Earning Medallion elite status on Delta without flying

[ad_1]

Earning airline elite status can bring a variety of benefits for frequent travelers — and Delta Air Lines Medallion status is no exception. However, last fall, the carrier announced major changes to how you earn elite status in the SkyMiles program, and those changes are now live.

In short, there’s just a single metric for qualification now: Medallion Qualification Dollars. And in making this change, Delta has also overhauled how credit cards can help in your pursuit of status.

Related: The 5 Delta SkyMiles Amex changes I’m most excited about

Here’s how you can spend your way to Delta Medallion status in 2024 without even setting foot on a plane.

Delta Medallion status requirements

As noted previously, you now qualify for Delta status based solely on MQDs (gone are Medallion Qualification Miles and Medallion Qualification Segments). Delta’s original announcement featured high thresholds, though these were softened a bit for 2024 in response to customer backlash.

Here are the current requirements to earn Delta Medallion status in 2024:

- Silver Medallion: 5,000 MQDs

- Gold Medallion: 10,000 MQDs

- Platinum Medallion: 15,000 MQDs

- Diamond Medallion: 28,000 MQDs

On most Delta-marketed tickets, you’ll earn 1 MQD per dollar spent (minus the taxes), though you will not earn on basic economy fares. You may also earn more than 1 MQD per dollar on partner-issued tickets credited to Delta SkyMiles. However, these earning rates were largely cut as of Jan. 1. Be sure to check Delta’s website to find out how many MQDs you’d earn when flying a partner-marketed flight.

Related: The best credit cards to reach elite status

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Earn Medallion status with credit cards

In previous years, select Delta credit cards allowed you to earn Medallion Qualification Miles based on spending. Now that MQMs have been retired, the carrier has overhauled how to use these cards to accelerate your progress toward status.

In short, Delta now allows you to earn MQDs across four of its cobranded cards with American Express. The exact details vary from card to card, but there are two general ways to use these cards to accelerate your progress to Medallion status.

MQD Headstart

In early February, Delta implemented a new perk called MQD Headstart for the following cards:

For each of these cards in your wallet, you’ll now receive a one-time deposit of 2,500 MQDs at the beginning of each qualification year. This puts you halfway to Silver Medallion status — though if you have two cards, you’ll automatically hit Silver Medallion before you even set foot on a Delta plane.

In addition, travelers with the Delta Reserve card prior to Feb. 1 received an extra 1,000 MQDs this year. I currently hold that card, and I received an email Feb. 1 with the subject “Updates To Your Delta SkyMiles® Reserve Card” and the following details:

This means existing Reserve cardholders received a total of 3,500 MQDs in 2024 — though this will drop back to 2,500 MQDs starting in 2025.

However, the ability to earn status on these cards doesn’t end there.

New status boosts

As mentioned previously, Delta Platinum and Reserve cardholders could previously earn bonus MQMs based on spending. That perk ended as of Jan. 1. Instead, you can now earn MQDs based on spending:

- Delta Platinum and Delta Platinum Business cards: Earn 1 MQD for every $20 spent.

- Delta Reserve and Delta Reserve Business cards: Earn 1 MQD for every $10 spent.

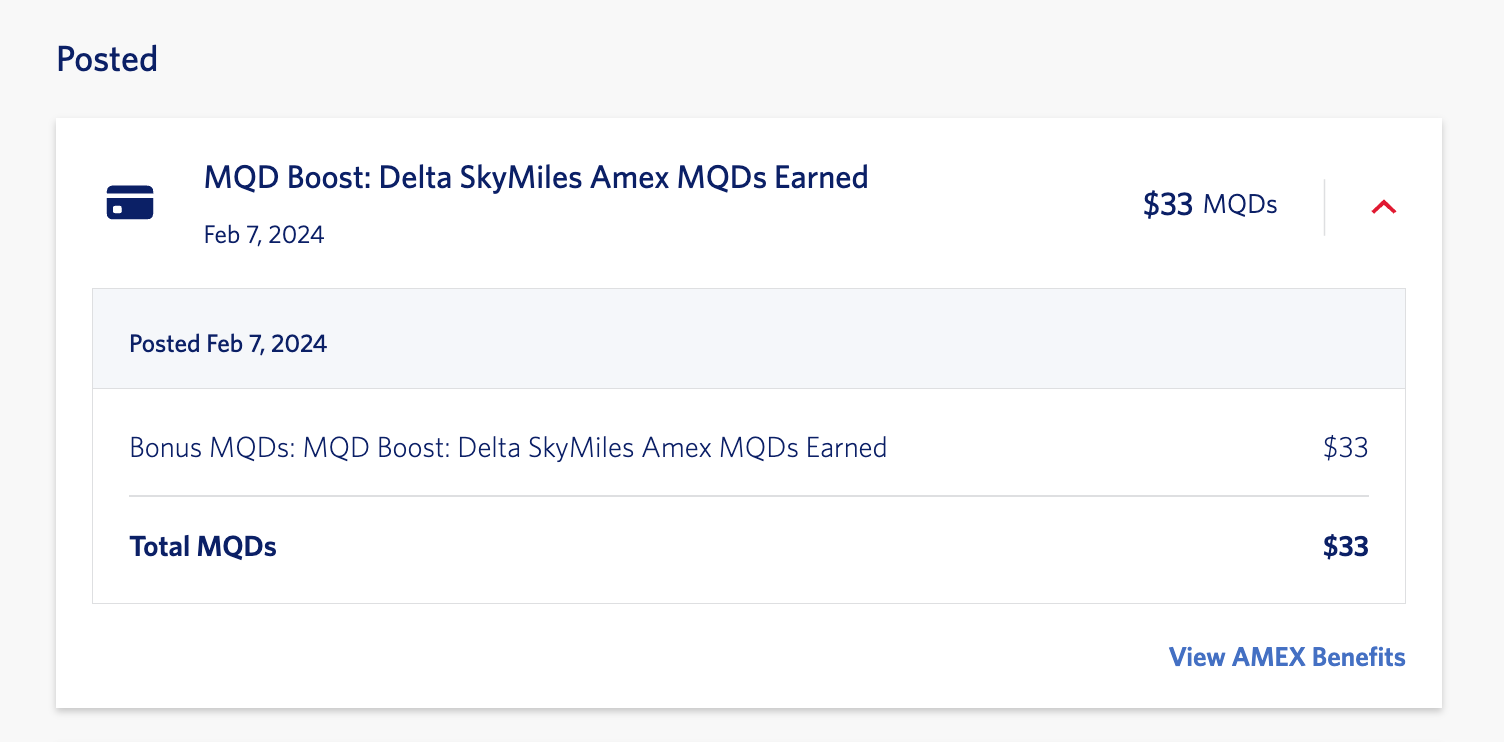

The terms of this perk indicate that it can take eight to 12 weeks for the MQDs to hit your account. However, I’ve found that it’s been much faster, as my first purchases of 2024 (both on Feb. 5) were posted to my SkyMiles account just two days later.

These status boosts (coupled with the MQD Headstart) mean that you can effectively spend your way to status each year since there’s no limit to the MQDs you can earn each year on these four cards.

For example, let’s say you have a personal Delta Reserve card. Every year, you’ll receive 2,500 MQDs. You can then earn 1 MQD for every $10 you spend on the card. This means you can unlock Medallion status with the following spending thresholds:

- $25,000: Silver Medallion (2,500 MQDs from spending; 2,500 from the head start)

- $75,000: Gold Medallion (7,500 MQDs from spending; 2,500 from the head start)

- $125,000: Platinum Medallion (12,500 MQDs from spending; 2,500 from the head start)

- $255,000: Diamond Medallion (25,500 MQDs from spending; 2,500 from the head start)

Now, there’s no debating that all of these numbers represent a lot of spending. At the low end, it’s still more than $2,000 per month, while reaching Diamond status requires more than $21,000 in monthly spending! In addition, these Delta cards offer comparatively poor earning rates on most purchases. When it comes to earning valuable rewards, you’d likely be better off with a top credit card for everyday spending.

Nevertheless, the majority of Delta cardholders likely fly with the airline at least somewhat frequently. In that context, spending on your Delta card can close the gap to a higher tier of status.

Should you get a Delta credit card to spend your way to status?

If you’re not currently a cardholder, the ability to earn status with spending could be a powerful incentive to get one.

For example, let’s say you spend $7,000 per year on Delta flights, with a combination of business and leisure travel. Without a Delta card, you’re looking at Silver Medallion status since $7,000 in spending translates to 7,000 MQDs. However, if you applied for the Delta Reserve card, you’d get a one-time boost of 2,500 MQDs, leaving you just 500 MQDs short of Gold Medallion status. You can earn those MQDs with just $5,000 in spending on the card since you’re earning 1 MQD for every $10 spent.

In addition, now is a great time to consider one of these cards, as they launched limited-time, elevated welcome offers (to coincide with an overhaul of their benefits):

Related: Best Delta credit cards

More ways to earn Delta status quickly

Beyond getting (and using) these four Delta cards as a shortcut to Medallion status, there are a few other ways to earn MQDs outside of flying.

Utilize a status challenge

In early 2024, Delta launched a new status challenge for elite travelers with other airlines. If you haven’t participated in a Delta challenge in the last three years and earned status with another carrier last year, you may be eligible for complimentary Medallion status (up to Platinum) for three months. Then, if you accrue a set number of MQDs during that three-month window, your status will be extended through Jan. 31, 2026.

Earn on award travel

When you book Delta (or partner) flights using SkyMiles, you’ll earn 1 MQD for every 100 SkyMiles you redeem. This means a 20,000-mile award ticket will net you 200 MQDs.

Remember that you also get a 15% discount on Delta-operated award flights as a Delta cardholder.

Earn with Delta Vacations

Last year, the Delta Vacations platform was overhauled, and you now earn 1 MQD for every $1 spent across the entire package (excluding taxes and fees). You also earn redeemable miles when booking this way.

Limited-time MQD offers

Finally, Delta will occasionally offer limited-time methods to earn MQDs for select activities. For example, through Feb. 29, you can earn 1 MQD for every dollar spent on hotel stays and car rentals booked through Delta Stays (with a checkout date on or before May 31).

Just be aware that this is a third-party booking site, which means that you wouldn’t be eligible to earn hotel points or utilize elite benefits by booking a property that’s part of a major hotel loyalty program.

Bottom line

There are lots of ways to earn Medallion status without boarding a plane. Through the airline’s cobranded credit cards, you can spend your way to multiple elite status tiers.

While most travelers will likely blend the above credit cards with some actual flying, it’s nice to know that you can use multiple Delta American Express cards to boost your Medallion qualification prospects.