Animal Spirits: Now Show Japan

[ad_1]

Today’s Animal Spirits is brought to you by Franklin Templeton and Fabric by Gerber Life

See here for more information on Franklin Templeton’s new Bitcoin ETF

See here for more information on Life Insurance with Fabric by Gerber Life

On today’s show, we discuss:

Listen here:

Recommendations:

Charts:

Tweets:

Yesterday was the first 2%+ one-day gain for the S&P 500 since 1/6/23, ending a streak of 281 trading days without one. Didn’t realize how long it had been! pic.twitter.com/dZYp4flifB

— Bespoke (@bespokeinvest) February 23, 2024

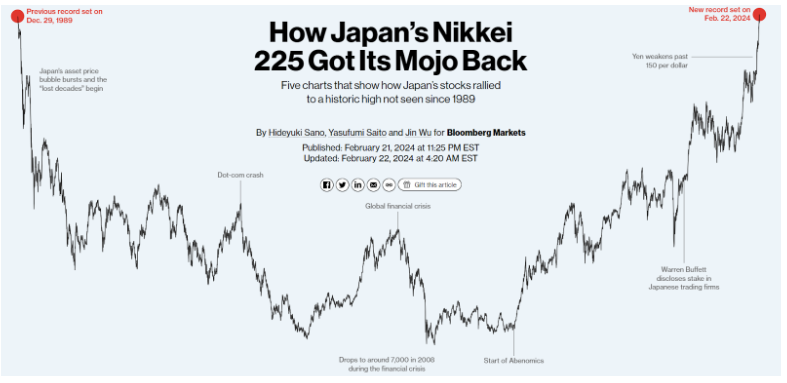

It’s not just the U.S., major indexes around the globe are soaring to new highs. Markets hitting records in February:

Japan’s Nikkei

Germany’s DAX

Stoxx Europe 600

France CAC 40

Argentina Merval

Taiwan Taiex— Gunjan Banerji (@GunjanJS) February 26, 2024

1/3 – Brief ETF trading volume thread

There are ETFs that “T” a LOT and those that don’t.

Here’s a look at the Top 20 U.S.-listed ETFs ranked by average daily ’23 AUM showing total value traded in ’23, turnover (avg. daily AUM/total value traded), and avg. “holding” period. pic.twitter.com/o0iiAUyR4L

— Ben Johnson, CFA (@MstarBenJohnson) January 8, 2024

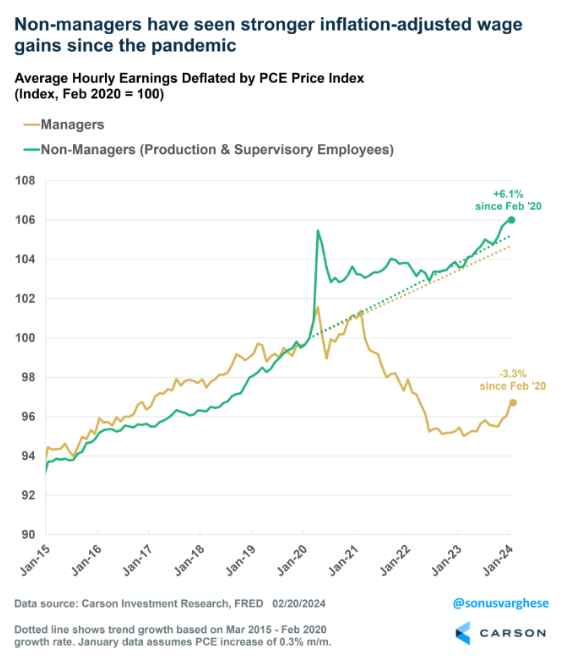

Maybe one reason ppl are confused about this economic moment is nobody’s ever seen a labor economy like this in their adult lifetime:

– Women’s wages > men

– Black wages > white

– Young wages > old

– Low-income > high-incomehttps://t.co/MTRqRFmrjb pic.twitter.com/MglFYGCrn5— Derek Thompson (@DKThomp) February 23, 2024

The 10 bitcoin ETFs netted +$2.3b last week. For context, that is more than any other ETF (out of 3,400) took in. $IBIT alone was #2. This brings total net to +$5b, which is more than BlackRock as a whole has taken in. Again, this is all net GBTC bleed. Throw that out and the… https://t.co/PlxnfQ7ETf pic.twitter.com/04LTixd3Zt

— Eric Balchunas (@EricBalchunas) February 17, 2024

It’s official..the New Nine Bitcoin ETFs have broken all time volume record today with $2.4b, just barely beating Day One but about double their recent daily average. $IBIT went wild accounting for $1.3b of it, breaking its record by about 30%. pic.twitter.com/MiCs1rzttM

— Eric Balchunas (@EricBalchunas) February 26, 2024

Cointucky derby update. It’s gonna be a solid flow day for the #Bitcoin ETFs once we get data for the remaining ETFs. Don’t yet have flows $IBIT, $BTCO, or $BRRR.

Even without those — the ETFs purchased at least ~$403 million worth of Bitcoin today. Will update more tomorrow pic.twitter.com/EPy7zVvSXZ

— James Seyffart (@JSeyff) February 27, 2024

Pretty wild coincidence. Bitcoin and Ethereum are up by the exact amount since the October bottom. pic.twitter.com/J9eQF7lmO7

— David Ingles (@DavidInglesTV) February 27, 2024

Inventory

📍There are now 498,000 single family homes on the market in the US.

📍That’s almost 1% more than last week, and now 16% more than last year at this time.

📍This is the first inventory increase of the year.

📍Mortgage rates are up sharply from last year so inventory is… pic.twitter.com/m0X39Qb7O6— Mike Simonsen 🐉 (@mikesimonsen) February 26, 2024

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

[ad_2]