GE Spins Off an Electrifying Energy Business – TipRanks Financial Blog

[ad_1]

After being a unified company for many years, General Electric (NYSE:GE) has undergone a transformation. As General Electric has spun off multiple businesses, investors can now buy and sell GE Vernova (NYSE:GEV) stock. Is untested GE Vernova worth a try, though? I would say yes, and I am bullish on GEV stock for the remainder of 2024.

GE Vernova specializes in power generation and green-energy solutions. It’s just one of three separate companies to emerge from the General Electric split-up, but we’ll get deeper into that in a moment.

To be honest, my bullish feelings about GE Vernova are tempered because, while General Electric has been involved in energy solutions for a long time, this stand-alone business is quite new. It’s unproven and untested, and the market still needs to achieve price discovery with GEV stock. Nevertheless, I’m considering a small share position because, as one analyst put it, GE Vernova is a leader in several niche-market segments.

General Electric’s Big Split-Up

When I was a kid, General Electric was known for producing light bulbs and household appliances. Over the years, however, the company grew into an important manufacturer of components for jets. Plus, General Electric eventually developed healthcare concepts and forward-looking clean-energy solutions. Now, in a historic move, this iconic U.S. industrial giant has split up into three different businesses.

I honestly never would have predicted that this would happen. It’s somewhat shocking, but it’s probably what General Electric needed to do after struggling over the past decade. I hate to use the word “mismanagement,” but General Electric just wasn’t heading in the right direction as it spread out into multiple market sectors.

With the split-up, General Electric can now focus on manufacturing jet parts. General Electric is officially now called GE Aerospace, but many people will probably still call the company General Electric. It will retain the GE ticker symbol.

General Electric spun off two companies that will stand on their own and trade under separate stock ticker symbols. There’s GE HealthCare Technologies (NASDAQ:GEHC), which obviously was General Electric’s healthcare segment. General Electric spun off GE HealthCare Technologies in early 2023.

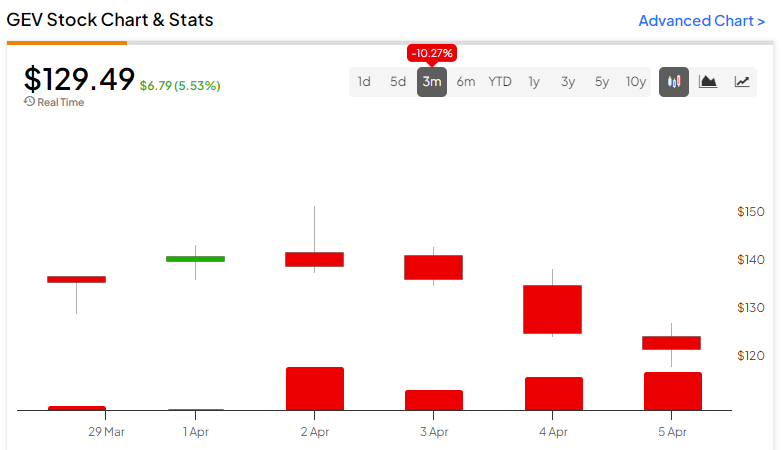

The spin-off that really caught my attention, however, is GE Vernova. GEV stock just started trading on April 2 of this year. Businesses that just started trading can be highly volatile; the market needs some time to achieve “price discovery,” in which the market figures out an appropriate price range for a stock.

That’s why I’m not immediately “loading the boat” on GE Vernova stock. At the same time, I’m open to the idea of taking a small share position since GEV stock fell from $150 to $130, and I’m considering a buy-the-dip strategy.

GE Vernova Identified as a Leader in Multiple Segments

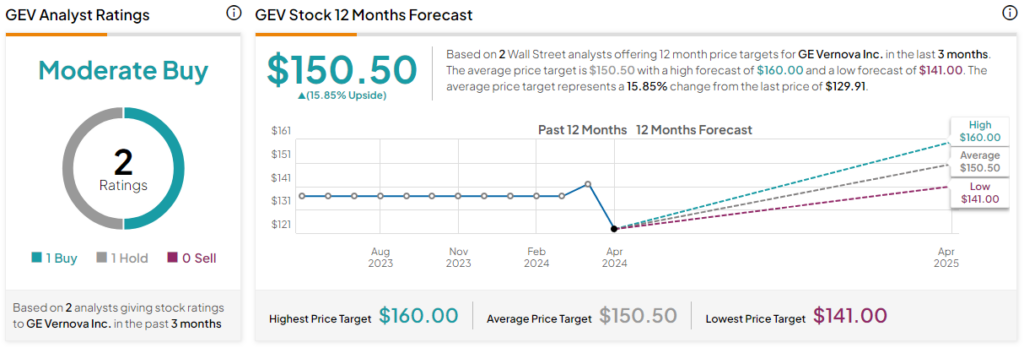

While GE Vernova just went public recently, the company already has a Wall Street expert in its corner. Specifically, RBC (NYSE:RY) Capital Markets Analyst Chris Dendrinos assigned GEV stock an Outperform rating and a $160 price target, implying bullish price action in the near term.

In a strongly bullish statement, Dendrinos said that GE Vernova is a “leader in each of the segments they play in.” Furthermore, Dendrinos asserted that GE Vernova has a “number two market share” in its power segment. The RBC analyst also believes that GE Vernova has a 10% or 15% share of Europe’s wind market, as well as a “leading position” in the U.S. wind market.

Regarding GE Vernova’s “electrification portfolio,” Dendrinos explained that the company is only competing against a “small pool of companies.” In other words, General Electric’s new stand-alone power solutions business has opportunities to assume its leadership position across several market niches in more than one region of the world.

That’s why I’m excited about this new company, which was part of an old company. I wouldn’t call GE Vernova fail-safe, but it has the GE brand, and this seems to derisk the company and the stock to a certain extent.

Unlike many other new businesses, GE Vernova started off as a giant company. Believe it or not, GE Vernova has over 80,000 employees across more than 100 countries. Moreover, the company has an “installed base of over 7,000 gas turbines” and “approximately 55,000 wind turbines.”

In addition, GE Vernova helps generate around 30% of the world’s electricity. Thus, GE Vernova stock has a safety factor that you won’t find in many recently-listed businesses.

Is GE Vernova Stock a Buy, According to Analysts?

On TipRanks, GE Vernova comes in as a Moderate Buy based on one Buy rating and one Hold rating assigned by analysts in the past three months. The average GE Vernova stock price target is $150.50, implying 15.85% upside potential.

Conclusion: Should You Consider GE Vernova Stock?

GE Vernova is new and old at the same time, which makes it unique among newly-listed companies. It’s also a leader, or at least probably in the top five, in more than one niche market segment.

The only major concern I can identify is that GE Vernova stock could be highly volatile for a while since the market is still in the process of determining its fair value. Yet, the stock has fallen since going public and could be on the cusp of a rebound. Consequently, I’m feeling optimistic about GE Vernova and am certainly considering a share position in GEV stock.