June 2023 Early Retirement Update – From Buenos Aires, Argentina

[ad_1]

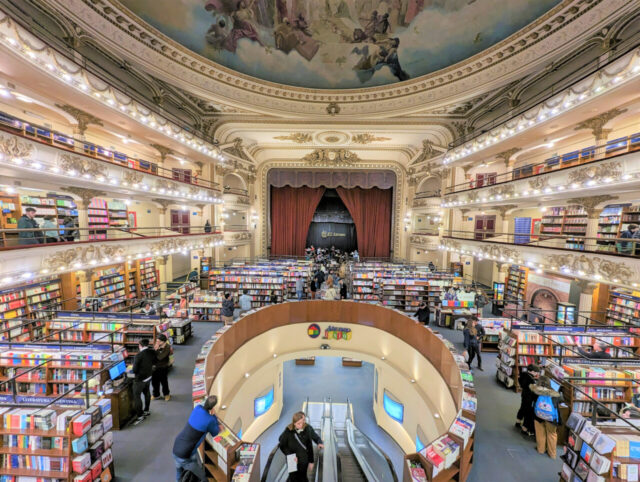

Hello and welcome back to Root of Good! I’m writing to you from our apartment in the Palermo neighborhood of Buenos Aires, Argentina. We are almost done with our one month stay here in the city. Next up, we depart for Puerto Madryn, a small coastal city in the Patagonia region of Argentina in a few short days.

Since we are in the southern hemisphere it’s actually wintertime here with daytime highs around 60F most days. As long as we wear a hat and a light jacket on the cooler days, the weather has been pleasant for exploring the city extensively during this past month.

On to our financial progress. June was a great month for our finances. Our net worth skyrocketed by $84,000 to end June at $2,767,000. Our income totaled a whopping $10,558, while our spending was a very low $1,536 for the month of June.

Let’s jump into the details from last month.

Income

Investment income totaled $6,036 in June. Our equity index funds and ETFs pay dividends quarterly at the end of March, June, September, and December. As a result, we had a rather large amount of investment income last month. Here’s more on our dividend investments.

Blog income totaled $681 for the month. I think this is the “new normal” for blog income since I only post on here about once per month.

My early retirement lifestyle consulting income (“consulting”) was $700 in June. That amount represents four hours of consulting last month. Fortunately I am not any busier because I keep pretty busy sightseeing most days while on vacation. So much to do!

Tradeline sales income totaled $425 in June. After a slow few months, my tradeline sales income is picking up again. I ramped up my tradeline sales in 2020 and discussed it in a bit more detail in my October 2020 monthly post and in my July 2021 monthly post.

For June, my “deposit income” totaled $45. Of this total, $13 comes from cash back and incentive bonuses from the Rakuten.com and Mrrebates.com online shopping portals (some of which was earned from you readers signing up through these links).

If you sign up for Rakuten through this link and make a qualifying $25 purchase through Rakuten, you’ll get a $10 sign up bonus.

The other $32 of deposit income came from a class action settlement from Zoom. I can’t remember how they caused me injury but I am certain that they did. And I am certain that I am $32 richer as a result of their injurious conduct!

Youtube income totaled $135 in June. Youtube only pays out when you exceed $100 in accumulated revenue. Recently, my Youtube earnings have been just under $100 per month on average, so I only get paid every other month.

Here is the Youtube channel for the curious. It’s random travel videos, birds, kids, and a couple of DIY videos. There are only a few main videos that bring in most of the traffic (and revenue!).

The last chunk of income came from credit card and bank bonuses. I cashed out $2,535 worth of American Express membership rewards points. These points came from a $1,700 credit card sign up bonus for the Business Platinum card and another $600 bonus for signing up for their business checking account. The remaining couple hundred dollars worth of credit card bonus money came from completing the rather high minimum spending requirement for the Amex business platinum card. Here is a referral link for the American Express Business Platinum card for those interested.

If you’re interested in tracking your income and expenses like I do, then check out Empower Personal Dashboard, formerly known as Personal Capital (it’s free!). All of our savings and spending accounts (including checking, money market, and five credit cards) are all linked and updated in real time through Empower Personal Dashboard. We have accounts all over the place, and Empower Personal Dashboard makes it really easy to check on everything at one time.

Empower Personal Dashboard is also a solid tool for investment management. Keeping track of our entire investment portfolio takes two clicks. If you haven’t signed up for the free Empower Personal Dashboard service, check it out today (review here).

Tracking spending was one of the critical steps I took that allowed me to retire at 33. And it’s now easier than ever with Empower Personal Dashboard.

Expenses

Now let’s take a look at June expenses:

In total, we spent $1,536 during June which is less than half of our regularly budgeted $3,333 per month (or $40,000 per year). Travel and groceries were the two highest categories of spending in June.

Detailed breakdown of spending:

Travel – $642:

We had a few non-summer trip related travel expenses during June. The first expense was a $6 convenience fee to pay our quarterly estimated state taxes of $300 using a credit card. We get travel benefits from using credit cards as much as possible, so I file the $6 credit card convenience fee under the “travel” category.

The other non-Argentina related travel expense was $23 for the taxes on four plane tickets to Miami. In December our family will cruise to the Caribbean and South America over Christmas break. I used about 44,000 Southwest points for the booking.

The remaining $613 of travel spending comes from the 17 days of June that we spent in Buenos Aires, Argentina. Since our lodging and flights were booked months ago, the $613 represents mostly dining out twice a day.

Average meals here start at $7 for a dozen hot and fresh empanadas (that can easily feed the four of us and leave some leftovers. On the upper end, we spent $45 for a steak dinner for four including our beers and sodas for the kids at a mid-range “parilla” (basically the Argentinian version of a steakhouse).

We average about $20-25 when we go out to eat at most places since plates tend to cost about $4-5 each, plus an appetizer or desert to share, plus a few dollars for drinks and a 10% tip. So far we have not cooked a single meal other than reheating take out or leftovers.

One of our little “hacks” is getting freshly prepared “takeout food” from our favorite bakery a couple blocks up the street. It’s fast and easy to point at the dishes we want, as they are already packaged in individual portions. It’s all hearty fare and maybe even a little healthier than our normal burger/steak/pizza/empanada meals here. Dishes like lentil or sweet pea stew (full of roasted beef shoulder, ham, and chorizo of course), mashed potato and beef pie, hand-made gnocchi with meat sauce and piles of stewed beef on top, stuffed cannellonis with beef sauce, or gigantic arm-length milanesa breaded steaks with a side of potatoes. Each portion is more than enough for one person and they cost $2.60-$2.80 per carry out tray. It’s nice to come back exhausted from a long day sightseeing and be able to heat up some great fresh food in a few minutes.

Other than dining out, we don’t have many other recurring expenses here in Buenos Aires. The bus, subway, and suburban train are all almost free, with tickets costs at USD $0.10 to $0.15 per ride. We took a few Ubers so far and those are $1.50 for short rides, $4-5 to downtown, and $15 (with a fat tip) to the international airport an hour out of town.

Museums and other attractions have mostly been free. We did pay $2-5 each to get into a few places.

We also had to pay $2 to reschedule our July flight to Iguazu Falls to one day later. The new flights were slightly cheaper than the original flights we bought, so the net cost after paying a small rebooking fee was only $2.

Needless to say, Argentina is a frugal mecca. We don’t really have to pay attention to price tags because almost everything is affordable even if it is considered expensive by local standards.

Argentina Cash Management

As far as cash management, we brought a stack of crisp, new, excellent condition USD $100 bills. Every few days I take one of those $100 bills to the moneychanger office across the street and get about 48,500 Argentine pesos in exchange. This foreign exchange trade takes place at the “blue dollar” rate which is about twice as good as the “official” exchange rate that basically no one uses.

Argentina is the rare country where you can’t get the best exchange rate by simply withdrawing cash from an ATM using your fee-free Fidelity or Schwab or Citigold ATM card. I haven’t tried to use my ATM card yet, but apparently the exchange rate is about 10-15% worse than the moneychangers. Credit cards are almost as bad. So far my Mastercard gives me an exchange rate about 8% worse than trading USD cash for a thick stack of pesos.

As a result of the bad exchange rate on credit cards, I pay cash for almost everything. This means carrying around an inch-thick folded wad of pesos everywhere we go just to cover a meal or two and any small incidental expenses during the day. Their largest bill here in common circulation is the $1,000 peso note, worth about USD $2. So a $45 steak dinner (22,500 pesos) has me counting out quite a stack of 1,000 peso notes to pay for the meal.

Get free travel like us

If you are interested in getting free travel from your credit card like I do, consider the Chase Ink Unlimited or Chase Ink Cash business cards (my referral link). Right now the Chase Ink business cards offer 75,000 Chase Ultimate Rewards points that can be redeemed instantly for $750 in cash. Mrs. Root of Good and I each received our new Chase Ink Unlimited cards during December, and we just picked up a new Chase Ink Cash card during March. The bonuses keep on rolling in the door!

Chase is pretty liberal when it comes to “what is a business”. If you sell stuff on eBay or Craigslist or do some odd jobs occasionally then you have a business and could get a credit card as a “sole proprietor”.

Another favorite travel card in my wallet is the Capital One Venture X card. The Venture X card is a “keeper” for me. First off, it comes with a $750 sign up bonus after spending $4,000 in the first three months. The bonus is paid in the form of 75,000 bonus points that you can redeem against any travel purchases from anywhere. Then you earn a solid 2 points per dollar spent forever! The other big perk is airport lounge access. You can get yourself plus unlimited guests into Priority Pass lounges. And you plus two guests can get into Plaza Premium network lounges and Capital One Lounges.

The Capital One Venture X card does have one catch – a $395 annual fee. But they reward you every year with an easy to use $300 travel credit plus $100 worth of points. Together, that makes $400 they give you annually which more than offsets the annual fee. Another benefit worth mentioning: you can add up to four authorized users for free, and they also get all the benefits of the Venture X card including the valuable airport lounge access. We used this perk to “gift” a pair of Venture X cards with airport lounge access to my brother in law and his wife to use on their family trip back home to Cambodia in April with their two young children.

Since the annual fee is offset in full by travel credits each year, I personally plan on keeping the Venture X card forever since the card benefits are so great.

Groceries – $302:

For groceries back home in Raleigh, our household spent a total of $302 during June. Most of that total comes from the 13 days of June that we were in town. A small portion of that $302 grocery total comes from our daughter who is staying in Raleigh all summer (because she has college classes and part time work). Since she is still in college, we are paying for her groceries while she’s living at home.

Our grocery purchases here in Argentina are recorded as “travel” expenses, and consist mostly of beer, wine, sodas, and other drinks plus yogurt, flan, and fresh fruits. Since we are staying in the same apartment for a month, we’ve also spent $10-15 on toilet paper, paper towels, soap, shampoo, and conditioner.

Taxes – $300:

Quarterly estimated North Carolina state income tax payment was $300 in June.

Utilities – $170:

We spent $140 on our water/sewer/trash bill.

The natural gas bill, which provides heating and hot water, totaled $30 for last month.

I paid the electricity bill in the first few days of July, so the total for electric in June was $0. We’ll have two electricity payments in July.

Healthcare/Medical/Dental – $65:

Our current 2023 health insurance costs $18 per month, thanks to very generous Affordable Care Act subsidies that we receive due to our low ~$45,000 per year Adjusted Gross Income.

I paid for health insurance for June and July before we left on vacation so I wouldn’t have to worry about that bill while we were gone. As a result, there was a $36 expenditure for health insurance in June.

Our 2023 dental insurance plans cost a total of $29 in premiums per month.

I chose a very basic plan for $9 per month for me that covers most preventive care but no fillings. Mrs. Root of Good has a different set of dental needs than I do so we kept the more comprehensive $20 per month plan for her (same as 2022’s plan).

By buying insurance, we should save a couple hundred dollars on my dental care. For Mrs. Root of Good, we will still save a few dollars compared to paying cash for the preventive dentist visits throughout the year.

Clothing/Shoes – $59:

$59 for clothes for the summer for the kids.

Restaurants – $1:

I redeemed a “free” burrito that I received as a freebie birthday gift from Moe’s. The app charges a bit under a dollar for the privilege of using the app to order ahead and have the food ready for pickup as soon as you walk in. Nice way to avoid waiting in line. Worth it.

I also noticed the full price of the steak burrito I ordered is now $14.00 including tax. Inflation is crazy!

Gas – $0:

No gas purchases in June. We were out of town most of the month and our oldest daughter’s college classes in Raleigh are all virtual.

Cable/Satellite/Internet – $0:

We generally pay $18 per month for a local reduced rate package due to having a lower income and having kids. 30 mbit/s download, 4 mbit/s upload. Right now the cost of the internet service is temporarily reduced to $0 due to the “Affordable Connectivity Program”.

Year to Date Spending – 2023

We spent $12,852 during the first six months of 2023. This annual spending is about $7,000 less than the $20,000 we budgeted for six months of spending in our $40,000 annual early retirement budget.

The 2023-2024 financial aid packages for our two college kids are preliminarily awarded. It looks like they’ll each receive about $2,300 cash back each semester of community college (net of tuition/books), plus the value of any subsidized 0% loans they want to take. Those cash back numbers may rise as additional grants/scholarships are applied closer to the start of the fall semester. College is looking pretty cheap so far, as I expected!

The one large expense anticipated for 2023 will be a used car. We failed in our attempts to acquire one during 2022 but that’s okay. The market appears to be cooling off a bit, since I am finally seeing a few cars under $10,000 that aren’t complete pieces of junk. The tentative plan is to buy a second car when we return from South America in August.

Fortunately, we are underspending our budget by a significant margin, so we should be able to “absorb” the used car purchase in our regular $40,000 per year budget without exceeding the budget by much. Right now we have a $7,000 budget surplus so that’s almost the same amount as what we’ll likely spend on a used car.

Monthly Expense Summary for 2023:

Summary of annual spending from all ten years of early retirement:

- 2014 – $34,352

- 2015 – $23,802

- 2016 – $38,991

- 2017 – $31,708

- 2018 – $29,058

- 2019 – $25,630

- 2020 – $28,466

- 2021 – $31,740

- 2022 – $29,449

- 2023 – $12,852 (Year to Date through June 30, 2023)

Net Worth: $2,767,000 (+$84,000)

Our net worth climbed $84,000 to end June at $2,767,000. We are within $100,000 of our all time high net worth, but have seen our net worth go sideways for the last 18 months. After inflation, our net worth has been slowly eroding in real terms. However, I expect in 5 or 10 years we will have much more money than we do today, even after factoring in inflation. No worries!

I realized the power of these investments when I logged in to my various brokerage accounts in the first days of July and transferred thousands of dollars worth of dividends over to my checking account to cover our routine spending. Here I am, 5,000 miles away from home, relaxing in our apartment in Buenos Aires, and all I have to do is click a few buttons and — boom! — I suddenly have enough money in our checking account to cover another month or two of spending. And I’ll do this again in 3 more months, and 3 months after that and on and on and on.

For the curious, our net worth reported above includes our home value (which is fully paid off). However, please note that I don’t consider my home value as part of my portfolio for “4% rule” calculation purposes. I realize folks ask me about that every month so I just wanted to state that here for clarity.

Life update

As I write this, we are approaching the end of our one month stay in Buenos Aires, Argentina. I have enjoyed staying put in one place for an entire month. We get to forget about the logistics of packing up and traveling to our next destination for a while.

But in a few days we will toss all our belongings in our bookbags and our one shared piece of checked luggage. Then head out the door to the airport for a two hour flight south to Puerto Madryn in Patagonia. I’m already researching things to do and places to eat in our new home, where we will spend two weeks whale-watching (we hope!).

I like this slower pace of travel a lot. I have time to catch up on news back home, chat with friends and family, do some reading and gaming, and relax quite a bit.

During this month in Buenos Aires, we have found several “favorite” eateries and attractions and made time to go back and visit them more than once. And we don’t have to rush to do anything, since we have ample time to check off all the must-sees and must-eats.

The second half of our trip will be a little faster paced. After our two weeks in Puerto Madryn, Argentina, we have two more destinations of one week each in Iguazu Falls, Brazil, and Sao Paulo, Brazil. Plus a one night layover in Buenos Aires on our way north to Brazil from Puerto Madryn.

Lots to see and do before the summer is over!

With that, I’ll leave you until next month’s update comes out. Enjoy the rest of July!

How is your summer going so far?

Want to get the latest posts from Root of Good? Make sure to subscribe on Facebook, Twitter, or by email (in the box at the top of the page) or RSS feed reader.

Related

Root of Good Recommends:

- Personal Capital* – It’s the best FREE way to track your spending, income, and entire investment portfolio all in one place. Did I mention it’s FREE?

- Interactive Brokers $1,000 bonus* – Get a $1,000 bonus when you transfer $100,000 to Interactive Brokers zero fee brokerage account. For transfers under $100,000 get 1% bonus on whatever you transfer

- $750+ bonus with a new business credit card from Chase* – We score $10,000 worth of free travel every year from credit card sign up bonuses. Get your free travel, too.

- Use a shopping portal like Ebates* and save more on everything you buy online. Get a $10 bonus* when you sign up now.

- Google Fi* – Use the link and save $20 on unlimited calls and texts for US cell service plus 200+ countries of free international coverage. Only $20 per month plus $10 per GB data.

* Affiliate links. If you click on a link and do business with these companies, we may earn a small commission.

[ad_2]