[ad_1]

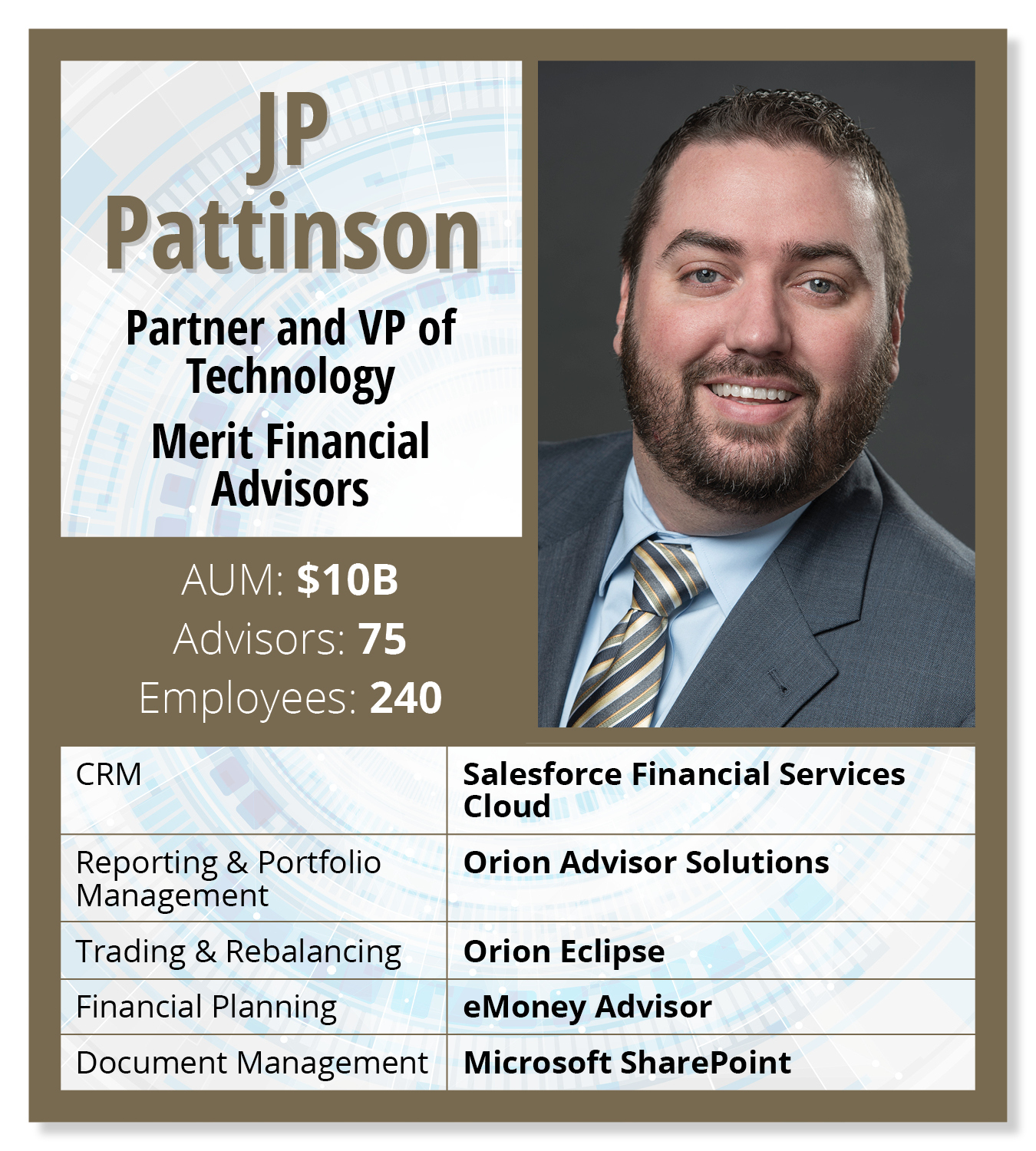

I’m a recovering advisor. I spent over 12 years in that role. I grew up in this business. Straight out of college, I started with an internship, which turned into what has now been my career with essentially the same firm. In 2017, Merit became a new company. We tripled in size. We’ve been big in the M&A space.

Merit made a significant investment into technology in late 2020 or early 2021, which was the culmination of why I went headfirst into technology. I’d always had a passion for it, and now that we were leaning into it and making an investment, I was excited. My passion pulled me towards it.

In 2022, I leaped into the technology space full-time, seeing how technology could influence how we do business at the branch level for clients. I gave up most of my clients. I still have a $20 million book of friends, family and critical clients who don’t want to move to another relationship. I maintain them, but 95% of my time is spent on technology.

CRM: Salesforce Financial Services Cloud

We’ve been on Salesforce since 2019. We started out of the gate with a Financial Services Cloud overlay. Part of our investment in technology led to the development of an investment team. Before, it was me and an assistant. Now we’re a team of 12. We’ve had significant growth in the lean-in. Part of that was bringing on someone with extensive development skills in Salesforce. That has transformed how we use Salesforce today: how it looks, how it feels, how we interact with it. It’s been a labor of love to customize the Salesforce platform.

We’ve been on Salesforce since 2019. We started out of the gate with a Financial Services Cloud overlay. Part of our investment in technology led to the development of an investment team. Before, it was me and an assistant. Now we’re a team of 12. We’ve had significant growth in the lean-in. Part of that was bringing on someone with extensive development skills in Salesforce. That has transformed how we use Salesforce today: how it looks, how it feels, how we interact with it. It’s been a labor of love to customize the Salesforce platform.

Reporting & Portfolio Management; Trading & Rebalancing: Orion Advisor Solutions, Orion Eclipse

We have Orion Advisor Solutions integrated into Salesforce. We use Eclipse by Orion for trading and rebalancing. We’re trying to build that one-stop shop. Orion’s done an excellent job within that integration. It allows you to use Orion but not leave Salesforce, which is nice.

Financial Planning: eMoney Advisor

We use eMoney for financial planning. We used to support eMoney and MoneyGuidePro by Envestnet. But being in the M&A space, we realized that 90% of the firms that we acquire, if they are doing financial planning, they are doing it with eMoney. From a scalability standpoint, it didn’t make sense to maintain multiple platforms when we could consolidate into one and lean into a heavier integration into eMoney.

Client Portal: Wealth Access

We use Wealth Access as our consolidated client portal. We’ve got a lot of options when it comes to how clients can access their accounts, whether it’s directly through the custodians or eMoney. But we chose to go through Wealth Access as the provider for that portal to pull it all together into one consolidated view. It’s something we can lean into. It is one consistent experience that’s not driven by a custodian or financial planning tool. It allows us to be nimbler when we create more relationships with new financial planning tools or if we want to move away from eMoney. Plus, if we wanted to add a custodian, it would bring consistency in a multi-custodial environment.

Document Management: Microsoft SharePoint

We use Microsoft SharePoint. We recently migrated from a cloud server experience into Microsoft SharePoint. We’ll look at integrating Microsoft SharePoint into other systems like Salesforce, for example, as the document repository. That way, we’re not leaving documents in Salesforce proper. We’re trying to have them live all within Microsoft SharePoint. That way, we have that single source of truth.

As told to reporter Rob Burgess and edited for length and clarity. The views and opinions are not representative of the views of WealthManagement.com.

Want to tell us what’s in your wealthstack? Contact Rob Burgess at [email protected].

[ad_2]