[ad_1]

Finance people spend a lot of time worrying.

About the next recession. The next bear market. The next Black Swan event. The level of interest rates and inflation and valuations and the Fed and basically everything else.

This makes sense. The bad stuff hurts more than the good stuff feels good so risk management rules the day.

I’m a finance guy so I worry about plenty of these things too. But there are certain risks people worry about too much.

Here are two things a lot of other people are worried about but not me:

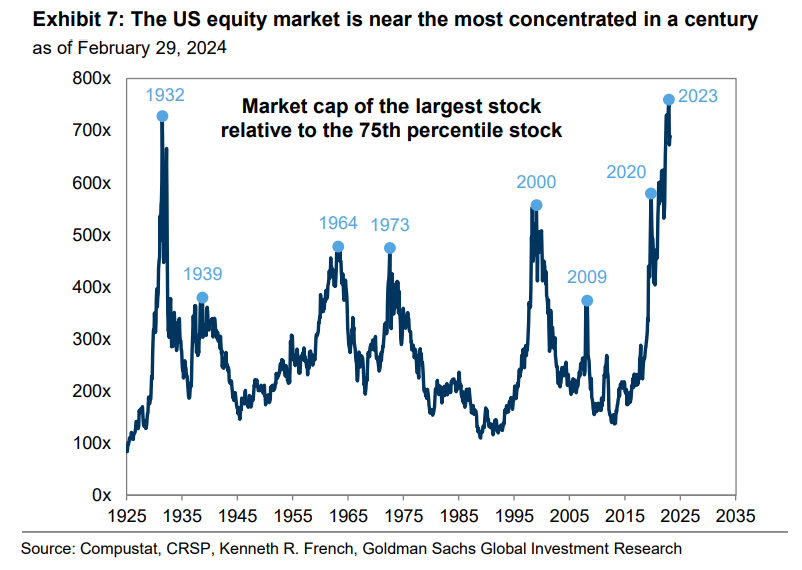

Stock market concentration. Here’s a chart from Goldman Sachs that shows by one measure, the U.S. stock market is as concentrated as it has ever been:

To which my reply is: So what?

Yes, the top 10 stocks make up more than one-third of the S&P 500. All this tells me is that the biggest and best companies are doing really well. Is that a bad thing?1

Stock markets around the globe are far more concentrated than the U.S. stock market. Emerging markets rose to their highest level since June 2022 yesterday. Out of an index that covers 20+ countries, a single stock (Taiwan Semiconductor) accounted for 70% of the move.

Stock market returns over the long run have always been dominated but a small minority of the biggest, best-performing companies.

Listen, large cap growth stocks will underperform eventually. No strategy works always and forever.

If you’re really that worried about concentration in the stock market, then buy small caps, mid caps, value stocks, dividend stocks, high quality stocks, foreign stocks or some other strategy.

But stock market concentration is not a new thing and it’s not going away anytime soon.

Government debt. Bloomberg is out with a new report that sounds the alarm on U.S. government debt levels:

With uncertainty about so many of the variables, Bloomberg Economics has run a million simulations to assess the fragility of the debt outlook. In 88% of the simulations, the results show the debt-to-GDP ratio is on an unsustainable path — defined as an increase over the next decade.

In the end, it may take a crisis — perhaps a disorderly rout in the Treasuries market triggered by sovereign US credit-rating downgrades, or a panic over the depletion of the Medicare or Social Security trust funds — to force action. That’s playing with fire.

I’ll believe it when I see it.

People have been sounding the alarm on government debt in this country for decades. There has been no panic. No financial crisis. No debt default.

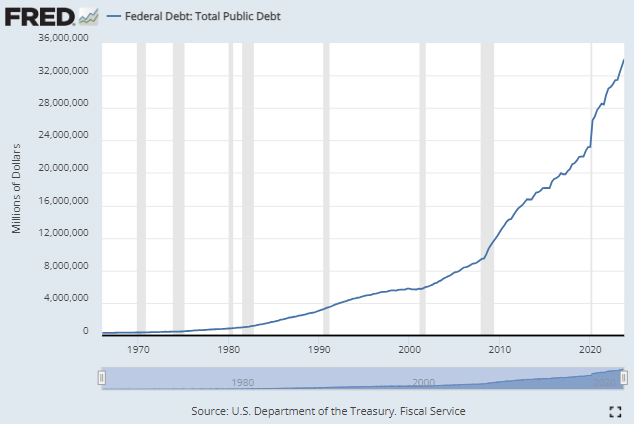

We obviously added a ton of debt during the pandemic:

I’m not ignoring this fact. Something has to be done eventually.

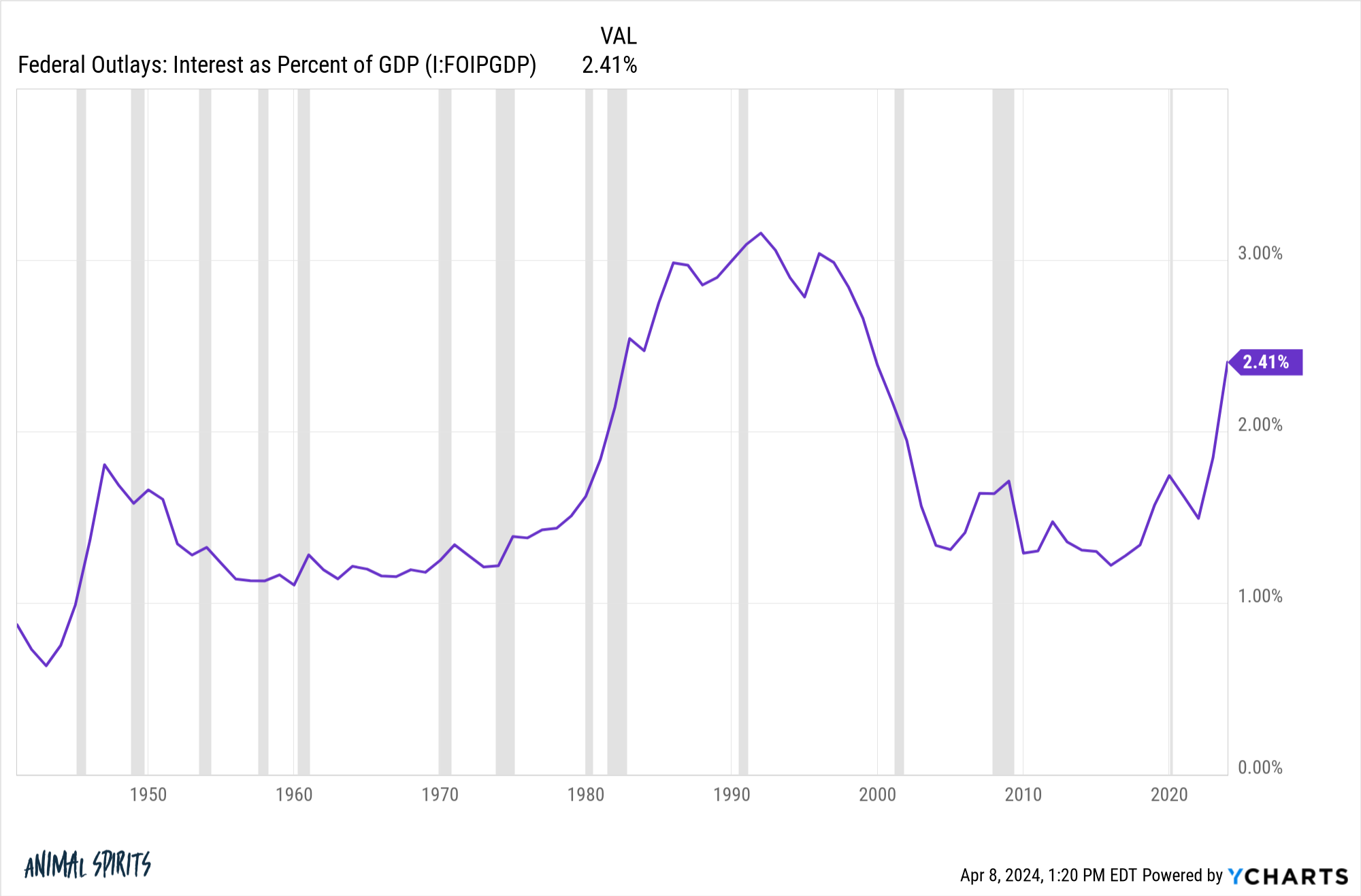

The most valid concern is what happens if the interest expense on our debt obligations crowds out spending in other areas. Interest expense relative to the size of the economy has shot higher in recent years from the combination of more debt and higher rates:

But we’re still well below the highs from the 1980s and 1990s. And when you look at the absolute numbers here, going from 1.5% of GDP to 3% of GDP isn’t exactly the end of the world.

The thing is if the economy continues to grow so too will government debt.2 That’s simply a function of the pie getting bigger.

One of the smartest things we do as a country is print debt in our own currency. We can’t default on government debt unless a crazy politician does something stupid.

And while government debt does seem unsustainably high, we have a number of built-in advantages in this country.

We have the world’s reserve currency. We have the biggest, most liquid financial markets in the globe (and there isn’t a close second place). We have the largest, most innovative corporations on the planet. We have the biggest, most dynamic economy in the world.

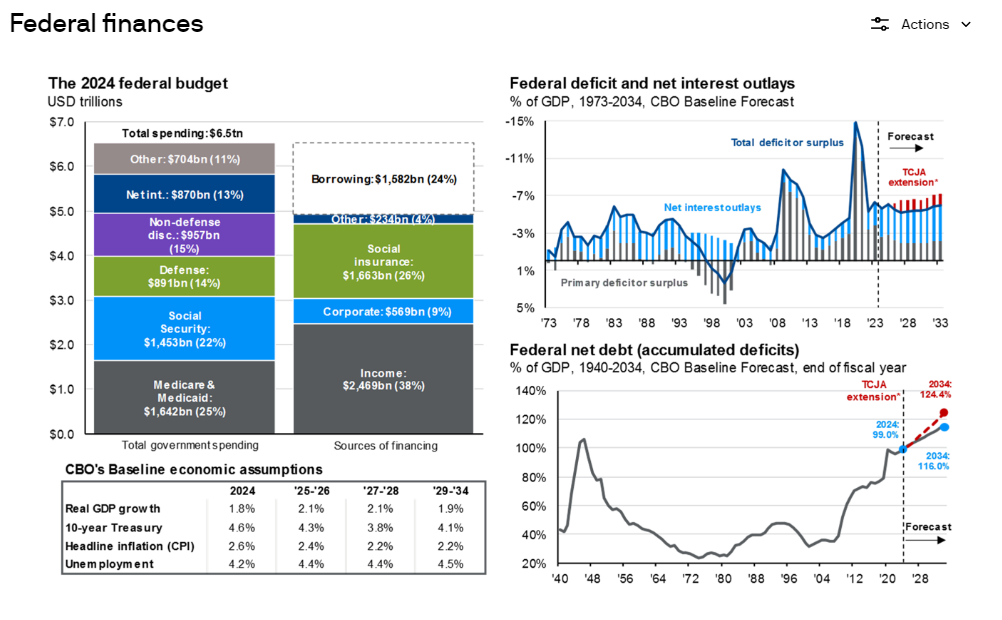

Debt-to-GDP is now as high as it was in World War II:

That seems scary until you realize in Japan, debt-to-GDP is closer to 300%. I’m not saying we should test our limits but there is no pre-set line in the sand on these things.

You also have to remember that while debt is a liability to the government, it’s an asset for someone else — retirees, pension plans, insurance funds, foreign buyers. Is there a higher quality fixed income option out there than Treasuries?

If there is a crisis, the Fed and Treasury can get creative as well. It’s not like they would just sit around and let our funding source blow-up.

Churchill once quipped, “Americans will always do the right thing, only after they have tried everything else.”

That’s my feeling on government debt as well.

You can call me naive for not worrying more about these topics but everyone else is already doing it for me.

Bill Miller once wrote:

When I am asked what I worry about in the market, the answer usually is “nothing”, because everyone else in the market seems to spend an inordinate amount of time worrying, and so all of the relevant worries seem to be covered. My worries won’t have any impact except to detract from something much more useful, which is trying to make good long-term investment decisions.

I’m not one of those nothing matters guys. Sometimes, there are legitimate risks to the financial markets. The problem is that most of the time, you can’t or won’t see the true risks coming.

I prefer to worry about the stuff I can control.

Let the market and other investors worry about the other stuff for you.

Further Reading:

Can Anyone Challenge the Economic Dominance of the United States?

1Some people think anti-trust regulation is a risk with the behemoth tech stocks if the government breaks them up. They haven’t shown any desire to do so but that’s a possibility. But even if they did break them up it’s possible that would unlock value. Can you imagine if AWS, YouTube or Instagram were standalone companies?

2And consumer debt.

[ad_2]