[ad_1]

What You Need to Know

- A rally in a stock tied to Trump Media, which runs the Truth Social platform, has minted a big windfall for him.

- Shares of DWAC, as the company is known, have soared 161% this year in anticipation of its merger with Trump Media.

- Trump Media has warned that it may run out of cash without the merger.

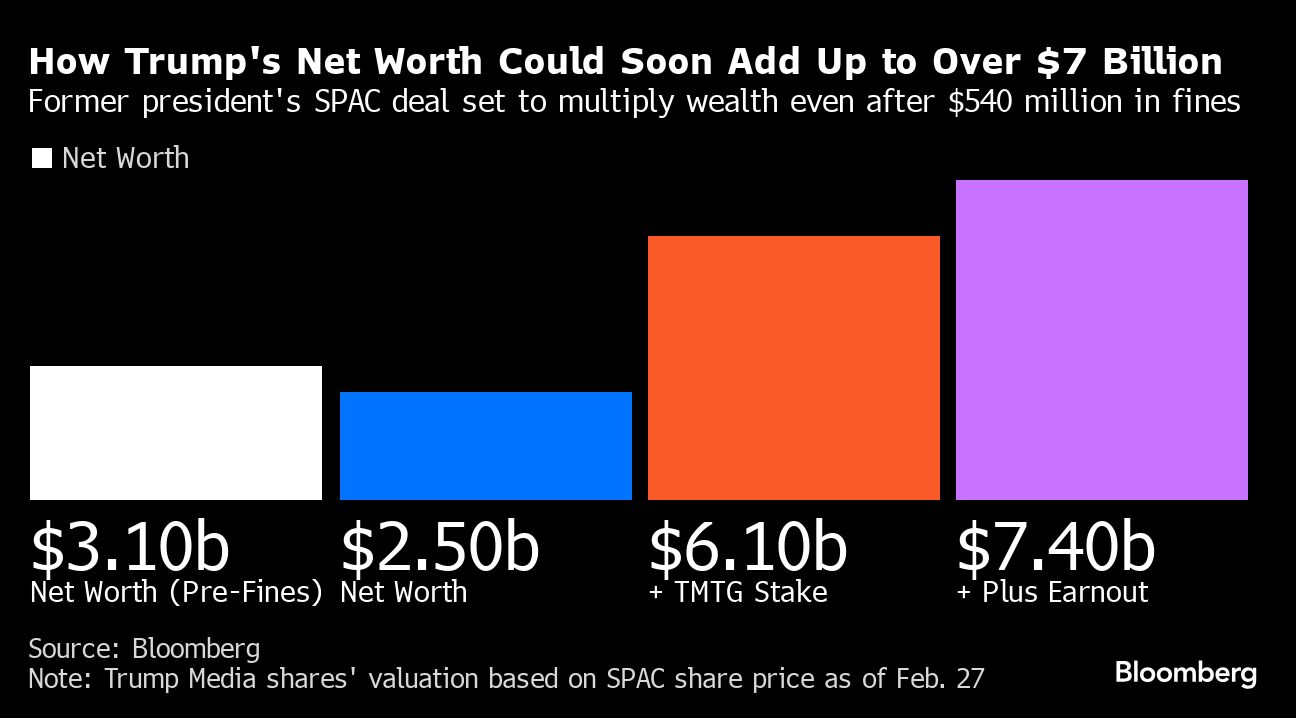

On the financial front, the news has appeared dire for former president Donald Trump this year. Within a span of just a month, two judges in two separate cases ordered him to pay about $540 million in total — a sum so great that pundits have speculated it could erode his campaign finances.

What’s gotten far less attention, though, is this: A frenetic rally in a stock tied to Trump Media & Technology Group — which operates the Truth Social platform he posts on daily — has minted a nearly $4 billion windfall for him.

There are any number of caveats to this figure, including how it’s only a paper profit for now that he’ll have to wait months to monetize, and yet the stock’s surge is a potentially huge financial boost for a billionaire candidate suddenly short on cash.

The type of transaction — known as a de-SPAC or blank-check deal — that would hand Trump this new-found wealth is a complex one that briefly became popular on Wall Street during the stock mania unleashed by pandemic-era stimulus.

In this particular deal, Truth Social’s owner would enter the stock market by merging with a publicly traded company called Digital World Acquisition Corp.

Shares of DWAC, as the company is known, have soared 161% this year in anticipation of the merger, which has been green-lit by the Securities and Exchange Commission and is now slated to go to a shareholder vote next month.

If it’s approved, Trump will hold a greater than 58% stake. At DWAC’s current price — it closed Tuesday at $45.63 per share — that stake is worth $3.6 billion.

Trump could get even more — close to an additional $1.3 billion worth, if the shares meet certain performance targets.

It seems improbable to many analysts that a stake in a money-losing social media company with little revenue and a fraction of its rivals’ user bases could potentially more than double Trump’s net worth.

But as Trump began to steamroll his Republican rivals in January, setting up a likely rematch with President Joe Biden in November, retail investors frantically bid DWAC shares up. And when a group on Wall Street known as momentum traders joined the buying frenzy, the conditions for an epic rally were in place. In just six days, the stock jumped 200%.

“This is a meme stock, it’s not the type of thing where you bust out P/E ratios — you can throw that out the window,” said Matthew Tuttle, the chief executive and chief investment officer at Tuttle Capital Management. “DWAC has now become the de facto way to bet on or against Trump,” he added.

But if Trump’s rebound carries him back to the White House — and many polls currently make him the favorite to win — there could be value, in theory, at least, in owning a cut of the mouthpiece that will carry his message.

“The fundamental bull case is that he confines his tweets to the Truth Social platform, which means if you want to see them or interact with them, you need to sign up as well, making advertising all the more profitable,” Tuttle said.

Penalties and Fees

While Trump’s windfall would more than cover the penalties and legal fees he faces — he is appealing New York state’s $454 million civil fraud verdict — he would need to wait at least five months before cashing in shares, unless the company files to expedite that timing.

[ad_2]