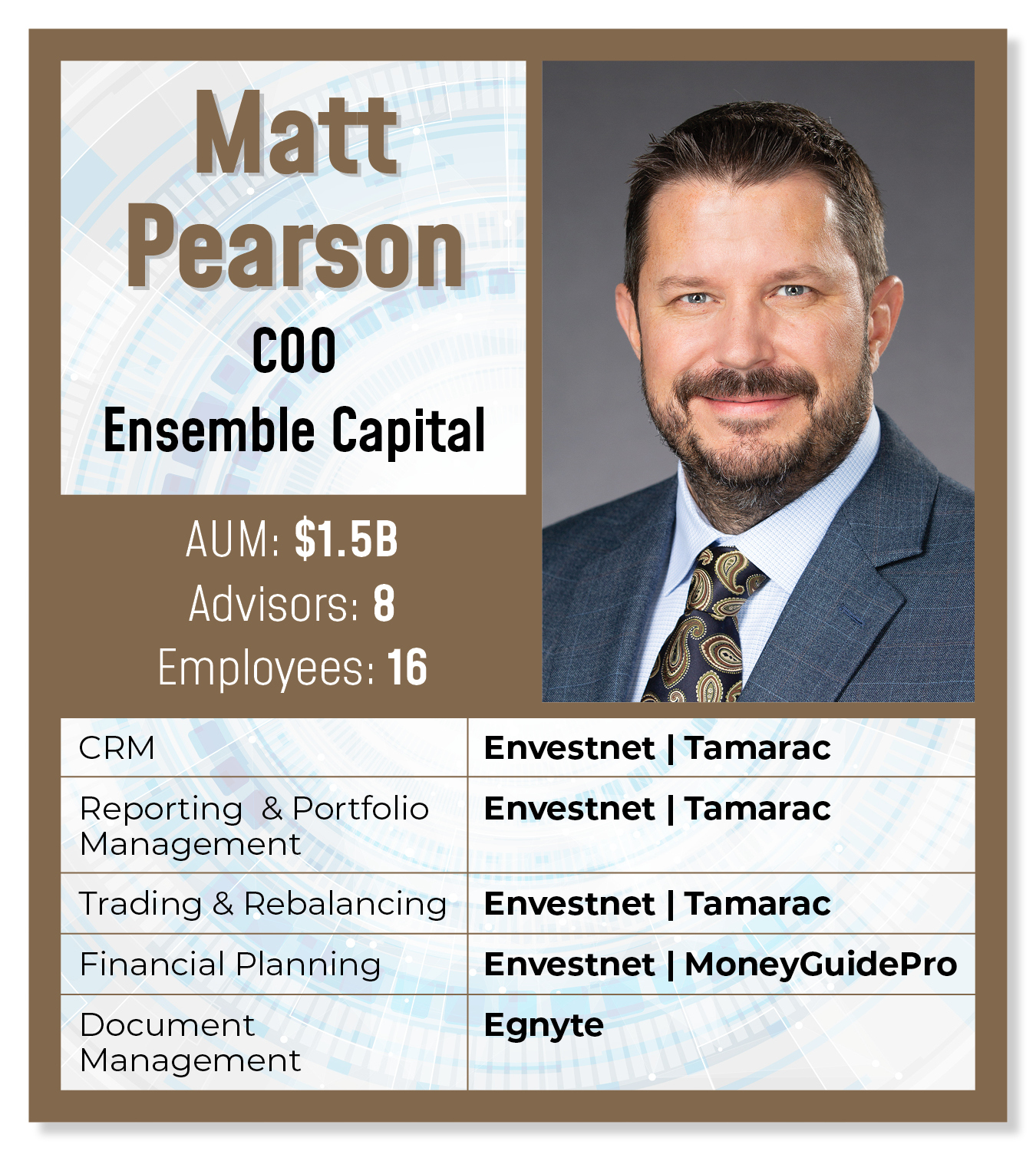

I joined Ensemble in 2008 when it was a founder model. In 2014, a small employee group bought out the founder. It was that transition that allowed us to start focusing on our tech stack. With the founder model, they’re used to doing things their way. We were paper-based all the way up to then. We realized that to reach the next phase of growth, we had to focus on our tech stack. I was promoted to COO in 2016. My goal then was to expand our tech stack and roll out several new software solutions.

CRM, Reporting, Rebalancing & Trading: Envestnet | Tamarac

In hindsight, one of the things that’s allowed us to be successful in rolling out different technologies is that we’re not afraid to tinker. We’re not afraid to go in and get our hands dirty. We’re not afraid to try out a new software package and potentially see it fail. We’ve gotten good at having a process for making change.

Out of the box, CRM is not going to do much. Previously, we were using PortfolioCenter and doing all our internal reconciliations. We had tinkered with Salesforce, but mostly we were using it as a Rolodex. It’s fine for that, but most modern CRMs, they’re capable of so much more. It’s just a matter of how much work you want to put into it. You can set up a Rolodex quickly. But if you don’t focus on setting the time aside to improve the platform to make it your own, you’re not going to get a lot out of it.

Out of the box, CRM is not going to do much. Previously, we were using PortfolioCenter and doing all our internal reconciliations. We had tinkered with Salesforce, but mostly we were using it as a Rolodex. It’s fine for that, but most modern CRMs, they’re capable of so much more. It’s just a matter of how much work you want to put into it. You can set up a Rolodex quickly. But if you don’t focus on setting the time aside to improve the platform to make it your own, you’re not going to get a lot out of it.

Most advisors on the Envestnet | Tamarac suite use it for rebalancing individual funds. We’re using their rebalancing platform but in a custom way. We’ve had a great relationship with Envestnet | Tamarac over the years. They’ve been able to customize our instance for us in certain cases where we’ve needed it.

There was a time a couple of years ago when the Envestnet | Tamarac service wasn’t as good as it is today. Over the last year and a half, we’ve been happy with them on the CRM side. If you’re with Salesforce or some of the other CRMs out there, you might have to hire a consultant or a separate third party to build out your workflows. On the CRM side, one of the places Envestnet | Tamarac has been strong, at least for us, is we’re able to envision what we want. It might be a 10- or 15-page document with all the different tasks. Once we have that together, they’ve been great at working with us to help build those out. We do some of it in-house. For times when it’s too complex, they’ll either help us build it or they’re able to do a separate service agreement to build out something specific for us. They’ve been good partners for us.

When I’m choosing a technology provider, one of the things I like to look at is their frequency of updates. Envestnet | Tamarac has a long history of updating its platform over time. If I’m evaluating somebody, I might ask them to show me their last 18 months of product enhancements. Anybody should be able to share that with you. What are those product enhancements? Would they be meaningful to me if I were on the platform? Envestnet | Tamarac has done a good job of deploying meaningful product enhancements in CRM, reporting and rebalancing.

Another reason I’m happy we’re on the Envestnet | Tamarac suite is because the integrations are great. We use Schwab as our primary custodian and their integration is good. They’re pushing to make it even better, but it’s good.

Model Portfolios: Equity Data Science

We use Equity Data Science to build out our model of stocks in the portfolio. Our trading team is working on that, and they’ve been happy with it. They’re about 18 months into the deployment, and it has given them a ton more visibility into position sizing and technical details on the trading side, including implications of changes we’ve made to the allocations between stocks.

File Sharing & Document Management: Egnyte

We also digitized our file cabinet. We’re using Egnyte for cloud-based file sharing and document management, which has worked well for us. We use it much like a file share, but it’s highly organized, with internal rules around how we title and where we put things. There are more robust platforms out there. As we continue to grow, we might look at something more robust. But from a cybersecurity perspective, Egnyte is dialed-in and user-friendly. It’s been great for us.

We also digitized our file cabinet. We’re using Egnyte for cloud-based file sharing and document management, which has worked well for us. We use it much like a file share, but it’s highly organized, with internal rules around how we title and where we put things. There are more robust platforms out there. As we continue to grow, we might look at something more robust. But from a cybersecurity perspective, Egnyte is dialed-in and user-friendly. It’s been great for us.

Egnyte doesn’t need to integrate too much. We’ve worked out some of our integrations because you can save locations to the file-share server. If we need to reference a location inside CRM we’ll point it back to Egnyte. There’s a hyperlink you can click to get back into the client folder if you need to.

Communications: Zoom

Zoom has been successful for us, as well. We have a vibrant social community inside Zoom. We’re remote-first so we don’t all get a chance to see each other in the office too much.

Digital Marketing: Hubspot

I know our team has appreciated having Hubspot for digital marketing. It’s robust and can do a lot in terms of giving us visibility into who is signed up to receive certain things on our website and who has watched some of our webinars and allows us to reach out to them.

Cybersecurity: Confidential

I don’t like to mention all the cybersecurity vendors we use because it gives potential bad actors more ammunition for crafting sophisticated phishing attempts.

We do periodic phishing testing. Out of the box, a lot of the platforms that provide phishing testing will be quarterly or annually. We’ve dialed all those up to their highest levels. We’re phishing testing once a week. If you click on a phishing email, you get enrolled in remedial training. There’s also monthly cybersecurity awareness training that we’re doing.

As told to reporter Rob Burgess and edited for length and clarity. The views and opinions are not representative of the views of WealthManagement.com.

Want to tell us what’s in your wealthstack? Contact Rob Burgess at [email protected].