[ad_1]

Welcome back to another monthly update from Root of Good! I’m releasing this update just a few days into the new month because we’re rushing out the door for a cruise in a couple of days. Our spring and summer travel schedule will keep us pretty busy with three cruises and a two month trip to Poland between now and September.

Spring is here in North Carolina. Just look at the thick layer of green pollen coating everything and you’ll know! Hopefully the air will be pollen-free when we’re sailing around the Caribbean next week on our cruise. We’ll visit Aruba, Colombia, Panama, Costa Rica, and a couple other places during our 11 night cruise. It’s a similar itinerary to the one we took over this past Christmas with the kids. But this time we are going without the kids since they have school.

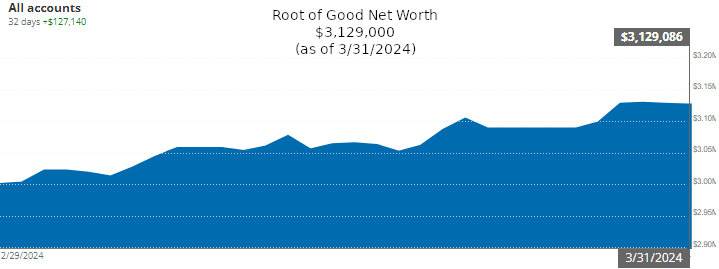

On to our financial progress. March was an incredible month for our finances in all regards. Our net worth shot up by $127,000 (!!), to end the month at $3,129,000. Our income of $10,736 far exceeded our spending of $3,525 for the month of March.

Let’s jump into the details from last month.

Income

Investment income totaled $8,486 in March. Our equity index funds and ETFs pay dividends quarterly at the end of March, June, September, and December. As a result, we had a larger than normal amount of investment income last month. Here’s more on our dividend investments.

Blog income totaled $1,090 for the month. This is a bit higher than average since many people signed up for the Empower dashboard recently. I assume that is because Mint closed down and everyone was scrambling to find a replacement to track their finances.

My early retirement lifestyle consulting income (“consulting”) was $350 last month which represents 2 hours of consulting. That’s a relatively slow month which I don’t mind a bit. We’ve been pretty busy with a few short trips and researching and planning several more upcoming trips. Who has time to work when you’re busy having fun!

Tradeline sales income totaled $800 in March. That’s a very good month compared to a typical month during the last year. I ramped up my tradeline sales a few years ago and discussed it in a bit more detail in my October 2020 monthly post and in my July 2021 monthly post. Most years I make around $4,000 to $6,000 in exchange for lending out my stellar credit report history from half a dozen credit cards.

For last month, my “deposit income” was $10. This deposit income came from cash back and incentive bonuses from the Rakuten.com and Mrrebates.com online shopping portals (some of which was earned from you readers signing up through these links).

If you sign up for Rakuten through this link and make a qualifying $25 purchase through Rakuten, you’ll get a $10 sign up bonus (or more!).

Youtube income was zero last month. Youtube only pays out when you hit $100 in accumulated revenue. Recently, my Youtube earnings have been slightly under $50 per month on average, so I only get paid every two or three months.

Here is the Youtube channel for the curious. It’s random travel videos, birds, kids, and a couple of DIY videos. There are only a few main videos that bring in most of the traffic (and revenue!).

If you’re interested in tracking your income and expenses like I do, then check out Empower Personal Dashboard, formerly known as Personal Capital (it’s free!). All of our savings and spending accounts (including checking, money market, and more than half a dozen credit cards) are all linked and updated in real time through Empower Personal Dashboard. We have accounts all over the place, and Empower Personal Dashboard makes it really easy to check on everything at one time.

Empower Personal Dashboard is also a solid tool for investment management. Keeping track of our entire investment portfolio takes two clicks. If you haven’t signed up for the free Empower Personal Dashboard service, check it out today (review here).

Tracking spending was one of the critical steps I took that allowed me to retire at 33. And it’s now easier than ever with Empower Personal Dashboard.

Expenses

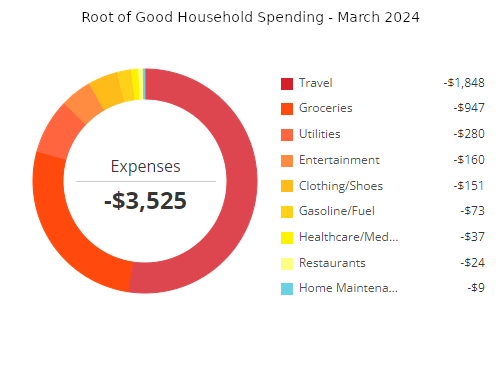

Now let’s take a look at March expenses:

In total, we spent $3,525 during the month of March which is about $200 more than our regularly budgeted $3,333 per month (or $40,000 per year). Travel and groceries were the highest two spending categories last month.

Detailed breakdown of spending:

Travel – $1,848:

Our travel spending of $1,848 includes the taxes and deposits for three cruises:

- 11 night Caribbean cruise in April – $400

- 10 night Caribbean cruise in May – $400

- 11 night Pacific/Mexico cruise in January 2025 – $878

All of the “deposits” will be returned to us in the form of onboard credit, which will roughly cover our mandatory gratuity charges while on the ship. For 32 nights of cruises, these prepaid charges work out to $52 per day ($26 per person). That’s how much our “free” promo cruises from our casino match deals actually cost. Still a great value but far from free.

The other $170 in travel spending covered our two trips in March.

We went to Atlantic City for 3 days in early March to get some more “free” cruises and higher casino status matches. The 2 nights in the oceanfront Tropicana hotel in Atlantic City was booked for free using Chase Ultimate Reward points. My Caesar’s Diamond status saved us $100 in resort fees. They did charge $16 for local taxes/fees once we checked in.

This trip was a lot of fun. We rarely do “quick getaway” type trips these days, so it was a fairly unique experience. It was our first time in Atlantic City, and I admit that AC exceeded our somewhat low expectations.

Other expenses in Atlantic City included $86 for 2 days of rental car, $14 in gas to get from the Philadelphia airport to AC and back, and $18 in tolls on my EZ-Pass. Our meals were all free thanks to comps from the casinos, Priority Pass lounge access, and some sandwiches and snacks we brown-bagged from home.

Our other mini-vacation during March was a quick trip to the Outer Banks of North Carolina. We realized that we’ve taken our kids to a few dozen countries all over the world. But we hardly ever visit places in our own state. So we packed up the car and drove to Kitty Hawk, Kill Devils Hill, and Hatteras, North Carolina for a busy two day trip.

The $60 hotel was paid with Chase Ultimate Reward points. It’s amazing how cheap the off-season rates are at the beach in North Carolina.

The only out of pocket spending on this trip was $39 for the gas to drive the ~500 miles down there and back from Raleigh. Our meals were a combo of food brought from home and some pizza paid for with free gift cards (thanks, Citibank!). Circle K even provided free slushies and road trip snacks through their rewards program.

Get free travel like us

If you are interested in getting free travel from your credit card like I do, consider the Chase Ink Unlimited or Chase Ink Cash business cards (my referral link). Right now, the Chase Ink business cards offer an above average $750 Chase Ultimate Rewards points that can be redeemed instantly for $750 in cash. I just signed up for another new Ink card to snag one of these great bonus offers.

Chase is pretty liberal when it comes to “what is a business”. If you sell stuff on eBay or Craigslist or do some odd jobs occasionally then you have a business and could get a credit card as a “sole proprietor”.

I use the 75,000 Chase Ultimate Rewards points by transferring them to my Chase Sapphire Reserve card (also offering a 60,000 point sign up bonus right now). With the Sapphire Reserve card, I can get 1.5x the points value by booking cruises, flights, hotels, or rental cars through their travel portal. Or 1.25x value by reimbursing myself for groceries. That turns the 75,000 points into $1,125 of free travel or $937.50 of free groceries. For example, I used 165,000 Chase Ultimate Reward points to pay for the $2,475 in taxes, fees, and gratuities on two of my fall cruises. Or I can transfer those Ultimate rewards points to over a dozen travel partners’ airline/hotel programs like United, Southwest, or Hyatt.

Capital One VentureX card

Another favorite travel card in my wallet is the Capital One Venture X card. The Venture X card is a “keeper” for me. First off, it comes with a $750 sign up bonus after spending $4,000 in the first three months. The bonus is paid in the form of 75,000 bonus points that you can redeem against any travel purchases from anywhere. Then you earn a solid 2 points per dollar spent forever! The other big perk is airport lounge access. You can get yourself plus unlimited guests into Priority Pass lounges. And you plus two guests can get into Plaza Premium network lounges and Capital One Lounges.

The Capital One Venture X card does have one catch – a $395 annual fee. But they reward you every year with a somewhat easy to use $300 travel discount plus $100 worth of points. Together, that makes $400 they give you annually which completely offsets the annual fee. Another benefit worth mentioning: you can add up to four authorized users for free, and they also get all the benefits of the Venture X card including the valuable airport lounge access. We used this perk to “gift” a pair of Venture X cards with airport lounge access to my brother in law and his wife to use on their family trip back home to Cambodia in April with their two young children.

Since the annual fee is offset in full by travel credits each year, I personally plan on keeping the Venture X card forever since the card benefits are so great.

Groceries – $947:

This month’s grocery spending was about double what we spent last month. I think this category of spending is somewhat lumpy – we buy in bulk occasionally when a deal presents itself. Then we consume from our “stash” until the next sale. March had better sales than February I guess.

The timing of our purchases also makes our month to month spending very lumpy. We can spend $300 pretty easily in a single grocery run if we hit multiple stores and stock up on staples. It looks like we didn’t shop much in late February, then we went on a big grocery run on March 2nd.

We also had several large grocery purchases at the end of March right before month-end. Part of that was to make sure our college student kids don’t starve while we are gone for half of April.

Utilities – $280:

We spent $162 on our water/sewer/trash bill.

The natural gas bill, which provides heating and hot water, totaled $118 for last month. Heat usage is trailing off as it gets warmer outside. In fact, we’ve had the AC on the past several days due to temperatures in the mid-80’s.

No electricity payments last month since I paid the bill in the very beginning of April.

Entertainment – $160:

I bought a new bicycle for $160 last month. It was more than half off the list price. I am still not sure if I’ll keep it or return it and find a better bike. Once I got the bike fully assembled I realized that it’s probably an inch too tall for me to ride comfortably. The website had the wrong pic in the listing page for this bike.

My old bike was stolen out of our back shed a couple months ago unfortunately. The monetary loss isn’t that big. But it’s a hassle to find a new bike that I like and that is as comfortable as my old bike. And I’ll spend a while (and a few dollars) adding some little tweaks to get the new bike just how I like it.

Clothing/Shoes – $151:

Four pairs of Saucony shoes for the ladies in the house.

Gas – $73:

Both of our cars were running low on gas during March. It cost $73 to refuel both cars for our routine driving around town.

I included the gas that we bought on our road trip separately in the “travel” category.

Healthcare/Medical/Dental – $37:

Our current 2024 health insurance is free, thanks to very generous Affordable Care Act subsidies that we receive due to our low ~$48,000 per year Adjusted Gross Income.

Our 2024 dental insurance plan costs $37 in premiums per month. We picked a plan from Truassure through the healthcare.gov exchange. The dental insurance does a good job of covering routine cleanings, exams, and x-rays plus most of the cost of basic procedures like fillings.

Restaurants – $24:

To celebrate a birthday, I picked up some Chinese takeout. They sell it by the pound and we got about 4 pounds. Two big trays of meat plus a few egg rolls and some doughnuts.

Cable/Satellite/Internet – $0:

We generally pay $18 per month for a local reduced rate package due to having a lower income and having kids. 50 mbit/s download, 10 mbit/s upload. Right now the cost of the internet service is temporarily reduced to $0 due to the “Affordable Connectivity Program”.

My internet company recently included a note on the bill that the ACP program will be ending in April. So we might have to pay for internet in May or June once the stimmies run out. And it appears the new “reduced rate” plan will cost a bit more at $20 or $25 per month.

On the upside, Spectrum gave us a year of free unlimited cell service as a consolation prize for losing the ACP benefit. Free cell service will save us $30+ compared to what we normally spend on a year of cell service.

Spending for 2024 – Year to Date

We spent $7,099 for the first three months of 2024. This annual spending is about $2,900 less than the budgeted $10,000 for three months per our $40,000 annual early retirement budget. I haven’t increased our annual budget for inflation in a decade, so at some point I need to revisit the budget numbers. But so far, so good! No need to give ourselves a raise if we’re managing just fine within the current budget.

We spent slightly more than our budget during March. However, 2024 is shaping up to be a relatively modest spending year so far. Our summer plans have us staying in Poland for two months and it’s one of the more affordable developed nations in the world. We’re also scheduled to take four cruises during 2024 but virtually all of the expenses are paid already other than uber or transit to get to/from the cruise ports.

An update on college costs

I had some comments recently asking how we’re paying for two kids in college, so I’ll take a minute to address that. Several years ago I wrote a summary of our plans to tackle college costs. Now that we’re in the middle, or end, of college for our two oldest kids, I can say it’s working out pretty well so far.

Both college kids have received financial aid in excess of their tuition and books during each semester of college. Sometimes several thousand dollars of extra financial aid, including the subsidized 0% interest federal loans that they take.

I give them the choice to spend or invest the surplus as they like. Substantially all of it ends up in investments for their future needs (new/used car, house down payment, trip around the world, epic totally awesome gaming PC, early retirement, etc). One of the kids got a part time job and has some spare cash from that, too.

It’s looking like each kid has a year or two left until they graduate with a bachelors degree. We don’t have the financial aid packages for the fall yet, but it’s likely that they will have most or all of their tuition and fees covered.

We have pretty sizeable 529 accounts to cover any shortfalls. If I’m actually paying anything out of the 529, then I’ll treat it as an expense in my numbers here in these monthly updates. But if the kids cover the costs from their financial aid awards, I don’t include their spending in my numbers.

To summarize, we’ve experienced very minimal out of pocket costs for college so far. Financial aid appears to be available to cover most or all tuition, fees, and books. In the event it’s not sufficient, our 529 accounts are more than adequate to cover shortfalls.

It’s also worth mentioning that both college kids live at home right now. We cover their housing, transportation (car, insurance, gas), and groceries. Tech toys and entertainment are their responsibility. Clothes are their responsibility beyond age 18 (a new rule!).

Monthly Expense Summary for 2024:

Summary of annual spending from more than a decade of my early retirement:

- 2014 – $34,352

- 2015 – $23,802

- 2016 – $38,991

- 2017 – $31,708

- 2018 – $29,058

- 2019 – $25,630

- 2020 – $28,466

- 2021 – $31,740

- 2022 – $29,449

- 2023 – $37,865

- 2024 – $7,099 (through 3/31/2024)

Net Worth: $3,129,000 (+$127,000)

What a month, huh? Great stock market returns pushed our net worth another $127,000 higher during March. That’s a good 3 or 4 years of living expenses generated in 31 short days.

I did my part to help stimulate the economy and keep this bull market running by booking three cruises. I’ll help out my international investments this summer while we’re running around Poland for two months. Maybe we’ll even overspend our budget this year!

For the curious, our net worth reported above includes our home value (which is fully paid off). I value the house at $300,000, which is probably what we would net after sales expenses. However, please note that I don’t consider my home value as part of my portfolio for “4% rule” calculation purposes. I realize folks ask me about that every month so I just wanted to state that here for clarity.

Life update

We’re entering a busy period of travel, so I made sure to push out a very early (for me) monthly update before I get distracted.

We only have slightly over two months at home in Raleigh between now and the end of September. I don’t know how we’ll manage with all this travel but I hope we can keep up. Laptops and phones will keep us connected and we live a fairly simple life overall.

In our family’s personal lives, there are a lot of unknowns that will be answered in the next week or two. Both of our kids have applied to transfer to four year universities for the fall, and the admission decisions for the most desirable schools are due very soon. We are anxiously awaiting this news to find out where they’re headed in the fall. They are both admitted to a very decent backup school already, so it’s just a matter of waiting for even better news right now.

This anticipated news also means that another kid of course might be too busy to travel with us during the summer of 2025. In that case, we’ll be down to three of us traveling (2 parents plus a soon-to-be 12 year old). I’m pretty ambivalent about this change. On the one hand it’s great to see our kids grow up but on the other hand, where did the time go?!

Okay folks, that’s it from me. Time to go hop on a cruise! See you again next month!

Any big exciting plans coming up this spring or summer for you?

Want to get the latest posts from Root of Good? Make sure to subscribe on Facebook, Twitter, or by email (in the box at the top of the page) or RSS feed reader.

Related

Root of Good Recommends:

- Personal Capital* – It’s the best FREE way to track your spending, income, and entire investment portfolio all in one place. Did I mention it’s FREE?

- Interactive Brokers $1,000 bonus* – Get a $1,000 bonus when you transfer $100,000 to Interactive Brokers zero fee brokerage account. For transfers under $100,000 get 1% bonus on whatever you transfer

- $750+ bonus with a new business credit card from Chase* – We score $10,000 worth of free travel every year from credit card sign up bonuses. Get your free travel, too.

- Use a shopping portal like Ebates* and save more on everything you buy online. Get a $10 bonus* when you sign up now.

- Google Fi* – Use the link and save $20 on unlimited calls and texts for US cell service plus 200+ countries of free international coverage. Only $20 per month plus $10 per GB data.

* Affiliate links. If you click on a link and do business with these companies, we may earn a small commission.

[ad_2]