Digital fraud attempts jump in Canada

[ad_1]

Article content

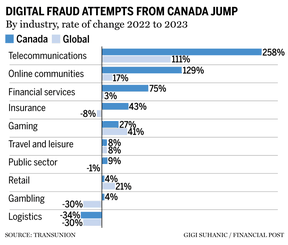

Suspected digital fraud attempts in Canada shot up almost 40 per cent in 2023, the third-highest increase among 19 countries, a TransUnion study says.

New data analysis from the credit reporting agency found that “five per cent of all digital transactions originating from Canada were suspected to be fraudulent.”

Article content

Sixty per cent of Canadians surveyed said they had been targeted by fraud and 10 per cent said they fell for it.

Article content

The highest rate of suspected digital fraud was in the retail sector, where eight in 100 transactions are suspected of being fraudulent (8.4 per cent). Communities like chat forums and online dating had a 6.2 per cent fraud rate and video gaming, 4.6 per cent.

Along with the drastic increase in fraud attempts, Canadians reported a diverse mixture of schemes from phishing to third-party seller scams.

Phishing, where fraudulent links are circulated via email and other telecommunications, was reported by half of Canadian respondents.

Meanwhile, third-party seller scams, where fraudulent posts for products are posted on legitimate retail websites, were reported by 22 per cent of respondents.

The rise of digital transactions during the pandemic brought a new reality for Canadians, said TransUnion. More transactions meant more opportunity for fraudsters, and suspected digital fraud attempts skyrocketed 202 per cent from 2019 to 2023.

“It’s important to be smart from the very beginning and be cautious to provide any personal information, whether you think it’s your family, your bank, or potentially one of your utility companies, or someone that you transact with,” said Patrick Boudreau, head of identity management and fraud solutions at TransUnion, adding that fraudulent schemes will often pressure victims to provide personal information.

Article content

The TransUnion survey found that Canadians take fraud and digital security risks seriously, and these concerns influence who they do business with. More than 70 per cent of Canadians said they would not return to a website if they had fraud concerns, and 42 per cent have abandoned their online shopping carts because of security concerns.

A recent poll by The Bank of Nova Scotia suggests newcomers, adults who came to Canada within the past 10 years, are more proactive in taking precautions to prevent financial fraud.

Newcomers are 47 per cent more likely to discuss financial security and fraud prevention than other Canadians, and 16 per cent more likely to frequently update their passwords to protect online accounts. Still, 38 per cent of newcomers report that they have fallen for a fraudulent scheme at least once, much higher than other Canadians.

Recommended from Editorial

“It is important to be hypervigilant and make sure that you double and triple check the information that’s coming through before you click any links, reply to anyone or provide any information,” Boudreau said.

Share this article in your social network