Are Index Funds Propping Up the Stock Market?

[ad_1]

A reader asks:

Lots of podcasts have discussed how large cap indexes just keep going up, and maybe that’s pushing P/E ratios too high from people buying index funds (me included). At the same time, mid- and small-cap indices have not seen the same overall growth.

Is there a risk that the S&P 500 gets out of hand relative to true value and then there is a fall as all exit at once?

I’ve always thought the worries about index funds wreaking havoc on stock prices were overblown.

If all the money flowing into index funds is propping up stock prices, why are large caps growing even faster than small and mid-caps? Wouldn’t it be easier to push up the prices of the smaller companies?

When you buy a market cap weighted index fund you buy those stocks in proportion to their current weights. It’s not like you buy more of the biggest stocks than the market already prices them at.

And if index funds are truly propping up the giant tech stocks, then how do you explain the drawdowns during the most recent bear market? The S&P 500 was down 25% peak-to-trough. These were the drawdowns for some of the biggest tech names:

- Google -45%

- Nvidia -66%

- Netflix -76%

- Facebook -77%

- Apple -31%

- Tesla -74%

Why didn’t index investors stop the bleeding in these stocks? And why did they go down so much more than the overall market?

Listen, index funds are having an impact on the market in many ways. It’s just not as cut and dried as some pundits would have you believe. There is something else going on when it comes to tech stocks (more on that in a minute).

Let’s get back to small and mid cap stocks.

These smaller and mid-sized companies have indeed been lagging large cap stocks for some time now. Many investors are ready to abandon diversification and put all of their money into large cap growth stocks because of it. They are clearly the best companies.1

Why would you own anything else?

Maybe that’s the case, but history is often unkind to investors who go all-in on any one segment of the market after it has experienced an extended period of outperformance.

I can’t predict the future so maybe we do live in a world where large cap growth stocks will always outperform. But what if this is all just cyclical? If nothing else, markets are always and forever cyclical.

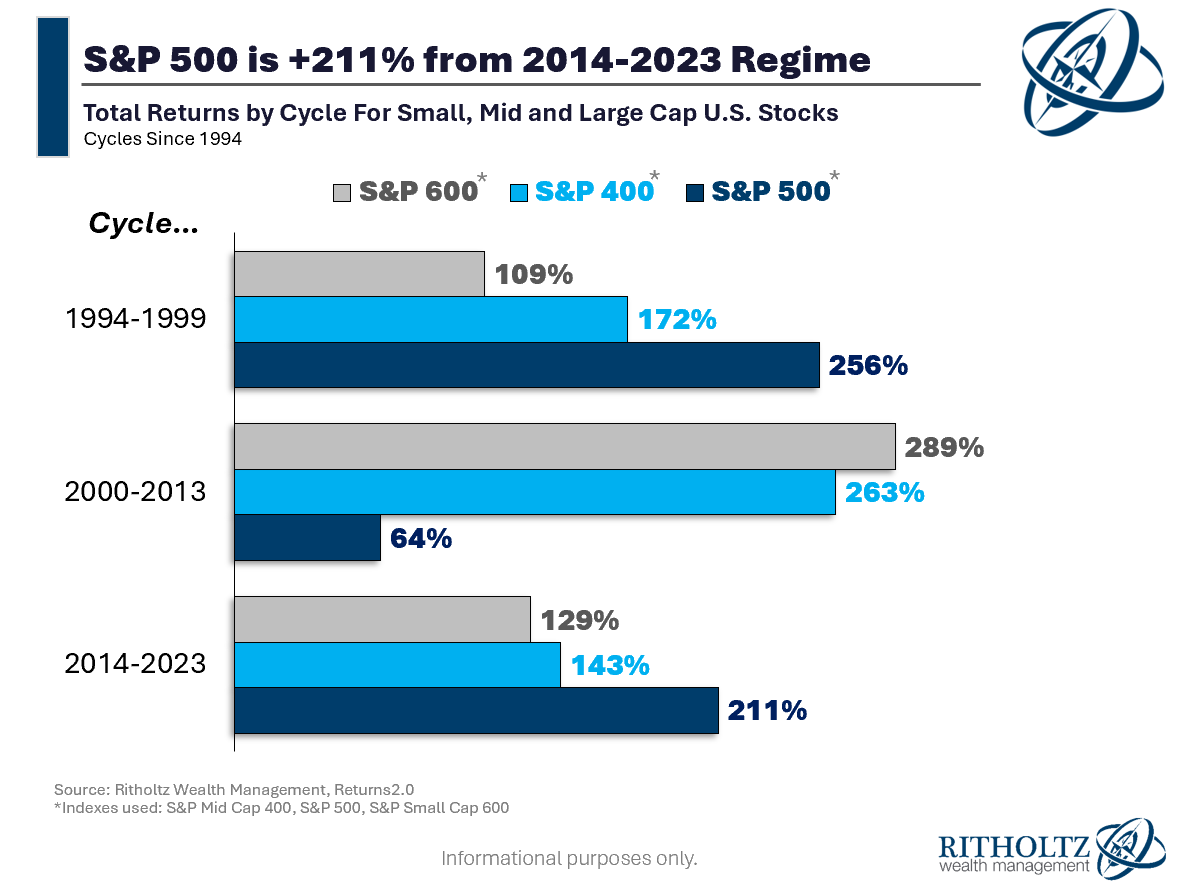

Here is a look at performance over different cycles for small, mid and large cap stocks since the mid-1990s:

Large cap stocks handily outperformed small and mid caps in the latter half of the 1990s. But look what happened following that period of outperformance — small and mid caps dominated large cap stocks for 14 years to kick off the new century.

Since 2014, the S&P 500 has lapped everything.

So what’s a better explanation — a new world order or the inherent ebbs and flows of outperformance in the stock market?

It’s also interesting to note the annual returns over the past 30 years are all very close:

- S&P 600 Small Cap +10.2%

- S&P 400 Mid Cap +11.2%

- S&P 500 Large Cap +10.1%

Sometimes better, sometimes worse, but it all shakes out in the end. Surprisingly, the S&P 500 has the lowest return of the three segments over this 30 year period.

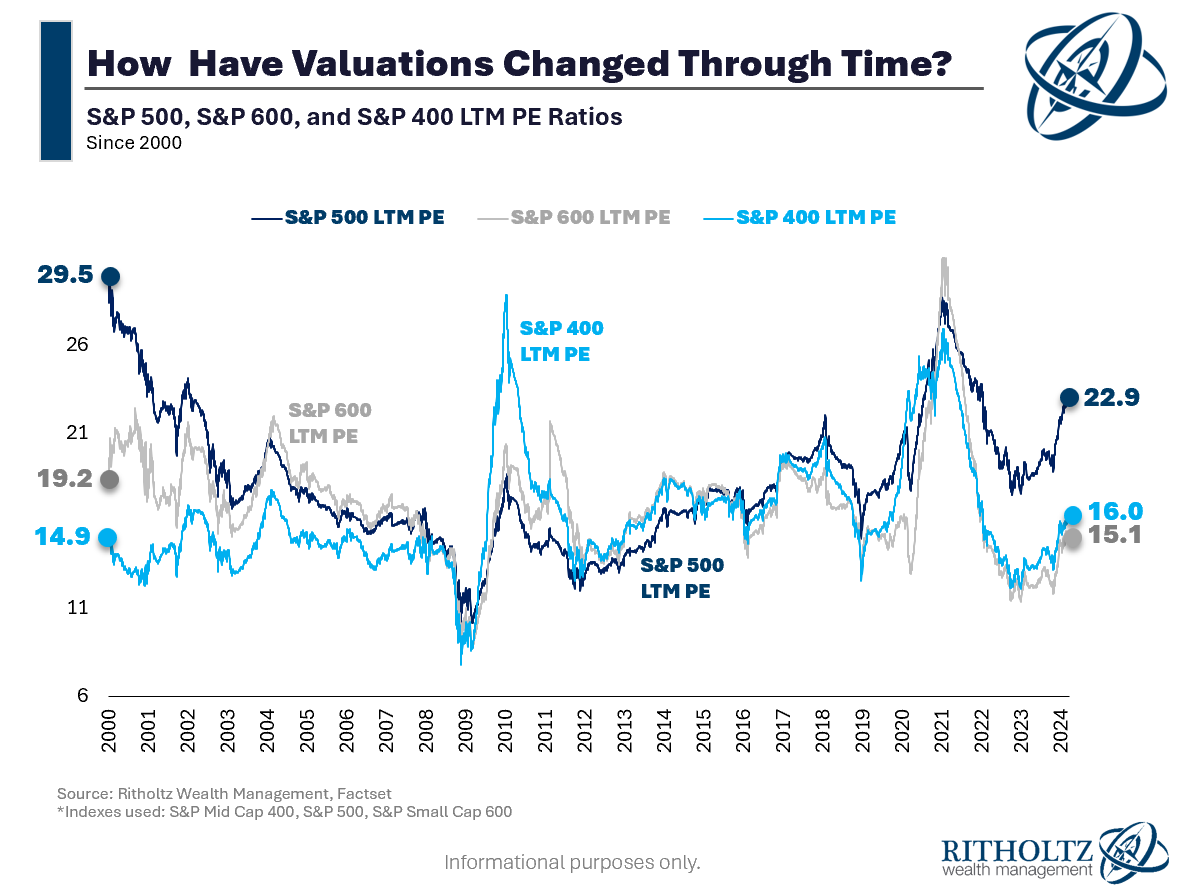

You can also get a better sense of these cycles by looking at the valuation changes:

The S&P 500 was wildly overvalued following the insanity of the dot-com bubble. Small and mid caps were more reasonably priced and didn’t get caught up in that mania to the same degree. That’s one of the main reasons they outperformed over the next cycle.

That outperformance led to higher multiples for small and mid caps, which subsequently underperformed. Now large caps again have a valuation premium.

I don’t know when but eventually this should matter.

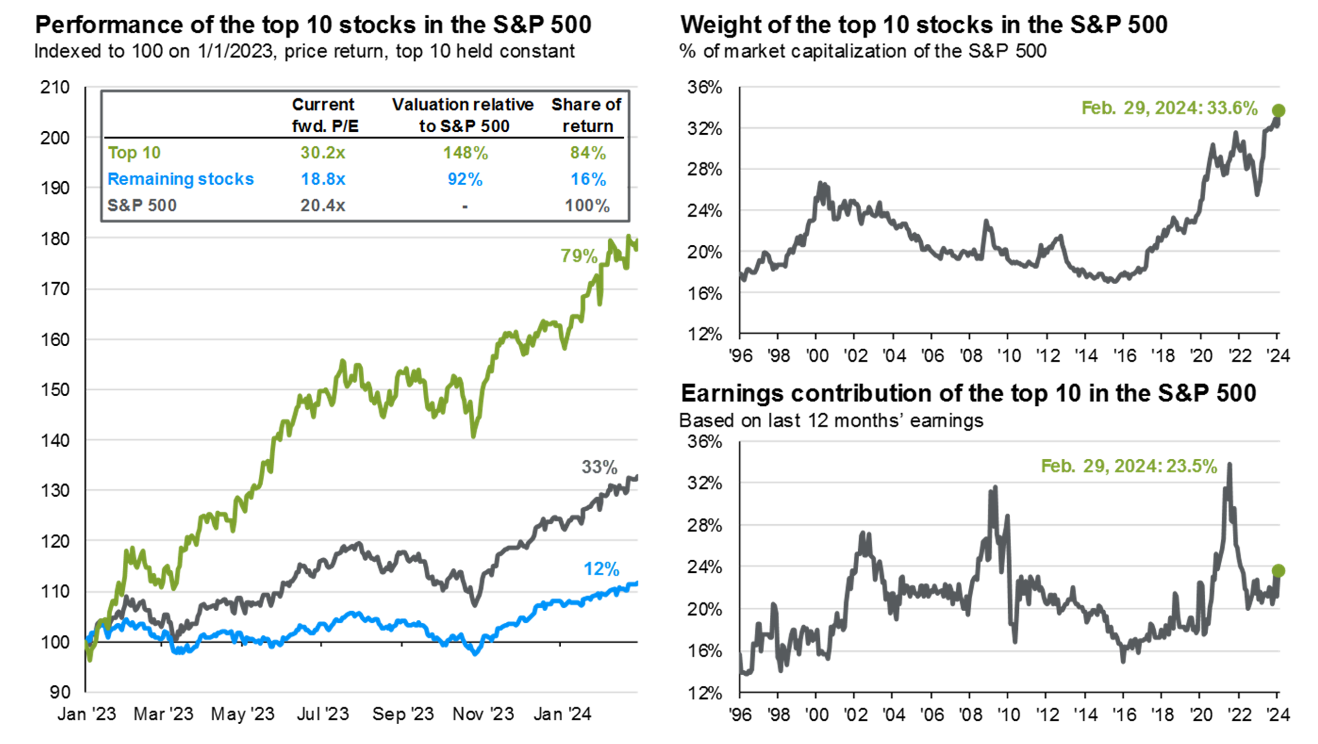

It’s also interesting to look at the impact of the biggest tech stocks on S&P 500 valuations. Here’s a good chart from JP Morgan:

So it’s not like the entire S&P 500 has ridiculous valuations. It’s more like the S&P 10 has a valuation premium while the S&P 490 is more reasonably priced.

To be fair, the biggest stocks in the S&P 500 have deserved a valuation premium. These stocks have had an outsized impact on performance so the valuations have been justified. These are the biggest, most successful corporations on the planet.

But how much of that success has been priced in already?

That’s the trillion-dollar question.

Does this mean large caps will underperform starting today? Probably not.

Does this mean small and mid cap stocks will automatically outperform going forward? There are no guarantees in the markets.

I don’t know what the future holds, so I own large cap stocks, mid cap stocks, and small cap stocks.

Diversification is my way of admitting I don’t know what is going to outperform when.

It’s also a strategy that gives you the best odds of holding the winners in your portfolio, one way or another.

We covered this question on this week’s Ask the Compound:

We also answered questions about luck vs. skill in investing, paying off your 6.5% mortgage early, dealing with people who won’t take good financial advice, when it makes sense to move to a new city as a young person and how to invest in the housing market.

Further Reading:

Debunking the Silly “Passive is a Bubble” Myth

1The best argument for this time really being different for small caps is companies staying private longer. Amazon around a $300 million market cap when it went public in the 1990s. Today they would remain private way longer, probably until they weren’t a small cap companie anymore.