[ad_1]

Welcome to The Market’s Compass US Index and Sector ETF Research, Week #466. As all the time it highlights the technical adjustments of the 30 US Index and Sector ETFs that I observe on a weekly foundation and usually publish each third week. Paid subscribers will obtain this week’s unabridged Market’s Compass US Index and Sector ETF Research despatched to their registered e-mail. Free subscribers from time to time will obtain an excerpt of the complete model. Previous publications will be accessed by paid subscribers by way of The Market’s Compass Substack Weblog.

Within the spirit of Christmas, this week’s Weblog might be despatched to each free and paid subscribers. I cannot be publishing the ETF Research or Crypto Candy Sixteen Research for the subsequent two weeks as I benefit from the Christmas Vacation and New Years celebration with household and mates. The following Market’s Compass ETF Research might be posted on Monday January eighth.

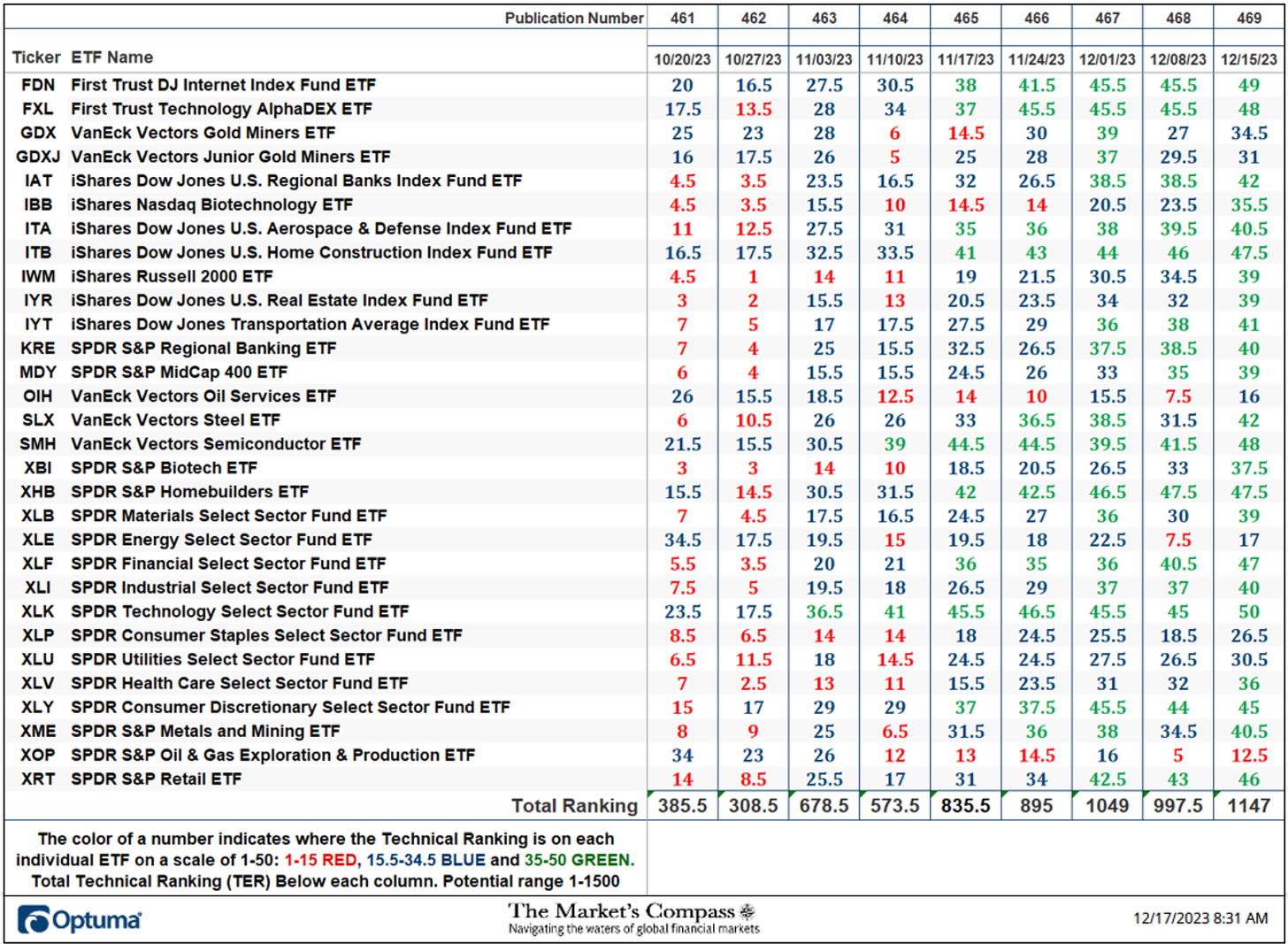

The Excel spreadsheet under signifies the weekly change within the goal Technical Rating (“TR”) of every particular person ETF. The technical rating or scoring system is a completely quantitative method that makes use of a number of technical issues that embrace however are usually not restricted to development, momentum, measurements of accumulation/distribution and relative energy. If a person ETFs technical situation improves the Technical Rating TR rises and conversely if the technical situation continues to deteriorate the TR falls. The TR of every particular person ETF ranges from 0 to 50. The first take away from this unfold sheet needs to be the development of the person TRs, both the continued enchancment or deterioration, in addition to a change in route. Secondarily, a really low rating can sign an oversold situation and conversely a continued very excessive quantity will be seen as an overbought situation, however with due warning, oversold circumstances can proceed at apace and overbought securities which have exhibited extraordinary momentum can simply turn into extra overbought. As well as, if a person TR “can’t “get out of its personal approach” whereas the broader market continues to rally it speaks volumes about poor relative energy. A sustained development change must unfold within the TR for it to be actionable.

For the week ending December eighth (the week earlier than final) there have been fifteen ETFs within the “inexperienced zone” (TRs between 35-50), twelve ETFs have been within the “blue zone” (TRs from 15.5 -34.5) and three have been within the “crimson zone” (TRs from 1-15). On the finish of final week twenty-three ETF have been within the “inexperienced zone”, six ETFs within the “blue zone” and just one remained within the “crimson zone”. That was the SPDR S&P Oil & Gasoline Exploration and Manufacturing ETF (XOP). The Complete ETF Rating or “TER”, rose by +14.99% to 1147 from 997.5.

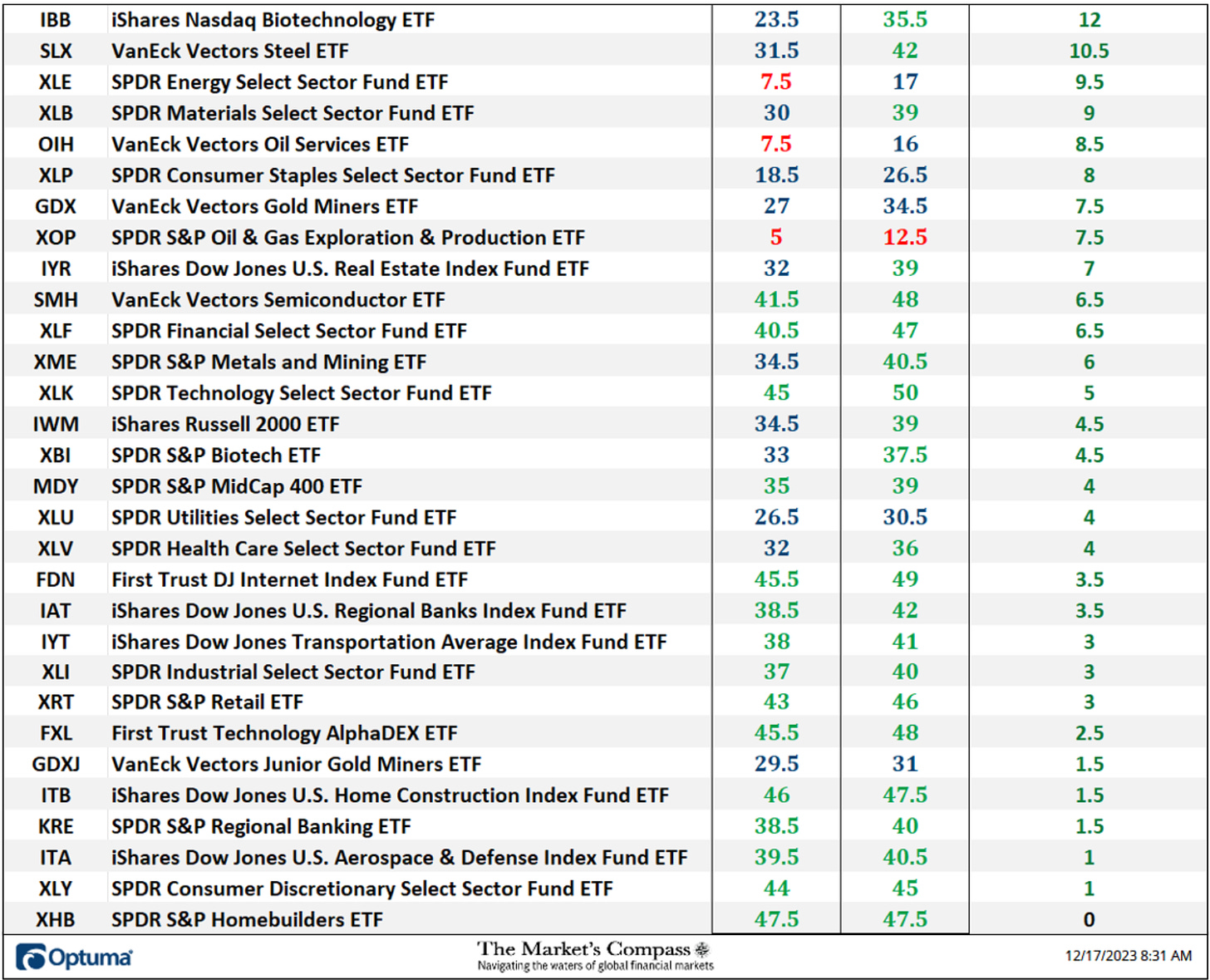

On every week over week foundation 29 ETFs noticed positive aspects of their TRs and one had a TR that was unchanged. The typical TR acquire on the week was +4.98. The highest three TR gainers have been the iShares Nasdaq Biotechnology ETF (IBB) which rose +12 to 35.5 from 23.5 adopted by the VanEck Vectors Metal ETF (SLX) which rose by + 10.5 “handles” to 42 from 31.5 and the SPDR Power Choose Sector Fund ETF (XLE) which rose +9.5 to 17 from 7.5. The SPDR Know-how Choose Sector Fund ETF (XLK) ended the week with not solely the most effective Technical Rating of the 30 ETFs we observe on this Research but in addition recorded an ideal TR of fifty.

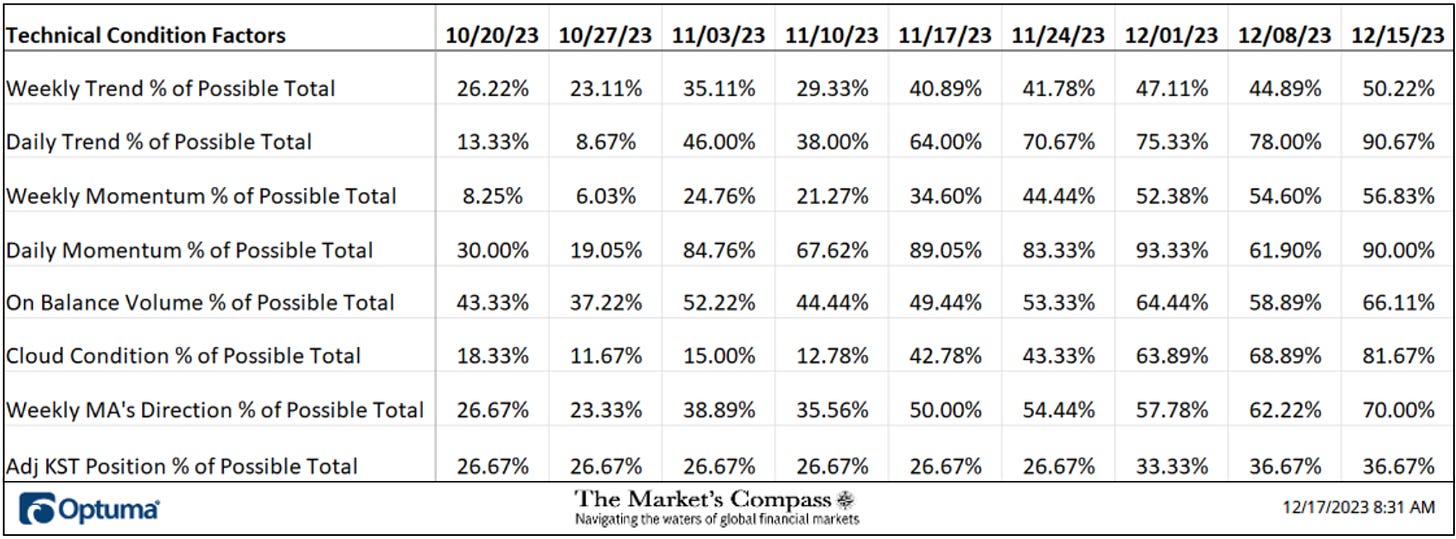

There are eight Technical Situation Elements (“TCFs”) that decide particular person TR scores (0-50). Every of those 8, ask goal technical questions (see the spreadsheet posted under). If a technical query is optimistic a further level is added to the person TR. Conversely if the technical query is detrimental, it receives a “0”. A couple of TCFs carry extra weight than the others such because the Weekly Pattern Issue and the Weekly Momentum Think about compiling every particular person TR of every of the 30 ETFs. Due to that, the excel sheet under calculates every Issue’s weekly studying as a p.c of the potential whole. For instance, there are 7 issues (or questions) within the Every day Momentum Situation Issue (“DMC”) of the 30 ETFs (or 7 X 30) for a potential vary of 0-210 if all 30 ETFs had fulfilled the DMC Issue standards the studying can be 210 or 100%.

One technical take away can be if the DMC rises to an excessive between 85% and 100% it could recommend a short-term overbought situation. Conversely a studying within the vary of 0% to fifteen% would recommend an oversold situation was creating. This previous week a 90.00% overbought studying of the DMC Issue was registered, or 189 of a potential whole of 210 optimistic factors.

As a affirmation software, if all eight TCFs enhance on every week over week foundation, extra of the 30 ETFs are bettering internally on a technical foundation confirming a broader market transfer larger (consider an advance/decline calculation). Conversely if all eight TCFs fell over the week it confirms a transfer decrease within the broader market. Final week seven TCFs moved larger and one was unchanged vs. the earlier week confirming the broader market transfer larger.

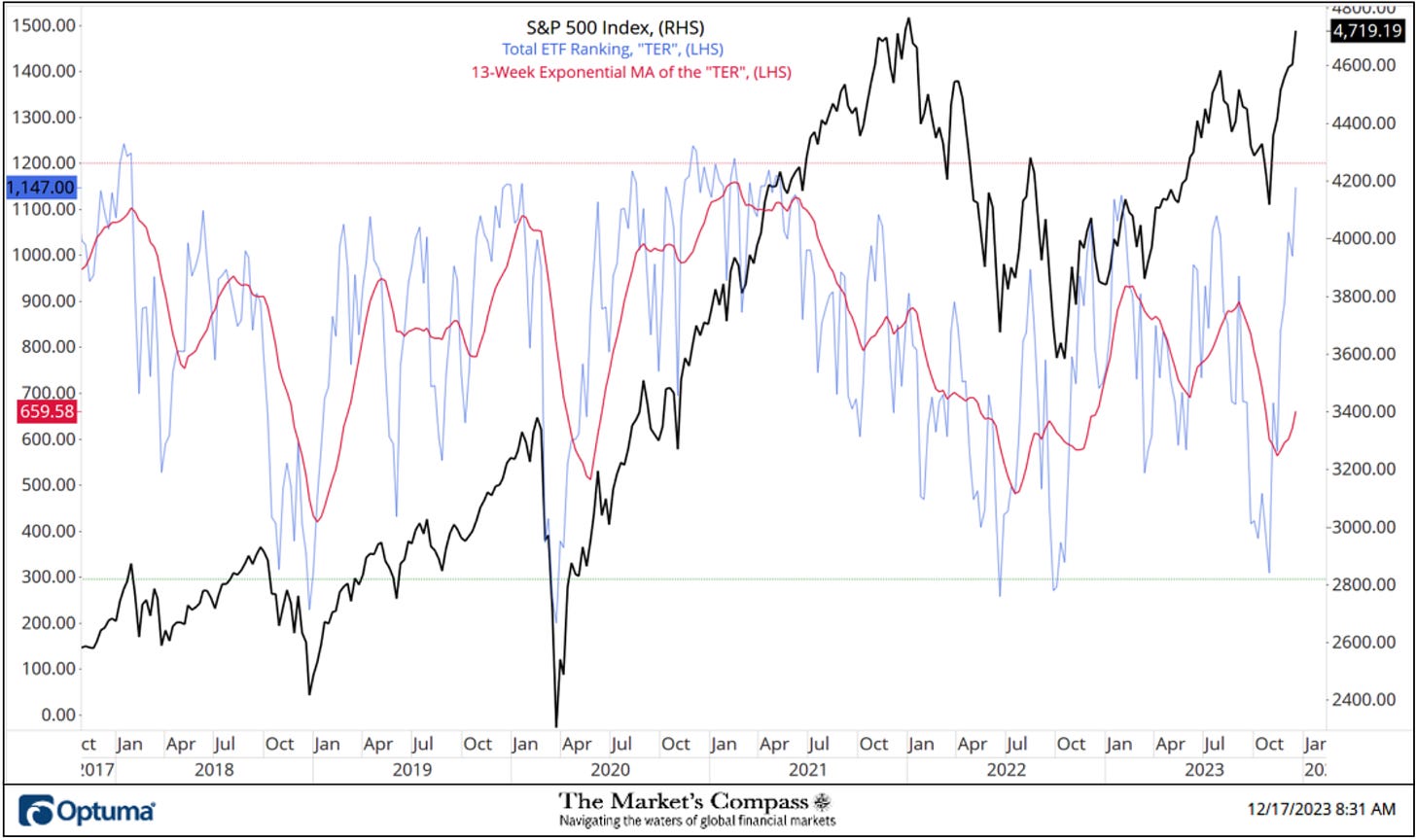

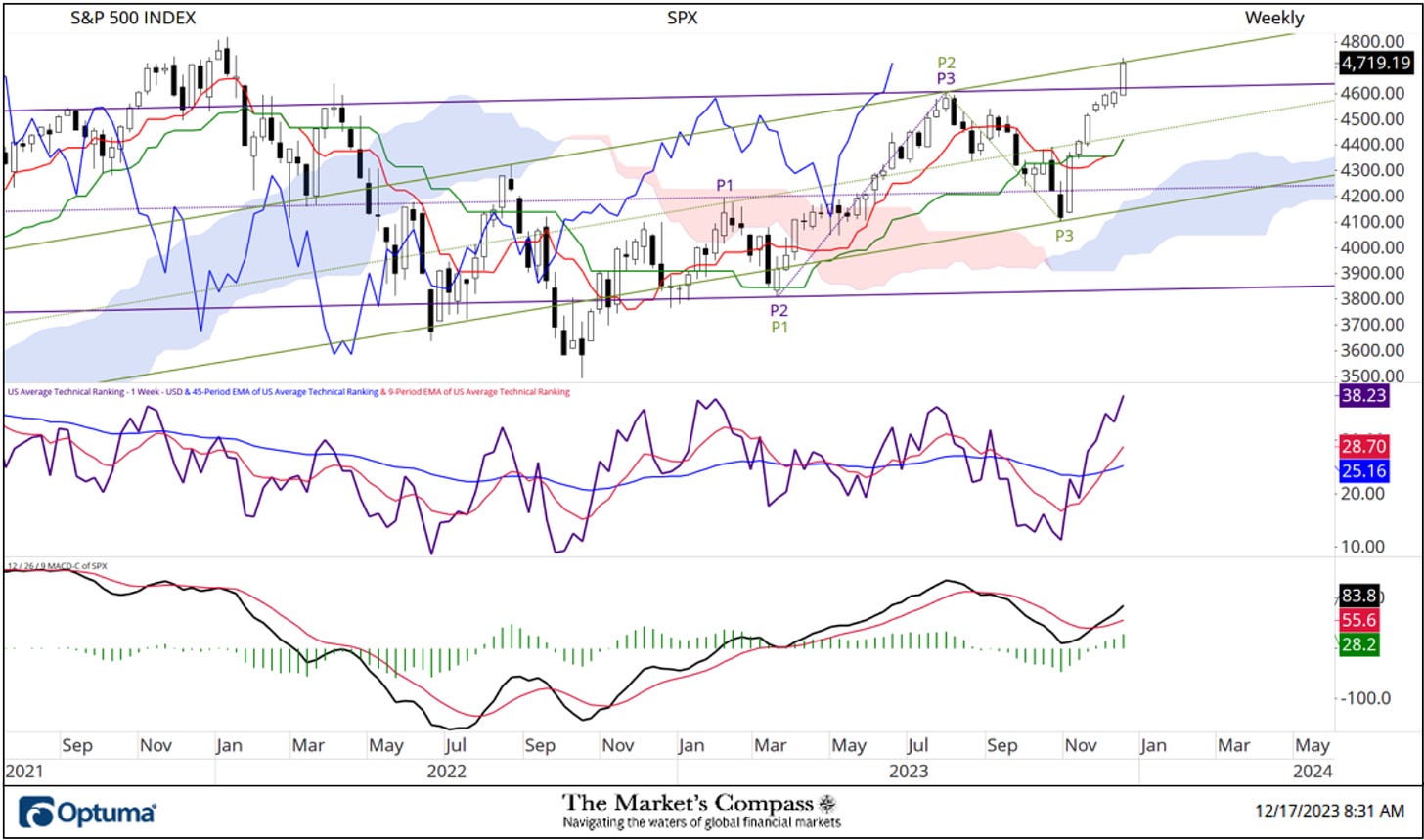

The “TER” Indicator is a complete of all 30 particular person ETF rankings and will be checked out as a further affirmation/divergence indicator in addition to an overbought oversold indicator. As a affirmation/divergence software: If the broader market as measured by the S&P 500 Index (SPX) continues to rally with no commensurate transfer or larger transfer within the “TER” the continued rally within the SPX Index turns into more and more in jeopardy. Conversely, if the SPX Index continues to print decrease lows and there may be little change or a constructing enchancment within the “TER” a optimistic divergence is registered. That is, in a vogue, like a conventional A/D Line. As an overbought/oversold indicator: The nearer the “TER” will get to the 1500 degree (all 30 ETFs having a “TR” of fifty) “issues can’t get a lot better technically” and a rising quantity particular person ETFs have turn into “stretched” the extra of an opportunity of a pullback within the SPX Index, On the flip aspect the nearer to an excessive low “issues can’t get a lot worse technically” and a rising variety of ETFs are “washed out technically” an oversold rally or measurable low is near being in place. The 13-week exponential transferring common (crimson line) smooths the unstable “TR” readings and analytically is a greater indicator of development.

On the finish of final week, the Complete Technical Rating, “TER”, rose to the very best degree,1147, since April of 2021. In doing so the “TER” lastly confirmed the brand new restoration closing value highs on Friday (4,719.19) though it may be thought of a double-edged sword in that the “TER” is shortly closing in on overbought degree. The 13-Week Exponential Transferring Common which had hooked larger in November is monitoring larger in live performance with the “TER”. The rally from the late October value lows has been impulsive and I anticipate that earlier than a significant pullback develops the SPX Index will problem the December thirty first, 2021, closing excessive at 4,766.16.

The Weekly Common Technical Rating (“ATR”) is the common Technical Rating of the 30 US Index and Sector ETFs we observe. Just like the TER, it’s a affirmation/divergence or overbought/oversold indicator.

After two weeks of failed makes an attempt (though it did make progress on the worth entrance) the massive cap index overtook the Higher Parallel (strong purple line) of the Customary Pitchfork (purple P1 although P3) by the tip of final week. After it turned clear that an vital swing low was in place eight weeks in the past I added a second Pitchfork. On this case it’s a Schiff Pitchfork variation (inexperienced P1 via P3) the Higher Parallel of that Pitchfork (strong inexperienced line) has to date capped the rally. The Common Technical Rating Oscillator, “ATR” has reached an overbought degree excessive at 38.23. It’s not unusual for the ATR to eclipse the 41/42 degree however it’s at present near that excessive degree. As I stated beforehand, the impulsive nature of the rally together with the flip in MACD again via its sign line suggests to me that the December 2021 highs might be challenged however the momentum oscillator has but to substantiate the brand new value restoration highs.

Extra on the shorter time period technical situation in “Ideas on the short-term technical situation of the SPX Index” later within the Weblog however first….

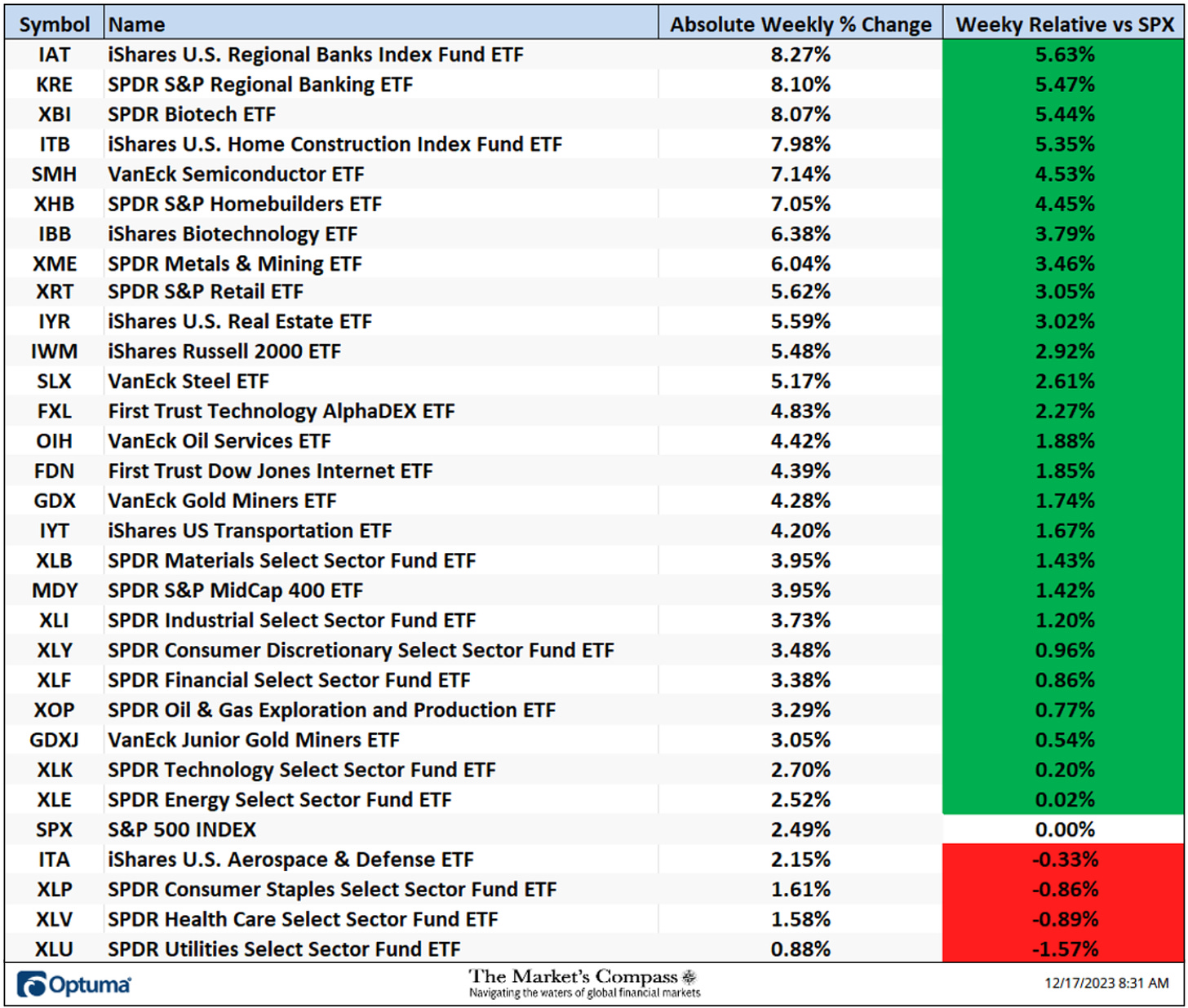

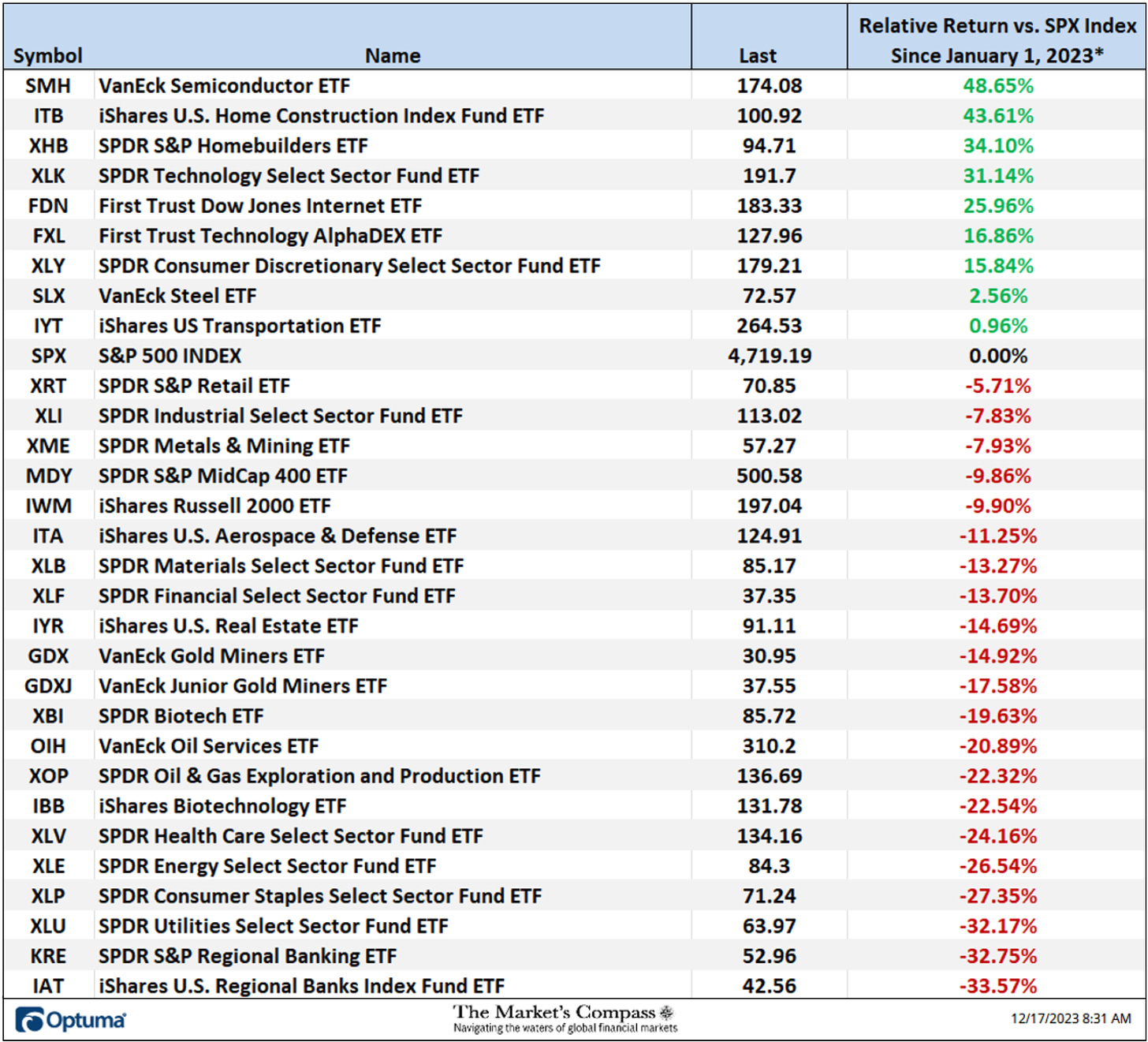

*Doesn’t embrace dividends

All 30 of the US ETFs we observe on this weblog superior on an absolute foundation final week. The typical absolute acquire on the week was +4.37% vs. a +2.49% acquire within the SPX Index. That added to the earlier week’s common absolute acquire of +0.90%. Solely 4 ETFs underperformed the massive cap indexes weekly acquire. The perfect two absolute gainers have been the iShares U.S. Regional Banks Index Fund ETF (IAT) up +8.27% adopted by a 8.10% acquire within the SPDR S&P Regional Banking ETF (KRE). As might be seen later within the Weblog, regardless of the higher efficiency final week, it can take much more backside fishing to get better all of the misplaced floor over the 12 months. Each financial institution ETFs are nonetheless on the backside of the year-to-date efficiency checklist.

*Of curiosity to scalpers, merchants, and technicians

After two weeks of value consolidation the SPX lifted off once more with MACD retaking the bottom above its sign line in optimistic territory and with it the momentum oscillator has confirmed the brand new value highs. The early turning Fisher Rework shouldn’t be giving a touch that the rally has run its course. One minor technical concern is that my US ETF Every day Momentum / Breadth Oscillator has but to substantiate the brand new value highs. Key value and Kijun Plot (strong inexperienced line) help is at 4,540.

*Doesn’t embrace dividends

For readers who’re unfamiliar with the technical phrases or instruments referred to within the feedback on the technical situation of the SPX can avail themselves of a quick tutorial titled, Instruments of Technical Evaluation or the Three-Half Pitchfork Papers that’s posted on The Markets Compass web site…

https://themarketscompass.com

Charts are courtesy of Optuma.

To obtain a 30-day trial of Optuma charting software program go to…

[ad_2]