Has “Funding Reduction” for Non-public Sector Outlined Profit Plans Gone Too Far? – Heart for Retirement Analysis

[ad_1]

Making liabilities look small doesn’t make them go away.

In doing background studying to determine what number of corporations might observe IBM and reopen a closed outlined profit plan, commentators stored referring to “funding aid,” which – mixed with the improved funded standing and de-risking – has dramatically diminished the probability that an organization could be pressured to contribute to its plan. I had not been following the rules for personal sector outlined profit guidelines and was shocked on the extent to which laws had severed the connection between rate of interest fluctuations and required contributions.

Funding aid has concerned backing away from the strict necessities launched within the 2006 Pension Safety Act. That laws – responding to the collapse of the dot-com bubble and the plunge in rates of interest on the flip of the century – did two issues. First, it diminished the interval for paying off unfunded liabilities to 7 years. Second, it specified the rates of interest for use for discounting promised advantages – the company bond yield averaged over the previous 24 months. (It really set three low cost charges that rely upon the dates the advantages are anticipated to be paid – in lower than 5 years, 5 to twenty years, and past 20 years. However the story is sophisticated sufficient with out contemplating three separate charges.)

On the similar time that Congress tightened funding requirements, the Monetary Accounting Requirements Board modified the reporting necessities, forcing firms to deal with web pension liabilities as debt on the stability sheet.

Shortly thereafter got here the International Monetary Disaster when the inventory market and the financial system collapsed. With the brand new funding and reporting necessities, the drop in funded standing imposed actual prices on sponsoring firms – their stability sheets took successful they usually confronted a pointy enhance in required pension contributions.

In response, Congress began its funding aid marketing campaign. The primary essential piece of laws was the 2012 Shifting Forward for Progress within the 21st Century Act, which required that the rate of interest established by the 2006 Pension Safety Act be averaged over the prior 25 years – a interval when charges had been considerably increased. It additionally set the minimal and most charges at 90 p.c and 110 p.c of the common, respectively.

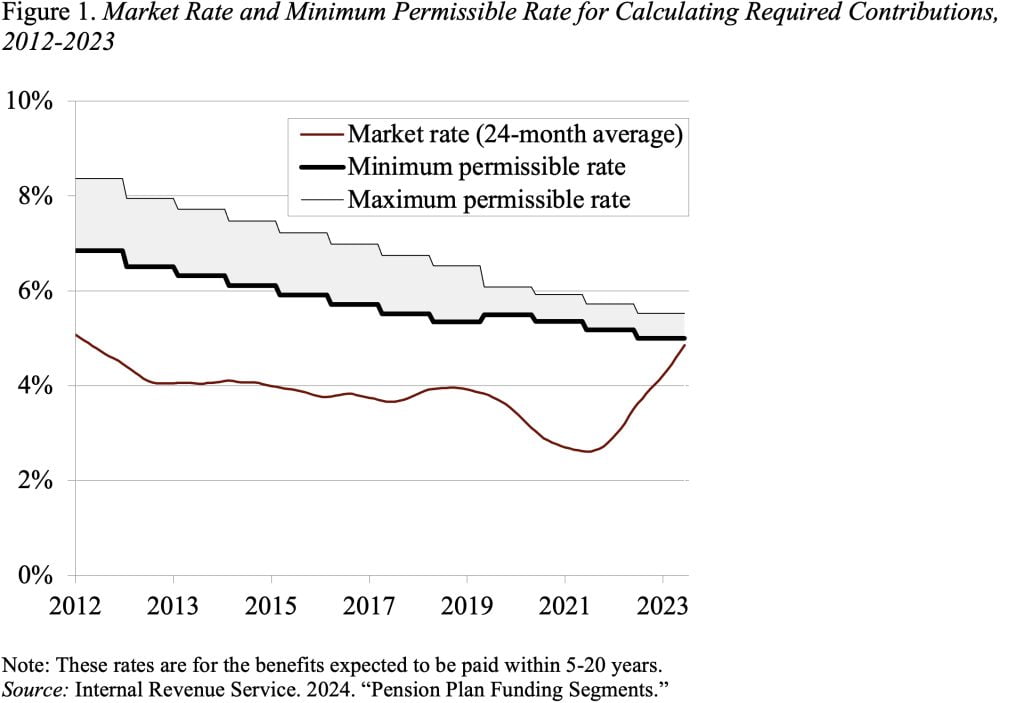

The 2012 laws envisioned the hall widening over time, which with market charges considerably under the hall, would have decreased the funding low cost fee – resulting in elevated liabilities and minimal required contributions. However extra iterations of funding aid prevented this widening from occurring. Consequently, the speed used to calculate liabilities for funding functions has been about 200 foundation factors increased than the “market fee” specified within the Pension Safety Act (see Determine 1).

The second and most dramatic items of funding aid have been included within the American Rescue Plan Act of 2021 (ARPA). First, it set a flooring of 5 p.c on the 25-year common and narrowed the hall across the common from 10 p.c to five p.c. The change comes simply because the 25-year common was transferring away from traditionally excessive charges, which might have eradicated the hole between the minimal permissible fee and the “market fee.” The laws additionally completely elevated the amortization interval from 7 years to fifteen years, which will increase the time for underfunded plans to succeed in full funding.

Sponsors will need to have lobbied for the ARPA provisions, and certainly increased assumed charges and the longer amortization interval will enable many to proceed their contribution vacation. However the plans’ liabilities need to be paid in some unspecified time in the future, and plans contributing the minimal could have insufficient assets.

I’m not an skilled on pension regulation, and it is sensible to guard sponsors in opposition to extreme volatility within the rates of interest. However at this level, my concern is that funding aid has gone too far, and we might as soon as once more see issues down the street.

[ad_2]