Austin Housing Market Trends and Forecast for 2024

[ad_1]

The Austin Housing Market Report for November reflects a dynamic real estate landscape with shifting trends and encouraging signs for potential homebuyers. The drop in median home prices, coupled with an increase in housing inventory, suggests a more favorable environment for buyers.

A recent report from Realtor.com has stirred the conversation by making bold predictions about the Austin housing market for 2024. The national forecast for home prices in the U.S. suggests a modest dip of 1.7% in 2024. However, what captures attention is the specific prediction for the Austin area—a substantial 12.2% drop in home prices next year.

This projection has sparked discussions among real estate experts and residents, prompting varied opinions and analyses. Contrary to the above-mentioned forecast, there could be a slight increase in Austin home prices for the upcoming year despite higher interest rates.

The interplay of factors like interest rates, buyer behavior, and creative solutions from the real estate industry will likely shape the trajectory of Austin’s real estate landscape. One thing is very clear as we approach the new year, the real estate landscape in Austin is poised for change, and whether it aligns with predictions or takes an unexpected turn remains to be seen.

Austin Housing Market Trends in 2024

How is the Austin Housing Market Doing Currently?

January Data Unveils an Upbeat Start:

In the vibrant city of Austin, Texas, the real estate landscape is buzzing with optimism as we step into 2024. According to the latest Central Texas Housing Market Report released by Unlock MLS, the data paints a promising picture. Residential homes sold have seen a commendable 4.3% surge, reaching 1,667 closed sales. Simultaneously, pending sales have experienced a 3.8% uptick, soaring to 2,480 listings. These figures indicate not only a growing interest among potential homebuyers but also a positive sentiment among sellers, setting a robust tone for the year ahead.

Fifteen Consecutive Months of Median Sales Price Decline:

Dr. Clare Losey, a housing economist for Unlock MLS and the Austin Board of REALTORS®, sheds light on a significant trend – January marks the fifteenth consecutive month of year-over-year median sales price declines in the Austin Round Rock housing market. This decline is attributed to a recent drop in mortgage rates, empowering more homebuyers to step into the market.

Empowering Buyers with Lower Prices:

The decline in mortgage rates, peaking in late October and subsequently dropping in November and December, has contributed to lower home prices. This has played a crucial role in the 4.4% decrease in the median price for residential homes, settling at $430,000 in January 2024 compared to the same period in 2023. The lowered prices have catalyzed an increase in residential homes sold, creating a more dynamic market for buyers.

How Competitive is the Austin Housing Market?

An In-Depth Look at Austin and Its Surroundings:

Delving deeper into the Austin Round-Rock MSA, various key metrics highlight the market’s competitiveness. With 3,064 new home listings, a 5.1% increase from January 2023, and 7,976 active home listings, a 3.6% decrease from the previous year, the market is vibrant and fluid.

City of Austin – A Closer Look:

The City of Austin, a central player in the region, recorded 520 residential homes sold in January 2024, a marginal 0.6% decline from the previous year. The median price for residential homes dipped by 2.8%, settling at $534,500. Although there is a 7.7% increase in active home listings, reaching 2,691, the market is still maneuverable for both buyers and sellers.

Are There Enough Homes for Sale in Austin to Meet Buyer Demand?

Inventory Insights:

Despite the increase in new home listings, with 3.2 months of inventory in the Austin Round-Rock MSA, the market is experiencing a modest 0.2 months more than January 2023. This suggests a balance between supply and demand, allowing buyers a reasonable selection without causing an oversaturation of options.

City of Austin and Surrounding Counties:

The City of Austin with 3.2 months of inventory and Travis County with 3.4 months both showcase a healthy equilibrium. Williamson County, with 2.6 months, leans towards a slightly more favorable position for buyers, while Hays County and Bastrop County stand at 3.7 and 4.5 months, respectively, indicating a competitive market but still favorable to buyers.

What is the Future Market Outlook for Austin?

President Kent Redding’s Insights:

Kent Redding, president of Unlock MLS and ABoR, emphasizes their commitment to providing REALTORS® with the most comprehensive and up-to-date listing data in Central Texas. The focus is on fostering a dependable and transparent marketplace, ensuring Central Texans have access to the industry’s most accurate housing data. As the year unfolds, a timelier monthly glimpse and analysis of the Austin-area housing market will be delivered, offering stakeholders valuable insights into the evolving dynamics.

Championing Affordable Housing:

Dr. Clare Losey acknowledges the need for more affordable housing in Central Texas. As the Austin Board of REALTORS® collaborates with the Austin City Council, the emphasis is on championing housing policies that assist those in need, further shaping the future landscape of the Austin housing market.

Is It a Buyer’s or Seller’s Housing Market?

The Balancing Act:

With a 3.2-month inventory and a decline in median sales prices, the Austin housing market currently tips the scale slightly in favor of buyers. However, the competition and variety of options ensure that sellers are not left without opportunities. As we navigate through 2024, the market’s equilibrium will be a fascinating aspect to observe, offering both buyers and sellers a dynamic and engaging real estate experience in the heart of Texas.

Austin Housing Market Forecast 2024 and 2025

According to Zillow, a leading real estate platform, the average home value in the Austin-Round Rock area stands at $451,322, reflecting a 7.3% decrease over the past year. Homes in this region typically go pending in approximately 66 days as of January 31, 2024.

Housing Metrics Breakdown:

1. Average Home Value:

The average home value in the Austin-Round Rock region, as reported by Zillow, is currently $451,322, indicating a decline of 7.3% over the past year.

2. Market Forecast:

Zillow’s 1-year Market Forecast for January 31, 2024, predicts a positive trend with an expected growth rate of 3.3%.

3. For Sale Inventory:

As of January 31, 2024, the Austin housing market boasts a total inventory of 9,369 homes available for sale.

4. New Listings:

In January 2024 alone, 1,638 new listings were added to the Austin-Round Rock real estate market, providing prospective buyers with a variety of options.

5. Median Sale to List Ratio:

The median sale to list ratio for December 31, 2023, stands at 0.975, indicating a balanced relationship between listing prices and actual sale prices.

6. Median Sale Price:

As of December 31, 2023, the median sale price for homes in the Austin-Round Rock area is $446,500.

7. Median List Price:

The median list price for homes in the region, reported as of January 31, 2024, is $514,250.

8. Percent of Sales Over List Price:

For December 31, 2023, 12.1% of home sales in the Austin area were recorded as being above the list price.

9. Percent of Sales Under List Price:

Conversely, 71.0% of home sales in the same period were under the list price, reflecting a buyer-friendly market.

Defining the Region:

The Austin-Round Rock Metropolitan Statistical Area (MSA) encompasses several counties, including Travis, Williamson, Hays, and others. This region’s housing market is considered one of the fastest-growing and most dynamic in the United States.

The housing market in the Austin-Round Rock MSA is robust and expansive, with a diverse range of properties catering to various preferences. The $451,322 average home value is a testament to the region’s attractiveness and sustained demand.

Are Home Prices Dropping in Austin?

Yes, home prices in the Austin-Round Rock area have experienced a 7.3% decrease over the past year, contributing to a buyer-friendly market. This decline provides an opportunity for potential buyers to enter the market at a more advantageous price point, reflecting the dynamic nature of the real estate landscape in this region.

Will the Austin Housing Market Crash?

As of the current data available, there is no indication of an impending housing market crash in Austin. The 1-year Market Forecast from Zillow projects a 3.3% growth, indicating a positive outlook for the coming months. The market’s resilience, coupled with consistent demand, suggests stability rather than an imminent crash.

Is Now a Good Time to Buy a House in Austin?

Considering the buyer-friendly conditions, including a decline in home prices by 7.3%, a significant inventory of 9,369 homes, and a relatively short average time of 66 days for homes to go pending, now appears to be a favorable time to buy a house in the Austin-Round Rock area. Prospective buyers can take advantage of the current market dynamics to secure a property that aligns with their preferences and budget.

Is the Austin Housing Market Overpriced?

The question of whether the Austin housing market is overpriced is a subjective one and can depend on several factors. Firstly, it is important to note that the Austin housing market has been experiencing an unprecedented level of demand over the past few years. This demand has been driven by a combination of factors, including a strong local economy, a growing population, and an influx of out-of-state buyers. This increase in demand has resulted in a significant rise in the median home price.

Recent research suggests that homes in Austin continue to be among the most overvalued in the United States. The study conducted by researchers from Florida Atlantic University and Florida International University reveals that homebuyers in Austin are still paying almost 51% more than what is expected for homes. Only Boise, Idaho, has a higher premium, with homebuyers paying an exorbitant 81% more.

However, it is equally essential to compare the affordability of homes in Austin to other major cities. Although the median home price in Austin is high compared to historical norms, it is still lower than in cities like San Francisco, New York, or Los Angeles. Additionally, Austin’s cost of living is generally lower than other major cities, which can make it more feasible for some buyers to own a home.

Another aspect to consider is the potential growth of the Austin housing market. While it is impossible to predict the future, many experts believe that Austin’s robust economy and growing population make it a worthwhile long-term investment for homebuyers. Furthermore, the city has a diverse economy, making it less vulnerable to economic shocks.

Ultimately, whether or not the Austin housing market is overpriced is subjective. While some buyers may find the high prices unaffordable, others may see it as a sound investment in a thriving city. It is crucial for prospective buyers to assess their financial situation and goals before deciding to purchase a home in Austin or any other market.

Is Austin a Good Place for Real Estate Investment?

Austin’s rapidly expanding economic industry is driving more people into the city which is increasing the housing demand. A number of reasons have affected the present situation of the Austin housing market, one of which is the high migration of firms and persons relocating to the city from Texas and out-of-state, which has led to a robust and varied economy that attracts people seeking opportunity.

A surge of people moving in, combined with rapid population growth and low mortgage interest rates, has turned Austin and its surrounding area into a sellers’ market. Austin’s engine of job and population growth is not projected to slow down anytime soon—the biggest drivers of residential real estate demand. Its economy has diversified and strengthened over the past two decades.

Companies like Google and Tesla are moving operations to Austin. The software giant Oracle has also relocated its headquarters here. As more companies move here, that means more people looking for homes, and the city is also attractive to outside investors. With a steady influx of job creation in the pipeline, the housing market will continue to post strong numbers. Big companies moving here will also play into what happens to the housing market.

If you’re considering real estate investment, Austin, Texas, is a city that should be on your radar. Known for its vibrant culture, strong economy, and population growth, Austin offers numerous opportunities for real estate investors. Let’s explore in detail why Austin is a promising destination for real estate investment.

Population Growth and Trends

Population Growth:

- Austin has been experiencing consistent and substantial population growth for many years. The city’s population has been steadily increasing, making it one of the fastest-growing metropolitan areas in the United States.

- The city’s appeal to newcomers is driven by factors like its vibrant tech scene, cultural attractions, and overall quality of life.

Trends:

- The population growth trend in Austin is expected to continue, with projections indicating a significant increase in residents over the coming years.

- As the city’s population expands, the demand for housing, both rental and owned, is likely to rise, creating opportunities for real estate investors.

Economy and Jobs

Economic Strength:

- Austin’s economy is robust and diverse, with a thriving technology sector, a burgeoning startup scene, and a strong presence of major corporations.

- The city consistently ranks high in terms of job creation and economic growth, making it an attractive destination for professionals seeking employment opportunities.

Job Market:

- The city’s job market is diverse and dynamic, with a focus on technology, healthcare, education, and entertainment.

- Employment opportunities continue to draw individuals to Austin, contributing to the population growth and housing demand.

Livability and Other Factors

Livability:

- Austin consistently receives high marks for its quality of life. The city offers a vibrant cultural scene, excellent healthcare facilities, and access to outdoor activities.

- It’s known for its music and arts culture, making it a desirable place to live for professionals and creatives.

Education:

- Austin is home to top-tier educational institutions, including the University of Texas at Austin. This draws students, academics, and their families to the city, further boosting the demand for housing.

Infrastructure:

- The city has invested in infrastructure and transportation improvements to accommodate its growing population, making it more accessible and commuter-friendly.

Austin Rental Property Market Size and Growth

Rental Market:

- Austin’s rental property market is substantial and continues to grow. The city offers a wide range of rental properties, from apartments to single-family homes, catering to a diverse tenant population.

- The city’s dynamic job market attracts young professionals, making it an ideal location for rental property investment.

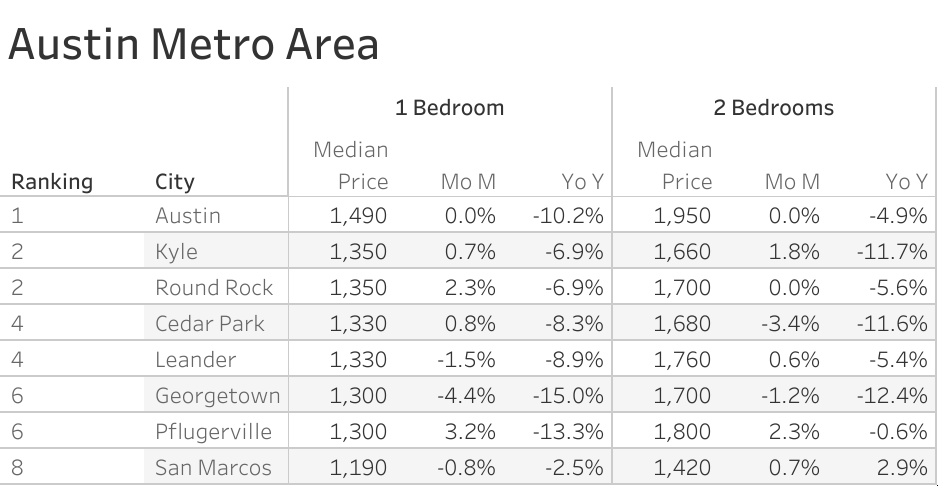

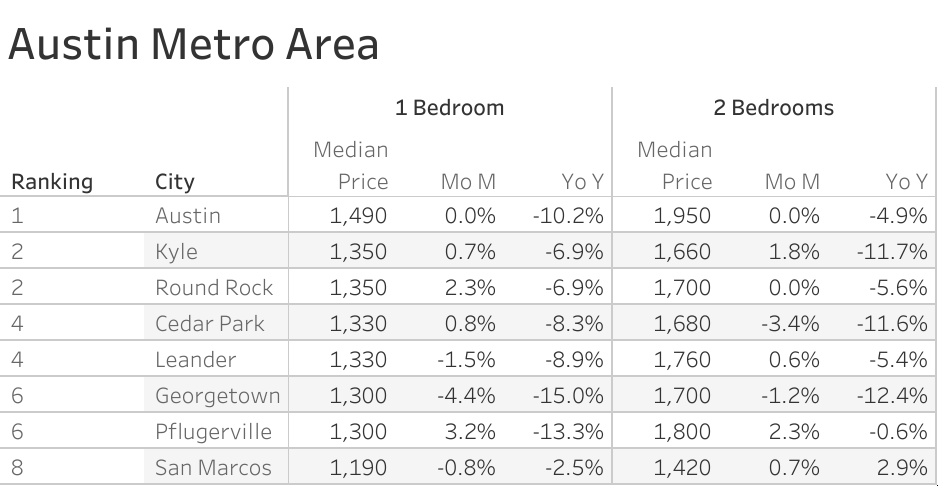

Zumper’s recent Austin Metro Area Rent Report delves into active listings across metro cities, revealing valuable insights into rental trends, pricing differentials, and changes in the rental landscape. The analysis, conducted last month, provides a comprehensive view of the most and least expensive cities, as well as those experiencing the fastest-growing rents in the metro area. According to the report, the Texas one-bedroom median rent stood at $1,119 last month, setting the baseline for understanding regional variations.

The best place to buy rental property is about finding growing markets. Cities like Round Rock, Cedar Park, and Pflugerville are good for investors looking to get started with rental property ownership at an affordable price. These cities look good for rental property investment this year as rents are growing over there. These trends provide a macro look at the growing rental demand. Each real estate market has its own unique supply-demand dynamics with unique neighborhoods that present their own opportunities for investors.

The Most Expensive Cities

- Austin: Topping the list as the most expensive city, Austin recorded one-bedroom rents at $1,490. This places it at the forefront of the rental market in terms of pricing.

- Kyle & Round Rock were tied for second with rents both at $1,350.

The Least Expensive Cities

- San Marcos: Earning the title of the most affordable city, San Marcos boasted one-bedroom rents at $1,190, offering a more budget-friendly option for renters.

- Pflugerville & Georgetown were tied for the second least expensive with rents both at $1,300.

Largest Declines in Yearly Percentage

- Georgetown had the largest decline, falling 15% since this time last year.

- Pflugerville was second with rent dropping 13.3%.

- Austin ranked as third with rent dipping 10.2%.

Growth Potential:

- The city’s population growth and job market strength contribute to the growth potential of the rental property market. As more people move to Austin, the demand for rental units is expected to rise.

- Investors can explore various rental strategies, including long-term leases, short-term rentals, and vacation rentals, to diversify their real estate portfolio.

Other Factors Related to Real Estate Investing

Investor-Friendly Environment:

- Austin’s business-friendly environment extends to real estate investment. The city offers attractive incentives and a favorable legal framework for real estate investors.

- Real estate investors benefit from a strong property rights regime and a well-regulated market.

Tax Benefits:

- Texas does not have a state income tax, which can be advantageous for investors looking to maximize their returns.

- Investors should explore the tax implications of specific investment strategies, including property taxes and capital gains.

Market Resilience:

- Austin’s real estate market has shown resilience during economic downturns, and it is considered one of the more stable markets in the country.

- Investors appreciate the market’s ability to weather economic fluctuations and maintain its growth trajectory.

Diversification:

- Investors can diversify their portfolios by exploring various types of real estate, from residential properties to commercial and mixed-use developments, taking advantage of Austin’s growing and diverse market.

As a real estate investor, Austin’s population growth, strong economy, livability, rental property market size, and other investor-friendly factors make it a compelling choice. However, it’s essential to conduct thorough market research, consult with local real estate experts, and tailor your investment strategy to your specific goals and risk tolerance. Austin’s real estate market offers exciting opportunities, but informed decision-making is key to success.

References:

- https://www.abor.com/new-center/market-stats

- https://www.zillow.com/austin-tx/home-values

- https://www.realtor.com/realestateandhomes-search/Austin_TX/overview

[ad_2]