[ad_1]

Four things I’m thinking about at the moment:

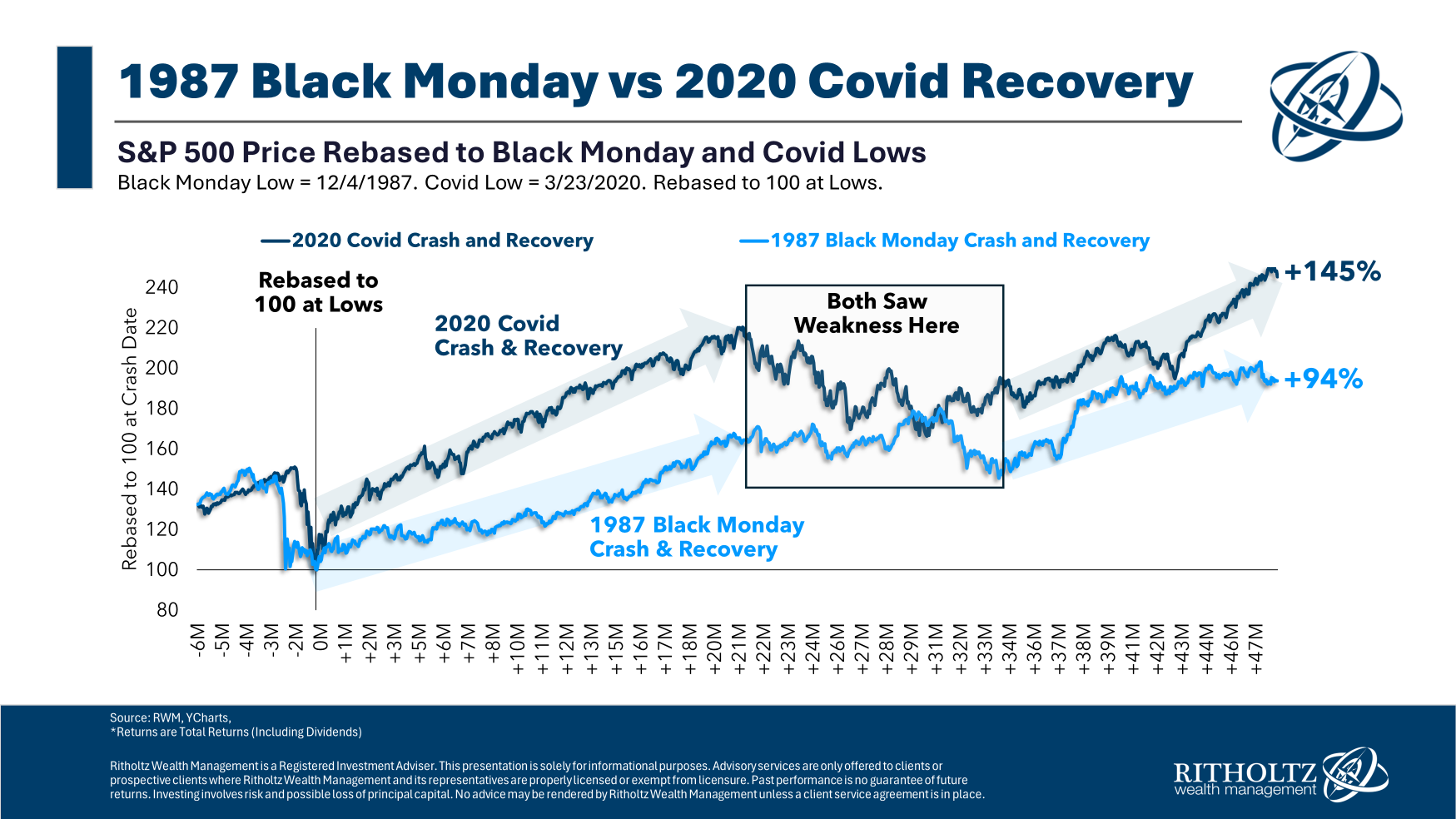

1. The Covid Crash was our 1987 crash. In the 15 trading days from October 6th through October 26th in 1987, the S&P 500 was down 31%. That plunge includes Black Monday which saw the market fall more than 20% in a single day.

Over the next four years from the bottom the S&P 500 was up a little less than 110% in total. It was a wonderful buying opportunity.

In the 26 trading days from late February 20th through March 23rd in 2020, the S&P 500 was down 34%.

In the four years or so since the bottom of the Covid Crash in March 2020, the S&P 500 is now up nearly 150% in total. It was a wonderful buying opportunity.

The bull market lasted well over another decade following the 1987 debacle. I don’t think we’ll be that lucky this time around but the Covid Crash is eerily similar to Black Monday.

2. People with money continue to spend money. I’m on spring break this week with my family in Florida.

Like many places, prices here are noticeably higher. Food, drinks, hotels, experiences — everything is more expensive than it was just a few short years ago.

But that’s not stopping people (me included) from spending money.

I know spring break is not real life, but people with money are willing to keep spending even at elevated prices. This helps explain much of what’s been happening in the economy in recent years.

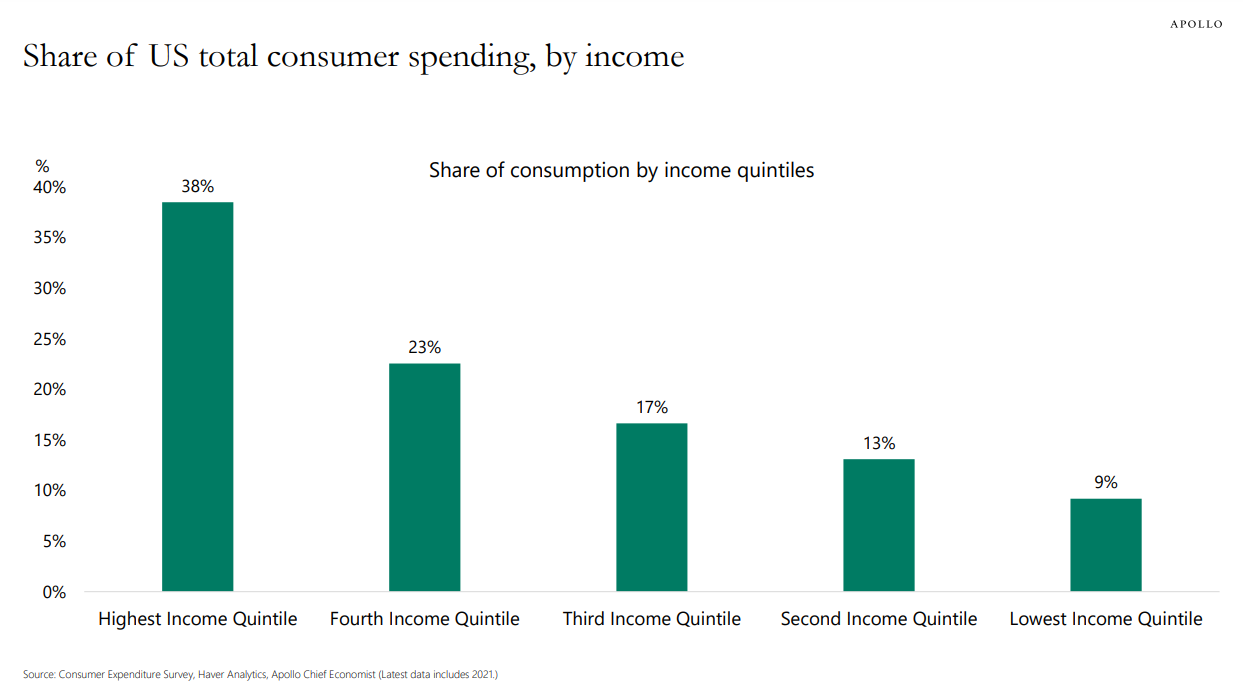

This chart from Torsten Slok shows the share of spending broken out by income:

People with money keep spending it.

Businesses know they have pricing power over consumers and are taking advantage.

Who’s going to blink first?

3. Nothing ages well in the markets. I’ve spent the past few years writing positively about the U.S. economy. I’ve done so not to predict what will happen in the future but to analyze what is happening in the present.

Last week, I made the case that we’re living in our own version of the Roaring 20s.

A permanently bearish guy who wears a bow tie1 even poked fun at my analogy by pointing out the original Roaring 20s ended in the Great Depression.

Jeez, I never thought of that.

I get it. I’m probably too glass-is-half-full most of the time.

But pointing out that good times are usually followed by bad times is not an original thought.

Of course today’s good times will end badly at some point!

There’s going to be a recession. There’s going to be a stock market crash. We’re going to find out who’s been swimming naked when Mike Tyson punches you in the face and all of that stuff.

Many people said my piece wouldn’t age well. The people who have been forecasting a recession for three straight years didn’t age well either.

The thing is, nothing ages well in the markets because they’re constantly changing. Markets are always and forever cyclical.

But the booms always more than make up for the busts.

Constantly predicting the end times might help you gain subscribers but it doesn’t help people make money.

If you don’t enjoy the booms because you’re always worried about the busts you’re never going to get ahead.

4. I would bet on weather & water in the housing market. With the caveat that long-term trends are notoriously hard to predict, the two housing themes I’m most bullish on in the coming decades are good weather and water.

I’ve traveled to Florida a handful of times in the past few years, and every time I check Zillow, the housing prices seem to keep rising.

The pandemic had something to do with this but you also have 10,00 baby boomers retiring every day and many of them want warm weather.

There are 70 million baby boomers and they control something like $70 trillion in assets. We’re looking at 10-15 years of boomers buying places in Florida, Arizona, the Carolinas and other warm destinations.

Most of them have paid off mortgages and an obscene amount of home equity. Good luck betting against this trend.

They have a lot of money money and are ready to enjoy retirement so most boomers won’t worry about sky-rocketing insurance premiums. They’ll roll the dice.

By the time the baby boomers die off the oldest millennials will start thinking about early retirement and Gen X will already be there.2

At that point we could actually see a reverse migration to the north and more moderate climate as the heat in the south becomes more unbearable in the summers.

Owning real estate by the Great Lakes is my personal climate change hedge for the next 10-30 years.

Michael and I talked the stock market, consumer spending, economic commentary, wealth inequality, Florida and more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Are We Living in the Roaring 20s?

Now here’s what I’ve been reading lately:

Books:

1If you’re in finance and wear a bow tie there’s a 95% chance you’re a permabear. Those are the rules.

2Crazy but true. I’m 42 (going on 43) and technically the oldest millennial alive. The baby boomers have 20-30 years in retirement. By the time most boomers are in their 90s, the oldest millennials like me will be in their 60s and thinking about retirement.

[ad_2]