January 2024 Early Retirement Update – Winter Frost Edition

[ad_1]

Welcome back to Root of Good for a frosty winter monthly update! We kept busy around the house during January with a lot of indoor activities while it was cold outside. Throughout the last month, we completed the planning and booking for our two month summer trip through Poland. I bet we looked at more than 1,000 airbnbs and hotels during our search for lodging. More on that in the “Travel” section down below.

At the beginning of the month, we celebrated New Years with family. We all got sick with flu-like symptoms during the early part of the month so we’ve been nursing ourselves back to health since then. It’s nice to not worry about missing work due to being sick, and having to come back to an office inbox with 1,000 unread emails.

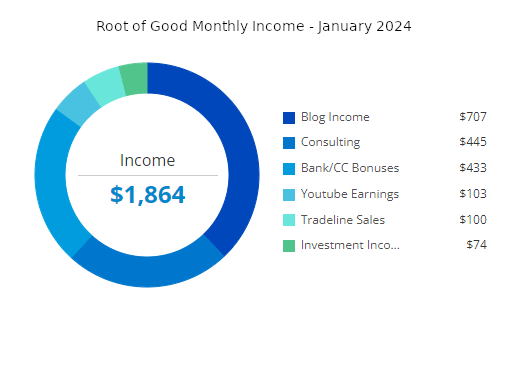

On to our financial progress. January was a decent month for our finances. Our net worth declined slightly, by $10,000, to end the month at $2,956,000. Our income of $1,864 slightly exceeded our spending of $1,828 for the month of January.

Let’s jump into the details from last month.

Income

Investment income totaled only $74 in January. Our equity index funds and ETFs pay dividends quarterly at the end of March, June, September, and December. As a result, we had a much smaller than normal amount of investment income last month. Here’s more on our dividend investments.

Blog income totaled $707 for the month. This is the “new normal” for blog income since I only post on here about once per month. I am glad to have other streams of income to provide for our family’s living expenses.

My early retirement lifestyle consulting income (“consulting”) was $445 last month which represents 2.5 hours of consulting. That’s enough to cover more than half our monthly grocery bill.

Tradeline sales income totaled $100 in January. February’s tradeline income should be even better because I’ve had a ton of new tradeline sales in the past few weeks. I ramped up my tradeline sales a few years ago and discussed it in a bit more detail in my October 2020 monthly post and in my July 2021 monthly post. Most years I make around $4,000 to $6,000 in exchange for lending out my stellar credit report history from half a dozen credit cards.

======================

Tradeline Sales

The company I use, Boost Credit 101, has temporarily opened enrollment for new tradeline sellers for the month of February, 2024. If you are interested in selling tradelines too, here is some more info.

Right now, Boost Credit 101 takes credit cards issued by the following banks:

- Alliant Credit Union

- Barclays

- Discover

- Huntington Bank

- PNC

- Chase

- Elan/Fidelity (10+ year old cards only)

- US Bank (10+ year old cards only)

Personal credit cards only (no business cards).

I’ve used Boost Credit 101 for several years and from my research and personal experience they are the best and most reputable tradeline selling company.

If interested in selling tradelines, please email investorsupport @ boostcredit101.com and make sure to mention that “Root of Good” sent you their way if you want me to get a little referral bonus from them (or don’t mention me if you don’t want to!).

Include this info when you email Boost Credit 101:

- Lender and card type (Example: Barclays Arrival, Chase Freedom)

- Opening date (month and year)

- Credit limit

- The statement date (aka closing date, this is not the same date as your payment due date)

- Address associated with the tradeline card

A few caveats about tradeline sales: for the cards you are selling authorized user slots on, you’ll need to keep your utilization of your credit limit to less than 10% of your total credit limit. So if you have a $20,000 limit, then you cannot have a balance higher than $2,000 when the statement closes.

The other concern is cancellation risk. Be aware that your credit card account could be closed for adding too many authorized users. Or the card issuer could close all of your accounts if you have multiple cards with them, even if you’re only selling tradelines on one credit card. It hasn’t happened to me (yet!) but it’s a risk that needs to be disclosed to you.

Good luck with tradeline sales if you go that route. And thank you if you mention that “Root of Good” referred you to Boost Credit 101!

======================

Okay, back to the rest of my income for January:

For January, my “deposit income” dropped to zero. In most months, I get a small amount of cash back and incentive bonuses from the Rakuten.com and Mrrebates.com online shopping portals (some of which was earned from you readers signing up through these links).

If you sign up for Rakuten through this link and make a qualifying $25 purchase through Rakuten, you’ll get a $10 sign up bonus (or more!).

In January my bank/credit card sign up bonus income spiked to $433. I cashed out 43,300 American Express Membership Rewards points into my Amex business checking account to snag this bonus. These points were earned almost a year ago but I was holding them in reserve in case I found a good use for them with Amex’s travel partners. I didn’t, so I converted them to cash in my checking account before closing my Amex Business Platinum card during January.

Youtube income was $103 last month. Youtube only pays out when you hit $100 in accumulated revenue. Recently, my Youtube earnings have been slightly under $50 per month on average, so I only get paid every two or three months.

Here is the Youtube channel for the curious. It’s random travel videos, birds, kids, and a couple of DIY videos. There are only a few main videos that bring in most of the traffic (and revenue!).

If you’re interested in tracking your income and expenses like I do, then check out Empower Personal Dashboard, formerly known as Personal Capital (it’s free!). All of our savings and spending accounts (including checking, money market, and five credit cards) are all linked and updated in real time through Empower Personal Dashboard. We have accounts all over the place, and Empower Personal Dashboard makes it really easy to check on everything at one time.

Empower Personal Dashboard is also a solid tool for investment management. Keeping track of our entire investment portfolio takes two clicks. If you haven’t signed up for the free Empower Personal Dashboard service, check it out today (review here).

Tracking spending was one of the critical steps I took that allowed me to retire at 33. And it’s now easier than ever with Empower Personal Dashboard.

Expenses

Now let’s take a look at January expenses:

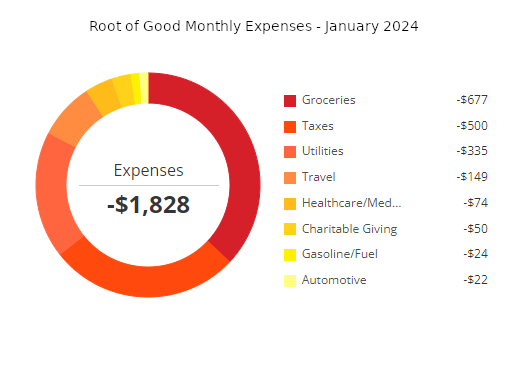

In total, we spent $1,828 during the month of January which is about $1,500 less than our regularly budgeted $3,333 per month (or $40,000 per year). Groceries and taxes were once again the highest two spending categories for the second month in a row.

Detailed breakdown of spending:

Groceries – $677:

I am surprised we spent so little during January. We loaded up on the $3.99/lb london broil sale at the grocery store last month and filled our freezer with at least 25-30 pounds of lean beef.

Based on our monthly grocery spending, it looks like prices at the grocery store have leveled off in recent months. Inflation is over I guess?

Taxes – $500:

I paid the fourth quarter estimated taxes of $500 to the State of North Carolina during January. They charge a 2% service fee for paying with a credit card. I included that $10 service charge in “travel” spending. Paying taxes with a credit card helps us hit the spending requirements for all of these credit card sign up bonuses we get.

Utilities – $335:

We spent $40 on our water/sewer/trash bill. Part of this bill was paid with rewards cards from our health insurance company, so the bill was smaller than usual.

The natural gas bill, which provides heating and hot water, totaled $118 for last month. We used the heat a lot as it got colder last month.

I paid $178 for two months worth of electricity bills.

Travel – $149:

We paid $10 in service fees to use a credit card to pay our $500 state income tax for the fourth quarter. I add that $10 into the travel category of spending because the big income tax payments on a credit card really help us hit those spending requirements for big sign up bonuses.

The remaining $139 of travel spending came from the taxes for half a dozen “free” flights booked using frequent flyer miles.

I thought we had spent a ton more on travel in the past month but it turns out pretty much everything was booked with points and miles. Or I paid with a credit card in the first few days of February so those travel expenses will show up next month.

Our two month summer trip to Poland is fully booked now. We reserved 65 nights of lodging for a total of $6,385, or an average of $97 USD per night. Of that total, about $4,400 was booked with Airbnb credits we got for free last year through our Chase Ultimate Rewards points.

We still owe about $2,000 for five different stays this summer. Those amounts will be paid in June or July closer to when we arrive at the apartments. Or we will pay in person for the two short stays we have booked at a castle and a palace.

We booked apartments with two or more bedrooms, or two hotel rooms everywhere we’re staying in Poland this summer. Most of the time we’ll stay in one place for a week or slightly longer. Weekly stays usually come with a discount of 5-15% compared to the nightly rates.

I paid a small amount in early February to put a hold on a rental car. We’ll get a rental car for our two month trip for about $1,000 in total.

Get free travel like us

If you are interested in getting free travel from your credit card like I do, consider the Chase Ink Unlimited or Chase Ink Cash business cards (my referral link). Right now, the Chase Ink business cards offer an above average $750 Chase Ultimate Rewards points that can be redeemed instantly for $750 in cash. Mrs. Root of Good and I each picked up another new Chase Ink card during January. The bonuses keep on rolling in the door!

Chase is pretty liberal when it comes to “what is a business”. If you sell stuff on eBay or Craigslist or do some odd jobs occasionally then you have a business and could get a credit card as a “sole proprietor”.

I use the 75,000 Chase Ultimate Rewards points by transferring them to my Chase Sapphire Reserve card (also offering a 60,000 point sign up bonus right now). With the Sapphire Reserve card, I can get 1.5x the points value by booking cruises, flights, hotels, or rental cars through their travel portal. Or 1.25x value by reimbursing myself for groceries. That turns the 75,000 points into $1,125 of free travel or $937.50 of free groceries. For example, I used 165,000 Chase Ultimate Reward points to pay for the $2,475 in taxes, fees, and gratuities on my two fall cruises. Or I can transfer those Ultimate rewards points to over a dozen travel partners’ airline/hotel programs like United, Southwest, or Hyatt.

Southwest Companion Pass deal – time to act now!

I picked up a pair of Chase Southwest cards during November. I timed my spending on these cards to trigger the sign up bonuses in the first part of January 2024, and thereby earned a Southwest Companion pass in early January that will be valid through December 2025. The Companion Pass is valid for the year you earn it plus the following calendar year.

The Companion Pass basically grants a free flight for your companion when you book flights for yourself (with points OR with cash). This means Mrs. Root of Good is flying free with me on Southwest for all of 2024 and 2025!

Right now is a great time to get these cards since you’ll get almost two full years of the Companion Pass.

Note that these cards have an annual fee (but they offer a lot of free points each cardmember anniversary so it offsets about half the annual fee). And you can apply for both cards on the same day if you want.

Referral links if you’re interested:

Chase Southwest Rapid Rewards Performance Business card – 80,000 SW miles ($199 annual fee) – select the “Performance business” card option

Chase Southwest Rapid Rewards Plus card – 50,000 SW miles ($69 annual fee)

For $268 in annual fees, we’ll get ~130,000 SW miles (plus an extra 10,000 mile head start toward the Companion Pass qualification), and the Companion Pass that offers buy-one-get-one-free Southwest flights for 2 years. Just pay taxes on the free ticket (usually $5.60 per one way segment in the USA). That’s about $3,600 worth of free flights for the two of us.

Healthcare/Medical/Dental – $74:

Our current 2024 health insurance is free, thanks to very generous Affordable Care Act subsidies that we receive due to our low ~$48,000 per year Adjusted Gross Income.

Our 2024 dental insurance plan costs $37 in premiums per month. We picked a plan from Truassure through the healthcare.gov exchange. The dental insurance does a good job of covering routine cleanings, exams, and x-rays plus most of the cost of basic procedures like fillings.

I paid two months of dental insurance premiums in January so our total medical/dental spending was $74.

Charitable Giving:

A friend and neighbor had his construction van raided by some thieves that did a lot of damage and stole all his work tools. His family set up a gofundme so we dropped $50 in there to help him get back on his feet. Can’t work hard and be self-sufficient if you don’t have the (literal) tools to do so.

Gas – $24:

A tank of gas for our new car totaled $24. The new car is more fuel efficient so we should spend a little less on gas on average.

Automotive – $22:

Our middle child just acquired her teen driver’s license in January. The DMV charged $22 for the license. We are excited because we don’t have to drive her to her college classes any more.

Cable/Satellite/Internet – $0:

We generally pay $18 per month for a local reduced rate package due to having a lower income and having kids. 30 mbit/s download, 4 mbit/s upload. Right now the cost of the internet service is temporarily reduced to $0 due to the “Affordable Connectivity Program”.

Spending for 2024 – Year to Date

We spent $1,828 for the first month of 2024. This annual spending is about $1,500 less than our $40,000 annual early retirement budget. I haven’t increased our annual budget for inflation in a decade, so at some point I need to revisit the budget numbers.

So far, so good for 2024. I don’t think it will be a horribly expensive year as we don’t have any major projects planned for the house. Our summer plans have us staying in Poland for two months and it’s one of the more affordable developed nations in the world.

The only wildcard for 2024 spending is another new used car. We have two cars right now but we may need to acquire another one depending on what our oldest two kids end up doing in the fall for college or internships.

Monthly Expense Summary for 2024:

Summary of annual spending from more than a decade of my early retirement:

- 2014 – $34,352

- 2015 – $23,802

- 2016 – $38,991

- 2017 – $31,708

- 2018 – $29,058

- 2019 – $25,630

- 2020 – $28,466

- 2021 – $31,740

- 2022 – $29,449

- 2023 – $37,865

- 2024 – $1,828 (through 1/31/2024)

Net Worth: $2,956,000 (-$10,000)

After two months of six figure gains in November and December, we lost a small amount ($10,000) in January to bring our net worth to $2,956,000 at month-end. We still hover just below the magic $3 million mark! I have a feeling we’ll hit that number at some point in 2024.

For the curious, our net worth reported above includes our home value (which is fully paid off). However, please note that I don’t consider my home value as part of my portfolio for “4% rule” calculation purposes. I realize folks ask me about that every month so I just wanted to state that here for clarity.

Life update

January flew by, didn’t it? We were really busy doing trip planning and research during the latter part of the month. Being a travel agent for yourself is almost like a full time job. But I enjoy the thrill of the hunt: finding a good bargain, and looking forward to staying in a diverse set of lodgings all summer.

We booked a few short stays in several different interesting places just to enjoy the ambiance. We actually rearranged our schedule a bit to snag the last two nights of availability for a small castle atop a hill in southern Poland. Our stay includes free access to their “starvation room / dungeon” and the place might be haunted. So there’s that to look forward to! And at only USD $50 per night, it was hard to turn down.

Since we didn’t travel anywhere during January, we tried to make the most of the occasional warm, sunny winter days. Now that there is frost on the ground early in the morning, our daily walks usually happen in the late morning once the sun is out and the temperature warms up a bit.

On our walk this morning, we saw a lot of trees already starting to bloom. They know what we know: spring is just around the corner!

Well folks, that’s it for me this month. See you again next month!

Who’s ready to thaw out when spring comes?

Want to get the latest posts from Root of Good? Make sure to subscribe on Facebook, Twitter, or by email (in the box at the top of the page) or RSS feed reader.

Related

Root of Good Recommends:

- Personal Capital* – It’s the best FREE way to track your spending, income, and entire investment portfolio all in one place. Did I mention it’s FREE?

- Interactive Brokers $1,000 bonus* – Get a $1,000 bonus when you transfer $100,000 to Interactive Brokers zero fee brokerage account. For transfers under $100,000 get 1% bonus on whatever you transfer

- $750+ bonus with a new business credit card from Chase* – We score $10,000 worth of free travel every year from credit card sign up bonuses. Get your free travel, too.

- Use a shopping portal like Ebates* and save more on everything you buy online. Get a $10 bonus* when you sign up now.

- Google Fi* – Use the link and save $20 on unlimited calls and texts for US cell service plus 200+ countries of free international coverage. Only $20 per month plus $10 per GB data.

* Affiliate links. If you click on a link and do business with these companies, we may earn a small commission.

[ad_2]