Do FIRE Principles Still Work Today?

Viktor applied FIRE principles frequently espoused on this blog. He grew up an immigrant raised by a single mother on welfare. He retired in 2020 at the ripe old age of 35. His wife recently joined him in early retirement.

He knows that these principles have worked for his household. Yet there is a sentiment that the FIRE movement was a product of luck. We’ve experienced a simultaneous decade plus bull market in stocks, bonds, and real estate accompanied by the introduction of cryptocurrencies since the great financial crisis. Building wealth was easy.

Was the ability to achieve financial independence just a matter of being in the right place at the right time? Did people like Viktor and myself reach the top of the ladder and pull it up behind us?

In todays’ guest post, Viktor shares his personal story. He then examines whether something similar is possible for someone starting at zero today. Take it away Viktor….

Is FIRE Too Good To Be True?

Something interesting is happening right now. On the one hand, you have a record number of Gen Zers identifying or expressing interest in retiring early. In fact, more than half of Gen Z respondents consider themselves part of the FIRE movement, according to a recent Credit Karma survey.

At the same time, you have an unprecedented amount of pessimism about their ability to retire early. Prospects of a decade of low or negative real economic growth, housing unaffordability, lack of consistent living wages, inflation, college debt burdens, bankrupting health care costs and general inability to save… just to name a few.

I’m just getting some solid footing on the other side of the early retirement journey. I was curious whether I might have just squeezed through a door that has effectively closed for the public at large.

I want to explore what the outlook is for someone starting today with zero. How much would you need to accumulate to reach early retirement?

My Journey

I started my professional career at Lehman Brothers in the summer of 2007. Having interned there the previous summer, it was a job I absolutely loved, found intellectually stimulating and financially rewarding.

But within a few years, I was on my way to the ER in the middle of the night with what I thought was a heart attack. Fortunately, it turned out to be a panic attack.

My early years on Wall Street were full of unprecedented upheaval and great financial distress as the Great Recession reared its ugly head. Many people lost their life savings and all hope of providing for their families’ well being. But it wasn’t the Lehman bankruptcy and the Great Recession that sent me to the ER.

It was the fear of failure…. long hours, pressure (both external and self-induced) and the workplace Machiavellian politics of the type A bubble I was living in that got me there.

I realized early on that the long-term prospects of me surviving, let alone being happy, in that environment were not good. But I didn’t yet know what to do about it. And that certainly didn’t help my anxiety…

Is FIRE An Escape?

And then I heard about FIRE and the safe withdrawal rate. All of a sudden, I had this magical function of three numbers: net worth, expense budget, and 4%. This could free me of the rat race I was descending into.

If I could get my annual expenses to be less than 4% of my net worth, i.e. a reasonably “safe withdrawal rate,” there was a very high probability that my assets could cover my expenses through appreciation and various forms of income generation indefinitely.

For example, let’s say my annual expenses were $40k and my net worth consisted of a broad stock portfolio worth $1M without any debts. The growth of that portfolio, monetized via dividends and stock sales, could cover my expenses for the rest of my life! I could be free to explore my passions and interests without worrying about a paycheck.

FIRE Mindset and Values

I was about 6 or 7 years out of college at that point. But I had a few things working for me that aligned with some of the basic tenets of FIRE, like a thoughtful, value-driven approach to consumption and maximizing saving rate.

I had a poverty mindset that came from growing up as an immigrant on welfare and public assistance. I saw my single mother free us of that within a few years of arriving in the US. She utilized an unbreakable work ethic as she transitioned from being a civil engineer to performing the most basic tasks at a nursing home and cleaning houses as a “side hustle”.

I also had my high school sweetheart, now my wife, by my side. Having someone supportive and aligned on the journey with you certainly makes it a lot more fun. Sharing finances with another person as part of a two income household for my entire adult life made a huge impact.

Getting Our Financial House in Order

I was able to pretty quickly advance in my career on Wall Street at a time where compensation became bipolar. The banks were cutting senior staff (highest earners) and investing in retaining junior people like me.

My wife and I were able to leave college with very little debt thanks to generous, needs-based financial aid packages and working throughout college. Completely paying that off was still the first thing that we prioritized financially once we graduated.

We also decided that we didn’t want to have kids. While that wasn’t a financial decision, it certainly helped build our savings until we changed our minds when we were nearly in our mid 30s.

As a result, we were more than halfway to hitting our numbers the first time I crunched them. I shared this magical discovery with my girlfriend (now wife) and she agreed that this was the path for us. We made a plan, set a target date, and got serious about making it happen.

Accelerating Our FIRE Plans

The plan evolved and dates moved over time, but we were very fortunate to have been able to get there. I retired at 35 on Labor Day 2020. It was a little earlier than expected, but some events in my personal life pushed me to make the leap. My wife just submitted her resignation and is currently working out her transition plan to be retired by the end of the year.

In many ways, FIRE was the culmination of the American Dream for me. And I’ve been wondering whether that was still attainable for the generation just getting started in their careers or for people starting to save later in life.

Related: Do You Need Good Luck to Achieve Financial Independence?

Getting Started

So, let’s dig in. Being a finance guy, I like numbers. But I also like breaking things down into easy to consume chunks. As I see it, there are three initial steps for anyone getting started:

- Create a budget for your retired life.

- Determine the necessary net worth to support that budget (ie build your investments to at least twenty-five times your annual spending corresponding to the 4% safe withdrawal rate).

- Create an investment plan to accumulate the necessary assets to produce the income needed to support that budget.

The first thing you want to do is get some ballpark estimates. Understand the feasibility and general shape of your game plan.

Defining the Goal

Now, there is an endless amount of content out there about all the nuances and considerations of the above three steps. So I am going to oversimplify things on purpose. Let’s just look at the scenarios where someone sets a retirement budget of $50K (“frugal”), $100K (“comfortable”) and $300K (“luxurious”, aka FatFIRE).

Based on the traditional safe withdrawal rate of 4%, one would need to accumulate a net worth of $1.25M, $2.5M and $7.5M to support those budgets, respectively.

The second key axis to your net worth target is the retirement age. The “standard” retirement age in the US is 64, according to SoFi Learn, which is a little over 40 years of working. So retiring after 30-35 years is nice. Retiring after 10-15 is amazing! I use 20 years as my baseline.

Determining Your Required Rate of Return

The last piece you need for the back of the envelope calculation is the rate of return that you expect from your earnings. I am looking at this from the perspective of the recent college grad just getting started.

This is generally an area where the more aggressive style investments would be recommended. The most common allocation would be a 100% broad-based, equity portfolio. For example, the Vanguard Total Stock Market ETF (VTI) is a very popular, low-cost investment product .

US equity returns over the last 100 years have averaged around 10%. However, most recent, forward-looking forecasts put equity returns somewhere around an annualized 6% over the next ten years. This is because we are still near the top of an investment cycle. There is a meaningful possibility of recession over the next few years. So to be a little conservative, I used 6% as my baseline.

This is where a good retirement calculator comes in handy. But I just did this in a spreadsheet. I like being hands on with these types of things to understand the different dimensions when I’m doing something for the first time.

Required Savings

Based on my calculations, if your desired budget in retirement is $50K, you would need to save $50K per year for 16 years to build the necessary portfolio worth $1.25M (assuming 100% equity allocation averaging 6% annual return). Effectively, you need to save your desired retirement budget each year for 16 years

Alternatively you could save $34K per year for 20 years. This would require saving 68% of your desired budget each year to reach your goal.

These numbers grow linearly for the other cases. You’d need to save $100K annually for 16 years or $68K for 20 years to reach a portfolio value of $2.5M.

Note the math is essentially the same for an older saver who is just starting to save for retirement.

Related: 7 Advanatages When You Start Saving for Retirement Late

It is also worth noting that taxes are not linear and do introduce a bit of complexity. An important next step after getting the basic picture is to look at real (i.e. accounting for inflation), after-tax income, returns and expenses.

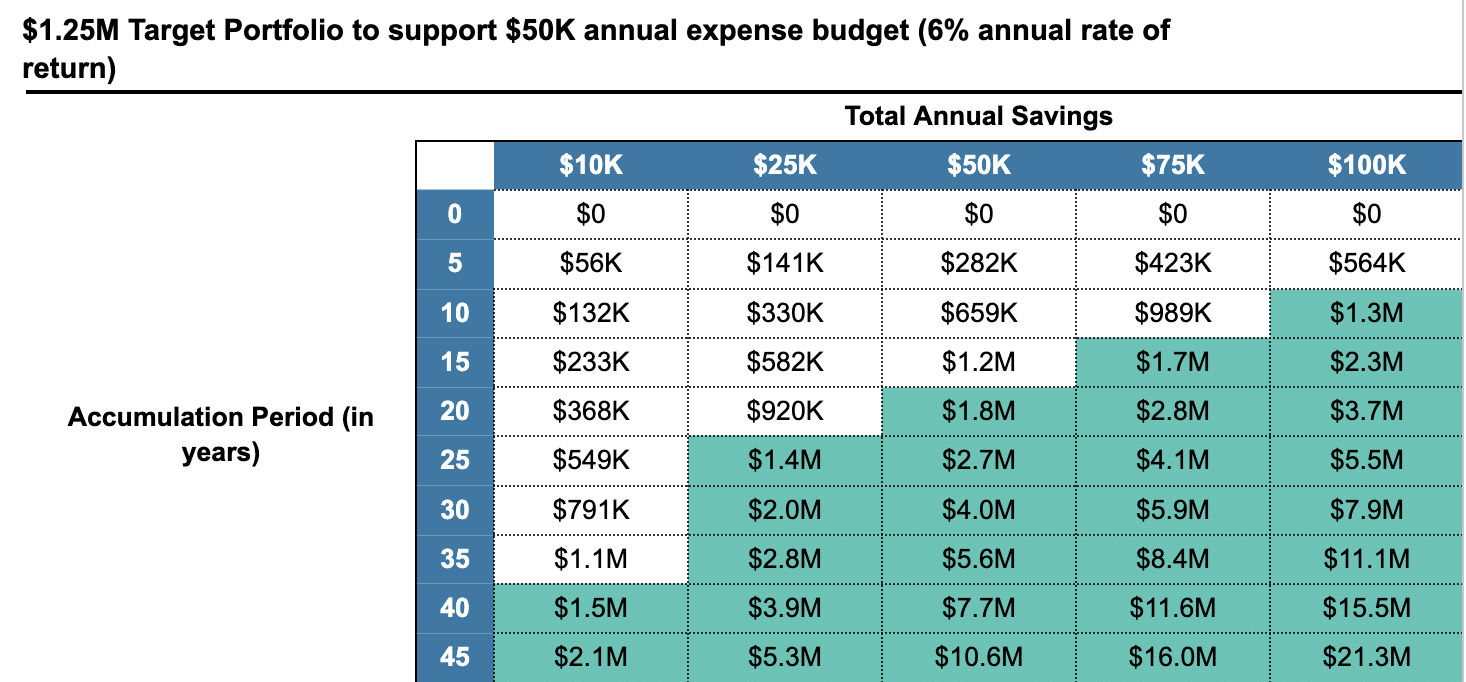

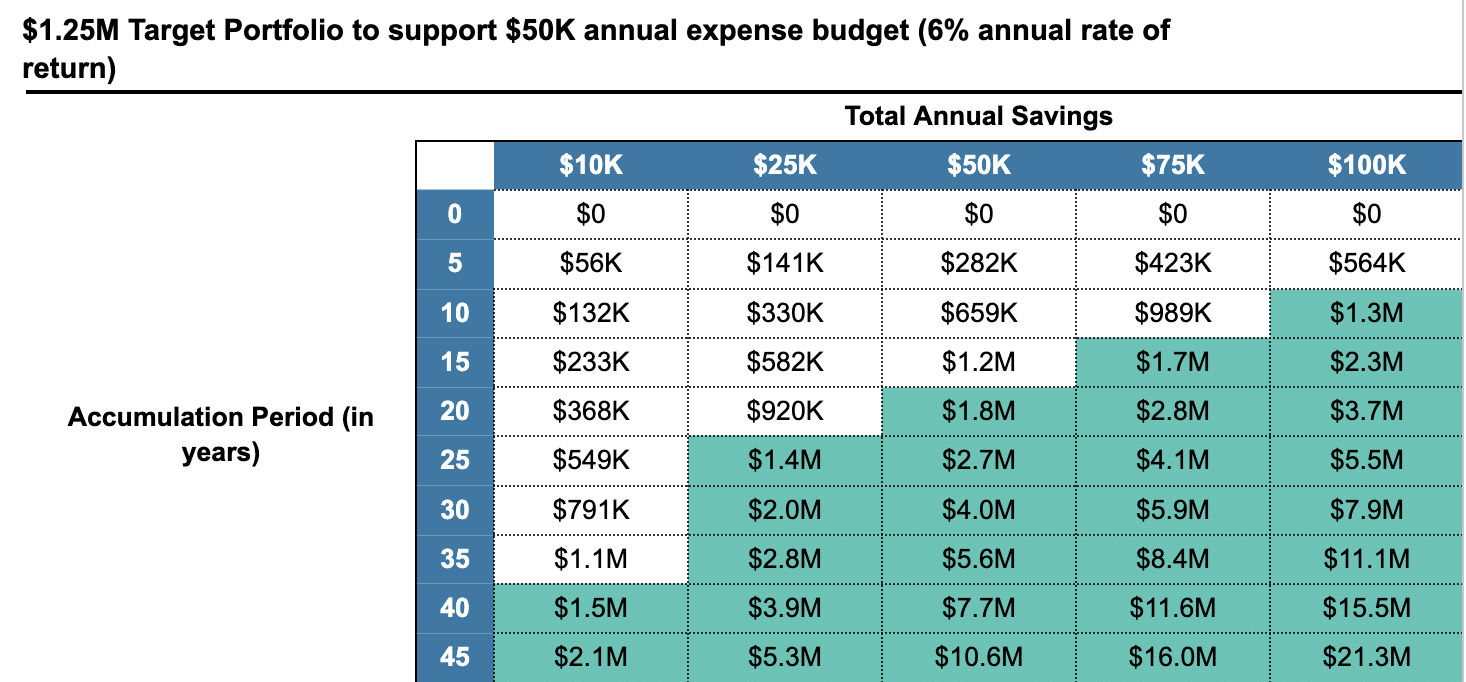

Below is a matrix that shows different combinations of savings per year versus number of years of accumulation. Areas in green is where you reach your $1.25M target. This supports a $50K budget at the traditional 4% withdrawal rate.

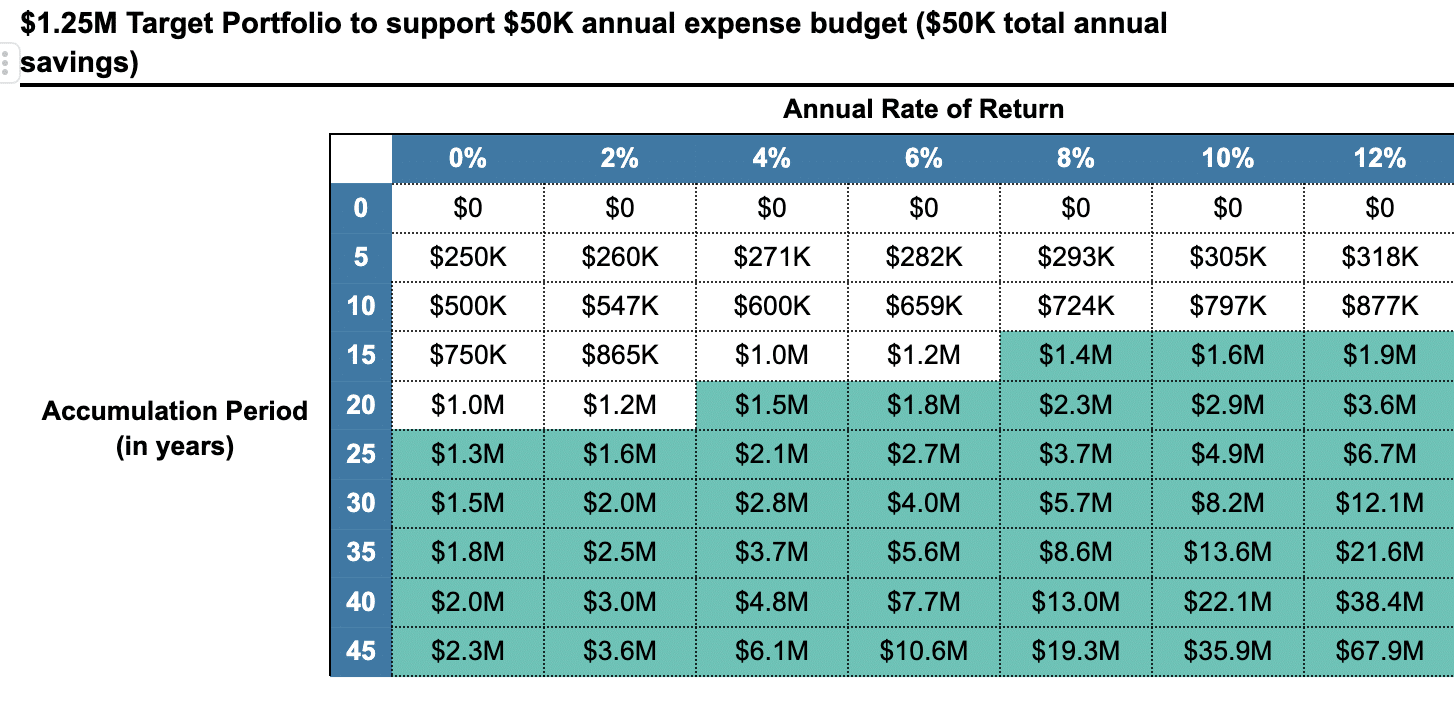

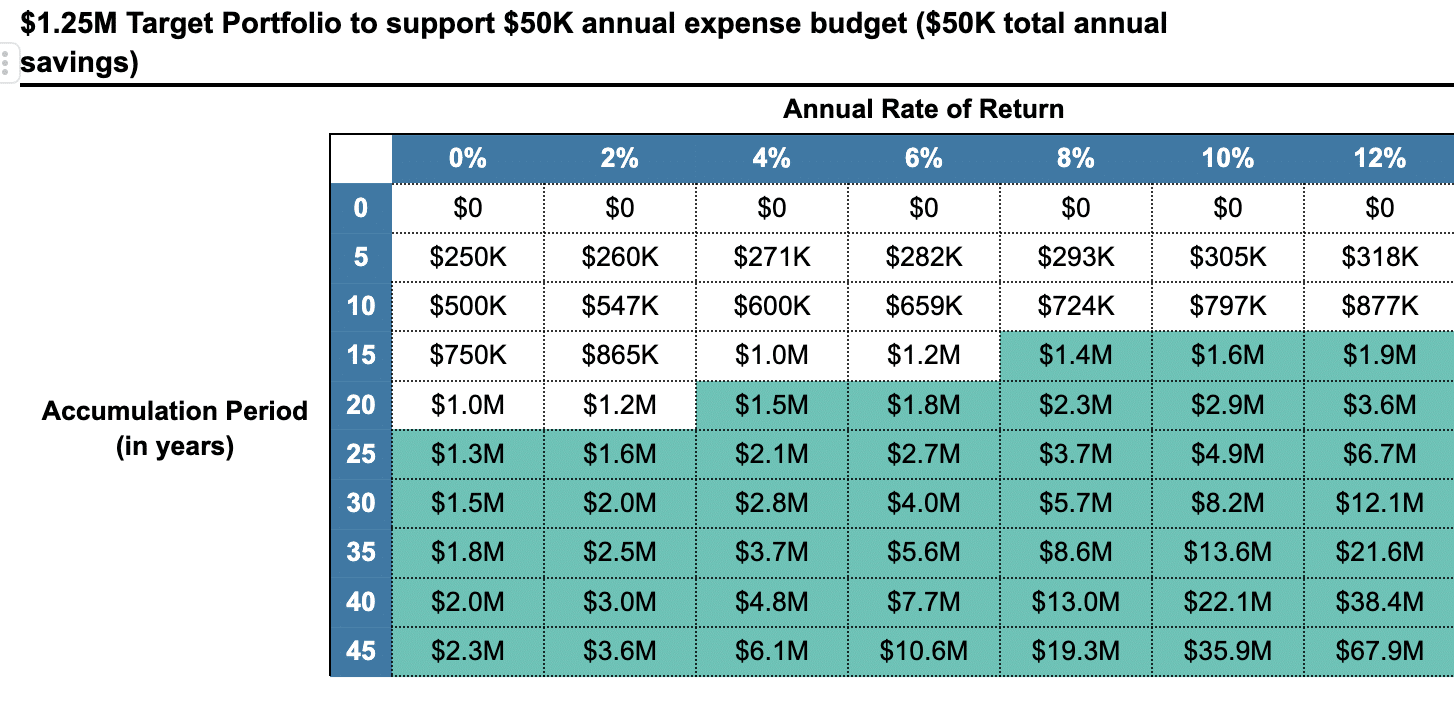

Here is matrix to understand how things might be different over your 20 year accumulation period depending on actual rates of return:

Is This Actually Possible Today?

To return to our starting question – how feasible is it for someone just getting started to successfully save enough to retire early?

Headwinds

There are certainly a number of headwinds.

- The typical college graduate, as of 2022, is starting nearly $30K in the hole due to college loans. Average salary for that college graduate is just under $60K. Inflation has pushed the cost of everyday goods up by nearly 20% just since Jan 2020.

- Average rent for a one bedroom apartment is $1,300 per month (or $16K per year). That varies from $730 in West Virginia to $1,650 in Hawaii. There is a tremendous amount of variability with this data between government (e.g. Census) and private (e.g. Zillow) estimates. Private estimates suggest these numbers are even higher.

As with everything, there is much variability in the calculation of the typical cost of living. The average annual expenses for a recent college graduate seem to fall somewhere between $35-$60K. So one would need $69-$94K in after-tax earnings, on average, to save enough in 20 years for a $50K early retirement budget. That goes up to $103-128K for the $100K early retirement budget.

Tailwinds

There are some tailwinds to consider as well.

- Advances in technology and investment fee compression have made it far easier and cheaper to invest today than ever before. You can do it all with a few taps on your smartphone or have everything fully automated for you.

- Technology is also unlocking an ever-growing number of income opportunities. What was once relegated to the realms of “side hustles” is surpassing traditional employment income for many people. This is especially true among younger generations.

- Continued move to a service-based economy, among the other factors mentioned above, is making part-time and contract-based work more prevalent.

- Covid has given everyone a new perspective on what’s important. It has made people more value-driven in their decisions and the value calculation has become a lot more holistic. It has also shown how resilient humanity can be in the face of unprecedented challenges.

The Reality of “Early Retirement”

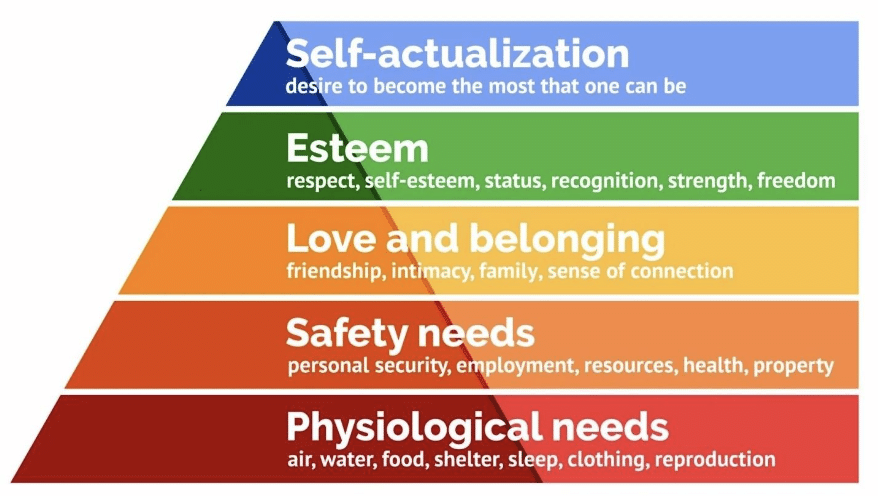

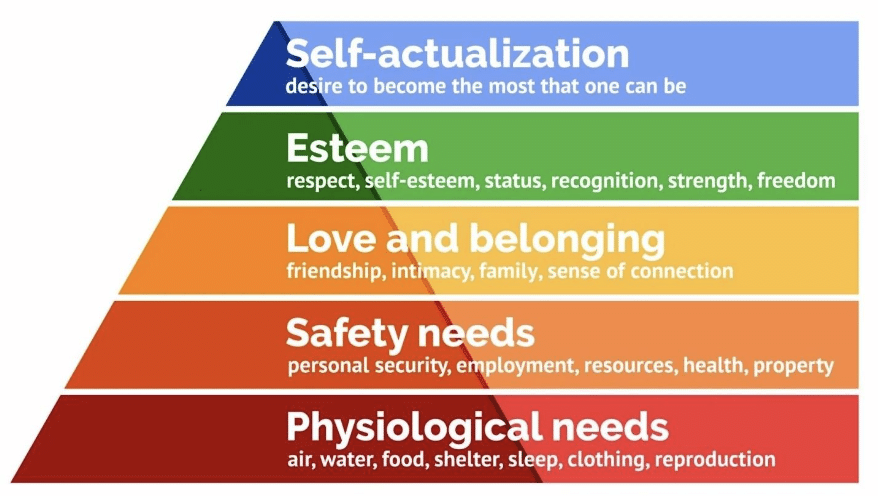

The reality is that with most early retirement, you will need to find other pursuits or interests to achieve what Maslow put at the top of his hierarchy of human needs: Esteem and Self-Actualization.

The changing work dynamics are making it more likely that meeting these needs in early retirement can produce some financial income to supplement your savings. For many, early retirement becomes a period of rewirement toward a more authentic self rather than the “traditional” retirement.

Principles vs. Techniques

While many important aspects have certainly changed in recent years, it appears that much of the fundamental structure that determines whether or not you reach early retirement remains in place.

As always, having a high income is going to be among the simplest paths to early retirement. For others, it will ultimately come down to individual decisions.

Some people might call them sacrifices. I prefer to think about them as priorities. What is important to you? What gives you joy? What has value for you and where does early retirement fit into that?

You have the three main dimensions to work within:

- How much you spend (now and in retirement),

- Your saving rate (in percentage terms and absolute dollars that your income allows), and

- The return you’re able to get on your savings.

All of those have unique trade-offs and challenges.

Despite it feeling magical when I first learned about it, there’s really no magic behind it. You may not be able to predict all the things that the world will throw at you along the way. And you may not have as much help as others do.

But with a clear plan guiding your decisions and persistence in following the tried and true principles, the road to financial independence and early retirement remains open to those that seek to pursue it.

Where are you on your journey to early retirement? How do these numbers compare to your experience? Do you think you can do it if you had to start from zero today?

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we’re familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

[ad_2]