[ad_1]

What is a CFO KPI?

What is kpi in business? A CFO Key Performance Indicator (KPI) or metric is a quantifiable high level measure of financial performance. These KPIs can be considered a specific subset of financial KPIs, used to help a CFO make informed decisions that steer their company in the right direction. These performance metrics can also be used to measure a company’s financial performance relative to competitors in the same industry. Publicly traded companies publish this information in quarterly reports for investors.

What KPIs Should be in a CFO’s Dashboard?

To determine what CFO KPIs are important, we should first look at what CFOs have to deal with on a regular basis. Most CFOs will have to deal with two major tasks at work other than attending thousands of meetings – making important financial decisions for the company, and financial reporting. To aid a CFO with these tasks, a very specific set of financial KPIs have become commonplace and are considered standard practice. Thankfully, some of the KPI gurus at insightsoftware have made a tidy little list for us.

Top 5 Excel Tips & Tricks Every Finance Manager Should Know

Here are the CFO KPI examples that we will be going over in this post:

- Quick Ratio

- Current Ratio

- Working Capital

- Operating Cash Flow

- EBITDA & EBITDA Growth

- Return on Equity

- Total-Debt-to-Equity Ratio

- Accounts Payable Turnover

- Cash Conversion Cycle

- Gross Profit Margin

- Earnings per Share

- Compound Average Growth Rate

- Employee Count

- Interest Coverage Ratio

While this list is not extremely long, it does require a lot of data and data processing to generate these KPIs. Most companies will make use of CFO dashboard software to automate the entire data gathering, processing, and visualization process. Here are a few of the different dashboards that insightsoftware has to offer:

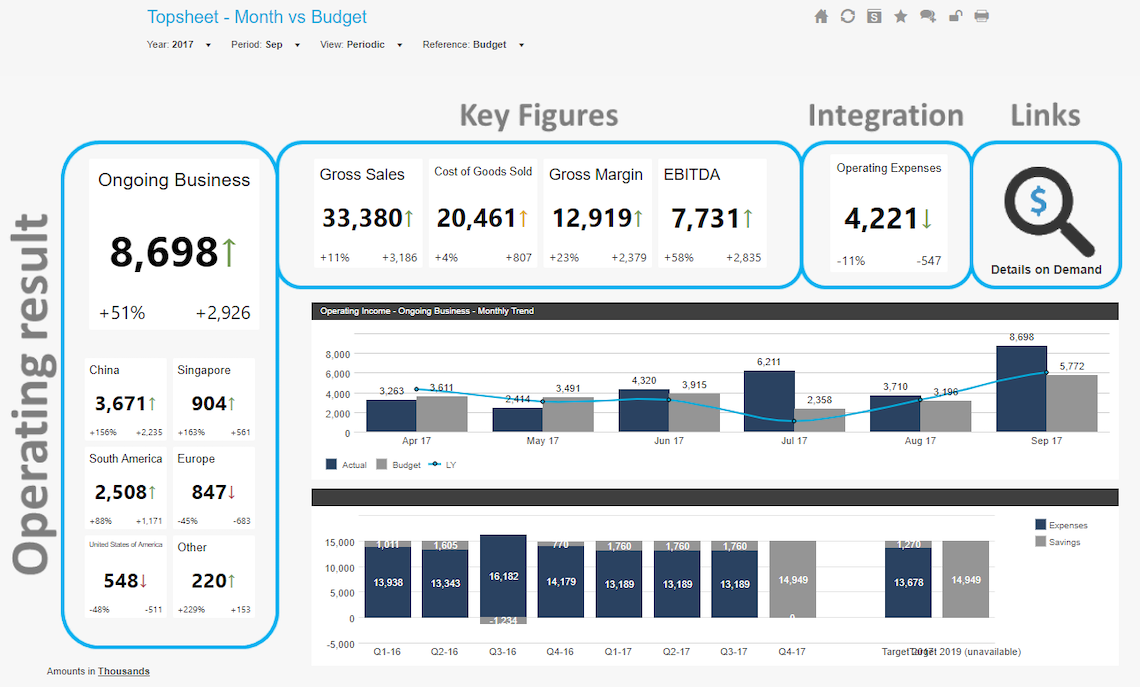

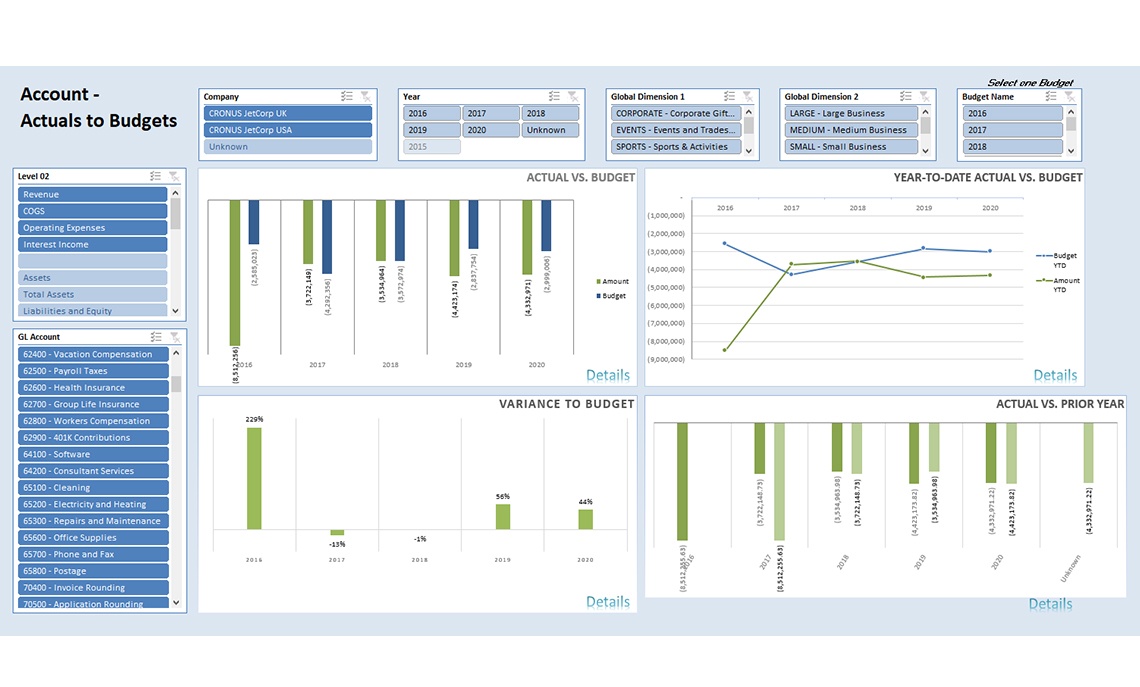

Topsheet Month vs Budget Example CFO Dashboard

Get your own customizable copy of this dashboard template for free here.

This dashboard has been specifically tailored to meet the criteria of a CFO KPI dashboard. All the key financial information for day-to-day operation is front and center, with monthly and quarterly trends available at a glance. This high-level financial overview utilizes predefined narrative template functionality to provide information in an easily consumable format, as well as enabling the CFO to tell the story behind the numbers.

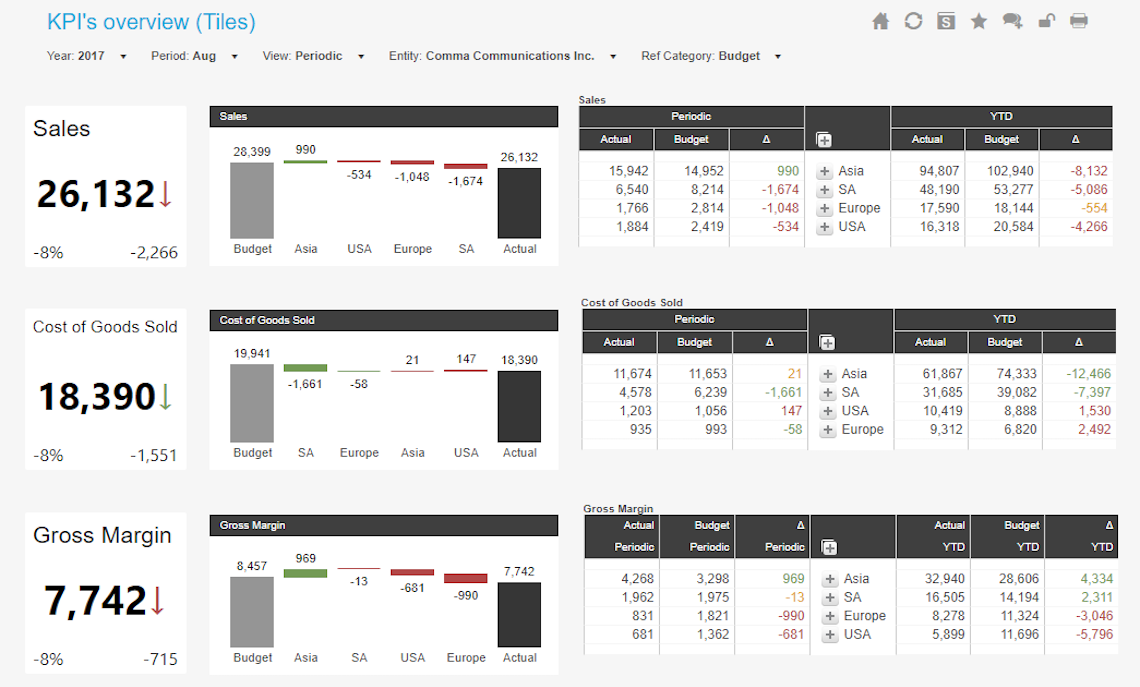

CFO KPI Overview Dashboard Example

Get your own customizable copy of this CFO dashboard template for free here.

For those C-Levels who love looking at data all the time, we have also developed an executive level KPI dashboard. This will help you quickly identify areas of the business that need immediate attention, enabling you to remedy the situation before it gets out of hand. This KPI dashboard utilizes CXO Software’s signature ‘performance tiles’ feature, dynamic waterfall charts, and drillable tables to give you the most relevant information in a user-friendly package. Get more information on this dashboard here.

KPIs and Metrics for the CFO’s Dashboard

The mantra of the corporate world is “time is money”. With this in mind, you can understand why a busy CFO would want financial information available instantly. This has been the driving force behind the development of CFO KPI dashboards and their implementation as standard practice. Here are 13 CFO KPI examples you can expect to see on a CFO dashboard.

- Quick Ratio – The quick ratio is one of the most commonly used CFO KPIs. It allows you to quickly assess the financial health of your company. This health check is accomplished by measuring a company’s ability to immediately fulfill its short term financial obligations. This financial metric should be front and center on a CFO KPI dashboard. Quick Ratio = (Cash + Marketable Securities + Accounts Receivable) / Current Liabilities

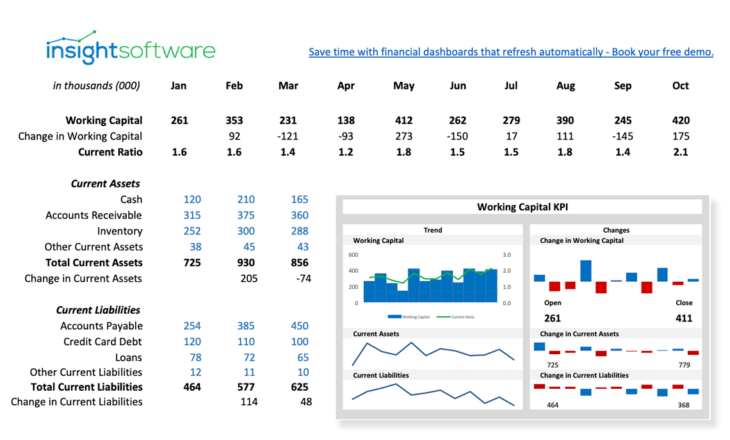

- Current Ratio – This CFO metric is commonly used alongside the quick ratio when assessing the financial well-being of a company. Similar to the quick ratio, it measures the ability to cover financial obligations. However, this financial metric has a longer time horizon associated with it, checking to see if a company can pay its obligations within one year.

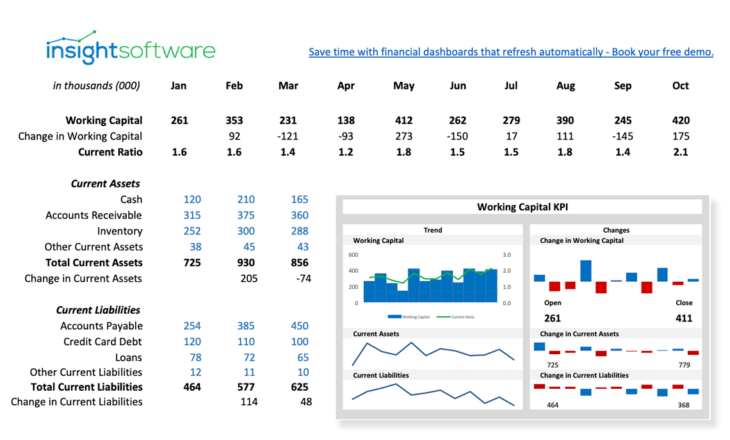

Get your own customizable copy of the Current Ratio dashboard template here. - Working Capital – Most CFOs like to keep an eye on the amount of working capital their company has, as this represents how much they have at their disposal for expansion. This CFO metric is best used in conjunction with the operating cash flow KPI when considering aggressive growth opportunities. Just remember, a cash strapped company is not a healthy company.

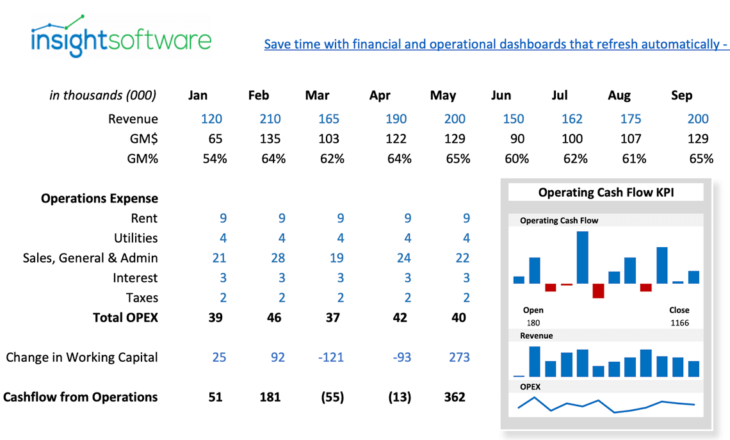

Get your own customizable copy of the Working Capital dashboard template here. - Operating Cash Flow – As its name implies, this financial metric measures how much cash flow is being generated from day-to-day operations. Due to the large amount of data that is often associated with this metric, it is best tracked using CFO dashboard software. As mentioned earlier, CFOs use this information when making CAPEX decisions. A positive cash flow is also viewed positively by creditors providing external financing for CAPEX.

Get your own customizable copy of the Operating Cash Flow dashboard template here. - EBITDA & EBITDA Growth – Earning Before Interest, Taxes, Depreciation, and Amortization. This is a very important metric when it comes to CFO reporting each quarter. It is often used as a substitute to net income as it removes any bias caused by strategic accounting. Most companies make use of financial reporting software to track this financial performance metric as it requires a lot of data crunching.

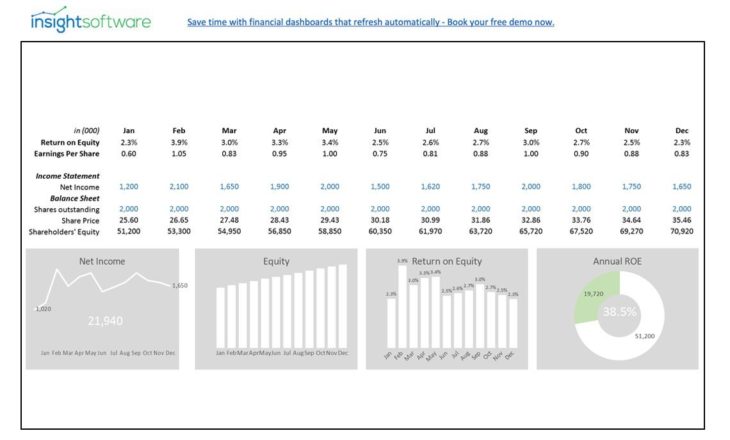

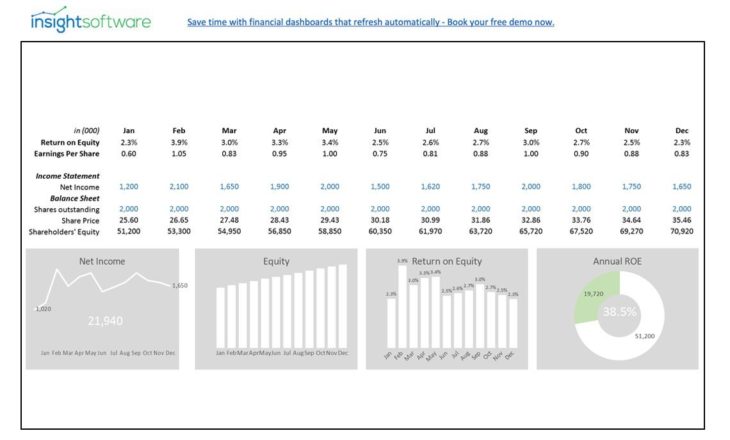

- Return on Equity (ROE) – As an investor or business owner, you care about how well your money is being utilized. This CFO dashboard metric is designed just for that purpose – it assesses the efficiency at which shareholders’ equity is being used. As such, this metric is extremely important for CFO reporting. CFOs, and investors alike, will use this metric to compare the financial performance of companies within the same industry.

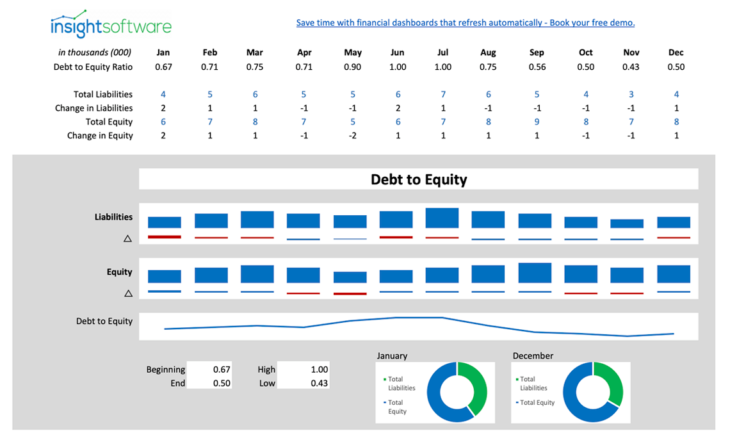

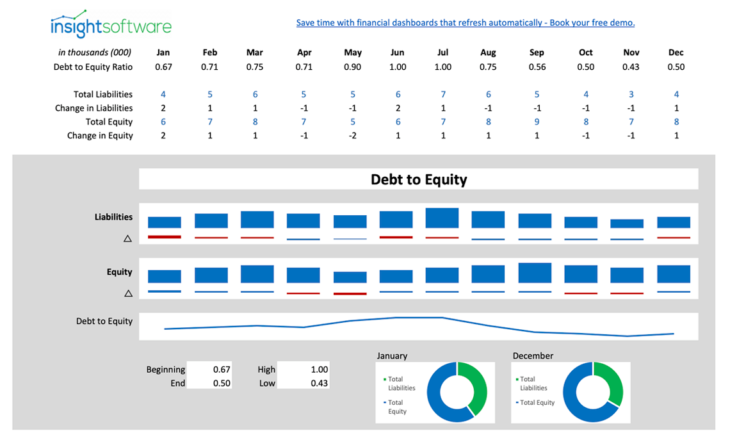

Get your own customizable copy of the Return on Equity dashboard template here. - Total-Debt-to-Equity Ratio – This CFO metric compares the company’s liabilities to its shareholder’s equity. Similarly, you can think of this as comparing how much you owe on your mortgage against how much equity you have in your house. Chief Financial Officers pay attention to this metric as it can be used to indicate when a company has over-extended itself. Large amounts of debt during expansion is normal, but should an economic downturn occur, this could result in bankruptcy.

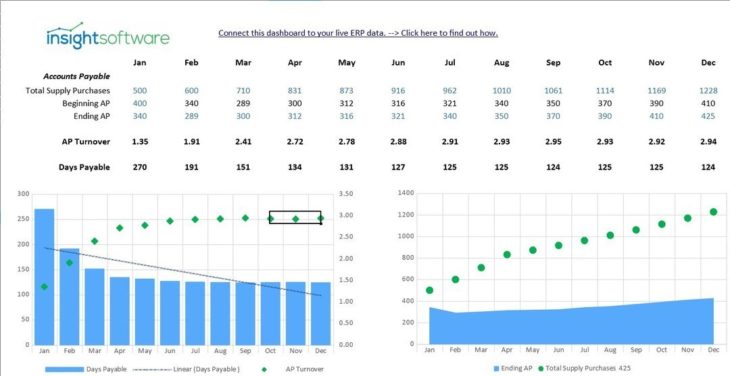

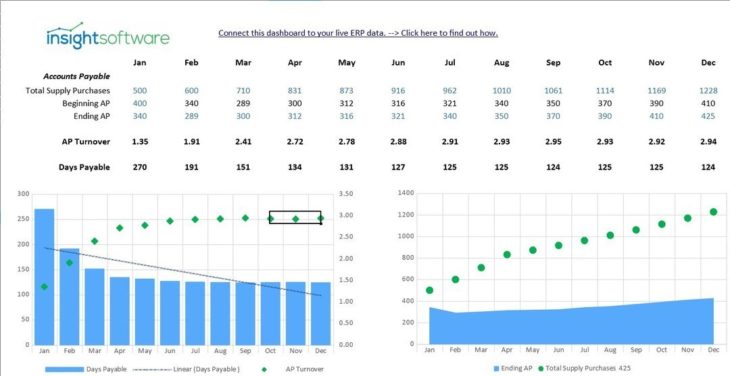

Get your own customizable copy of the Debt to Equity Ratio dashboard template here. - Accounts Payable Turnover – This financial metric is often used by the CFO as a leading indicator of a company’s financial well-being. This CFO dashboard metric measures the amount of time it takes a company to pay its suppliers. A decreasing ratio (meaning the time to pay is getting longer) is one of the first signs of cash flow issues. An increasing ratio, on the other hand, can indicate that a company’s resource allocation is inefficient, and that they could be using the money for something better.

Get your own customizable copy of the AP Turnover Model dashboard template here. - Cash Conversion Cycle (CCC) – Most CFOs like the keep an eye on the cash conversion cycle performance metric as it measures the number of days it takes to convert goods back to cash. This is extremely important when it comes to cash flow analysis and inventory management. This metric is actually comprised of three other financial metrics. As such, it is extremely data heavy and best tracked using financial KPI software. CCC = Days of Inventory Outstanding + Days Sales Outstanding – Days Payables Outstanding

- Gross Profit Margin – This CFO metric should be one of the key highlights on any C-level financial dashboard. The gross profit margin KPI is used to assess the financial health of a company by examining its sales. To do this, it removes the cost of goods sold (COGS) from the revenue, and expresses this as a percentage of revenue. This effectively determines how profitable a company is. A largely fluctuating gross profit margin can often be seen as a sign of poor management.

- Earnings Per Share (EPS) – When it comes to KPIs, nothing says reporting like EPS. This CFO reporting metric is one of two pieces of information every investor wants to know. (The other important figure being revenue). This metric really appeals to investors as it tells them how much money each of their shares is making. It is also a fundamental metric that can be used to compare companies regardless of industry. EPS = (Net Income – Preferred Dividends)/(End-of-Period Common Shares Outstanding)

- Compound Average Growth Rate (CAGR) – The compound average growth rate CFO metric is especially important when it comes to quarterly reports. All investors want to see company growth, whether it be revenue or EPS. This performance metric calculates how much compound growth (positive or negative) the company has achieved over a specific period. To further reiterate the importance of these growth figures, they are often displayed front and center on CFO dashboard software. CAGR = ((Ending Balance)/(Beginning Balance))^(1/n)-1Where n is the number of years over which the growth occurred.

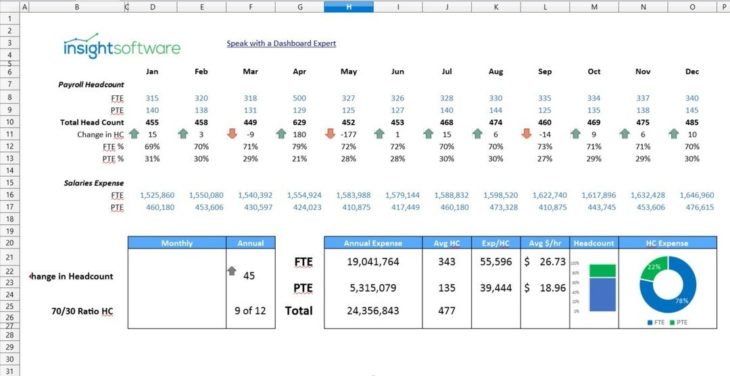

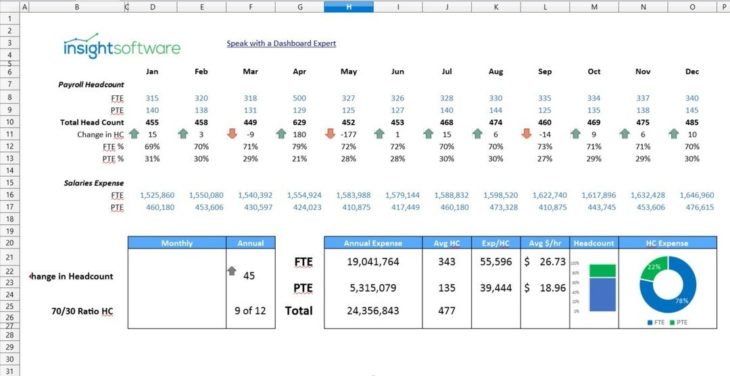

- Employee Count – This CFO KPI tracks how many full-time and part-time employees are on the payroll. This data is typically used for two purposes: determining performance metrics on a per employee basis, and illustrating how labor costs are impacting financial performance. CFOs will often compare how financial metrics perform between full-time, part-time, and contract employees to see which are most cost effective.

Get your own customizable copy of the dashboard template here. - Interest Coverage Ratio – At insightsoftware, this is one of our favorite CFO metrics. This metric is particularly useful because it is able to provide insight into the financial health of a company from two different perspectives. It can be used to analyze the debt levels of a company as well as the company’s profitability. If your company is looking to borrow funds for capital expansion, this metric should be reviewed. Lenders will often use the interest coverage ratio when assessing their level of risk with a loan. A high coverage ratio represents a low risk loan, while a high ratio could result in rejection. Interest Coverage = EBIT/Interest Expense

Just remember that knowing which KPIs to use for a CFO dashboard is only half the battle. The data gathering, processing, and visualization is just as important. Without proper software, your finance team and CFO would spend weeks gathering and crunching data, only to realize they are making decisions based on outdated information. If this hasn’t convinced you to use a dashboard software solution, we have some sample CFO dashboards that you can download and try for yourself.

Sample CFO Dashboards

CFO dashboards come in a variety of different flavors, depending on what you would like to focus on. However, all of our dashboards have one thing in common: they scale to the size of your business. This helps you save money in the long run as you can avoid costly software migrations as your business grows. Here are three different dashboards that you can grow your business with:

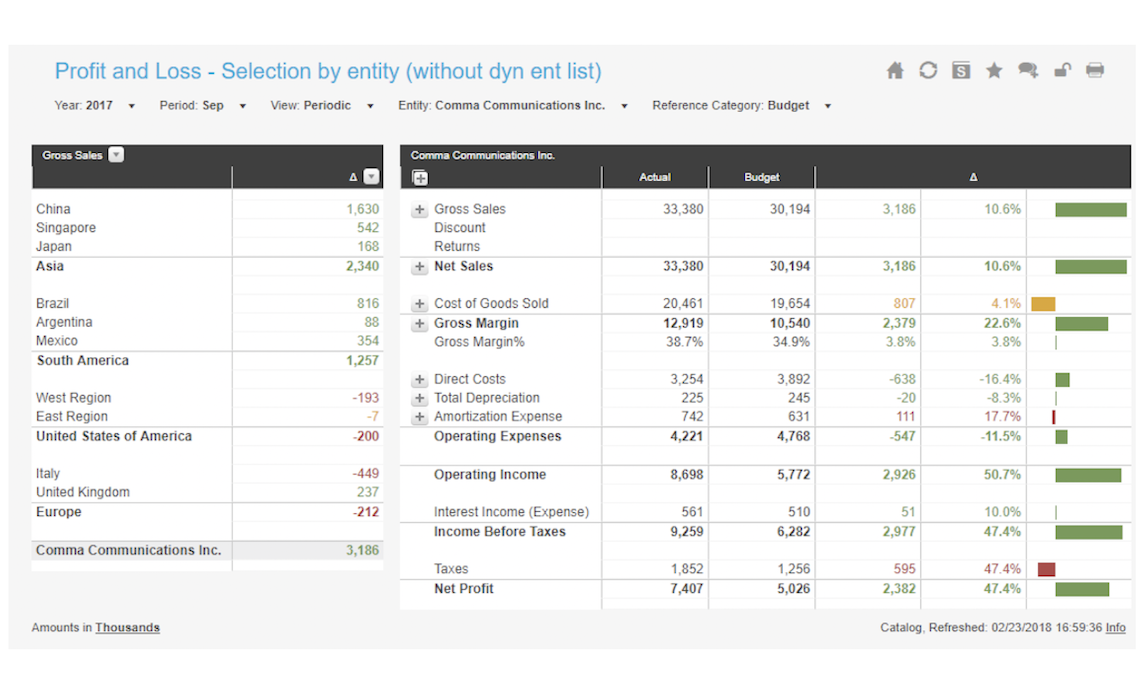

Profit and Loss Dashboard

The first dashboard we have focuses on profit and loss. Do not let the simplicity of the name fool you. This is by no means a simple dashboard. It has been built upon the idea that your organization is layered with a complex structure, involving thousands of data points across different business segments. This dashboard will automatically gather all your data and process it, enabling easy visualization.

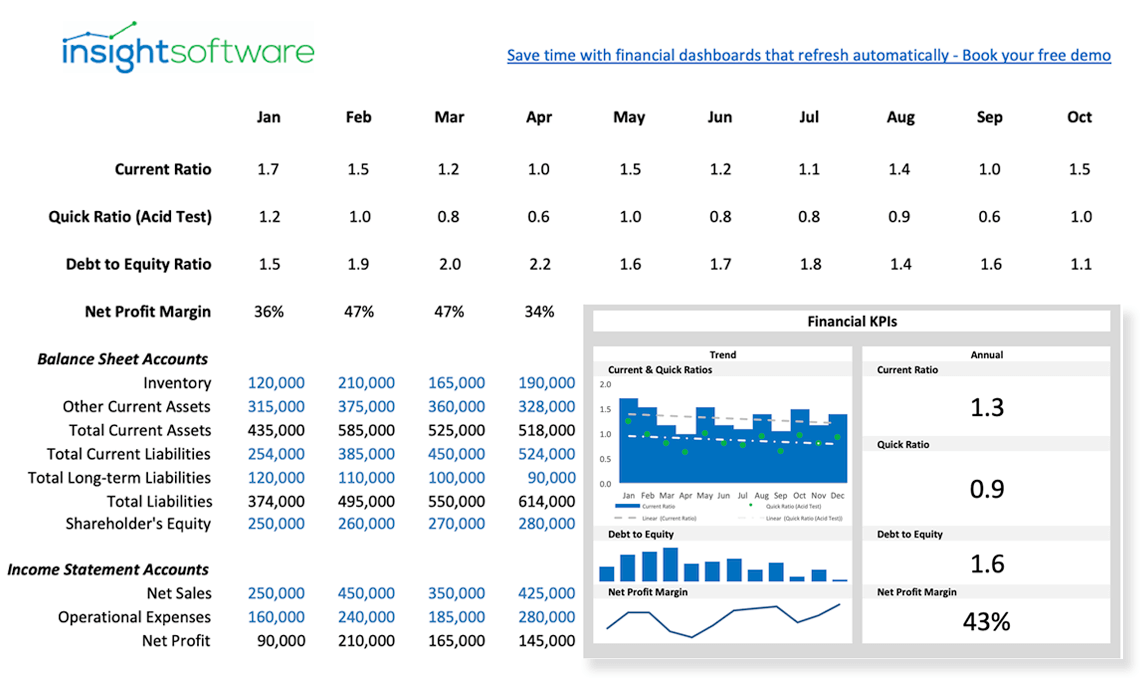

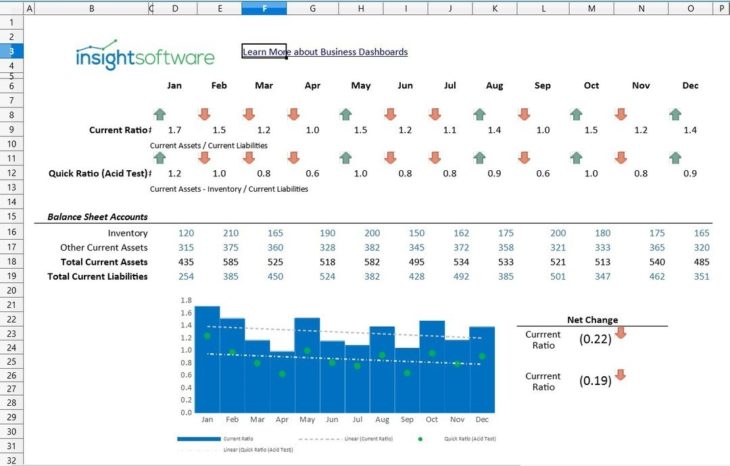

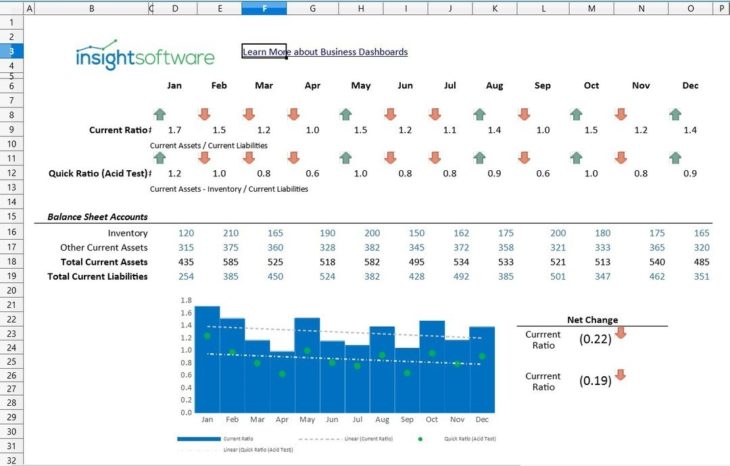

Financial Ratios KPI Dashboard

Financial ratios are the bread and butter of any CFO. These ratios are the quick checks that give insight into the financial health of your company. This dashboard provides a list of traditional financial ratios that require your attention, and presents them in a simple and effective manner. This dashboard is the definition of data-driven decision making. Download a free copy of this Excel dashboard template here.

Master Financial Dashboard for CFOs & Finance Managers

If there is any financial metric or KPI you want to analyze, this dashboard has it. You can pull up any financial information you need with a couple clicks. Need financial information for a meeting? No problem. Want to review the quarterly report before submitting it? Easy-peasy. This dashboard is an all-in-one solution.

Hopefully you found something that piqued your interest in the CFO dashboards provided here. However, if you didn’t find the exact dashboard you wanted, feel free to check out all of our sample dashboards!

5 Things Not to do When Choosing a Financial Reporting Solution

[ad_2]