[ad_1]

By Sabrina Corlette and Rachel Schwab

January 16, 2024 Replace: H.R. 824 was superior by the U.S. Home of Representatives’ Committee on Training & the Workforce in June 2023. Extra just lately, advocates for the measure are pushing to connect the proposal to an upcoming appropriations invoice as a “coverage rider.”

On Tuesday, June 6, the U.S. Home of Representatives’ Training & Workforce Committee will think about a invoice, H.R. 824, that might encourage the proliferation of telehealth protection as a standalone worker profit. Proponents of this laws—lots of whom stand to revenue from the sale of those merchandise—argue that it could give employers and employees extra inexpensive choices. Nonetheless, beneath the proposed laws, standalone telehealth merchandise could be nearly totally exempt from regulatory oversight, posing vital dangers to shoppers who might face misleading advertising of those preparations as an alternative choice to complete protection.

Background

The supply of well being care companies by way of telehealth modalities expanded dramatically through the COVID-19 pandemic. Though charges of telehealth use have moderated considerably because the peak of the general public well being emergency (PHE), they continue to be nicely above pre-pandemic ranges.

Federal and state policymakers inspired using telehealth by means of a number of PHE-related coverage modifications. For instance, early within the pandemic many employees had been staying residence and dealing with reductions in work hours, generally rendering them ineligible for medical insurance by means of their employer. The Biden administration sought to assist fill gaps in entry to well being companies by issuing steerage quickly suspending the applying of group well being plan guidelines to standalone telehealth advantages when provided to workers ineligible for the employer’s group well being plan. This coverage was solely relevant through the PHE.

Ordinarily, any employer-sponsored plan overlaying medical companies for workers and dependents is topic to Inexpensive Care Act (ACA) and different federal requirements for group well being plans. Thus, absent the PHE-related suspension of the principles, a standalone telehealth profit would want to adjust to, for instance, mandates to cowl preventive companies with out cost-sharing, the ban on annual greenback limits on advantages, psychological well being parity necessities, and the annual cap on enrollees’ out-of-pocket spending. Nonetheless, H.R. 824 would lengthen and broaden on the COVID-era coverage by permitting employers to supply telehealth as an “excepted profit” to all workers—not simply these ineligible for the employer’s main medical plan.

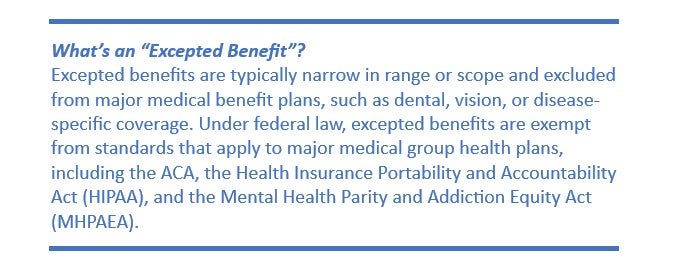

Excepted advantages will be engaging to employers as a result of they aren’t topic to most federal requirements that apply to group medical insurance, together with shopper protections beneath the ACA, HIPAA, and MHPAEA. Dental and imaginative and prescient insurance coverage are among the many most typical kinds of excepted advantages, and lots of distributors notoriously present inadequate protection. Mounted indemnity insurance coverage, one other excepted profit, is commonly marketed to shoppers as complete insurance coverage protection regardless of overlaying solely a fraction of enrollees’ precise incurred prices.

Telehealth as an Excepted Profit Would Cut back, Not Improve, High quality Protection

Nothing beneath federal regulation prevents employers from overlaying telehealth for workers, both by reimbursing brick-and-mortar suppliers for providing video and audio consultations or by contracting with telehealth distributors comparable to Teladoc. The truth is, the overwhelming majority of huge corporations (96%) and small corporations (87%) at present cowl some type of telehealth companies. Designating telehealth protection as an excepted profit is thus unlikely to broaden employees’ entry to those companies. As an alternative, the proposal poses a number of issues for employees and their households.

First, separating telehealth companies from workers’ well being advantages fractures care supply and frustrates the coordination of look after sufferers, who will seemingly must see a unique supplier than their typical supply of care to entry lined telehealth advantages. It might additionally topic enrollees to surprising further price sharing, comparable to two deductibles, and trigger confusion about what companies are lined and by whom.

Second, designating telehealth protection as an excepted profit places shoppers in danger by encouraging the advertising of merchandise which might be exempt from important federal protections. A telehealth insurer might cost a better premium to somebody with a pre-existing situation and refuse to cowl sure therapies, or alternatively, the insurer might deny them protection altogether. Excepted advantages are additionally exempt from psychological well being parity guidelines, can place annual or lifetime caps on advantages, and may impose price sharing for preventive companies, which can deter enrollees from getting the care that they want.

Third, excepted advantages have a troubled historical past, with distributors usually deceptively advertising these merchandise as an alternative choice to complete medical insurance. Brokers usually package deal excepted profit merchandise collectively, in order that they seem on the floor like a complete coverage, with out clearly speaking that these preparations don’t adjust to key shopper protections and depart enrollees at vital monetary threat.

Fourth, a standalone telehealth profit that an worker can select in lieu of a serious medical plan might disproportionately hurt decrease revenue employees. These employees could also be inspired to enroll within the telehealth profit, probably packaged with one other excepted profit comparable to a hard and fast indemnity coverage, as an inexpensive different to their employer’s main medical plan. However employees could not notice that these merchandise aren’t topic to the identical shopper protections as the excellent group plan and don’t present actual monetary safety in the event that they get sick or injured.

Conclusion

Expanded entry to telehealth companies has been a boon for sufferers, significantly these residing in rural areas and those that lack transportation choices or flexibility at work. Employers, to their credit score, embraced telehealth through the pandemic and haven’t regarded again. A whopping 76% of employers with 50 or extra workers predict that using telehealth of their well being plans will both keep the identical or enhance, and a considerable majority of each massive and small corporations consider that telehealth shall be very or considerably essential to offering enrollees with entry to a variety of well being care companies, significantly for behavioral well being.

Thus, whereas H.R. 824 is touted as increasing telehealth protection, its predominant impact would as an alternative be to silo medical companies delivered by means of video and audio modalities from the remainder of the care supply system, enhance the potential for scams and misleading advertising, and expose employees and their dependents to well being and monetary threat by rolling again important shopper protections.

[ad_2]