[ad_1]

Wagely, a fintech out of Indonesia, made a name for itself with earned wage access: a way for workers in Southeast Asian countries to get advances on their salaries without resorting to higher-interest loans. With half a million people now using the platform, the startup has expanded that business into a wider “financial wellness” platform, and to give that effort an extra push, the company’s now raised $23 million.

The news is especially notable given the funding crash that startups in Indonesia have faced in the last couple of years, underscoring how developing countries have been hit even harder than developed markets in in the current bear market for technology. Indonesia’s Financial Services Authority in January said that Indonesian startup funding was down 87% in 2023 compared to a year before, down to $400 million from $3.3 billion.

That economic pressure is not exclusive to startups: ordinary people are under even more pressure.

While the consumption of goods and services has grown significantly, salary growth across sectors has not kept up. Workers are on the lookout for solutions including credit to meet their needs between fixed-payroll cycles.

But access to credit is not all-pervasive.

Millions of workers are underbanked and lack credit history. In some cases, such workers are forced to find alternatives, which can be to find a job that pays wages in a shorter interval than a traditional pay cycle of a month. This results in a higher attrition rate for employers. Similarly, workers who cannot loan money from a bank or financial institution in the event of an emergency often get trapped by loan sharks, who charge exorbitant interest rates and follow predatory practices. It’s no surprise that earned wage access has been held up by global banking institutions like JP Morgan as a financial panacea: it’s important for both employees and employers.

The concept of earned wage access has been prevalent among companies in developed markets like the U.S. and U.K. — especially after the COVID-19 pandemic impacted jobs and household incomes for many individuals. In 2022, Walmart acquired earned wage access provider Even to offer early pay access to its employees. Other big U.S. companies, including Amazon, McDonald’s and Uber, also offer employees early wage access programs.

Wagely, headquartered in Jakarta, brought that model to Indonesia in 2020 and entered Bangladesh in 2021. The startup believes offering earned wage access in these markets is even crucial, since 75% of Asian workers live paycheck to paycheck and have significantly lower salaries than their counterparts in the U.S. and other developed countries.

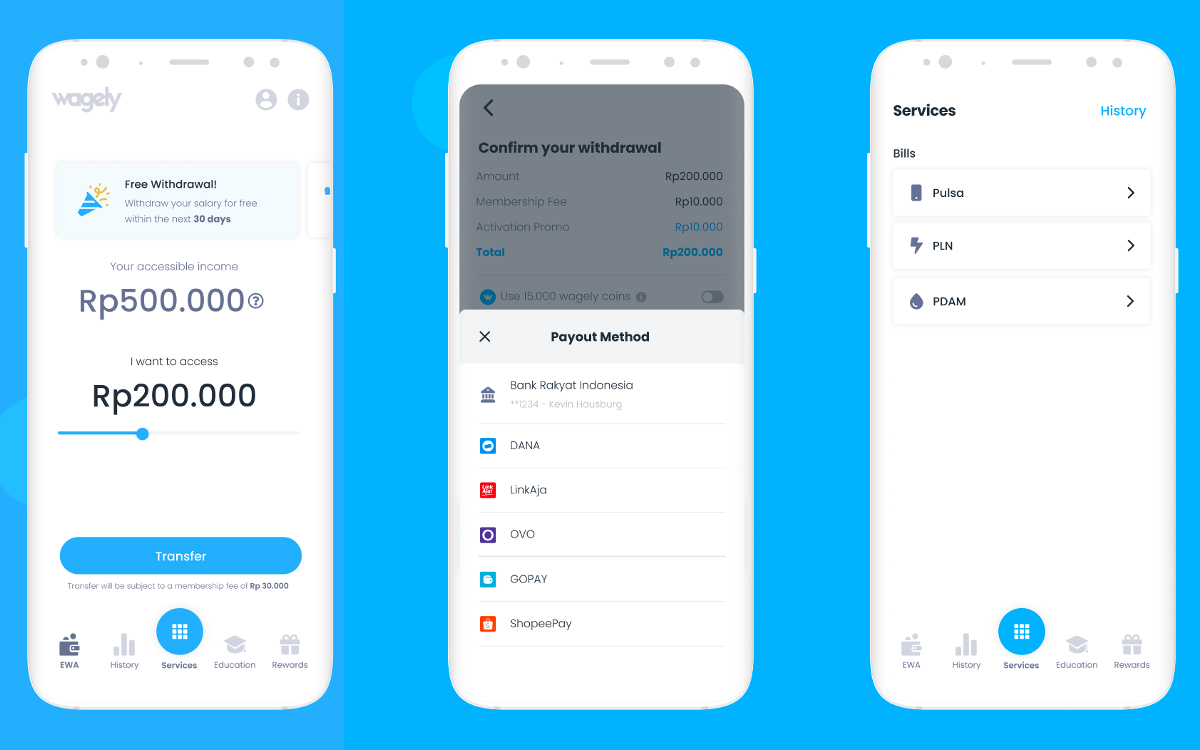

Image Credits: Wagely

“We’re partnering with companies to provide their workers a way to withdraw their salaries on any day of the month,” Kevin Hausburg, co-founder and CEO at Wagely, said in an interview.

Like other earned wage access providers, Wagely charges a nominal flat membership fee to employees withdrawing their salaries early.

Hausburg told TechCrunch the fee, which he describes as a “salary ATM charge,” generally stays between $1 and $2.50, depending on the partial wage employees withdraw, as well as their location and financial well-being.

Wagely, which has a headcount of about 100 employees, with approximately 60 in Indonesia and the remaining 40 in Bangladesh, has disbursed over $25 million in salaries in 2023 alone through nearly one million transactions and serving 500,000 workers.

Since its last funding round announced in March 2022, the startup, the founder said, saw about five times growth in its revenues and tripled its business from last year, without disclosing the specifics. These revenues come solely from the membership fee that the startup charges employees. Nonetheless, it still burns cash.

“We’re burning cash because it’s a volume game,” said Hausburg. “However, the margins and the business model itself is sustainable at scale.”

While Wagely has been Southeast Asia’s early earned wage access provider, the region has added a few new players. This means the startup has some competition. Also, there are global companies with the potential to take on Wagely by entering Indonesia and Bangladesh over time.

However, Hausburg said the convenience makes the startup a distinct player. It takes three taps from downloading Wagely’s app or accessing its website through a browser to having money in your bank account, the founder stated.

“This is something that no other competitor is even close to because other earned wage access companies are focusing on different things,” he said.

One of the areas where global earned wage access providers have shifted their focus nowadays is lending — in some cases, to lend money to employers. Some platforms also include advertising to generate revenues by offering different products they cross-sell to workers. However, Hausburg said the startup did not go with advertising or any other services that did not make any sense for the workers it services.

“Focus on what your customers need. Don’t get distracted, and don’t try to optimize for short-term revenue,” he noted.

Wagely’s business model works on economies of scale. That is, to become profitable, it needs to expand from half a million people to multiple millions.

With Capria Ventures leading this latest round, the startup plans to utilize the funding to go deeper into Indonesia and Bangladesh, expand into financial services, including savings and insurance, and explore generative AI-based use cases, including automated document processing and local language conversational interfaces for workers.

Recently, Wagely partnered with Bangladesh’s commercial bank Mutual Trust Bank and Visa to launch a prepaid salary card for employees in the country, which has a smartphone penetration rate of around 40% but a vast infrastructure for card-based payments and ATMs. It’s keeping an eye on other Asian countries but does not have immediate to enter any new markets anytime soon, the founder said.

Wagely is not disclosing the amount of debt versus equity in this round but has confirmed it’s a mixture of the two. The debt portion would be specifically used to fund salary disbursements. It was also the first time the startup, which received a total of about $15 million in equity before this funding round, raised a debt.

“It is unsustainable to grow the business just with equity, especially because we are pre-disbursing earned salaries to workers, and the only way that you can build this business sustainably is with having a very strong partner on the debt side that provides you that capital. And now was the time,” Hausburg told TechCrunch.

Employers do not provide advance payment of wages by themselves; instead, they reimburse Wagely for the amount disbursed to employees at the end of the pay cycle. This requires the startup to maintain a sufficient reserve to cover advance wages for employees registered on the platform. The startup conducts “rigorous checks” on employer partners and works with publicly listed and well-compliant, reputable private companies to mitigate the risk of non-repayment by employers for the advanced wages provided to employees after the pay cycle concludes.

“The Wagely team has demonstrated excellent execution with impressive growth in providing a sustainable and win-win financial solution for underserved blue-collar workers and employers,” said Dave Richards, managing partner, Capria Ventures, in a prepared statement.

[ad_2]