[ad_1]

Investing is all about earnings and returns – nobody places their cash right into a inventory with out an expectation that the funding will become profitable. The trick is discovering the shares that ship the perfect returns.

There’s a bent to need to leap on the bandwagon, to purchase into the massive names which have grabbed the headlines. And that may herald earnings – there is no such thing as a doubt that Microsoft and Nvidia have proven astounding development over the previous yr. However there may be additionally revenue and potential to be discovered underneath the radar, in smaller shares with decrease costs. The chance is increased, however the attainable upside might be astounding.

For lower than $5 per share, traders can discover penny shares with triple-digit upside potential. These shares supply a mix of things: low entry price, excessive return potential, and endorsement from Wall Avenue analysts. This makes them worthy of traders’ consideration.

With this in thoughts, we’ve used the TipRanks database to drag up the small print on two such alternatives. Each have acquired sufficient help from Wall Avenue analysts to earn a ‘Robust Purchase’ consensus ranking. To not point out every boasts substantial upside potential of over 300%.

Eledon Prescribed drugs (ELDN)

We’ll begin with Eledon, a medical stage biopharmaceutical firm specializing in immune-modulating therapies for life-threatening situations. Eledon is at the moment focusing its efforts on the event of tegoprubart, a brand new drug with important implications within the discipline of organ transplantation. Particularly, tegoprubart has the potential to cut back organ rejection, enhance transplant perform, and improve affected person longevity post-transplant. That’s a tall order for one drug, but when achieved, it will probably show to be a gold mine for Eledon.

Up to now, early testing has proven that tegoprubart has potential. The drug operates via a number of mechanisms of motion, primarily by focusing on the CD40 ligand, or CD40l. Blocking this pathway impacts the communication of key immune cells and will increase a specialised inhabitants of T cells that suppress immune response. These actions, geared toward stopping immune response towards overseas tissues, give tegoprubart its potential as a protecting agent for transplanted organs.

On the medical facet, Eledon at the moment has tegoprubart present process two parallel research: the Part 2 BESTOW trial, which goals to enroll as many as 120 kidney transplant sufferers, and concurrently, a single-arm Part 1b medical trial geared toward stopping rejection in sufferers receiving kidney transplants. The corporate not too long ago reported enrollment of the twelfth affected person within the BESTOW trial, and likewise not too long ago amended its protocol for the Part 1b trial to permit a second cohort and eventual enrollment of as much as 24 sufferers within the research.

Wanting ahead, these trials ought to deliver vital milestones to Eledon this yr. The corporate ought to report interim medical knowledge from the Part 1b trial throughout 2Q24, whereas the BESTOW research ought to full enrollment by the top of this yr.

Towards this backdrop, a number of members of the Avenue consider ELDN’s $1.60 share value appears to be like like a steal.

Among the many bulls is Leerink analyst Thomas Smith, a 5-star analyst rated within the prime 1% of the Avenue’s inventory professionals. Smith acknowledges tegoprubart’s promising potential, noting, “We stay inspired by tegoprubart’s medical profile thus far and proceed to see its best-in-class potential in kidney transplant primarily based on potential benefits on each efficacy and security/tolerability vs. present standard-of-care. We anticipate that ELDN’s two parallel research in kidney transplantation will proceed to construct on these encouraging outcomes, and we proceed to view ELDN as a beautiful pureplay possibility within the burgeoning CD40L/CD40 house… We stay optimistic on tegoprubart’s efficacy/security profile forward of further knowledge in kidney transplant anticipated in 2Q24.”

To this finish, Smith charges ELDN shares an Outperform (i.e. Purchase), and his $7 value goal factors towards a one-year upside potential of 332%. (To view Smith’s monitor document, click on right here)

The Leerink view could show to be the conservative perspective on ELDN. The inventory’s Robust Purchase consensus ranking is supported by unanimous constructive opinions from 5 analysts, with a mean value goal of $15.60 suggesting ~863% upside from the present share value. (See ELDN inventory forecast)

Acumen Prescribed drugs (ABOS)

Subsequent up is Acumen, a biotech agency specializing in growing new therapies for Alzheimer’s illness. Alzheimer’s is a devastating sickness that impacts the reminiscence of sufferers, finally resulting in a lack of their skill to perform independently. There’s hope on the horizon, nonetheless, and Acumen is a part of it.

New medicine have slowed down the development of Alzheimer’s, and Acumen is one among many firms engaged on therapies with even larger potential within the therapy of the illness. Acumen is at the moment engaged on therapies with a ‘disease-modifying’ strategy, designed to focus on the underlying causes of the situation. This can be a discipline ripe with potential, as there are at the moment some 6 million Alzheimer’s sufferers within the US, 32 million globally.

Acumen has developed a drug candidate, sabirnetug (ACU193), and introduced it into the medical trial stage. The drug is a selective focusing on agent working towards poisonous soluble amyloid beta oligomers, or AβOs. These are recognized to be an early set off of Alzheimer’s and have been proven to be ‘persistent drivers’ of the neurodegeneration and different pathologies of the illness. Acumen’s sabirnetug helps to protect neurologic perform by stopping poisonous AβOs from binding to dendritic spines.

Early medical trials confirmed promise, and the corporate is now on monitor to provoke a Part 2 medical research throughout 1H24. The Part 2 trial, ALTITUDE-AD, will research the efficacy of sabirnetug towards early Alzheimer’s illness. A Part 1 research, a subcutaneous dosing possibility for sabirnetug, can also be anticipated to start out this yr.

This biopharma firm has caught the attention of analyst Geoff Meacham from Financial institution of America. Meacham sees Acumen’s drug candidate as a robust asset, however he additionally perceives the background situations as favorable for the corporate.

“We proceed to assume ACU193 gives intriguing upside as a subsequent—and presumably best-in-class—mAb by particularly focusing on Aβ oligomers vs. its opponents. Certainly, whereas admittedly early, we thought the section 1 knowledge regarded differentiated given its speedy onset of motion on key biomarkers and restricted questions of safety. On the identical time, Acumen ought to profit from 1) a positive regulatory backdrop; 2) infrastructure investments from its industrial rivals; and three) enhancing medical experiences (new tips, increasing diagnoses, enhanced therapy protocols/ danger mitigation, and many others.). Thus, whereas we acknowledge the medical and industrial dangers, we proceed to see robust upside potential,” Meacham opined.

Constructing on these ideas, Meacham proceeds to price ABOS shares as a Purchase, assigning the inventory a $14 value goal, which means an upside of ~329% inside a one-year horizon. (To look at Meacham’s monitor document, click on right here)

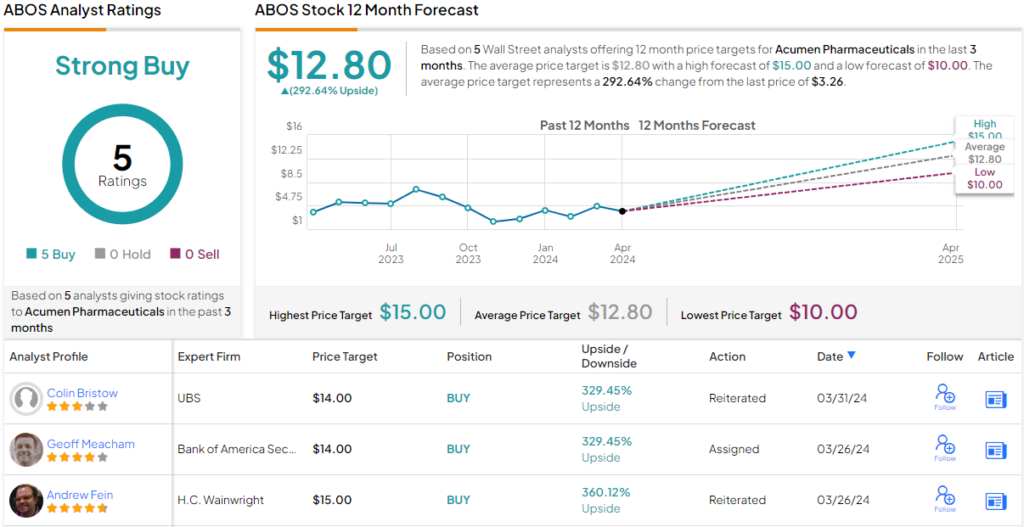

General, Acumen will get its Robust Purchase consensus ranking from 5 unanimously constructive analyst opinions. The shares are buying and selling for $3.27, and their $12.80 common value goal suggests ~293% share appreciation for the approaching 12 months. (See ABOS inventory forecast)

To search out good concepts for penny shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely vital to do your individual evaluation earlier than making any funding.

[ad_2]