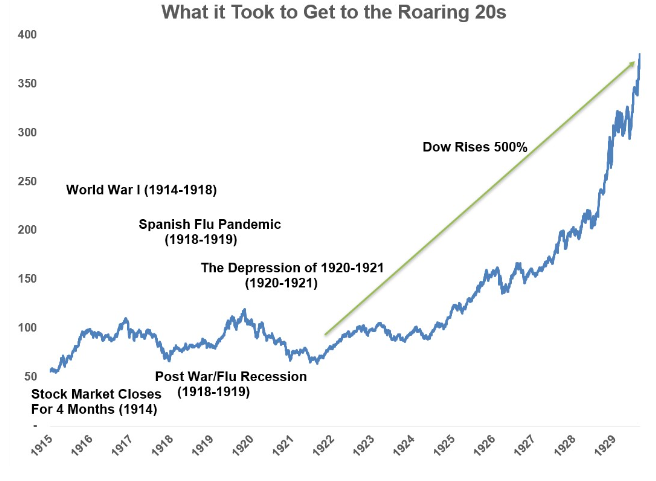

Animal Spirits: The Roaring Twenties

[ad_1]

Today’s Animal Spirits is brought to you by TBIL and the US Benchmark Series:

See here for more information on investing in TBIL and the US Benchmark Series

See here to register for The Compound Insider

On today’s show, we discuss:

Recommendations:

Charts:

Tweets:

US AIRLINE PASSENGER TRAVEL WILL SET RECORD IN MARCH AND APRIL, UP 6% OVER 2023 LEVELS — AIRLINE GROUP

— *Walter Bloomberg (@DeItaone) March 19, 2024

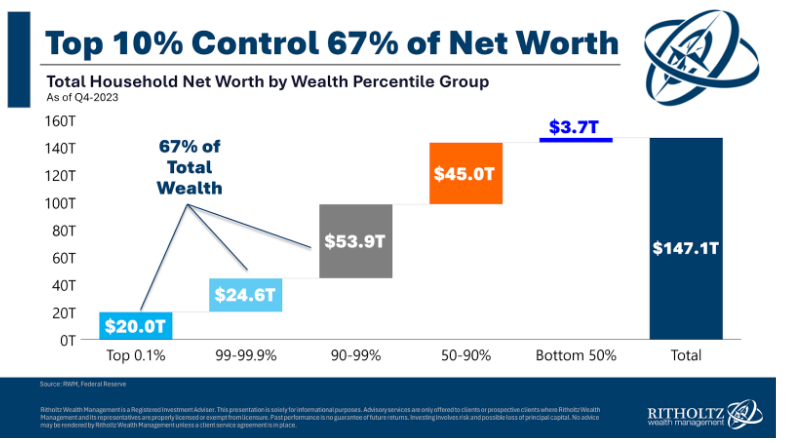

Net worth is at all-time highs

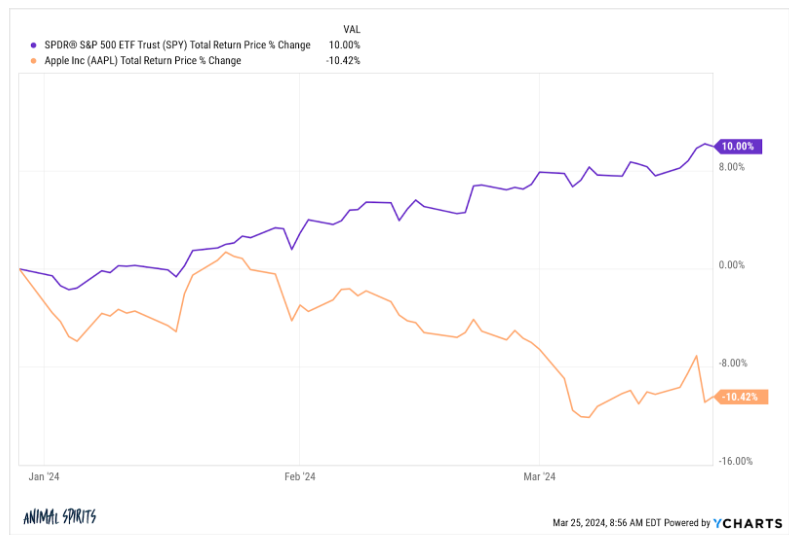

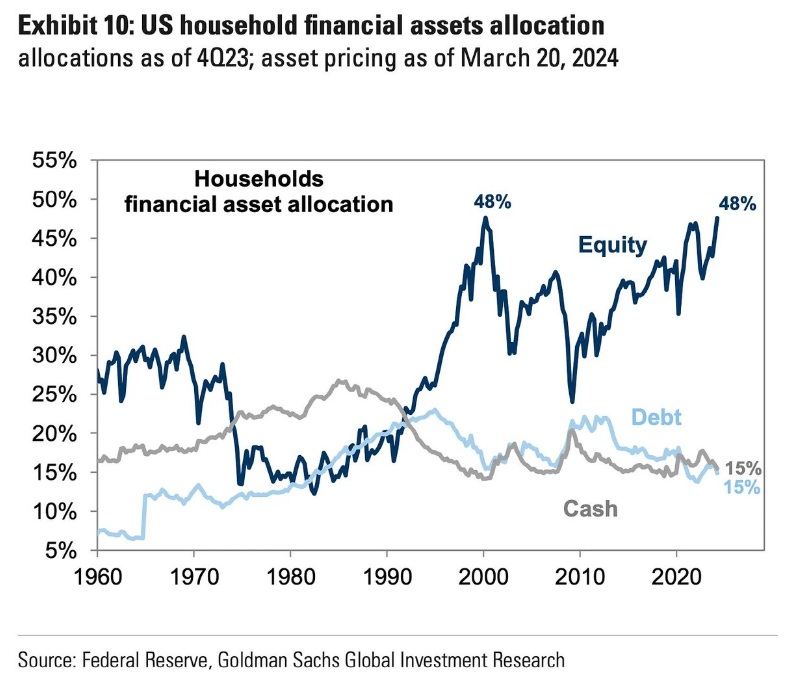

Stock prices are at all-time highs

Housing prices are at all-time highs

Economic activity is at all-time highs

Air travel is at all-time highs

You can earn 5% on your cashI know ppl don’t like good news but this is the roaring 20s (w/o the vibes)

— Ben Carlson (@awealthofcs) March 21, 2024

Yesterday saw a new high in new highs. As shown in the chart, yesterday our reading on stocks making new 52-week highs in the S&P 500 broke out above the prior high from late last year. pic.twitter.com/0t8XHRBUoC

— Bespoke (@bespokeinvest) March 22, 2024

52wk highs on SPX hit 23% yesterday, the highest in 3-years. Rarely do we see internal highs peak with prices, they usually lead $SPX. pic.twitter.com/gSv4BFyqCW

— RenMac: Renaissance Macro Research (@RenMacLLC) March 22, 2024

Even with inflation adjustment, Americans are just spending way more on food than we did pre-pandemic — either eating more, buying more expensive stuff, or relying more on restaurants & delivery. pic.twitter.com/ehOqnoIpXB

— Matthew Yglesias (@mattyglesias) March 21, 2024

honestly wild pic.twitter.com/2ueqPdbItJ

— Derek Thompson (@DKThomp) March 19, 2024

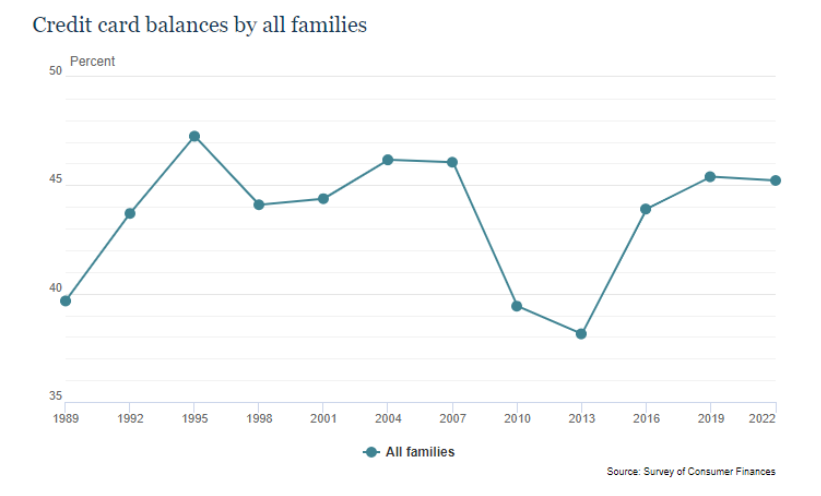

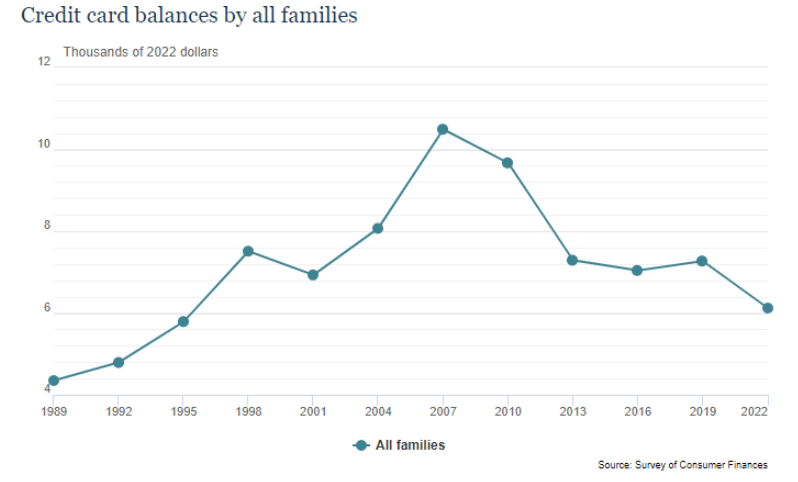

Want to know what the median credit card debt is among U.S. households?

$0.

While some struggle with credit card debt, this isn’t the case for the majority of Americans, even if the headlines suggest otherwise.

— Nick Maggiulli (@dollarsanddata) March 21, 2024

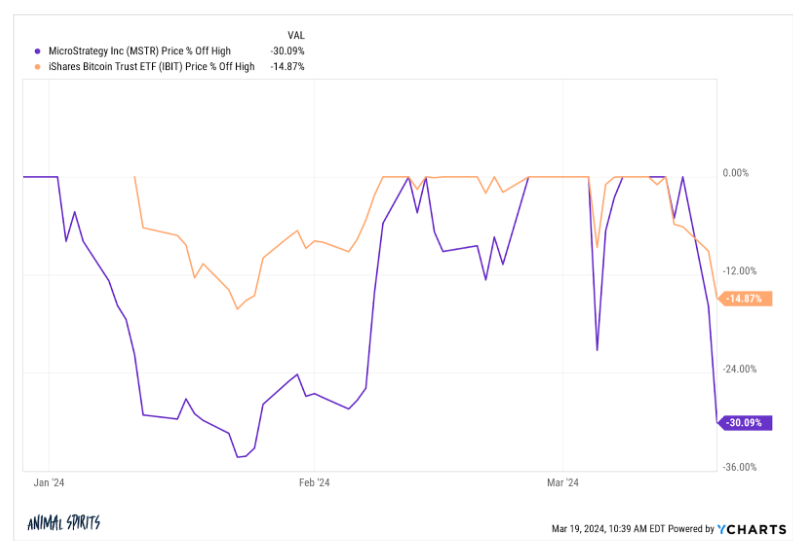

$IBIT and $FBTC have now taken in cash for 49 straight days, something only 30 other ETFs have ever done (and none of them did it right out of gate). Among active streaks they 4th after $COWZ $CALF (which are over 100 days, damn) and $SDVY. Great chart from @thetrinianalyst pic.twitter.com/CUxFNFa7tN

— Eric Balchunas (@EricBalchunas) March 22, 2024

Monday housing data!

Available inventory of homes on the market is growing and will continue to grow until we’re finally in an environment of falling interest rates. The market could peak at 40% inventory growth over last year.

There are 9 million fewer people locked-in to 3%…

— Mike Simonsen 🐉 (@mikesimonsen) March 11, 2024

Here is a more detailed take on why I think Zillow loses:

~50% of Zillow’s revenue comes from selling leads to buyer agents.

Zillow is a public company. You can verify this. Their buyer lead program is called “Premier Agent”

Zillow has been trying to capture listing leads to… https://t.co/8RhTnZWEtA

— Nick El-Tawil (@tawillionaire) March 18, 2024

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

[ad_2]