Arizona Housing Market Prices and Forecast for 2024

[ad_1]

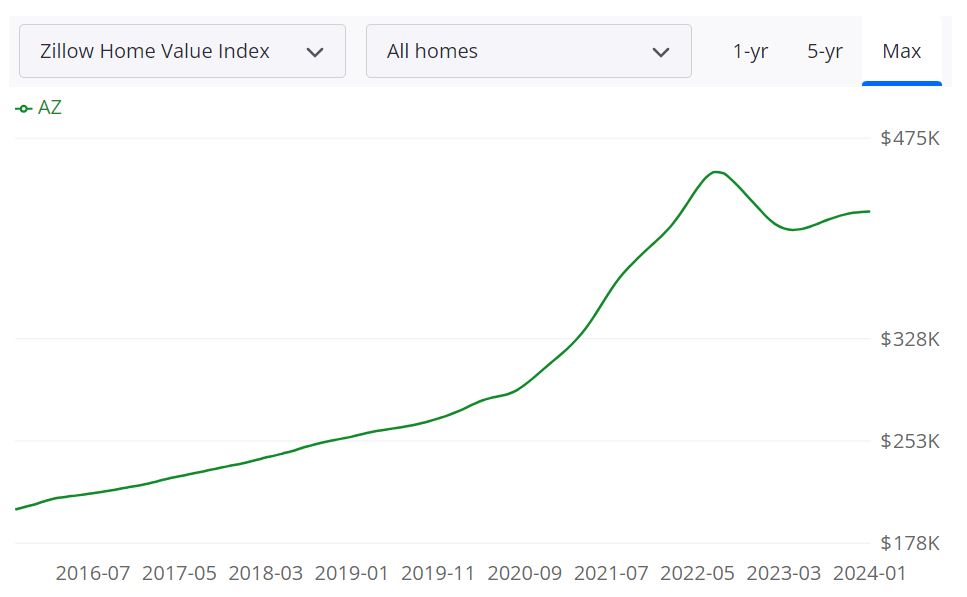

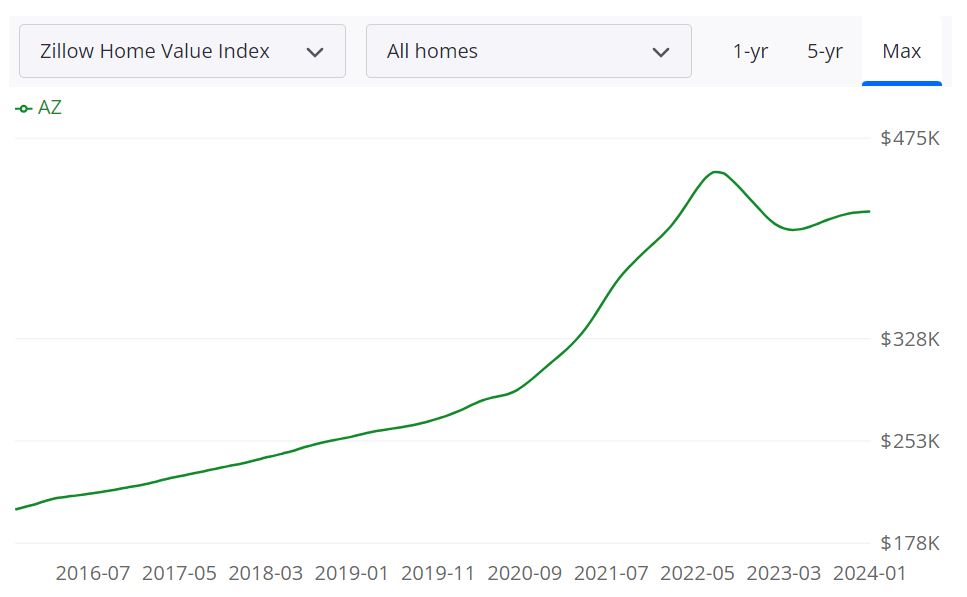

The Arizona housing market has experienced fluctuations last year, and many are eager to know what the future holds for this dynamic real estate market in the U.S. Various data sources, such as Zillow and housing market forecasts, provide insights into the current state and potential developments. Let’s explore the forecast for the Arizona housing market for 2024.

How is the Arizona Housing Market Doing Currently?

One of the most pressing questions in the real estate market is whether home prices in Arizona will go down in 2024. The data and forecasts show that while there might be minor fluctuations, the overall trend appears to be positive. With an expected increase in home values in major cities like Phoenix and Tucson, it suggests a stable and potentially appreciating housing market.

Hence, the Arizona housing market has its ups and downs, but it remains strong and attractive to both buyers and sellers. Keeping an eye on the latest data and forecasts is crucial for making informed real estate decisions in this dynamic market.

Average Home Value in Arizona:

According to Zillow, the average Arizona home value stands at $421,939, experiencing a notable 0.9% increase over the past year. This indicator provides a snapshot of the overall health and stability of the housing market.

Days on Market:

Properties in Arizona are swiftly making their mark in the market, with an average of 34 days from listing to pending. This rapid turnover is a testament to the demand for housing in the region.

For Sale Inventory:

Currently, there are 25,523 properties available for sale in Arizona as of January 31, 2024. This figure provides a glimpse into the abundance of housing options available to prospective buyers.

New Listings:

In January 2024 alone, 7,037 new listings entered the market, contributing to the dynamic inventory and offering fresh opportunities for potential homeowners.

Median Sale to List Ratio:

The median sale to list ratio as of December 31, 2023, is 0.988. This ratio serves as a key indicator of the alignment between listing prices and actual sale prices, providing insights into negotiation dynamics.

Median Sale Price:

With a median sale price of $409,000 recorded on December 31, 2023, the Arizona housing market reflects a diverse range of property values, catering to various budget considerations.

Median List Price:

As of January 31, 2024, the median list price for homes in Arizona is $473,300. This figure signifies the current expectations of sellers in the market.

Percent of Sales over/under List Price:

Examining the market dynamics as of December 31, 2023, 17.7% of sales were recorded above the list price, while 58.2% were transacted under the list price. These percentages shed light on the prevailing negotiation trends.

Is Arizona a Buyer’s or Seller’s Housing Market?

Assessing the current state of the Arizona housing market prompts the essential question of whether it favors buyers or sellers. The data indicates a balanced landscape, with key metrics such as the median sale to list ratio providing insights into the negotiation dynamics. The 0.988 median sale to list ratio as of December 31, 2023, suggests a relatively equitable alignment between listing prices and actual sale prices. This indicates a favorable environment for both buyers and sellers, fostering a market that accommodates the interests of both parties.

Are Home Prices Dropping in Arizona?

Contrary to concerns about declining home prices, the data indicates a resilient market in Arizona. The average home value stands at $421,939, marking a 0.9% increase over the past year. The positive trajectory in home values suggests stability and potential for appreciation, alleviating worries about a significant drop in prices. This steady growth aligns with the overall health of the housing market, providing assurance to potential buyers and sellers alike.

Will the Arizona Housing Market Crash?

Addressing fears of a housing market crash requires a comprehensive understanding of the factors influencing the real estate landscape. As of the current data, there are no imminent signs of a market crash in Arizona. The regional housing market forecasts for various cities indicate diverse trajectories, with some experiencing moderate declines or stabilization, while others show positive growth. The absence of widespread negative trends and the robust demand for housing suggest a stable market, mitigating concerns about a significant crash at this juncture.

Is Now a Good Time to Buy a House in Arizona?

For potential homebuyers, the current scenario presents a favorable window of opportunity. The median sale price, recorded at $409,000 as of December 31, 2023, reflects a diverse range of property values catering to various budgets. Additionally, the percentage of sales under list price at 58.2% as of December 31, 2023, indicates the potential for negotiations and advantageous deals for buyers. Considering the stable market conditions and the availability of diverse housing options, now could indeed be a good time for prospective buyers to enter the Arizona real estate market.

Regional Arizona Housing Market Forecast:

Expanding our lens to the regional level, we explore the housing market forecast for various cities in Arizona. Each region presents a unique trajectory, influenced by local factors that shape the demand and supply dynamics. Let’s delve into the forecast for key cities in the state as provided by Zillow.

Phoenix, AZ:

As of January 31, 2024, Phoenix, a major metropolitan statistical area (MSA) in Arizona, is projected to experience a 0.1% increase in housing prices by February 29, 2024. Looking ahead, the forecast anticipates a more significant rise of 1.2% by April 30, 2024, and a substantial 6.3% surge by January 31, 2025. This suggests a robust and optimistic outlook for the Phoenix housing market.

Tucson, AZ:

Contrastingly, Tucson, another significant MSA in Arizona, is predicted to see a slight decline of -0.1% in housing prices by February 29, 2024. However, the market is expected to rebound with a 0.2% increase by April 30, 2024, and a more considerable 4.8% surge by January 31, 2025. This indicates a period of adjustment followed by a positive trend in the Tucson housing market.

Lake Havasu City, AZ:

For Lake Havasu City, the forecast is optimistic, projecting a 0.2% increase in housing prices by February 29, 2024, and a steady 1% rise by April 30, 2024. The market is expected to experience a 5.2% surge by January 31, 2025, signifying sustained growth in this particular region.

Yuma, AZ:

Yuma is poised for a positive trajectory, with a forecasted 0.2% increase in housing prices by February 29, 2024, followed by a 1.2% rise by April 30, 2024. The most notable surge is expected by January 31, 2025, with a projected 6.7% increase. This suggests a flourishing housing market in the Yuma region.

Flagstaff, AZ:

Flagstaff, however, faces a slight dip with a projected decline of -0.2% in housing prices by February 29, 2024. Nevertheless, the market is expected to rebound with a 0.5% increase by April 30, 2024, and a more substantial 5.7% surge by January 31, 2025, indicating a resilient recovery.

Sierra Vista, AZ

The forecast for Sierra Vista anticipates a steady 0.4% increase in housing prices by February 29, 2024, a more significant 1.8% rise by April 30, 2024, and a 5.4% surge by January 31, 2025.

Show Low, AZ

Show Low is expected to experience a 0.2% increase in housing prices by February 29, 2024, followed by a 1.4% rise by April 30, 2024, and a notable 7.1% surge by January 31, 2025.

Payson, AZ

The forecast for Payson is optimistic, projecting a 0.7% increase in housing prices by February 29, 2024, a 2% rise by April 30, 2024, and a substantial 7.1% surge by January 31, 2025.

Nogales, AZ

Nogales is expected to see a relatively stable market with a projected 0% increase in housing prices by February 29, 2024, followed by a 0.9% rise by April 30, 2024, and a 5.9% surge by January 31, 2025.

Safford, AZ

Safford is forecasted to experience a steady 0.4% increase in housing prices by February 29, 2024, a more significant 1.5% rise by April 30, 2024, and a 4.7% surge by January 31, 2025.

ALSO READ: Will the US Housing Market Crash?

If mortgage rates go on a decreasing trajectory in 2024, prospective buyers may return to the market to increase the demand. The important thing to take away from the shortage of housing units is that economists anticipate that the price of homes may continue to rise slowly in the AZ housing market in 2024.

On the supply side, it favors the property sellers. The bottom line here is that a stark imbalance between supply and demand continues to put upward pressure on AZ home prices. This partly accounts for the somewhat bold Arizona real estate market forecast for coming years. The other factors are that the economy of Arizona is robust, but the state is struggling with elevated levels of inflation and housing price growth. In 17 different states, the unemployment rate is at an all-time low.

As of September, Arizona has a 4.0 percent unemployment rate, a 0% change from a year ago. The pace of population increase in Arizona is the fourth fastest in the country. A significant number of states saw a loss in population as a consequence of COVID-19, low birth rates, and migration to neighboring states. Florida, Texas, and Arizona are the three states with the most rapid population increases. Years of underbuilding are a key contributor to the low inventory.

According to a study conducted by the Weldon Cooper Center for Public Service at the University of Virginia, Arizona’s population is projected to expand by 26.1% between 2020 and 2040 – an increase of 1,897,585 people. As the population is expected to rise yet there are only a few available homes on the market.

This also raises a bit of a concern that in Arizona wages are not keeping up with the rising costs of housing. When prices go up, some buyers can no longer afford to buy and drop out. The faster that pricing goes up, the more buyers tend to drop out, at least in a healthy market. Mortgage rates also play an impact here. In the past few years, interest rates have remained at historically low levels.

This is one of the causes that contributed to a countrywide increase in home-buying activity. However, rates have increased somewhat during the previous several months in 2022. If rates continue to rise, the Arizona real estate market might experience a general cooling trend. However, the persistent supply deficit is projected to “outweigh” this effect, guaranteeing that the AZ housing market will stay competitive long into 2023.

Of course, there is also a great deal of uncertainty in the air. From escalating inflation to the conflict in Ukraine, several elements might affect the economy in the future. Consequently, it is difficult to make reliable projections for the Arizona real estate market or any other market in the United States.

Here’s the median price of a home in some of the counties of Arizona (source: Realtor.com)

The data from Realtor.com shows the median listing home price and listing price per square foot for various counties in Arizona. Maricopa County has the highest number of homes for sale and rent, with a median listing home price of $549K and a listing price per square foot of $286. Coconino County has the highest median listing home price of $725K, while Cochise County has the lowest median listing home price of $296K. The data indicate that the housing market in Arizona is diverse and offers options for buyers with different budgets.

|

Counties |

Median listing |

Listing |

For sale |

For rent |

|---|---|---|---|---|

|

Maricopa County |

$549K |

$286 |

20,105 |

15,772 |

|

Pima County |

$394.7K |

$229 |

4,782 |

1,213 |

|

Yavapai County |

$607.5K |

$312 |

3,697 |

225 |

|

Pinal County |

$395K |

$212 |

4,983 |

752 |

|

Mohave County |

$403.8K |

$250 |

4,257 |

334 |

|

Coconino County |

$725K |

$392 |

1,173 |

221 |

|

Navajo County |

$495K |

$283 |

1,230 |

55 |

|

Gila County |

$485K |

$293 |

641 |

35 |

|

Yuma County |

$325K |

$213 |

1,046 |

172 |

|

Cochise County |

$296K |

$179 |

1,575 |

129 |

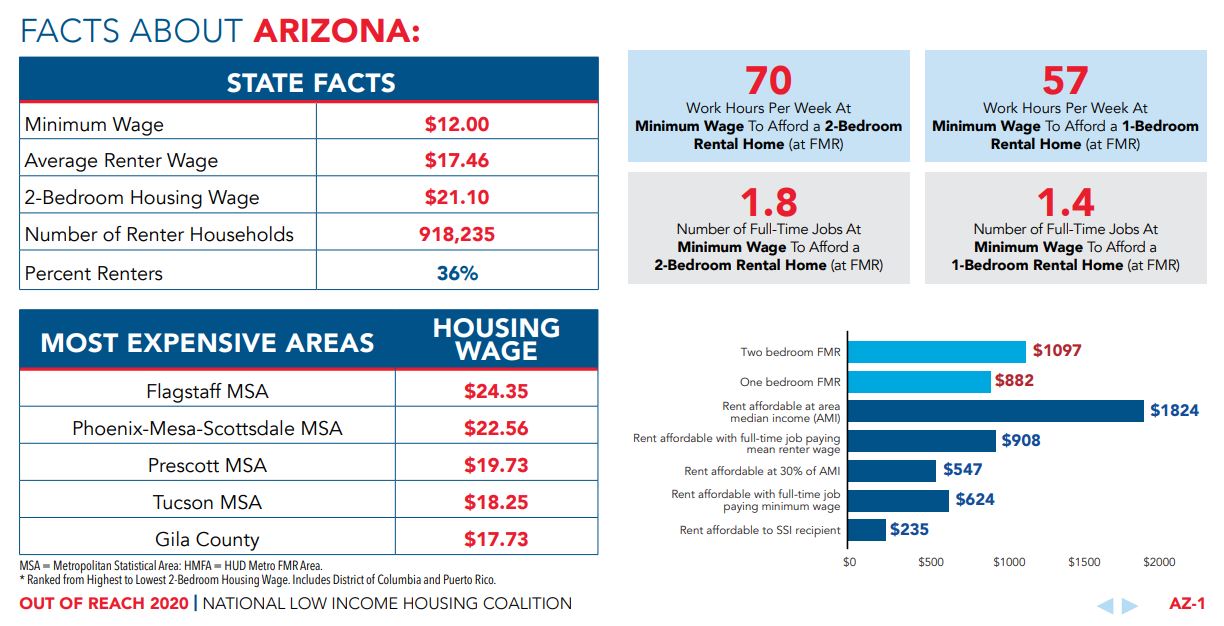

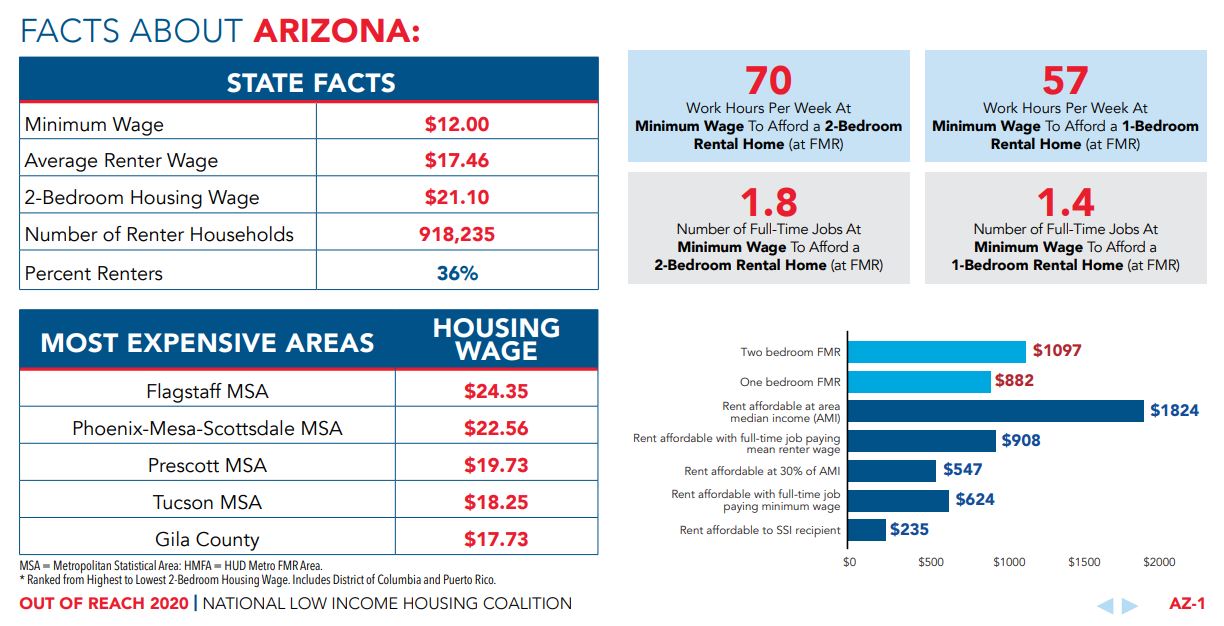

Arizona’s housing market has over 900,000 renter households, accounting for 36% of the total number of households. According to a report from the National Low Income Housing Coalition (NLIHC), rental prices in Arizona have become out of reach for many residents. For too many low-income workers, wages have not kept pace with rising rents and home prices. Workers need to make $21.10 an hour to afford a 2-bedroom rental at a fair-market rate.

In Arizona, the Fair Market Rent (FMR) for a two-bedroom apartment is $1,097. To afford this level of rent and utilities — without paying more than 30% of income on housing — a household must earn $3,658 monthly or $43,892 annually. Assuming a 40-hour workweek, 52 weeks per year, this level of income translates into an hourly Housing Wage of $21.10.

The minimum wage in Arizona is $12.00/hr and the Average Renter Wage is $17.46. Cost-burdened is defined as spending more than 30% of one’s monthly income on housing and utilities. Neighborhoods in west and South Phoenix are the most cost-burdened. In some cases, more than 50% of households are paying 30% or more of their income on housing costs, while less than 29% of renting households are housing cost-burdened in the north.

Flagstaff MSA is the most expensive MSA where you need an hourly wage of $24.35 to afford a 2-bedroom rental. The second most expensive MSA is Phoenix-Mesa-Scottsdale, where you need an hourly wage of $22.56 to afford a 2-bedroom rental.

Between 2010 and 2018, the City of Phoenix’s median income increased by only 10%, median rent increased by over 28%, and the median home price increased by over 57% during this time. In 2018, half of Phoenix renters were considered housing-cost burdened, 25% of homeowners were housing-cost burdened and altogether 36% of the entire population is housing-cost burdened. According to a report by Phoenix.gov, 65 % of households that fall within or below the moderate-income range would require some amount of subsidy to achieve housing that is considered affordable at their income level.

Sources:

- https://www.zillow.com/az/home-values/

- https://www.realtor.com/realestateandhomes-search/Arizona/overview

- https://www.thecentersquare.com/arizona/how-arizona-s-population-will-change-in-the-next-20-years/article_86c80054-4e38-5825-b0d1-ede98be1c649.html

[ad_2]