[ad_1]

Binance, the world’s main cryptocurrency alternate, has been beneath scrutiny amid regulatory pressures, lawsuits, and its founder’s authorized troubles. Many individuals are presently questioning whether or not Binance will collapse in 2024.

The Early Days of Binance

Based by Changpeng Zhao (generally known as C.Z.) in 2017, Binance has since change into one of the crucial influential platforms within the cryptocurrency world. With its fast progress and dominance out there, it has attracted hundreds of thousands of customers worldwide.

The corporate Binance was launched in 2017 after elevating $15 million by way of its BNB Preliminary Coin Providing. It rapidly established a robust presence within the crypto world and purchased Belief Pockets in 2018. In 2019, the corporate launched its decentralised alternate (DEX) forward of schedule. Binance was initially primarily based in China however needed to relocate because of strict regulatory restrictions.

Later, it developed its personal blockchain, generally known as Binance Sensible Chain, which was subsequently renamed BNB Chain. This blockchain facilitates trades on the platform, and the token of the Binance Sensible Chain known as Binance Coin (BNB). Moreover, the corporate additionally launched a stablecoin referred to as BinanceUSD (BUSD).

Changpeng “C.Z.” Zhao: The Man Behind Binance

Picture: Binance

CZ is a recognisable determine within the crypto world, usually partaking with the crypto group through social media and convention appearances. Born in China and emigrating to Canada on the age of 12, he has a background in laptop science and a historical past of working within the monetary sector.

C.Z.’s Imaginative and prescient for Binance

Zhao had a transparent goal for Binance – to rival different exchanges out there by offering options for the assorted challenges he noticed within the cryptocurrency buying and selling infrastructure. These challenges ranged from weak technical structure, insecure platforms, inadequate market liquidity, poor buyer help, and insufficient language help.

Due to U.S. regulatory guidelines, Binance created a supposedly unbiased firm, Binance US, for its American purchasers in 2019. Nevertheless, this subsidiary has fewer cryptocurrency choices and sure restrictions in comparison with its mother or father firm.

Binance has achieved nice success, but it surely has additionally been embroiled in controversy. The corporate has encountered ongoing regulatory scrutiny, significantly in the USA. In 2023, the Securities and Trade Fee charged Binance US and C.Z. with violating federal securities legal guidelines.

Vital Milestones and Controversies in Binance’s Journey

From its launch in 2017 to the lawsuits in 2023, Binance’s journey has been a rollercoaster of highs and lows.

- February 2018: The Starting of Suspicion

Studies emerged in February 2018 that Binance was beneath investigation by U.S. legislation enforcement businesses for doable violations of cash laundering and terror financing legal guidelines. These investigations would later change into the inspiration for a sequence of authorized actions towards the corporate.

- March 2023: Congress Will get Concerned

On March 1, 2023, Senators Elizabeth Warren, Chris Van Hollen, and Roger Marshall despatched a letter to C.Z. and Binance US CEO Brian Shroder, demanding solutions to a number of allegations and entry to the businesses’ steadiness sheets. The senators weren’t happy with the responses they acquired and accused the executives of mendacity.

- Could 2023: The CFTC Information Swimsuit

The Commodity Futures Buying and selling Fee prosecuted Binance, CZ, and Chief Compliance Officer Samuel Lim, alleging seven counts of buying and selling irregularities and market manipulation. These fees got here as a major blow to Binance, as they vehemently denied any wrongdoing.

- June 2023: The SEC Joins the Fray

Following the CFTC’s lawsuit, the Securities and Trade Fee (SEC) filed a go well with towards Binance, Binance US, and C.Z., accusing them of assorted violations, together with unregistered securities gross sales and permitting U.S. prospects to make use of the Binance alternate. The SEC acquired an emergency restraining order towards Binance US, main the alternate to cut back its operations within the U.S.

- July 2023: The Exodus Begins

In July 2023, 4 senior members of the Binance US crew left the corporate, marking the start of a wave of exits that may proceed for months to return. This mass exodus raised considerations concerning the stability and way forward for Binance.

- August 2023: The DOJ Considers Fraud Costs

The Division of Justice (DOJ) was reported to be contemplating fraud fees towards Binance. To forestall a possible run on the alternate, the division leans in the direction of imposing fines or non-prosecution agreements.

- September 2023: Layoffs, Departures, and Lack of Cooperation

In September 2023, Binance US laid off round 100 staff, roughly a 3rd of its workforce. CEO Brian Shroder additionally departed from the corporate. Moreover, the SEC complained about Binance’s lack of cooperation within the discovery course of, additional straining the connection between the 2 events.

- October 2023: Binance Fights Again

In October 2023, Binance, CZ, and Binance US filed motions to dismiss the SEC and CFTC circumstances towards them. They argued that the regulatory businesses misinterpreted securities legal guidelines and have been overstepping their authority. The SEC responded by accusing Binance of getting a “tortured interpretation of the legislation.”

- November 2023: Indictments and Resignations

In November 2023, the federal government filed indictments towards Binance and C.Z. in Washington State. As a part of a deal, C.Z. stepped down from his place at Binance. The penalties imposed on Binance and its founder totalled over $4 billion, together with private fines for C.Z. and Samuel Lim.

The Settlement and Its Implications

In a landmark transfer, C.Z. pleaded responsible to federal cash laundering fees and resigned as CEO. On the identical time, Binance agreed to pay a colossal $4.3 billion to U.S. authorities to resolve prison fees. This verdict has left the crypto world speculating a few doable Binance chapter or a possible Binance financial institution run.

The Ripple Impact on the Crypto World

Much like what occurred with FTX, the authorized troubles of Binance and C.Z. have despatched shockwaves by way of the cryptocurrency trade. Many consider that this may very well be an indication of elevated regulation and scrutiny of crypto exchanges, which may result in extra authorized challenges for different platforms.

The Potential Binance Collapse

The query now is not only “Is Binance in hassle?” however fairly, “Might Binance collapse?” The corporate’s authorized woes and the resignation of its founder have led many to invest concerning the potential for a Binance collapse in 2024.

Monetary Implications

The hefty $4.3 billion payout to U.S. authorities may have vital monetary implications for Binance. If the corporate is unable to fulfill this monetary obligation, it may result in Binance’s insolvency.

Operational Implications

With CZ stepping down as CEO, there may very well be operational disruptions inside Binance. His departure may doubtlessly create a management void and trigger uncertainty amongst staff and customers.

Regulatory Implications

Binance’s authorized troubles may additionally result in additional regulatory scrutiny. This might end in further authorized challenges, which may additional pressure the corporate’s sources and doubtlessly result in its downfall.

The way forward for Binance is unsure. The corporate faces huge challenges, each financially and operationally. Nevertheless, the potential Binance collapse is just not a foregone conclusion. With exemplary management and strategic strikes, the corporate may navigate these tough waters and emerge stronger.

What ought to I be careful for?

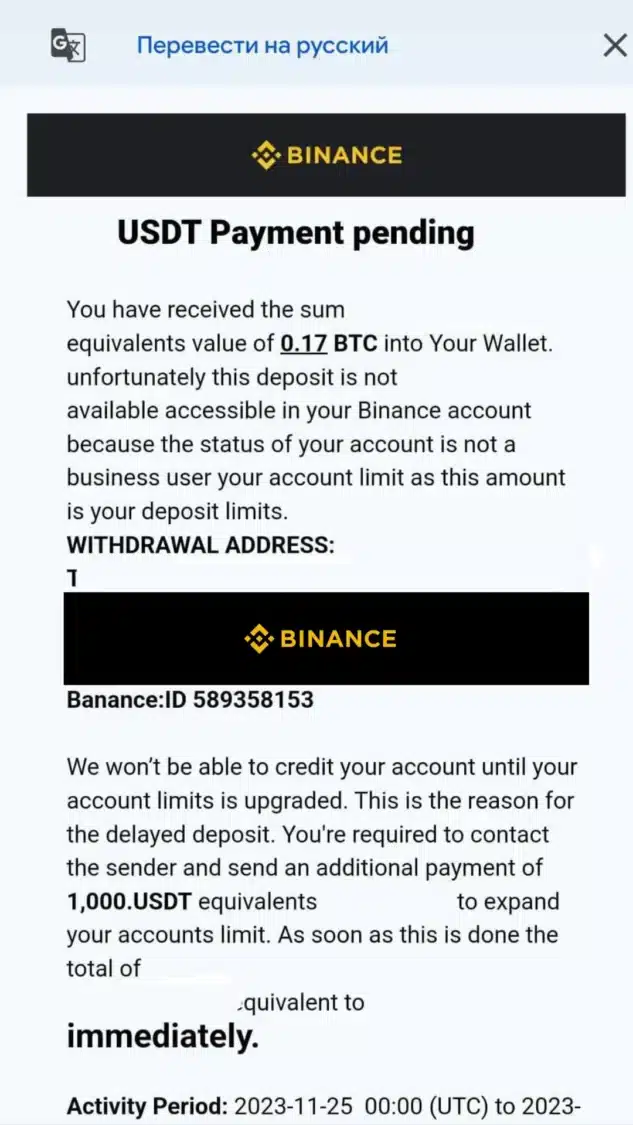

As we’ve got seen in earlier collapses of exchanges, scammers are likely to benefit from the state of affairs. They are going to attempt to rip-off folks by sending phishing emails that will look genuine however lead on to the scammer’s pocket. We extremely suggest that you just confirm the e-mail tackle of the alternate when receiving a suspicious e mail. As a rule of thumb, it’s best to by no means must pay hefty sums of cash prematurely with a purpose to withdraw cash out of your crypto account, and it’s best to by no means share your pockets’s seed phrase with anybody.

Regularly Requested Questions (FAQ)

Who’s Changpeng Zhao?

Changpeng Zhao, often known as C.Z., is the founding father of Binance. He just lately resigned as CEO following his responsible plea to federal cash laundering fees.

Is Binance in hassle?

Sure, Binance is presently going through a sequence of authorized and regulatory challenges, together with a large payout to U.S. authorities and the resignation of its founder and CEO, CZ.

Will Binance go bankrupt?

Whereas it’s doable that these challenges may result in a Binance collapse, it’s not a certainty. The corporate’s future will largely rely upon its capacity to navigate these points successfully.

What would occur if Binance went bankrupt?

If Binance went bankrupt, it could seemingly have vital repercussions for its customers and the crypto market. It may end in a lack of funds for customers and will disrupt the general stability of the crypto market.

What’s the distinction between Binance and Binance US?

Binance and Binance US are technically separate entities, with the latter created to cater to U.S. purchasers because of regulatory necessities. Nevertheless, Binance US affords fewer cryptocurrency choices and has sure restrictions in comparison with its mother or father firm.

Is there a hyperlink between the collapse of Binance and SBF (Sam Bankman-Fried) of FTX?

The SEC believes that Binance and its former CEO, Changpeng Zhao, dedicated crimes much like these noticed at FTX by Sam Bankman-Fried.

What does this imply for the way forward for cryptocurrency?

The challenges going through Binance may sign a shift in the direction of elevated regulation and scrutiny of crypto exchanges. This might doubtlessly result in extra transparency and safety within the crypto market, but it surely may additionally deter some customers and buyers.

The Highway Forward for Binance

The way forward for Binance is unsure, with authorized points surrounding its founder, lawsuits, and numerous regulatory pressures. The world’s main cryptocurrency alternate is at a crossroads, as we’ve got seen from earlier examples, resembling the autumn of Mt. Gox. New gamers could enter the trade with higher management and administration. We consider that is extremely seemingly. Solely time will inform whether or not Binance will overcome these obstacles and proceed to thrive or succumb to the challenges it presently faces. Within the meantime, the cryptocurrency world is watching with anticipation.

[ad_2]