[ad_1]

The Hong Kong-listed shares of electric vehicle (EV) maker XPeng (HK:9868) have plunged nearly 34% year-to-date amid ongoing macro challenges in China and the intense competition in the EV market. That said, the average price target of analysts indicates solid upside potential and a rebound in XPeng stock, reflecting optimism about the EV company’s long-term growth potential.

XPeng’s Recent Performance

Like many of its Chinese peers, XPeng reported a month-over-month decline in its January deliveries primarily due to seasonal factors. The EV maker’s January deliveries declined 59% from the previous month to 8,250 units. Nevertheless, XPeng’s January deliveries increased 58% year-over-year.

XPeng delivered 2,478 X9 MPV (Multi-Purpose Vehicle) units in January, with orders for X9 Max trim contributing about 70% of the overall X9 orders. Given the solid demand for the X9 model, deliveries for which began in early January, the company is ramping up its manufacturing capacity to ensure accelerated deliveries.

XPeng is also optimistic about the adoption of its ADAS (Advanced driver assistance systems) technology. As per the company, the monthly active penetration rate for its XNGP ADAS technology has surpassed 85%, and the feature is now available in 243 cities nationwide. XPeng intends to expand XNGP’s coverage to major urban road networks, private roads across the country, and parking lots by 2024.

While macro uncertainty in China and growing rivalry in the world’s largest EV market continue to weigh on XPeng, the company looks well-positioned to boost its long-term growth.

What is the Target Price of XPeng?

Last month, Bank of America analyst Ming Hsun Lee reiterated a Buy rating on XPeng stock following a conference call with the management. Lee highlighted that the company is targeting higher sales volume growth than the broader industry’s growth estimate for 2024, backed by new model launches, continuous sales network expansion, upgrades, penetration into tier 3/4 cities, and higher exports.

Likewise, DBS analyst Rachel Miu is bullish on XPeng and reiterated a Buy rating with a price target of HK$66, saying that the stock’s valuation is yet to reflect the company’s improving prospects. The analyst sees increased sales and better days ahead for the company due to the launch of its new mid-market segment brand this year and the strategic investment by Volkswagen (DE:VOW).

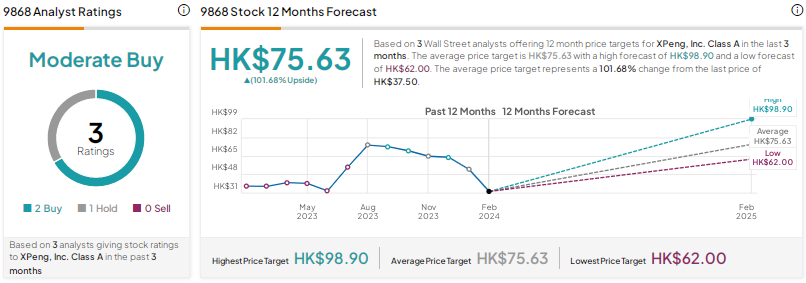

XPeng stock has a Moderate Buy consensus rating based on two Buys and one Hold. The average XPeng share price target of HK$75.63 implies nearly 102% upside potential.

Conclusion

Despite near-term headwinds, including macroeconomic uncertainty in China, some analysts remain optimistic about XPeng due to its long-term growth potential in the EV space and the prospects for its ADAS technology.

[ad_2]