New Orleans on the flight again residence. I’ll be incomes the Southwest Companion Cross in early January (extra on that in a minute), so Mrs. Root of Good’s flights will likely be free apart from $17 in taxes we’ll pay in January. I’ve lodges booked free of charge utilizing Marriott factors and Chase Final Rewards factors. Our foremost out of pocket price for the journey would be the rental automobile which must be $200-300 for 5 days in Phoenix.

Get free journey like us

In case you are taken with getting free journey out of your bank card like I do, contemplate the Chase Ink Limitless or Chase Ink Money enterprise playing cards (my referral hyperlink). Proper now, for a restricted time, the Chase Ink enterprise playing cards provide an eye-popping 90,000 Chase Final Rewards factors that may be redeemed immediately for $900 in money. Mrs. Root of Good simply picked up one other new Chase Ink card final month, and I simply obtained my new Ink card in October. The bonuses carry on rolling within the door!

I’m guessing the 90,000 level enroll bonus will solely final for just a few extra weeks, so enroll now in order for you the upper bonus quantity.

Chase is fairly liberal in the case of “what’s a enterprise”. When you promote stuff on eBay or Craigslist or do some odd jobs often then you’ve got a enterprise and will get a bank card as a “sole proprietor”.

I exploit the 90,000 Chase Final Rewards factors by transferring them to my Chase Sapphire Reserve card (additionally providing a 60,000 level enroll bonus proper now). With the Sapphire Reserve card, I can get 1.5x the factors worth by reserving cruises, flights, lodges, or rental vehicles by way of their journey portal. Or 1.25x worth by reimbursing myself for groceries. That turns the 90,000 factors into $1,350 of free journey or $1,125 of free groceries. For instance, I booked 3 nights in a $100 per night time French Quarter New Orleans resort for a complete of 20,000 Final Reward factors. Or I can switch these Final rewards factors to over a dozen journey companions’ airline/resort packages like United, Southwest, or Hyatt.

Southwest Companion Cross deal – time to behave now!

I additionally picked up a pair of Chase Southwest playing cards throughout the first a part of November. My aim is to obtain the enroll bonuses within the first a part of January 2024, and thereby earn a Southwest Companion go that will likely be legitimate by way of December 2025. The Companion Cross is legitimate for the 12 months you earn it plus the next calendar 12 months.

The Companion Cross principally grants a free flight to your companion while you guide flights for your self (with factors OR with money). This implies Mrs. Root of Good is flying free on Southwest for all of 2024 and 2025!

Simply bear in mind to NOT full the spending requirement till after January 1st of 2024 otherwise you’ll miss out on an entire 12 months of Companion Cross advantages.

Be aware that these playing cards have an annual price (however they provide plenty of free factors every cardmember anniversary so it offsets about half the annual price). And you’ll apply for each playing cards on the identical day in order for you.

Referral hyperlinks should you’re :

Chase Southwest Fast Rewards Efficiency Enterprise card – 80,000 SW miles ($199 annual price) – choose the “Efficiency enterprise” card choice

Chase Southwest Fast Rewards Plus card – 50,000 SW miles ($69 annual price)

For $268 in annual charges, we’ll get ~130,000 SW miles (plus an additional 10,000 mile head begin towards the Companion Cross qualification), and the Companion Cross that provides buy-one-get-one-free Southwest flights for two years. Simply pay taxes on the free ticket (normally $5.60 per a technique section within the USA). That’s about $3,600 value of free flights for the 2 of us.

Clothes/Footwear – $60:

Some new shirts and different gadgets.

Training – $18:

Two transcripts that have been despatched to East Carolina College for $18 whole.

Thrilling information: our oldest daughter simply graduated from group faculty this fall! She begins at East Carolina College in just a few weeks within the on-line Enterprise Administration bachelor’s program. Monetary assist will not be finalized but, however it seems that our out of pocket prices will likely be $0 after the assorted grants, with our daughter getting a good dwelling stipend every semester.

Gasoline – $16:

A half tank for our new automobile got here to $16. The brand new automobile is extra gasoline environment friendly so we should always spend rather less on gasoline.

Cable/Satellite tv for pc/Web – $0:

We usually pay $18 monthly for an area lowered fee bundle because of having a decrease earnings and having children. 30 mbit/s obtain, 4 mbit/s add. Proper now the price of the web service is quickly lowered to $0 because of the “Inexpensive Connectivity Program”.

12 months to Date Spending – 2023

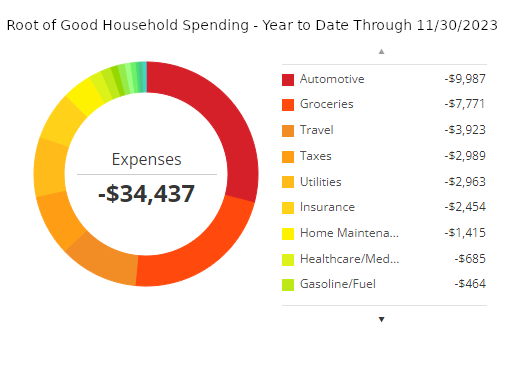

We spent $34,437 throughout the first eleven months of 2023. This annual spending is about $2,000 lower than the $36,667 we budgeted for eleven months of spending in our $40,000 annual early retirement price range.

It seems that our new automobile buy didn’t throw our annual spending off by very a lot. We’re nonetheless operating a small price range surplus with solely two months of spending remaining within the 12 months.

December is nearly half over at this level, so I don’t foresee any surprising bills arising earlier than year-end. So we should always end off 2023 barely under our annual spending goal of $40,000 per 12 months.

Month-to-month Expense Abstract for 2023:

- January – $3,423

- February – $1,675

- March – $1,679

- April – $1,566

- Might – $2,976

- June – $1,536

- July – $2,064

- August – $2,615

- September – $12,714 (we purchased a brand new used automobile)

- October – $1,513

- November – $2,682

Abstract of annual spending from all ten years of early retirement:

- 2014 – $34,352

- 2015 – $23,802

- 2016 – $38,991

- 2017 – $31,708

- 2018 – $29,058

- 2019 – $25,630

- 2020 – $28,466

- 2021 – $31,740

- 2022 – $29,449

- 2023 – $34,437 (12 months to Date by way of November 30, 2023)

Web Price: $2,817,000 (+$134,000)

Our web value recovered remarkably in November to finish the month at $2,817,000. This represents a $134,000 (!!!) achieve from the October web value determine. That’s an enormous amount of cash to realize in a single month, however doesn’t actually change something with our present spending. That’s all long run cash. I’ll go away it within the portfolio to maintain on rising. And to insulate in opposition to future months of six determine losses!

For the curious, our web value reported above consists of our residence worth (which is totally paid off). Nevertheless, please word that I don’t contemplate my residence worth as a part of my portfolio for “4% rule” calculation functions. I notice people ask me about that each month so I simply wished to state that right here for readability.

Life replace

As 2023 attracts to an in depth, I’m feeling grateful for one more good 12 months of early-retired life! It took us a decade to avoid wasting and make investments our method towards this life-style. And now I’ve loved an entire decade of being retired. That feels fairly nice!

This 12 months introduced plenty of modifications. Our son graduated from elementary college and began center college within the fall. Our center baby simply graduated from highschool this previous spring and can graduate from group faculty subsequent spring (at age 17!). Our oldest daughter simply graduated from group faculty this week and is beginning at a 4 12 months college in January.

Onward and upward, proper?

The youngsters’ altering schedules imply our schedules change, too. Our days used to have two built-in day by day walks – one within the morning to stroll our son to the elementary college and one within the afternoon to select him up. Now he carpools to center college within the morning with a pal. We opted to proceed the morning stroll routine to maintain getting some train. We handle about two miles across the neighborhood and thru the park every morning (apart from just a few days the place it was actually freezing exterior). Plus a shorter afternoon stroll to select him up from the bus cease.

All this strolling is sweet for us. It makes exploring varied ports, cities and mountain climbing trails much less exhausting since we’re accustomed to strolling just a few miles a day already.

Just a few days after this submit goes dwell, we’ll be hopping on a aircraft to Miami the place we’ll spend the remainder of December on a cruise destined for South America, Central America, and the Caribbean. On Christmas Day, we will likely be docked at an island about thirty miles off the coast of Honduras. We’ll test off just a few new nations and benefit from the hotter climate within the tropics alongside the best way.

Okay people, that’s it for me this month. Joyful Holidays!

Who’s prepared for some enjoyable over the winter break??!!

Wish to get the most recent posts from Root of Good? Be sure that to subscribe on Fb, Twitter, or by e-mail (within the field on the high of the web page) or RSS feed reader.

Associated

Root of Good Recommends:

- Private Capital* – It is one of the best FREE approach to observe your spending, earnings, and full funding portfolio multi functional place. Did I point out it is FREE?

- Interactive Brokers $1,000 bonus* – Get a $1,000 bonus while you switch $100,000 to Interactive Brokers zero price brokerage account. For transfers underneath $100,000 get 1% bonus on no matter you switch

- $750+ bonus with a brand new enterprise bank card from Chase* – We rating $10,000 value of free journey yearly from bank card enroll bonuses. Get your free journey, too.

- Use a buying portal like Ebates* and save extra on every part you purchase on-line. Get a $10 bonus* while you enroll now.

- Google Fi* – Use the hyperlink and save $20 on limitless calls and texts for US cell service plus 200+ nations of free worldwide protection. Solely $20 monthly plus $10 per GB information.

* Affiliate hyperlinks. When you click on on a hyperlink and do enterprise with these firms, we might earn a small fee.

[ad_2]