[ad_1]

The primary time I heard about Robotic Course of Automation (RPA), I used to be at a convention, wedged between a person who appeared just a little too smitten by Excel spreadsheets and a lady who had an uncanny skill to concurrently sip her espresso and discuss in regards to the inventory market. When the keynote speaker talked about RPA, the room fell silent, and I might nearly hear the collective “Huh?”

Now, don’t get me fallacious. I’ve handled my fair proportion of monetary jargon. However RPA? It sounded just like the title of a band my teenage nephew could be into, not a revolutionary device within the finance business. Little did I do know, it was about to change into my new greatest good friend.

So, what is that this RPA factor, you ask? Think about when you had a private assistant who was tremendous quick, by no means acquired drained or took breaks, and will juggle a number of duties with out breaking a sweat. Appears like a dream, proper? Nicely, that’s primarily what RPA is – your very personal digital assistant.

However as a substitute of fetching espresso or sorting mail, this assistant takes over repetitive, rule-based duties like invoicing or processing transactions. It’s like having a superhero sidekick on your finance division, solely with out the flashy costume and fancy catchphrases. And one of the best half? It doesn’t even demand a pay increase or workplace house!

In all seriousness, RPA is remodeling the best way we deal with funds, making processes quicker, extra correct, and environment friendly. It’s like we’ve been making an attempt to open a can with a spoon all this time, and somebody simply handed us a can opener. Recreation. Changer.

So buckle up, people! We’re about to dive into the thrilling world of RPA, and belief me, it’s going to be an exciting trip!

Key Takeaways

- Robotic Course of Automation (RPA) in finance refers to using software program bots to automate repetitive, rule-based duties resembling information entry, bill processing, monetary reporting, and reconciliation. It helps improve effectivity, cut back errors, and release employees for extra strategic duties.

Why Ought to You Care About RPA?

Now you is likely to be pondering, “Positive, RPA sounds cool, however why ought to I care? I’m not operating a tech big or a multinational company.” Nicely, let me let you know about Joe.

Joe runs a small accounting agency. His crew used to spend hours every day manually coming into information into spreadsheets and cross-checking numbers. They had been so swamped with mundane duties that they barely had time for strategic planning or shopper conferences. Then Joe determined to offer RPA a whirl.

Quick ahead six months, Joe’s crew is now free of the repetitive information entry duties. An RPA bot does all of it – shortly, precisely, and tirelessly. Their productiveness has shot by way of the roof. They’ve extra time for purchasers, technique improvement, and even for these little workplace celebrations on Fridays (Sure, those with donuts!). By embracing RPA, Joe turned his small agency into an environment friendly, thriving enterprise.

However what are these advantages in layman’s phrases? Image RPA as a super-efficient manufacturing unit manufacturing line, solely as a substitute of assembling vehicles or devices, it’s processing monetary information. It takes the uncooked supplies (information), follows a set course of (guidelines), and churns out the completed product (experiences, invoices, and many others.), all when you sit again and sip your espresso. It’s like having a private chef making ready your meals when you calm down and luxuriate in your favourite TV present.

The thrilling a part of implementing RPA? Nicely, it’s like discovering an additional hour in your day, or uncovering a secret productiveness hack. It’s about doing extra with much less, with out burning out your crew or blowing up your finances. It’s the fun of seeing your enterprise run like a well-oiled machine, leaving you with extra time to concentrate on development and innovation.

So sure, RPA is price caring about. As a result of who wouldn’t need a superhero sidekick, a private chef, and an additional hour of their day? Embrace the RPA revolution. It’s not only for the tech giants, it’s for each enterprise that goals huge!

Advantages Of RPA In Finance

Simply image RPA as a pleasant robotic assistant, all the time able to lend a serving to hand. Now, let’s dive into the good things:

- The Time-Saver: Consider RPA as your private time-turner. It takes over these repetitive duties, releasing up your valuable time. You’ll be able to lastly make amends for that e book you’ve been that means to learn or possibly even sneak in an additional espresso break!

- The Error Exterminator: Ever make a mistake in your calculations and spend hours discovering it? Yeah, we’ve all been there. However with RPA, it’s like having a trusty sidekick who’s acquired your again, decreasing these pesky errors to nearly zero.

- The Price-Cutter: Think about a magical pair of scissors that snips away at pointless operational prices. That’s RPA for you! It’s like having a thrifty aunt who is aware of simply the place to seek out value financial savings.

- The Compliance Champion: Maintaining with altering rules can really feel like chasing a mischievous gremlin, can’t it? Nicely, RPA is like your individual private superhero, making certain you’re all the time on the precise aspect of the regulation.

- The 24/7 Employee Bee: Image a diligent employee bee that by no means sleeps. That’s RPA! It’s there for you around the clock, tirelessly getting the job accomplished. Speak about dedication!

- The Productiveness Powerhouse: Bear in mind when Popeye would eat his spinach and abruptly get super-strong? Nicely, RPA is like your organization’s spinach, boosting productiveness to new heights!

- The Scalability Famous person: Have to ramp up operations shortly? No drawback! With RPA, it’s like having a magic bean that grows precisely as huge as you want it to, precisely once you want it.

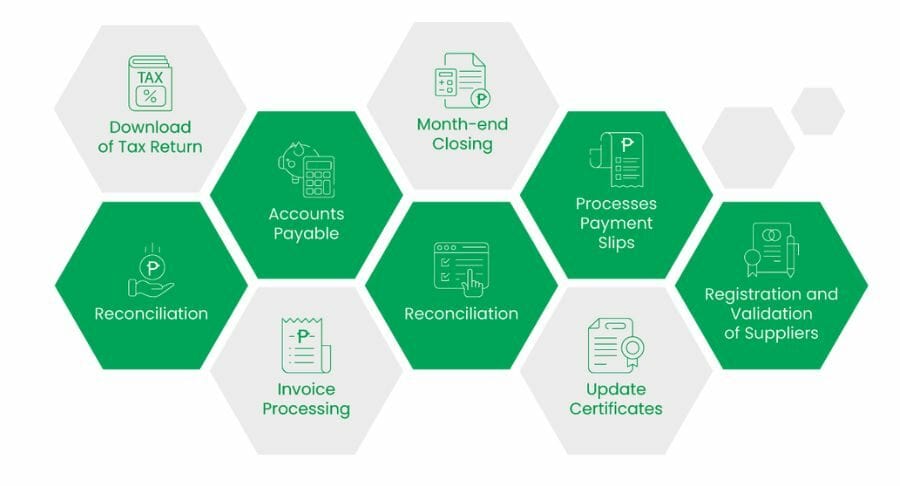

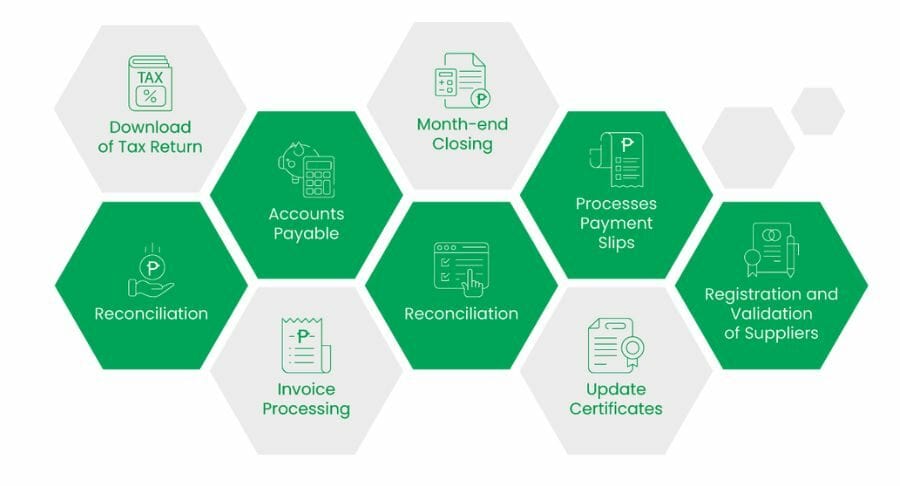

Finance Robotic Course of Automation Use Circumstances

Alright, my finance-savvy pals, let’s dive into some real-world examples of how RPA is getting used to automate finance duties. Image these as phases in a rock live performance – each bringing its personal distinctive rhythm and vibe to the present!

- Opening Act: Bill Processing: Think about a bot working tirelessly, processing all these invoices that used to eat hours of your time. It’s like having a private assistant who by no means wants a espresso break!

- Second Act: Monetary Reporting: Bear in mind these lengthy nights making an attempt to compile monetary experiences? Nicely, with RPA, you possibly can say goodbye to them! It’s like having a super-fast typist who doesn’t make typos – fairly cool, proper?

- Intermission: Reconciliation: Ah, the dreaded reconciliation course of. However wait, right here comes our RPA celebrity, reconciling accounts prefer it’s a stroll within the park. It’s as when you have a detective who immediately spots discrepancies. Sherlock Holmes, eat your coronary heart out!

- Headliner: Payroll Processing: That is the place RPA actually shines. It handles payroll like a professional, making certain everybody will get paid on time and precisely. Consider it as a strict however honest payroll supervisor who by no means misses a beat.

- Encore: Compliance Checks: And for the grand finale, we now have compliance checks. With RPA, you’ve acquired a dependable guard canine, continuously sniffing out any potential compliance points. It’s like having a superhero combating off regulatory villains!

Getting Began with RPA Finance

So, you’re able to welcome RPA into your enterprise. That’s improbable! However the place do you begin? Nicely, it’s similar to planning a highway journey. Earlier than you hit the gasoline, you want a map, some snacks, and naturally, the proper highway journey playlist.

Firstly, take into consideration what duties you wish to automate. Search for these repetitive, rule-based duties which can be essential however not precisely thrilling. , those that make you’re feeling such as you’re caught in a unending sport of whack-a-mole. This might be something from information entry and bill processing to accounting processes and compliance checks.

Subsequent, think about your finance features capability and abilities. Similar to you wouldn’t ask your grandma to DJ your highway journey (except she’s actually into techno), you must guarantee your crew has the precise abilities to handle RPA, or that you’ve the sources to supply the mandatory coaching.

Now comes the enjoyable half – selecting your RPA instruments and suppliers. It’s like selecting the correct automotive on your highway journey. You need one thing dependable, environment friendly, and simple to deal with. Right here’s a step-by-step information:

- Analysis: Similar to you’d learn automotive opinions, begin by researching completely different robotic course of automation instruments, also called software program robots. Take a look at their options, ease of use, scalability, and buyer satisfaction.

- Seek the advice of consultants: Speak to business consultants or rent a guide. They’re like your trusty mechanic, guiding you on what is going to work greatest on your particular wants.

- Attempt before you purchase: Most suppliers provide free trials as a part of buyer onboarding. Use them. It’s like taking a check drive earlier than shopping for the automotive. Be sure the device suits your wants and is simple on your crew to make use of.

- Take into account assist and coaching: Verify what sort of assist and coaching the supplier presents. It’s like having roadside help – you hope you by no means want it, however it’s good to have simply in case.

- Make the choice: When you’ve gathered all the knowledge, make your choice. Bear in mind, there’s no one-size-fits-all resolution. Select what’s greatest for your enterprise.

Implementing RPA in Finance: A Step-by-Step Information

Alright, pals! Now that we’ve packed our luggage and picked our trip, it’s time to hit the highway with RPA. Buckle up, as a result of we’re about to embark on a journey to automate your monetary operations. And don’t fear, I’ll be proper there with you, declaring the sights and ensuring we don’t miss any turns.

Step 1: Determine Your Wants

Our first cease is determining what you want from monetary course of automation. Consider it as packing on your journey. You wouldn’t fill your suitcase with ski gear when you’re heading to the seashore, proper? Equally, take a look at your enterprise processes and establish which of them are repetitive, rule-based, and time-consuming. Perhaps it’s constructing monetary statements, or maybe it’s information entry. No matter it’s, listing them down.

Actual-Life Instance: Take the case of XYZ Financial institution. They discovered that their employees was spending an excessive amount of time manually coming into mortgage software particulars. By figuring out this as a course of ripe for automation, they took their first step in the direction of RPA.

Step 2: Select Your RPA Software

Now that you’ve your listing, it’s time to decide on your RPA device. Bear in mind our automotive analogy from earlier? That is the place it comes into play. Do your analysis, seek the advice of consultants, take check drives, and select the device that most closely fits your wants.

Case Research: ABC Insurance coverage determined to go together with an RPA device that provided flexibility, scalability, and sturdy buyer assist. By selecting a device that matched their wants, they set themselves up for fulfillment.

Step 3: Map Out Your Course of

Subsequent, we have to map out the method you wish to automate. It’s like setting your GPS earlier than you begin driving. You want to know the place you’re going, proper?

Actual-Life Instance: DEF Logistics automated their bill processing. They mapped out every step of the method, from receiving an bill to coming into information and eventually, issuing fee. This gave them a transparent roadmap for automation.

Step 4: Take a look at Your RPA Software

Earlier than you go all in, check your RPA device. It’s like checking your automotive’s brakes earlier than a protracted drive. Be sure all the pieces works as anticipated.

Case Research: GHI Retail examined their RPA device by automating a small, low-risk course of. This allowed them to establish any points early and make essential changes with out disrupting their complete operation.

Step 5: Implement and Monitor

Lastly, it’s time to implement your RPA device and begin automating! However bear in mind, similar to you’d control the highway whereas driving, you must monitor your RPA device to make sure it’s working appropriately.

Actual-Life Instance: JKL Manufacturing carried out RPA of their provide chain and stock administration. They repeatedly monitored the system, making tweaks as wanted to make sure optimum efficiency.

And there you may have it! A step-by-step information to implementing RPA in your company finance operations. Bear in mind, it’s not a race. Take your time, benefit from the journey, and earlier than it, you’ll be cruising down the freeway of effectivity!

Potential Challenges and Overcome Them

Alright, my finance savvy pals, let’s get actual for a second. Similar to any highway journey, the finance robotic course of automation journey isn’t all the time easy crusing. You may hit a pothole, take a fallacious flip, and even run out of snacks (the horror!). However guess what? That’s utterly regular, and extra importantly, it’s okay.

Consider these hiccups as plot twists in your favourite film. They add a little bit of suspense, make the journey extra attention-grabbing, and once you overcome them (which you’ll), they make the victory even sweeter. So, let’s speak about some frequent RPA roadblocks and find out how to navigate round them.

Selecting the Unsuitable Course of

That is like setting your GPS to the fallacious location. You may find yourself at a dead-end or someplace you didn’t intend to be. To keep away from this, ensure you’re automating the precise processes – ones which can be rule-based, repetitive, and excessive quantity.

Overcoming It: When you’ve automated the fallacious course of, don’t panic. Take into account it a apply run. Assessment your processes once more, establish the precise one, and alter your course.

Lack of Abilities or Coaching

Implementing RPA with out the precise abilities is like making an attempt to drive a automotive with out figuring out find out how to change gears. It may well result in confusion and inefficiency.

Overcoming It: Put money into coaching on your crew or rent consultants. Bear in mind, it’s okay to ask for assist. In spite of everything, even one of the best drivers typically want a co-pilot.

Resistance to Change

Change may be scary. It’s like switching out of your comfortable outdated automotive to a shiny new one. It takes time to regulate.

Overcoming It: Communication is essential right here. Clarify the advantages of RPA to your crew, contain them within the course of, and tackle their considerations. Belief me, as soon as they expertise the magic of RPA, they’ll be as enthusiastic about it as you’re.

Bear in mind, setbacks aren’t roadblocks, they’re simply velocity bumps. They gradual you down a bit, however they don’t cease you. And once you do encounter them, don’t beat your self up. Take a deep breath, remind your self of why you began this journey, and maintain going.

Seeking to the Future: RPA and Past

Alright, my fellow finance aficionados, let’s take a second to gaze into our crystal ball. What will we see? That’s proper, it’s the way forward for RPA – and oh boy, is it shining vivid!

Simply think about, your enterprise operating like a well-oiled machine, with bots dealing with these mundane duties that used to make you yawn. Image your self sipping a cup of espresso, watching as your monetary experiences are generated in real-time, with out you lifting a finger. Appears like a dream, doesn’t it? Nicely, buckle up, as a result of with RPA, this dream is about to change into a actuality.

However wait, there’s extra! The way forward for RPA isn’t nearly automation. It’s about integration, collaboration, and innovation. We’re speaking about RPA working hand-in-hand with different applied sciences like synthetic intelligence (AI), machine studying, and information analytics. It’s like forming a brilliant band with the best musicians of all time. Every one brings their distinctive abilities to the desk, making a symphony of effectivity and productiveness that may depart you in awe.

Now, I do know what you’re pondering. “That sounds wonderful, however can I actually sustain with all these modifications?” And the reply is a powerful, “Sure!” Bear in mind, you’re not simply any enterprise proprietor. You’re a trailblazer, a pioneer, a rockstar! You’ve already taken step one by embracing RPA. And belief me, if you are able to do that, you possibly can actually trip this wave of technological revolution.

Fast Recap

Nicely, my finance trailblazers, we’ve come a good distance collectively on this RPA journey! Similar to any good highway journey, we’ve made some stops alongside the best way, found some thrilling sights, and sure, even navigated a couple of velocity bumps. However that’s all a part of the journey, isn’t it?

Let’s take a second to look in our rear-view mirror and recap what we’ve lined. We began off by figuring out our wants and selecting our RPA device, similar to packing for a visit and choosing our trip. Then, we mapped out our course of, examined our RPA device, and eventually carried out it – akin to setting our GPS, checking our brakes, and hitting the open highway.

We additionally mentioned potential challenges, like selecting the fallacious course of, lack of abilities, and resistance to vary. However bear in mind, these are simply plot twists that make our journey extra attention-grabbing and our victory sweeter. And similar to any good film, we ended with a glimpse into the longer term – a future the place RPA groups up with AI, machine studying, and information analytics to create a symphony of effectivity.

Now, as we attain the top, I would like you to recollect one factor: You’re not alone on this journey. We’re all on this collectively, navigating the twists and turns of the RPA highway. So, don’t be shy. Attain out, share your experiences, ask questions, and let’s study from one another. In spite of everything, that’s what group is all about.

So, are you prepared to begin your RPA journey? I can’t wait to listen to about your adventures. Bear in mind, each step you are taking is a step in the direction of a extra environment friendly, productive, and revolutionary future. So, buckle up, rev your engines, and let’s hit the RPA freeway collectively. Right here’s to the journey, my pals – could or not it’s as thrilling and rewarding because the vacation spot!

Regularly Requested Questions

What’s RPA in monetary evaluation?

RPA in monetary evaluation includes using automation to collect and analyze monetary information, generate experiences, forecast developments, and support in decision-making. It reduces handbook effort, accelerates evaluation, and gives extra correct and well timed insights.

What does RPA imply in banking?

In banking and different monetary establishments, RPA refers back to the software of automation to streamline banking processes like mortgage processing, customer support, compliance checks, and transaction processing. This leads to quicker service, improved accuracy, and enhanced buyer expertise.

What does RPA imply in accounting?

RPA in accounting means utilizing automation to deal with routine accounting duties resembling accounts payable and receivable, payroll, tax submitting, and audit procedures. It helps enhance accuracy, velocity up processes, and permit accountants to concentrate on strategic features.

What’s Fintech RPA?

Fintech RPA refers to using robotic course of automation in monetary expertise companies and different elements of the monetary providers sector. It’s used to automate duties resembling funds processing, fraud detection, buyer onboarding, and information administration, thereby enhancing operational effectivity and customer support.

What’s the strategic function of robotic course of automation in finance and accounting?

The strategic function of RPA in finance and accounting is to streamline operations, improve effectivity, cut back errors, and supply well timed monetary insights. It frees up finance and accounting professionals to concentrate on strategic decision-making and enterprise development.

What’s automation in monetary providers?

Automation within the monetary sector includes utilizing expertise to streamline and automate monetary processes and handbook duties. This contains customer support, danger administration, back-office operations, and compliance, amongst others.

Will robots take over finance?

Whereas robots and automation will definitely change finance departments by taking up repetitive duties, they gained’t utterly exchange people. They may as a substitute release finance professionals to concentrate on higher-value duties that require human judgment, creativity, and strategic pondering.

Have any questions? Are there different subjects you prefer to us to cowl? Go away a remark beneath and tell us! Additionally, bear in mind to subscribe to our Publication to obtain unique monetary information in your inbox. Thanks for studying, and joyful studying!

[ad_2]