Agency networks – The new reality in insurance distribution | Insurance Blog

[ad_1]

Competitive pressure, increased capital availability (even with current rates), and the evolving business landscape (thanks in part to the pandemic) have created an opportunity for independent insurance agents (IAs) to get creative to grow and remain independent in the insurance industry.

As such, many IAs have sought out agency networks that provide benefits historically harder to come by as a standalone business / agency. For carriers, understanding the role of agency networks and why they are important will be critical for the effective use of this distribution structure. Knowing why agencies join and switch networks can also help carriers make strategic choices for the future.

We will now explore these topics along with the benefits of agency network participation and how carriers should respond to this growing distribution trend.

To kick things off, let’s discuss the competitive pressure and increased capital availability that is increasingly causing agencies to seek out networks.

The “death” of the agent has been greatly exaggerated

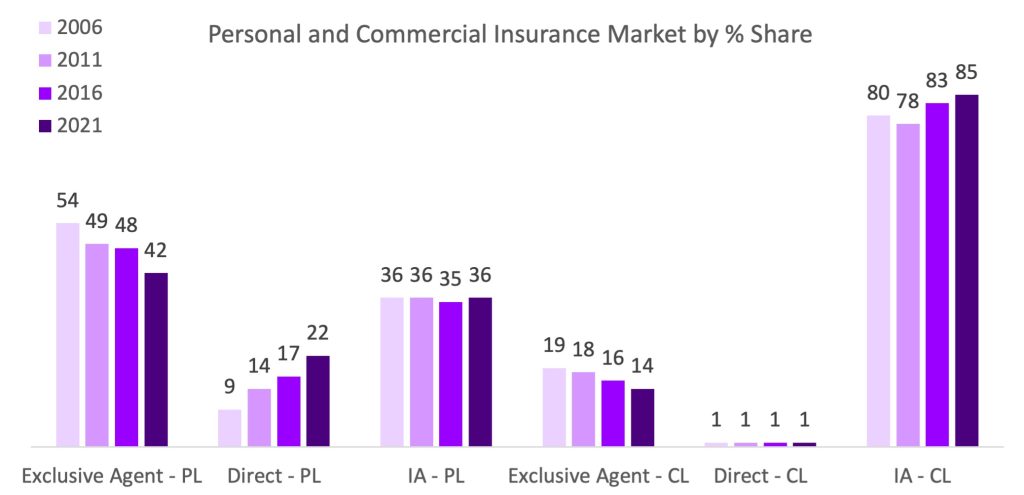

For two decades, the industry has focused on the impact of direct and alternative distribution, such as insurance embedded into the purchase process of a vehicle and other point-of-sale offers. Our research shows that IAs remain the dominant channel, especially in commercial lines.

Source: Independent Insurance Agents & Brokers of America

It is our perspective that IAs will continue to grow their market share and expand their relevancy as exposures increase in complexity and commercial working arrangements continue to evolve. In short, the “death” of the agent has been greatly exaggerated.

Evolving landscapes and operational demands add pressure

While IAs remain dominant, several forces continue to impact this channel, including:

- Private equity investment: Agency consolidation is rapidly increasing driven by private equity investment, and despite the interest rate hike slowing some of the M&A market, the deal pipeline remains rich and capital remains available for target agencies

- Change in work environment: The virtual or hybrid work environment requires greater capabilities than ever before for agencies to operate, retain good talent, etc., which is both a skill and capability gap for many agency owners

- Continued competition for talent: Despite the growth of alternative staffing models (e.g., temporary or gig workers, virtual workforces), IAs are challenged to secure and retain the talent they need to run their business; further, the average age of producers and account management staff exceeds 50, indicating younger talent is not joining the insurance workforce at a sufficient rate for the coming waves of retirement

- Prospecting has “gone digital”: The necessity for IAs to be “open for business” on all channels a prospect or customer chooses makes the need for an online presence critical. As such, the necessity for digital marketing capabilities have increased substantially, leaving IAs seeking guidance on how to execute the best digital strategy

When combined, these factors have changed the playing field and shifted engagement models across the industry. The performance gap between small- to mid-sized independent agencies and larger agency/brokerage roll-ups has widened with larger players using their capital to buy enhanced capabilities required to outperform the competition.

Agency networks level the playing field for IAs

Simply put, networks help bridge the gap created by these factors for agents that want to be competitive while remaining independent. Many networks offer different capabilities (e.g., marketing, training, technology) and provide access to increased compensation (through pooling premiums to overcome entry gates for increased base and variable compensation) in exchange for a fee. This structure allows small and mid-sized IAs to compete on a more level playing field with larger standalone agencies and agency roll-ups. Furthermore, network structures have offered a compelling alternative for EA’s to get the best of both worlds – they are able to get choice of carriers while also receiving the business and operational support they need from their network. This has provided an alternative for historical EA talent increasing the pool of viable IAs reinforcing the value networks are adding.

These advantages mean networks are only growing in popularity. There are nearly 40,000 independent agencies in the United States as of 2022, an increase of 4,000 from 2020. It is not surprising to us, given 2/3 of agencies have <$500k in revenue and could reap benefits from joining up with other agencies, that a super majority of agencies are in an agency network. Our survey of 500 IAs across the U.S. shows that over 70% of agencies participate in one of the approximately 150 networks.

And what is the cost for carriers?

That’s one of the burning questions. What does this rapid expansion of networks and their growing power in the marketplace mean for the industry? What about the resulting impact on total cost of distribution?

While the rise of agency networks is largely positive for IAs, there is a high cost for carriers. To engage with networks and balance the benefits vs. costs, carriers will need a deeper understanding of key IA challenges and why they are joining networks.

What’s driving agencies to join networks?

A common misconception is that independent agents (IAs) join networks only to increase revenue. The truth is that these networks offer additional benefits beyond revenue and can be valuable to carriers too.

The drive for agencies to join networks is multi-layered. Knowing why agencies join networks can help carriers make strategic choices for the future. For a deeper understanding of the key motivations, we must consider the challenges and goals of agencies.

Today’s key challenges and goals for insurance agencies

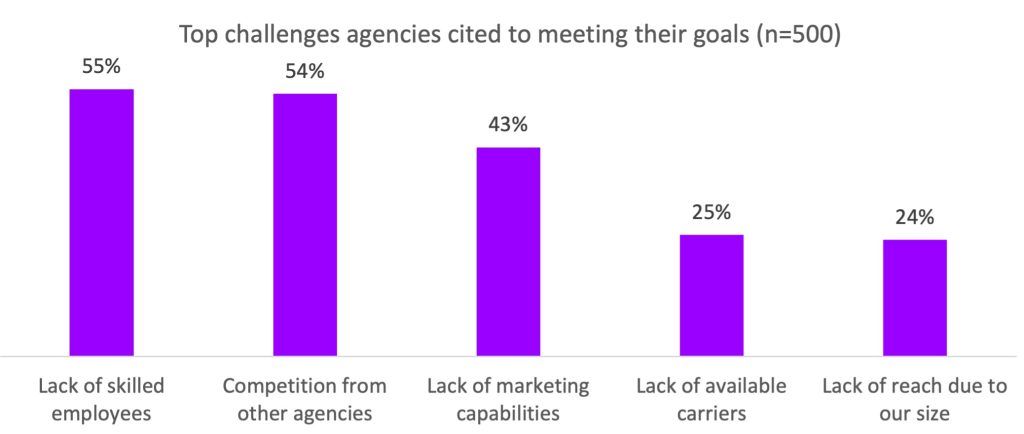

Evergreen challenges of standalone IAs are becoming exacerbated by operational demands described earlier in this post. We see this across four dimensions:

- Skill: The skillsets needed to manage the business come at the expense of skillsets needed to grow the business. Further, agencies have had difficulty keeping up with tech skills required to acquire and serve customers digitally

- Scale: Smaller size makes it difficult for agencies to attract and retain talent and achieve leverage with carriers

- Scope: While a key value proposition for agencies is their breadth of product, many smaller agencies lack capacity to understand a large variety of products and brands; further their smaller employee base means they can’t have specialized roles and must deploy generalist model

- Capital: Investing in capabilities and tools that will enable differentiated skill, scale, or scope requires capital that is out of reach for many IAs

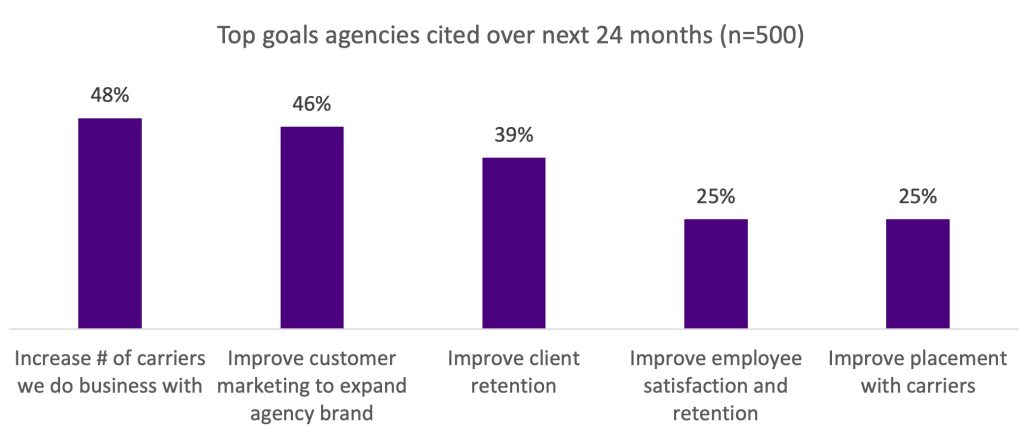

So, we were not surprised when we asked agencies about their goals and challenges that the lack of skilled employees (skill), competition from other agencies (scale, scope, and capital), and lack of marketing capabilities (skill, capital) were the top three challenges preventing agencies from achieving their main goals of growth and increased retention.

Agency networks have moved in as a valuable option to address these challenges and goals.

Top three reasons independent insurance agencies join agency networks

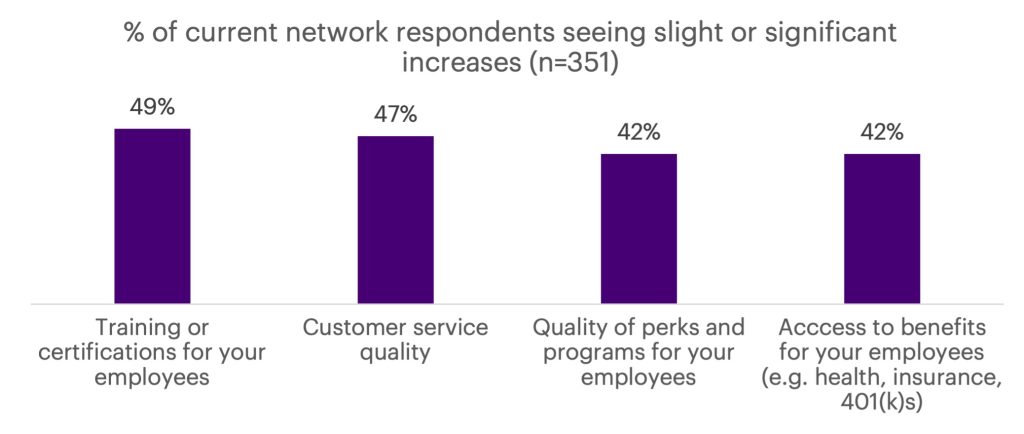

Our research found that networks delivered on three primary objectives: Talent, Marketing sophistication, and Carrier access and breadth.

1. Build talent:

IAs often lack the scale and resources for effective recruiting, training, and employee development. More than 55% of our respondents say finding employees with the right skillsets is a primary challenge. Agencies also face additional challenges in providing competitive compensation and benefits, training, and staff development.

Network members from our survey saw improvements to their talent concerns in both the experiences they were able to deliver to their customers (e.g., service quality due to upskilling or access to customer service capabilities) as well as benefits that allowed for further upskilling and retaining of employees.

2. Access additional marketing capabilities:

With today’s “always on, always open” culture, an online presence is necessary. The digitally driven marketplace has increased marketing complexity for IAs. As with the other themes, agents who belong to associations say they have benefited from joining, but opportunity for improvement remains. Approximately 50% of survey respondents say building additional marketing capabilities is both a near-term priority and a challenge for their agencies in driving additional growth.

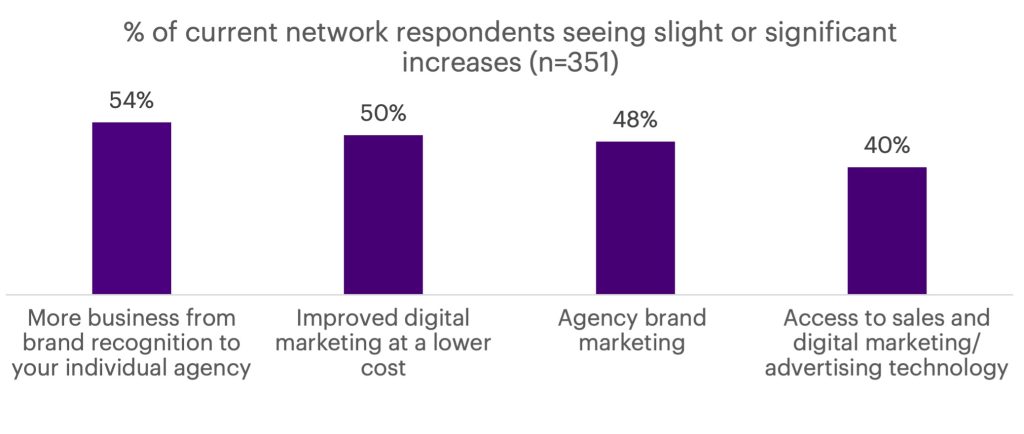

An increase in IA brand awareness was highlighted by independent agents that were part of networks due to the connection with their national network brand. Additionally, IAs within networks were able to access more cost-effective digital marketing and better technology for marketing.

3. Increase carrier access and breadth:

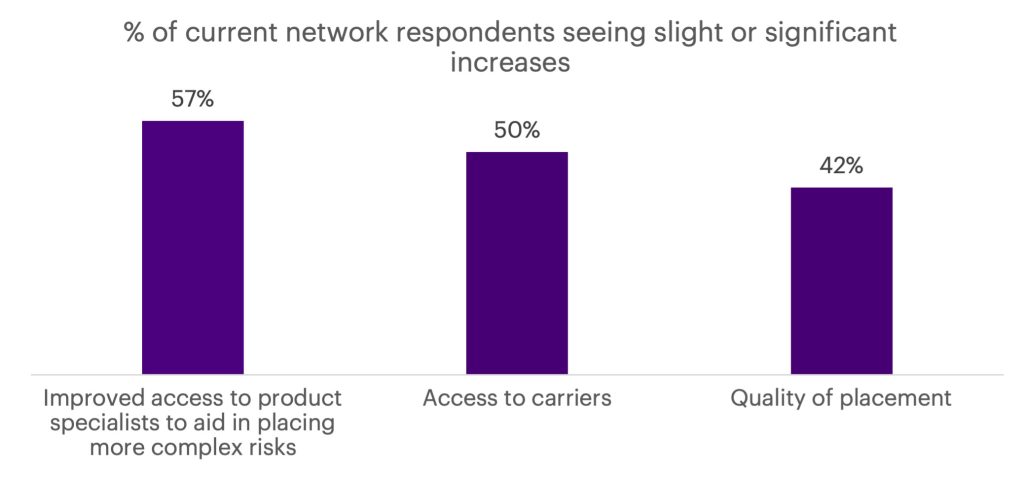

We found that 48% of IAs want to increase the number of carriers they do business with. Another 25% of IAs highlight the lack of available carriers, and 23% say the lack of competitive products remain barriers to meeting their goals. Given the importance to the IA channel’s value proposition of the ability to place business with multiple carriers across a spectrum of product offerings and price points, this presents significant opportunities for networks and carriers alike.

In fact, 91% of our respondents agree agency networks allow for smaller agencies to have better placement or servicing options. Agencies say they are able to gain access to more carriers via their networks and that they have access to specialists for complex risks.

Considering these findings, today’s participation rate of IAs in networks is not surprising. In response to the participation rate, carriers must determine the best ways to engage and leverage networks to meet their own goals.

4 ways carriers can unlock benefits through agency networks

While networks have been largely positive for IAs, they have caused an increase in the total cost of distribution for carriers who are paying more, in some cases, for business they already had on the books. To defend profitability, carriers must look at ways to maximize their own benefits from agency networks.

Let’s look at four ways to do this:

1. Create compensation plans that benefit both partners

To maximize the scale of networks and avoid overpaying for performance not aligned to the carrier’s goals, carriers can create simple and clear base & variable compensation programs for agencies that drive desired agency behavior. For example:

- Connect increases in network access fees (overrides) to increases in mutually beneficial outcomes for a pay-for-performance approach.

- Require the network to provide the producing agencies within the network with a portion of the access fee—not just the variable compensation or profit share commission.

2. Address the skill and technology gaps

Agencies need support to develop skills and technology that are critical for their business. While networks fill some of the gaps, carriers should consider creating partnerships in which agencies can use technology and non-carrier specific systems to improve efficiency. For example:

- Digital marketing training for employees

- Self-service client capabilities that reduce operational workload

- Use of generative AI to quickly and accurately respond to an agency’s request the first time

3. Complement, don’t replicate

There are hundreds of agency networks vying to provide capabilities and benefits to the 40,000+ IA market. Carriers should consider the capabilities provided to agents by the network and where the carrier can fill the gap. This requires understanding the networks that are most influential in the carrier’s distribution strategy and what they provide to their agencies. Carriers can then take a deeper look at where they can step in to complement their capabilities.

4. Pick winners and partner

Because networks can be used as a meaningful path for growth in the context of a broader distribution strategy, carriers should identify the set of networks that can support their business objectives. Furthermore, developing an engagement model suited to that network partner and aligning on how they will jointly provide for agency needs will be crucial steps for success.

Agency networks are a force within insurance distribution that is big and getting bigger. These networks provide tangible benefits to agencies that help them meet their goals and address challenges. Carriers are already partnering with these networks today, and by acknowledging how carriers can complement and incent networks, carriers can use agency networks as a meaningful lever to achieve their objectives, in service of their broader Total Enterprise Re-invention.