A Big Week for Big Tech

[ad_1]

In the realm of technology, there exists no phenomenon as transformative and intriguing as the rapid advancement of Artificial Intelligence. Over the past few years, the field of AI has experienced an unprecedented explosion, captivating industries, governments, and societies worldwide. From self-driving cars to personalized recommendation systems, AI’s impact permeates nearly every facet of modern life. But what exactly has fueled this remarkable surge in AI development, and what does it signify for our future?

The recent explosion in artificial intelligence can be attributed to a confluence of factors, including exponential increases in computational power, the availability of vast amounts of data, and …alright computer, I’ll take it from here.

I asked Chat GPT to write an introduction and the first paragraph of an article describing the recent explosion in AI. While those words don’t sound like they came from my brain, the software did exactly what I asked it to do—and it did it in about three seconds—for zero dollars. The hype is real. AI is going to change all of our lives the same way the internet did.

Sitting at the center of this technological revolution is Jensen Huang, the co-founder and CEO of Nvidia. This week, he presented to an arena filled with 11,000 people, saying:

In 2023, generative AI emerged, and a new industry beings. Why? Why is it a new industry? Because the software never existed before. We are now producing software, using computers to write software, producing software that never existed before. It is a brand new category. It took share from nothing. It’s a brand new category.

Computers can now write articles and create images that would have taken us, humans, exponentially longer to produce. Using Midjourney, I typed in “Planet of the Apes on the floor of the New York Stock Exchange (I just watched the movies, which were excellent, so I had them on the brain).

While these images are amazing, most people will never have a reason to use MidJourney. Most people aren’t playing around with ChatGPT. But just because you might not be actively using some of these tools, that doesn’t mean you’re not getting the benefits of AI.

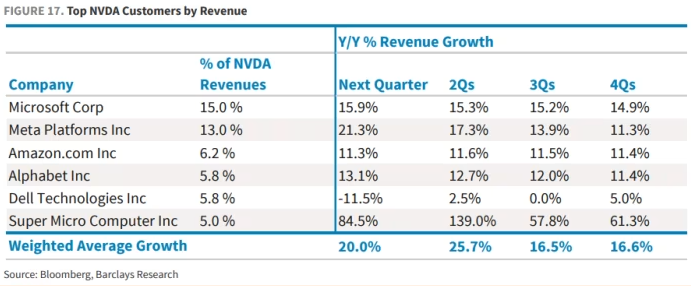

15% of Nvidia’s revenue comes from Microsoft, and another 13% comes from Meta. If you’re a big tech customer —and who isn’t at this point—you’ve experienced the magic of AI.

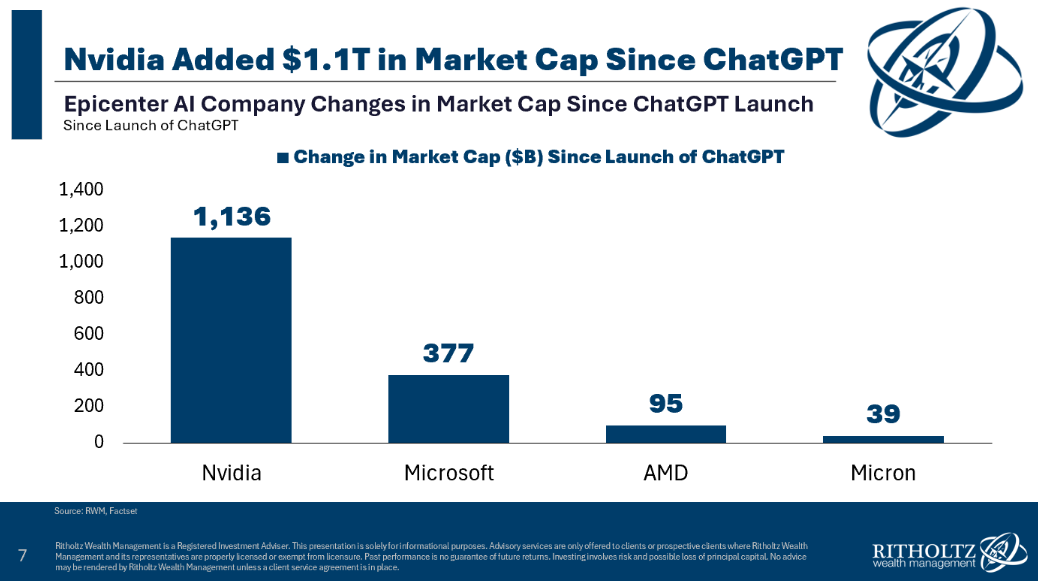

It’s not a stretch to say that the enthusiasm for this brand new category saved the stock market. Things were looking pretty dicey for large tech and the market in general prior to the release of ChatGPT in November 2022. Nvidia had fallen 66% peak-to-trough. Netflix and Meta were both 75% off their highs. Amazon was cut in half. Google saw its market cap decline from $2 trillion to $1.08 trillion. It was a bloodbath.

Here are the returns from the time ChatGPT entered our lives through today: (they’re indexed to 100 since the launch, so Nvidia is up 96%, Meta is up 55%, and so on)

And here are the market cap gains over the same time for the companies at the epicenter of this movement:

The coming wave of artificial intelligence is unstoppable. While most people are only aware of it through its impact on the stock market, it won’t be long before it’s impacting your daily life. Even if you’re not an early adopter, this technology will adopt you as it gets embedded into all of our favorite companies and products. Buckle in. The future is now.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.