[ad_1]

How Rental Property Depreciation Works & How to Calculate It

As an investor in real estate, rental property depreciation is a concept that may have been on your radar, but you haven’t had the chance to grasp it fully yet.

Depreciation is actually an easy concept to understand, much simpler than you may have initially thought.

But before we begin, it’s important to note that the most suitable expert for your specific needs would be a tax professional in your local area.

Understanding and complying with local or state regulations and rental property tax laws can be complex.

So make sure that you’re following all the necessary steps accurately.

Now, here’s what you should know to grasp rental property depreciation as real estate investors.

What Is Rental Property Depreciation?

When you acquire a rental property, specifically an investment property, you inherit all the expenses, such as maintenance expenses.

This also includes all the expenses associated with enhancing and managing the property.

Since you make money from it, possessing and renting property is considered a business venture. You must also report any money you produce on your taxes.

Property is an asset that allows you to earn money comparable to a business and the equipment or machinery it purchases to make its product.

Over time, the value of these manufacturing machinery or your leased property depreciates.

So, the IRS offers a break by presuming that your investment property would depreciate over a period of time as you rent and maintain it.

It enables you to deduct the expenditures and loss of value over time.

Property and significant equipment may also face economic depreciation.

Economic depreciation is a fall in asset value caused by unfavorable factors, such as an overall drop in real estate prices.

How Rental Property Depreciation Works

When it comes to rental property depreciation, there are various aspects to consider.

You’ll need to know which system to employ, if the property is depreciable, when to begin depreciating it, and what the tax implications are.

Starting Depreciation

First of all, keep in mind when you could start depreciating your rental property.

Begin depreciating your own residential rental property when it is ready to rent, not when it is leased.

If you acquire rental real estate and are prepared to rent it on the first day, but it doesn’t rent for two weeks, you may begin depreciating it from the day it was ready to rent.

When you no longer own the rental property or have recovered your basis or the money you spent purchasing and maintaining it, you will cease depreciating it.

Consider the following information regarding instances where depreciation starts and ends:

Placed in service

Assume you had your rental property ready to go on March 10 but did not locate a renter until June 30.

Even if no one moved in until the end of June, you may begin claiming depreciation on the rental property as of March 10.

Suppose you decided to replace the rental’s roof in October 2023, but construction begins in December 2023, and poor weather delays completion until March 2024.

In that case, you cannot depreciate the new roof cost until 2024.

Depreciation starts on the day the item is brought into operation and is available for use as intended.

Idle property

Even idle property might be depreciated.

This implies that you may continue to depreciate your residential rental home while preparing it for a new tenant or wait to re-rent it after someone leaves.

Cost basis fully recovered

Once you have recovered the cost of purchasing or maintaining the property, you must cease depreciating it.

You may only claim depreciation after your cost basis has been completely recovered.

Even if you did not utilize the depreciation claim, you could not file a claim for more than the entire amount of the rental property.

Retired from service

You can’t claim depreciation on a rental property withdrawn from service.

When you leave the property or convert it to personal use, it no longer qualifies as an income-producing activity, and you are no longer eligible to claim depreciation.

Furthermore, if the object is destroyed, sold, or exchanged, you will lose the opportunity to claim depreciation.

Depreciable Rental Property

Rental property owners discover that most of their properties are depreciable since the fundamental requirement for depreciation is that the property be an investment or company, not their primary home.

You will need to lease the space to a tenant, whether residential or commercial.

Here are a few more rules:

- You must have owned the property for at least a year.

- The property must withstand wear and tear.

- You must own the property, which means you are not renting it from another investor.

- It must have an established useful life.

Almost every real estate investment, mainly residential rental buildings, should meet these criteria.

Additionally, working with a qualified tax accountant can help you navigate the specific rules and benefits related to your property’s business use.

You may also find a rental property depreciation calculator useful for determining the depreciation schedule for your property.

Still, I will show you how to calculate it on your own later.

Depreciation Systems

The depreciation method utilized for residential rental properties that were put into service after 1986 is the Modified Accelerated Cost Recovery System (MACRS).

This accounting technique amortizes expenses over 27.5 or 30 years, depending on the procedure employed.

This is the “useful life” period defined by the IRS for a rental property.

Depreciation is calculated using either the Alternative Depreciation System (ADS) or the General Depreciation System (GDS).

Your tax approach and the kind of property will determine whether you use the ADS or the GDS. Of course, you’ll utilize a GDS since it’s the conventional approach for listing rental homes.

However, in the following instances, ADS is necessary, especially when:

- The property is mainly utilized for farming.

- The property is funded with tax-exempt bonds or serves a tax-exempt purpose.

- The property is used for business 50 percent or less of the time.

You may also use ADS if it allows for further depreciation deductions.

Talk to an experienced tax professional about your alternatives. It is a great way to make the best decision for your case.

Tax Concerns

Investing in rental property may be a wise financial decision.

For starters, a rental property may offer a consistent income stream as you create equity in the property, which (hopefully) rises over time.

There are also some tax advantages.

You may often deduct your rental expenditures from any rental revenue you make, reducing your total tax obligation.

Most rental property expenditures, such as mortgage insurance, property taxes, repair and maintenance costs, home office expenses, insurance, professional services, and management-related travel expenses, are deductible in the year they are incurred.

Another vital tax benefit, the depreciation allowance, operates somewhat differently.

Depreciation is a deduction for the expenses of purchasing and renovating a rental property.

Instead of claiming a single substantial deduction in the year you buy (or enhance) the property, depreciation spreads the deduction throughout the property’s useful life.

If you rent out real estate, you usually record your rental income and costs for each rental property on the relevant line of Schedule E when filing your annual tax return.

The net gain or loss is subsequently reported on your 1040 form.

Depreciation is one of the costs you’ll list on Schedule E, so the depreciation amount effectively decreases your annual tax bill.

How to Calculate Rental Property Depreciation?

Below is how to calculate the amount of real estate depreciation for a rental property.

But I still suggest you work with a tax professional or a property management agency since the process might be complicated.

1. Know the cost basis of the property.

The cost basis refers to how much you spent on the property.

It takes into account some expenses, such as closing costs, but it also counts every cent you spend to purchase the property.

However, some charges (such as insurance payments) cannot be included in the property’s cost base.

For example, if you paid $5,000 in closing fees after purchasing your home for $200,000, your cost basis would be $205,000.

Take note: If you cannot immediately put your property into service (i.e., rent it out), you may need to adjust your cost base accordingly.

For example, you would have to raise or lower your cost base if you wait a while before putting it on the market.

2. Divide the cost basis by Useful Life.

Now that you understand the cost foundation, you may divide it by the useful life.

Again, the GDS states that the useful life of residential rental properties is 27.5.

Therefore, the computation would be $205,000 / 27.5 = $7,454.45.

In this case, you would be entitled to deduct $7,454.45 in yearly property depreciation.

If you own numerous rental properties, you must record depreciation for each one separately.

This might be stressful, so it doesn’t hurt to hire a property management agency to assist you when tax time arrives.

How to Claim the Special Depreciation Allowance?

Certain rental properties may be eligible for a specific depreciation allowance, allowing you to write off a portion of the asset’s purchase price during the tax year it is put into use.

Certain properties purchased before September 2017 and those purchased after that date are eligible for this special depreciation exemption.

Before utilizing this allowance, make sure your property qualifies because the conditions for claiming this extra depreciation are tight.

Other Things to Focus on

The annual amount of depreciation that you can deduct depends on several factors.

Again, if you need help deciding what to include in your depreciation computation, have an accountant assist you.

It would be best to establish a determining basis for the building and the property.

The IRS will not let you utilize the amount you paid for the building and the property as the basis.

Determining Cost Basis

The amount you spend on the property, whether with cash, a mortgage, or another method, forms the basis of the asset.

The basis includes some settlement and closing costs, legal fees, recording fees, transfer taxes, surveys, title insurance, and any sum you promised to pay (like back taxes) at the time you bought the property.

You cannot incorporate all settlement fees and closing costs on your own.

These consist of rent for the property’s tenancy before closing, fire insurance premiums, and fees associated with obtaining or refinancing a loan, such as points, mortgage insurance premiums, credit report expenses, and appraisal fees.

Let us say you spent $205,000 on a house.

To determine your basis, you’ll probably need to utilize the most recent real estate tax assessment.

This typically splits the property into land and building tax values. The tax office in your county usually has this information.

Your basis would be $174,250 (85% of $205,000) if you discovered that your basis in the home was 85% of the entire value.

The base of the land would be $30,750. Next, you must determine which adjusted basis to apply for calculating depreciation.

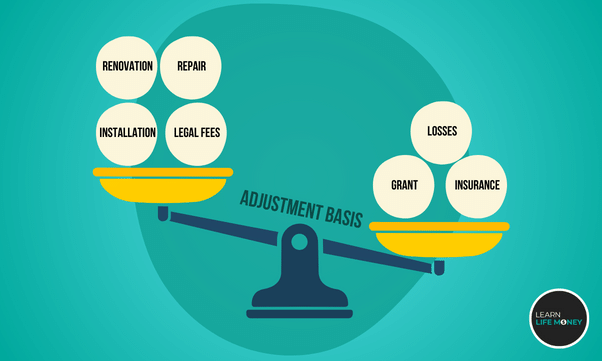

Determining Adjusted Basis

If something happens between purchasing the property and preparing it for rental, you could need to adjust your foundation.

The cost of any renovations or additions made before the property is put into service with a useful life of at least a year.

Aside from that, the money spent on repairing damaged property, the price of installing utility services, and some legal fees are examples of increases to the base.

Deductions from the basis may come from money you receive to grant an easement, insurance payments you receive for theft or damage, and casualty losses not covered by insurance for which you made a deduction.

What Rental Property Can’t Be Depreciated?

There are regulations governing the depreciation write-off process.

The following items are not eligible for a depreciation deduction on a tax return:

- Dirt and rocks remain dirt and rocks ten years later. Work with an accountant to assess the structure’s value concerning the land value and then depreciate just the structure.

- If you live in the property, you cannot depreciate it.

- After 27.5 years, you cannot depreciate a residential property.

Final Thoughts Rental Property Depreciation

Depreciation may be beneficial if you invest in rental properties since it enables you to stretch out the expense of purchasing the property over decades, lowering your annual tax burden.

Of course, if you depreciate something and sell it for more than its depreciated worth, you must pay depreciation recapture tax on the excess gain.

Because rental property tax regulations are intricate and change frequently, I suggest you consult an experienced tax professional before starting, managing, and selling your rental property company.

This will allow you to achieve the most beneficial tax treatment while avoiding surprises at tax time.

Frequently Asked Questions on Rental Property Depreciation

Can I claim depreciation on my rental property if I don’t make a profit?

Yes, you can claim depreciation on your rental property even if you don’t make a profit. Depreciation is a non-cash expense, meaning you can deduct it from your taxable income regardless of your property’s profitability.

Are there any limits to rental property depreciation?

Yes, there are limits to the amount of depreciation you can claim each year. The IRS sets depreciation schedules based on the type of property and its useful life.

What happens to depreciation when I sell my rental property?

When you sell your rental property, you may have to recapture some or all of the depreciation you claimed as ordinary income. This is known as depreciation recapture.

What is the Straight-Line Depreciation?

The straight-line method is a strategy for determining an asset’s decline in value over a specified period. This depreciation calculation implies that the asset’s value decreases by the same amount annually. Using this way, you can readily determine the annual depreciation amount on your rental property during a given year.

Do I need to hire a tax professional to calculate rental property depreciation?

While you can calculate rental property depreciation independently, involving a qualified tax professional can help ensure you are taking full advantage of all available deductions and complying with tax laws.

Where can I find more information about rental property depreciation?

The IRS provides detailed information about rental property depreciation in Publication 946, “How To Depreciate Property.” You can also consult with a tax professional for personalized advice.

[ad_2]