Greensboro Housing Market Trends and Forecast for 2024

[ad_1]

The Greensboro, NC housing market in 2024 demonstrates resilience and attractiveness to both buyers and sellers. With consistent price appreciation, a seller-friendly environment, and relatively quick sales cycles, Greensboro presents opportunities for real estate investors and homeowners alike.

How is the Greensboro housing market doing currently?

Median Listing Prices and Trends in Greensboro

According to the data by Realtor.com, in February 2024, the median listing home price in Greensboro, NC stood at $299,000, reflecting a 1.4% year-over-year increase. The median price per square foot was $166, with the median home sold price recorded at $270,000. This data indicates a steady growth trajectory in the housing market, making Greensboro an area of interest for both buyers and sellers.

Market Trends

The housing market in Greensboro, NC exhibits several noteworthy trends:

- Seller’s Market: Greensboro, NC is currently experiencing a seller’s market, suggesting higher demand for homes compared to the available inventory. This scenario often leads to competitive bidding and higher sale prices.

- Sale-to-List Price Ratio: The sale-to-list price ratio stands at 98.99%, indicating that homes in Greensboro are generally selling close to their asking prices.

- Median Days on Market: The median days on market for homes in Greensboro is 34 days, indicating a relatively fast-paced market environment. Although this figure has slightly increased compared to the previous year, it remains lower than the national average.

Forecast

Looking ahead, the forecast for the Greensboro, NC housing market suggests continued stability and growth. Factors such as favorable mortgage rates, economic development initiatives, and a strong job market contribute to the overall positive outlook for the region.

Housing Market Drivers in Greensboro

The Greensboro housing market is being driven by a number of factors, including:

- Strong job growth: Greensboro is one of the fastest-growing cities in North Carolina, with a job growth rate of 3.2% over the past year. This is attracting new residents to the area, who are driving up demand for housing.

- Low inventory: There is a shortage of homes available for sale in Greensboro, which is driving up prices.

Overall, the Greensboro housing market is strong and competitive. Sellers are likely to get good prices for their homes, and buyers need to be prepared to act quickly when they find a home they like.

Greensboro Housing Market Forecast 2024 and 2025

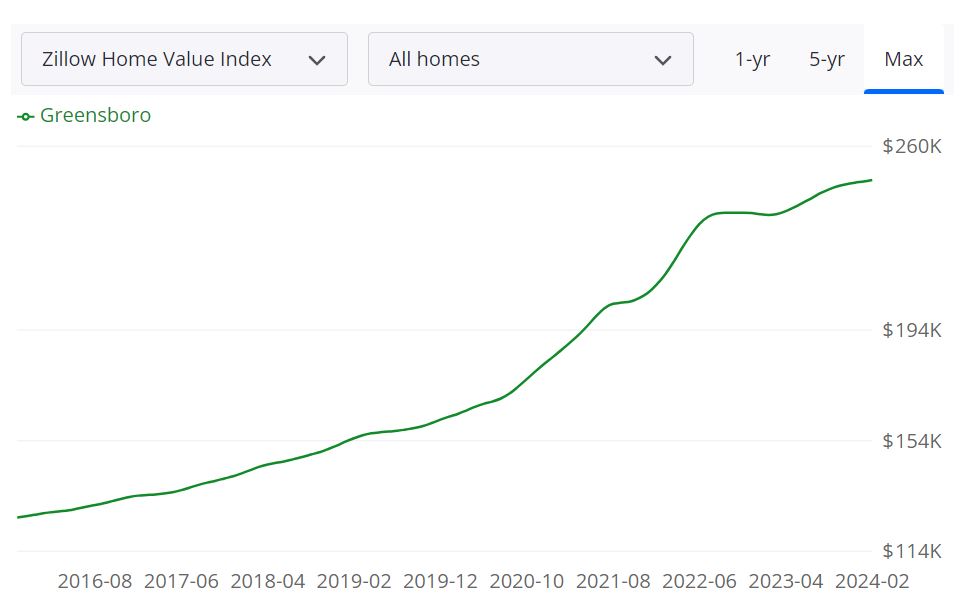

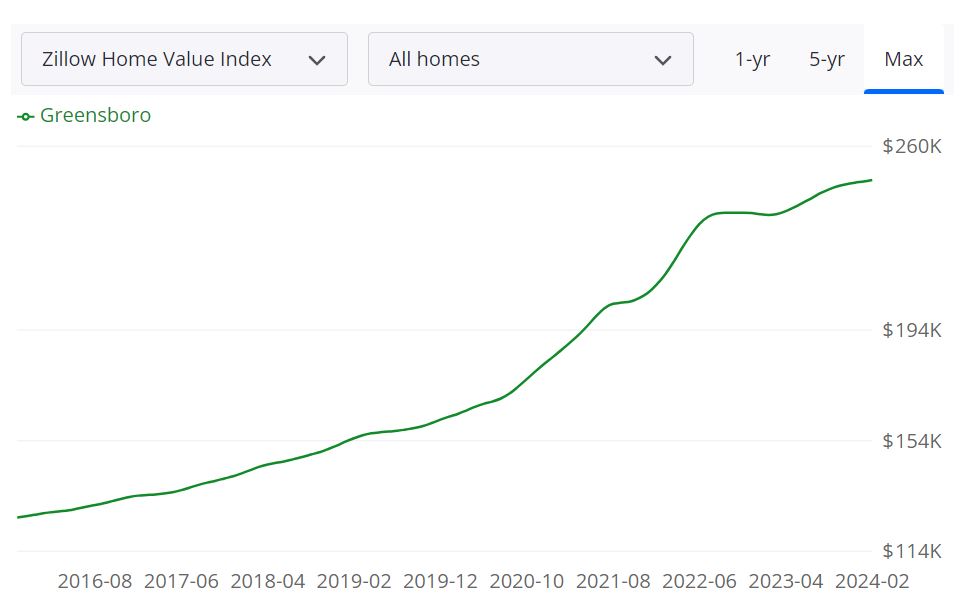

The Greensboro housing market is showing resilience and promising signs of growth, with key metrics indicating a favorable outlook for both buyers and sellers. According to Zillow, the average home value in Greensboro stands at $248,614, marking a 5.3% increase over the past year. Homes in Greensboro typically go pending in around 14 days, reflecting the competitive nature of the market.

Key Metrics Explained:

- 631 For Sale Inventory (February 29, 2024): This figure represents the total number of homes available for sale in Greensboro as of February 29, 2024. A higher inventory may indicate more options for buyers.

- 234 New Listings (February 29, 2024): This metric signifies the number of newly listed homes in Greensboro as of February 29, 2024, indicating ongoing activity in the housing market.

- 0.985 Median Sale to List Ratio (January 31, 2024): The median sale to list ratio reflects the relationship between the sale price and the listing price of homes in Greensboro. A ratio close to 1 indicates that homes are typically selling close to their list price.

- $235,400 Median Sale Price (January 31, 2024): This represents the middle point of all home sale prices in Greensboro as of January 31, 2024.

- $283,333 Median List Price (February 29, 2024): The median list price indicates the middle point of all homes listed for sale in Greensboro as of February 29, 2024.

- 28.2% Percent of Sales Over List Price (January 31, 2024): This percentage reflects the portion of home sales in Greensboro that closed above the listing price as of January 31, 2024.

- 57.9% Percent of Sales Under List Price (January 31, 2024): Conversely, this percentage represents the portion of home sales in Greensboro that closed below the listing price as of January 31, 2024.

The Greensboro Metropolitan Statistical Area (MSA) encompasses the city of Greensboro along with surrounding areas. It is a geographical region defined by the U.S. Office of Management and Budget for use by federal agencies in collecting, tabulating, and publishing federal statistics. Within the Greensboro MSA, several counties contribute to the housing market, including Guilford, Randolph, and Alamance. The housing market within the Greensboro MSA is considered substantial, with a diverse range of properties catering to various buyer demographics.

Greensboro MSA Housing Market Forecast:

In line with the positive trajectory of the Greensboro housing market, the forecast for the Greensboro MSA indicates further growth and stability. According to data, the forecast predicts a 0.3% increase by March 31, 2024, followed by a more significant uptick of 0.9% by May 31, 2024. Looking ahead to February 28, 2025, the forecast suggests a robust 1.8% increase, highlighting sustained momentum and confidence in the market’s performance.

Are Home Prices Dropping in Greensboro?

As of the latest data, home prices in Greensboro are not dropping. On the contrary, the median sale price has seen a 5.3% increase over the past year, indicating a trend of appreciation rather than depreciation. The current housing market in Greensboro leans towards being a seller’s market. With low inventory levels, high demand, and homes often selling above list price, sellers have the upper hand in negotiations. Buyers may face fierce competition and need to act quickly to secure desirable properties.

Will the Greensboro Housing Market Crash?

While predicting market crashes is inherently challenging, the current indicators do not suggest an imminent housing market crash in Greensboro. The market is characterized by stable growth, healthy demand, and relatively low levels of distressed properties. However, external factors such as economic downturns or significant policy changes could potentially impact market dynamics.

Is Now a Good Time to Buy a House in Greensboro?

Despite the competitive nature of the market, now could still be a favorable time to buy a house in Greensboro for those who are financially prepared and able to act swiftly. With low mortgage rates as compared to last year and the potential for continued appreciation in home values, purchasing a home in Greensboro could be a sound investment for the long term. However, prospective buyers should conduct thorough research, evaluate their financial readiness, and work with experienced real estate professionals to navigate the market effectively.

Should You Invest In Greensboro Real Estate Market?

Deciding whether to invest in the Greensboro real estate market requires a comprehensive understanding of the market dynamics, economic trends, and your own investment goals. Let’s delve into the factors that can help you make an informed decision.

Market Stability and Growth

The Greensboro real estate market has shown consistent growth in recent years, with a 5% increase in average home values over the past year. This stability suggests a relatively favorable environment for investors seeking long-term appreciation.

Rental Income Potential

With a substantial number of available rentals in Greensboro, there’s potential for generating rental income. Both traditional rentals and short-term rentals like Airbnb could provide avenues for cash flow. Analyze rental rates, occupancy rates, and local regulations to determine the potential income from rental properties.

Economic Factors

Assess the overall economic health of Greensboro. Job growth, diversification of industries, and overall economic stability can impact the demand for housing. A thriving job market often translates to increased housing demand, making it an attractive prospect for real estate investment.

Local Development

Stay informed about ongoing and planned developments in Greensboro. Urban revitalization projects, new infrastructure, and community enhancements can contribute to increased property values over time. Such developments can make an area more appealing to both residents and potential renters.

Risk Management

Investing in real estate carries inherent risks. It’s essential to diversify your investment portfolio and consider potential market fluctuations. Market research, understanding local regulations, and having contingency plans can help mitigate risks associated with real estate investment.

Expert Advice

Consulting with real estate professionals, financial advisors, and property managers who are familiar with the Greensboro market can provide valuable insights. They can help you navigate market trends, identify investment opportunities, and make informed decisions aligned with your financial goals.

Buying an investment property is different from buying an owner-occupied home. Whether you are a beginner or a seasoned pro you probably realize the most important factor that will determine your success as a Real Estate Investor in Greensboro, NC is your ability to find great real estate investments in that area.

According to real estate experts, buying in a market with increasing prices, low interest, and low availability requires a different approach than buying in a cooler market.

We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in the U.S. growth markets. We can help you succeed by minimizing risk and maximizing profitability.

References:

- https://www.zillow.com/Greensboro-nc/home-values

- https://www.realtor.com/realestateandhomes-search/Greensboro_NC/overview

[ad_2]