Galveston Housing Market Trends and Forecast for 2024

[ad_1]

Given the current data, the Galveston housing market appears to be leaning towards a balanced market, albeit with some nuances. While sellers may need to adjust their expectations regarding pricing and time on the market, buyers can benefit from a less competitive landscape and potential opportunities for negotiation.

Galveston Housing Market Trends in 2024

How is the Housing Market Doing Currently?

According to data by Redfin, in February 2024, the median home price in Galveston dipped by 3.5% compared to the previous year, settling at $360,000. Additionally, homes are spending more time on the market, with an average of 83 days compared to 66 days in the preceding year. Despite this, there has been a slight uptick in the number of homes sold, rising from 81 to 85.

Examining the sale-to-list price ratio provides further insight into the market’s performance. Currently standing at 95.4%, this figure has experienced a modest decrease of 0.47 percentage points year-over-year. Similarly, the percentage of homes sold above the list price has decreased by 5.2 percentage points, now at 4.7%. Additionally, approximately 24.1% of homes have experienced price drops, a decrease of 0.17 percentage points from the previous year.

How Competitive is the Galveston Housing Market?

Galveston, compared to other markets, is relatively less competitive. Homes typically sell within 85 days, and multiple offers are a rarity. On average, homes sell for about 5% below the list price and go pending within the aforementioned 85-day timeframe. However, certain properties, identified as “hot homes,” can sell for approximately 1% below the list price and go pending in as little as 21 days.

Are There Enough Homes for Sale to Meet Buyer Demand?

Examining migration and relocation trends can shed light on the supply and demand dynamics within the Galveston housing market. Between December ’23 and February ’24, 24% of homebuyers in Galveston expressed interest in moving out of the area, while 76% intended to stay within the metropolitan region.

While 2% of homebuyers nationwide are considering relocating to Galveston from outside metropolitan areas, data suggests that the majority of potential buyers are already located within the vicinity. Notably, individuals from Los Angeles, New York, and San Francisco show the highest interest in moving to Galveston.

What is the Future Market Outlook for Galveston?

Forecasting the future of the Galveston housing market involves considering various factors, including economic indicators, population trends, and government policies. While recent data indicates a slight downturn in prices and a modest increase in days on the market, it’s essential to approach these trends with a nuanced perspective.

Galveston’s appeal as a coastal destination, coupled with its proximity to major metropolitan areas, positions it favorably for continued growth. However, external factors such as interest rates, employment opportunities, and natural disasters can influence market dynamics.

Galveston Housing Market Forecast 2024 and 2025

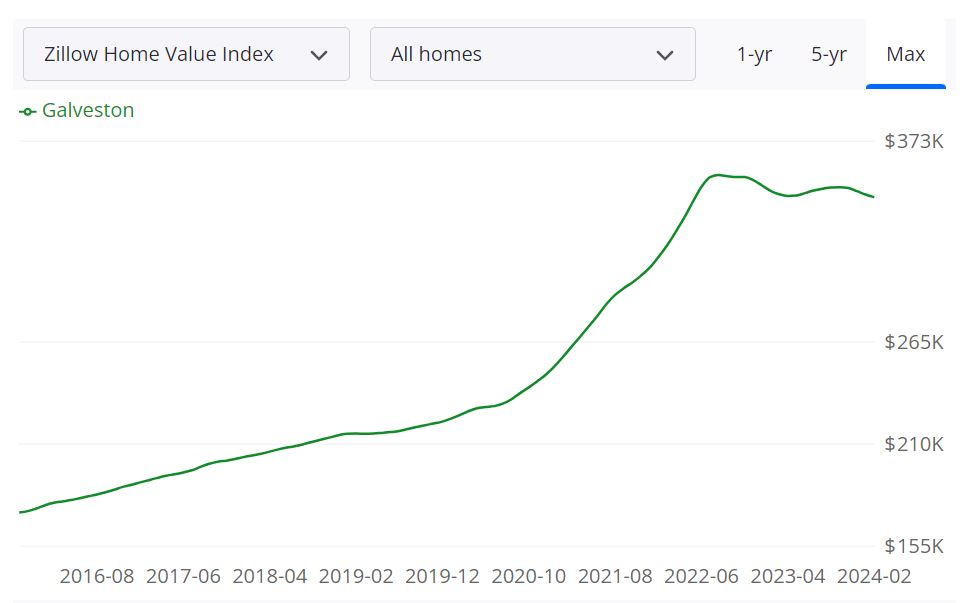

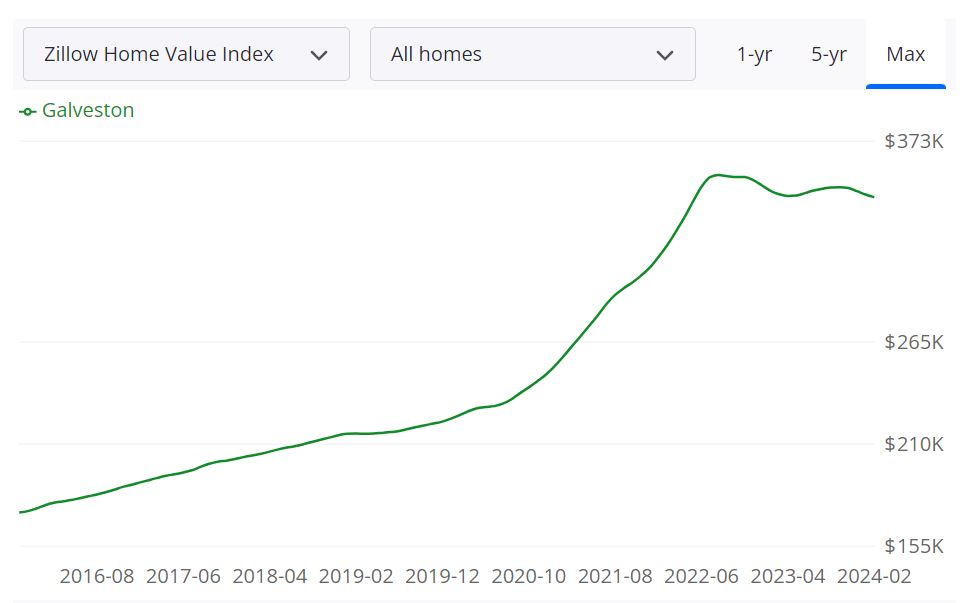

Galveston’s housing market demonstrates resilience and activity, with a balance of inventory, competitive pricing, and negotiation opportunities. According to Zillow, as of February 29, 2024, the average home value in Galveston stands at $343,334, marking a slight decrease of 1.0% over the past year. Additionally, homes in Galveston typically go pending in around 67 days.

For Sale Inventory and New Listings

One crucial aspect of any housing market is the inventory of homes available for sale. As of February 29, 2024, Galveston boasts a total of 833 properties listed for sale. Moreover, there have been 157 new listings added to the market, indicating ongoing activity and interest in the region.

Median Sale Price and List Price

The median sale price and median list price provide valuable benchmarks for assessing the affordability and competitiveness of the housing market. As of January 31, 2024, the median sale price in Galveston was recorded at $352,000, while the median list price stood higher at $417,333. This variance suggests potential negotiation opportunities for buyers and sellers.

Sale to List Ratio

The median sale to list ratio is a key indicator of market competitiveness and pricing trends. In Galveston, the ratio stands at 0.959 as of January 31, 2024. This figure signifies that, on average, homes are selling for approximately 95.9% of their list price, highlighting the importance of strategic pricing strategies for sellers.

Percent of Sales Over and Under List Price

An analysis of the percentage of sales over and under the list price provides insights into market dynamics and buyer behavior. As of January 31, 2024, approximately 2.5% of sales in Galveston were recorded above the list price, indicating instances of competitive bidding and high demand for certain properties. Conversely, 83.8% of sales occurred under the list price, suggesting opportunities for negotiation and potentially favorable conditions for buyers.

Are Home Prices Dropping in Galveston?

Despite the slight 1.0% decrease in the average home value over the past year, Galveston’s housing market does not exhibit significant signs of widespread price drops. The median sale price of $352,000 as of January 31, 2024, remains relatively stable, indicating resilience in the market. However, individual property prices may vary based on factors such as location, condition, and demand. Buyers and sellers should carefully analyze recent trends and consult with real estate professionals to make informed decisions.

Will the Galveston Housing Market Crash?

Speculating on whether Galveston’s housing market will experience a crash requires a comprehensive understanding of economic indicators, market fundamentals, and external factors. While no market is immune to fluctuations, Galveston has shown resilience and stability despite minor fluctuations in home values.

The diverse economy, ongoing development projects, and desirable coastal location contribute to the market’s overall strength. However, unforeseen events or economic shifts could impact market dynamics. Therefore, stakeholders should remain vigilant, monitor market trends, and adapt their strategies accordingly.

Is Now a Good Time to Buy a House in Galveston?

Deciding whether now is a good time to buy a house in Galveston depends on individual circumstances, financial considerations, and long-term goals. With a balanced inventory, competitive pricing, and favorable mortgage rates, buyers may find opportunities in the current market.

Additionally, the slight decrease in home values over the past year could present advantageous negotiating positions for buyers. However, it’s essential to conduct thorough research, assess personal finances, and consider factors such as job stability and future plans before making a decision.

Should You Invest in the Galveston Real Estate Market?

Population Growth and Trends

Population Growth: Galveston has experienced steady population growth over the years. This is an encouraging sign for real estate investors as a growing population typically leads to increased housing demand.

Tourism Influence: The city’s vibrant tourism industry, driven by its beautiful beaches and historic attractions, contributes to a consistent influx of visitors. This can create opportunities for short-term vacation rentals and investment properties catering to tourists.

Economy and Jobs

Economic Diversity: Galveston’s economy is diversified, with sectors such as healthcare, education, tourism, and maritime industries playing a significant role. A diverse economy can provide stability and job opportunities, attracting both residents and potential tenants.

Job Market: The presence of the University of Texas Medical Branch and other healthcare facilities in Galveston creates employment opportunities. Additionally, the Port of Galveston is a crucial economic driver, offering jobs in logistics and trade.

Livability and Other Factors

Quality of Life: Galveston offers an appealing quality of life with its coastal setting, historic charm, and cultural attractions. This can make it an attractive place for renters, particularly those looking for a coastal lifestyle.

Education: The city is home to educational institutions like the University of Texas Medical Branch, making it an appealing location for students and academics. This can drive demand for rental properties.

Hurricane Risk: Galveston’s location on the Gulf of Mexico means it’s susceptible to hurricanes. Investors should be aware of potential insurance costs and the need for hurricane-resistant properties.

Rental Property Market Size and Growth

Size of the Market: Galveston’s rental property market is substantial, catering to both long-term and short-term renters. Vacation rentals are in high demand, particularly during the summer months, providing opportunities for investors.

Tourism Impact: The city’s tourism industry significantly impacts the rental market. Investors can benefit from short-term rentals, such as Airbnb, by targeting tourists visiting the island.

Year-Round Rental Demand: Galveston’s educational and healthcare institutions create a year-round demand for rental properties, making it a potentially stable income source for investors.

Other Factors Related to Real Estate Investing

Property Appreciation: While Galveston has seen a slight decrease in home values, the market has potential for appreciation, especially in desirable neighborhoods.

Local Regulations: Understanding local regulations, especially related to short-term rentals, is crucial. Galveston has specific rules governing short-term rental properties.

Property Management: Consider the logistics of property management, especially if you plan to invest in vacation rentals. Many investors hire local property management companies to handle day-to-day operations.

Market Research: In-depth market research, including neighborhood analysis and potential risks like hurricane exposure, is essential before investing. Working with a local real estate agent with knowledge of the Galveston market can be valuable.

Investing in the Galveston real estate market can be a viable opportunity, but it requires careful consideration of the factors mentioned above. The city’s population growth, diverse economy, and appealing quality of life create a foundation for real estate investment. Additionally, the presence of tourism and educational institutions offers various avenues for rental income.

However, investors should be cautious about hurricane risks and adhere to local regulations, especially regarding short-term rentals. To make an informed decision, conduct thorough market research and consider consulting with local real estate experts who can provide insights specific to the Galveston market.

References:

- https://www.zillow.com/galveston-tx/home-values/

- https://www.redfin.com/city/7178/TX/Galveston/housing-market

- https://www.realtor.com/realestateandhomes-search/Galveston_TX/overview

[ad_2]